Edda Wind Secures Green Financing for Newbuild Program

Edda Wind announced it has entered into a green term loan facility agreement for the pre- and postdelivery financing of four new commissioning service operation vessels (CSOV) under construction at Vard.The agreement is a €161 million green loan facility with Crédit Agricole Corporate and Investment Bank, Danske Bank A/S, DNB Bank ASA and SpareBank 1 SR-Bank ASA, with expiry in 2029 and a profile of 12 years. The facility corresponds to a leverage ratio of 60% of the total ready…

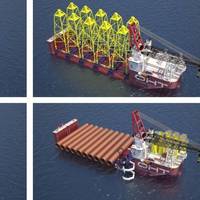

Havfram Secures Loan for Offshore Wind Vessel Construction

Offshore wind installation company Havfram has signed a Senior Secured Green ECA Term Loan Facility to fund its two wind turbine installation vessels ("WTIVs"), currently under construction at CIMC Raffles in China. The Facility was entered into with a syndicate led by DNB Bank ASA (Coordinator, Bookrunner, Green Loan Advisor and Agent) with SpareBank 1 SR-Bank ASA, Credit Agricole, Sparebanken Vest and Rabobank as Mandated Lead Arrangers and with Export Finance Norway as ECA lender.

Cadeler Secures Loan to Fund Offshore Wind Vessel Construction & Upgrades

Danish offshore wind installation services company Cadeler said Monday it had entered into an unsecured green loan facility with HSBC. The purpose of the loan facility is, among others, to fund Cadeler’s construction of the X-class and F-class newbuild vessels and the upgrade of the existing O-class vessels with new cranes. The financing includes a non-committed accordion option of up to EUR 50 million.Cadeler entered into an unsecured green term loan facility in an aggregate amount of EUR 50 million (tenor of up to five years) with The Hongkong and Shanghai Banking Corporation Limited…

Profile: Stars Align for Wallem Commercial Services

Market drivers have created a significant opportunity for Wallem to grow a specialised area of business, according to Capt. Anurag Mathur, Managing Director, Commercial Services, Wallem Group.Wallem’s portfolio of commercial services is ideally placed for expansion across a full range of vessel types, according to the executive appointed to drive for growth in January 2023. And Capt. Anurag Mathur, whose previous roles include senior managing directorships at leading ship owning and ship management companies…

Viasat Buys Inmarsat, Creating Global Satellite Communications Powerhouse

U.S.-based global communications company Viasat has completed the acquisition of its UK-based rival Inmarsat."The combined company enhances our scale and scope to continue to drive growth in the increasingly dynamic and competitive satellite communications industry. The company’s assets, once fully integrated, are expected to increase the pace and scope of innovation in the global satellite connectivity sector, offering new and improved capabilities to customers that will address the ever-increasing speed…

Performance Shipping Takes Delivery of Secondhand Tanker

Greek shipowner Performance Shipping announced on Thursday that it has taken delivery of a 2013-built LR2 Aframax oil product tanker that it agreed to purchase in November 2022.The 105,408 dwt P. Long Beach (formerly Fos Hamilton) was acquired for $43.75 million, partially financed through a term loan facility with Alpha Bank S.A.Long Beach is equipped with an eco-electronic engine and fitted with a ballast water treatment system (BWTS).The vessel is the fourth vessel delivered to the company during the course of this year, bringing the Performance Shipping’s current fleet to a total of eight Aframax tankers.Andreas Michalopoulos, the Company’s Chief Executive Officer, said, “The delivery of our second LR2 Aframax tanker, the M/T P.

Performance Shipping Takes Delivery of Secondhand Aframax Tanker

Greek tanker owner Performance Shipping announced on Monday it has taken delivery of a secondhand Aframax tanker it agreed to purchase in September 2022.The P. Monterey, formerly Phoenix Beacon, is a 105,525 dwt tanker built in 2011. It is equipped with a ballast water treatment system (BWTS), and its next scheduled special survey is not due until 2026.The vessel was acquired for a total purchase price of $35 million and partially financed through the recently announced term loan facility with Piraeus Bank S.A.Following the delivery, P. Monterey will commence a time charter contract with ST Shipping & Transport Pte Ltd., a wholly-owned subsidiary of Glencore, at a daily rate of $32,000 per day for a period of 24 months +/- 45 days at the option of the charterer.P.

Performance Shipping Takes Delivery of Secondhand LR2 Tanker

Greek shipowner Performance Shipping Inc. announced it has taken delivery of its first LR2 Aframax oil product tanker, a 2010-built 105,304 dwt vessel it purchased in August 2022.As previously announced, the P. Aliki—formerly named Alpine Amalia—was acquired for a total purchase price of $36.5 million and financed with $18.25 million cash on hand and $18.25 million from the recently announced term loan facility with Alpha Bank S.A.The vessel will enter into a time charter contract with Trafigura Maritime Logistics Pte Ltd. commencing in mid-November at a daily rate of $45,000 per day for a period of minimum seven months to a maximum of 10 months at the option of the charterer.Andreas Michalopoulos…

SBM Offshore Secures $620M Loan for Brazil-bound FPSO

Dutch floating oil and gas production firm SBM Offshore has secured a $620 million bridge loan facility for the financing of the construction of FPSO Alexandre de Gusmão, to be deployed in Brazil for Petrobras.The FPSO Alexandre de Gusmão will be deployed at the Mero field in the Santos Basin offshore Brazil. Mero is a project under Libra Consortium responsibility, in which Petrobras is the operator with 40 percent and with the following partners: Shell Brasil with 20 percent, TotalEnergies with 20 percent, CNODC and CNOOC Limited with 10 percent each, together with Pré-sal Petróleo S.A.

Nordic Shipholding to Sell Its Remaining Tankers

Nordic Shipholding said on Monday it will sell its three remaining tankers after the lossmaking Danish shipowner failed to line up a merger partner.The company said it held extensive discussions with potential merger partners and lenders to secure the group's long-term viability, but that the talks had stalled. It will now move to sell its remaining vessels, including the 2009-built handysize tankers Nordic Agnetha (37,791 dwt) and Nordic Amy (37,759 dwt) as well as the 2009-built LR tanker Nordic Anne (73,774 dwt)."Given the volatility in the sale and purchase market for these vessels, it is probable the group may recognize a further write-down of the vessels’ carrying value in the range of $4 million to $5 million in this financial year…

Seanergy Takes Delivery of 2009-built Bulk Carrier. Secures Charter with NYK Line

Seanergy Maritime Holdings Corp. has taken delivery of the M/V Friendship bulk carrier.The vessel is a 176,952 dwt Capesize bulk carrier, built in 2009 by Namura Shipbuilding Co., Ltd. in Japan. "The M/V Friendship is the fifth Capesize delivery that Seanergy has successfully completed in 2021 to date," the company said.Seanergy also said that the has been fixed on a time charter with Japan's NYK Line, which is an existing charterer of Seanergy. The charter is expected to commence immediately…

OHT Gets $135M Loan for 'Alfa Lift'

Oslo-listed offshore heavy transport and wind installation company OHT has received and accepted a firm offer for a USD 135 million Senior Secured Green ECA Credit Facility.The loan was accepted by OHT's ship owing company OHT Alfa Lift AS, which is building the offshore wind foundation installation vessel Alfa Lift in China. OHT ordered the Alfa Lift on speculation in 2018, and has since secured contracts to install foundations at the world's largest wind farm - the Dogger Bank in the UK.Sharing further details on the loan…

Golden Ocean to Acquire 18 Modern Dry Bulk Vessels

Dry bulk shipping company Golden Ocean Group has entered into a Heads of Agreement to acquire 18 modern scrubbers fitted dry bulk vessels from affiliates of John Fredriksen's Hemen Holding, which is Golden Ocean's largest shareholder, for $752 million.Of the 18 vessels, ten are Newcastlemaxes built 2019-21, and eight are Kamsarmaxes built 2020-21 "The transaction will add significant scale to Golden Ocean’s operating fleet, contribute to reducing cash breakeven levels and is in line with the company's fleet renewal strategy…

Performance Shipping Acquires Fifth Aframax Tanker

Athens-based shipowner Performance Shipping said it reached a deal to purchase the Kalamas, a 105,400 dwt Aframax tanker built in 2011 by Sumitomo Heavy Industries Marine & Engineering Co. Ltd, Japan, from an unaffiliated third party seller for a total purchase price of $22 million. The vessel, the company’s fifth Aframax tanker, is expected to be delivered between November 15 and December 22, 2020, and will be renamed P. Yanbu.Upon delivery of the Kalamas, the cargo-carrying capacity of the company’s fleet will have increased by 23.9% to approximately 546,094 deadweight tons (dwt). The M/T Kalamas was built to high specification and has been retrofitted with a ballast water treatment system (BWTS), in compliance with the Ballast Water Management (BWM) Convention.

Hornbeck Offshore Strikes Restructuring Deal with Lenders

US-based offshore vessel provider Hornbeck Offshore has struck a comprehensive balance sheet restructuring support agreement with its lenders.The announcement on Tuesday follows Hornbeck’s previous announcement earlier this month when the company said it was in talks with lenders over the terms of the balance sheet restructuring, to be implemented through a prepackaged chapter 11 filing in the Southern District of Texas.Hornbeck Offshore said Tuesday that it had entered into restructuring…

International Seaways Signs Refi Deal

New York-headquartered product tanker company International Seaways has closed on senior secured credit facilities worth a total of USD 390 million.The crude oil and petroleum product tanker company said that the facilities consists of a 5-year USD 300 million senior secured term loan facility, a 5-year USD 40 million revolving credit facility, of which USD 20 million has been drawn, and a 2.5-year USD 50 million senior secured term loan credit facility.The NYSE-listed ship owner and operator said that the proceeds from the loans were used to refinance USD 385 million existing high-cost secured and unsecured debt of the company and its subsidiaries.Jeffrey Pribor…

Exmar Secures FLNG, VLGC Financing

Belgium-headquartered manager of specialized floating assets Exmar said that China Export Credit Insurance Corporation (Sinosure) approved the release of $40 million from the debt service reserve account under the TANGO FLNG loan facility.The documentation for the release of the restricted cash has been signed and the effective release will occur within the coming days.In the meantime the TANGO FLNG has exported its second cargo for YPF in December 2019 and the third cargo is being produced.Exmar has two Very Large Gas Carriers under construction at Jiangnan, due for delivery in the course of 2021.The two vessels will each enter a five…

Seacor Borrows $200M for SEA-Vista

Florida-based marine services company Seacor Holdings said that its indirect wholly-owned tanker subsidiary SEA-Vista entered into an amended and restated $200 million credit agreement, which refinanced its existing credit facilities, with a syndicate of lenders led by JPMorgan Chase.The agreement provides for a $100 million revolving credit facility and a $100 million term loan facility, both of which mature in December 2024. The agreement allows SEA-Vista to use the borrowings for general corporate purposes, including acquisitions, and contains a $50 million accordion feature subject to lender approval.At closing, the revolving credit facility remained undrawn, and approximately $76 million of the term loan proceeds were used to fund the repayment of SEA-Vista’s original credit facility.

GOGL Profits Up in Q3

The Bermuda registered, Norway based dry bulk shipping company Golden Ocean Group (GOGL) announced a net income of $36.7 million and earnings per share of $0.26 for the third quarter of 2019 compared with net loss of $33.1 million and loss per share of $0.23 for the second quarter of 2019.EBITDA stood at $81.1 million for the third quarter of 2019, compared with $21.5 million for the second quarter of 2019.Birgitte Ringstad Vartdal, Chief Executive Officer of Golden Ocean Management AS, said: “Our strong performance in the third quarter is the result of our strategic decision to gear our fleet towards modern, fuel-efficient vessels in…

NMP Acquires Eleven Vessels

Navios Maritime Partners (NMP) s agreed to acquire eleven vessels and liquidate Navios Europe I.As of September 30, 2019, Navios Partners had a receivable of $48.2 million from Navios Europe I. On November 22, 2019, an agreement was reached to liquidate Navios Europe I. The agreement is subject to definitive documentation which is expected to be completed by the end of 2019.It is expected that Navios Partners will acquire the five containerships - Esperanza N, Protostar N, Harmony N, Castor N and Solar N - owned by Navios Europe I with a net equity value approximately equal to the receivable.Navios Partners entered into a share purchase agreement for the acquisition of four drybulk vessels - TBN 1…

Wilson Buys Two Bulkers

Wilson Ship Management, a short sea company working hand in hand with major players within the Norwegian and European industry, has signed an agreement to purchase the two bulk carriers MV Lauren C (2007) and MV Nicole C (2008), both of 5,000 dwt.The vessels are expected to be acquired during the first quarter of 2020. Upon acquisition, both vessels will be given Wilson names. The purchase is financed through equity and deductions from the company's loan facility in the bank.The acquisition of MV Lauren C and MV Nicole C marks the growth of today's fleet with two vessels. The acquisition underpins Wilson's long-term belief in the market and is the company's first vessel in the 5,000 dwt segment.Meanwhile, Wilson has entered into an agreement to sell the bulk carrier MV Wilson REEF.

Vista Shipping to Finance Product Tankers

Hafnia Tankers, a member of BW Group, and shipyard-affiliated leasing company CSSC (Hong Kong) Shipping have formed a joint venture named Vista Shipping to finance and operate product tankers.A term loan facility of USD 111 million is intended to be used to finance four LR1 newbuildings. A banking consortium consisting of KfW IPEX-Bank, Societe Generale Hong Kong Branch and OCBC Singapore participate with 33% each as lenders at the term loan facility and have reached financial close.KfW IPEX-Bank acts as Facility Agent, Sinosure Agent and Security Agent. The 12-year post-delivery financing profits from Sinosure cover and is secured by…

OET Gets Loan for Two Suezmax Newbuilds

Greece-based shipping company Okeanis Eco Tankers (OET) said it has secured funding to finance the pre-delivery of two new ECO scrubber-fitted Suezmax tankers.The Greek tanker owner and operator said that it has secured commitment to a USD 45.9 million secured loan facility from Alpha Bank A.E. to finance 88.95% of the total pre-delivery yard installments for the vessel pair.The two ECO design, scrubber-fitted 158,000 DWT Suezmax tankers are under construction at Hyundai Samho Heavy Industries and set for delivery in August 2020.The loan facility is available immediately, and the Company expects to draw on it shortly to finance 100% of the installment due in November 2019.