LNG is the Bridge to ‘Zero Emissions’ Shipping

The advent of industry wide tightening of allowable sulfur emissions is getting nearer. Suddenly, with the deadline now little more than one year away, the countdown clock will very soon be ticking much louder. Simply stated, the cap on allowable sulfur content in marine fuels, presently at 3.5 percent in many geographical regions, will be reduced to 0.5 percent in January 2020. The 0.1 percent sulfur cap, already in effect since 2015 in coastal Emissions Control Areas (ECAs) in Europe and North America…

Exmar Avoids Loss by Selling Vessels

Belgian shipowner Exmar reported a $28 million net profit for the year 2017, on IFRS, compared to $40.4 million in 2016. The Nicolas Savery-led shipowner said that despite the drop, the result has been positively impacted by the sales of vessels including FSRU’s Excelerate, Explorer and Express that have been sold to their charterer, Excelerate Energy. On the FSRU (Floating Storage and Regasification Units) market, several projects have suffered delays or cancelled. There has been one long-term contract awarded for an FSRU in 2017 worldwide and it was to EXMAR. Currently 26 FSRUs exist out of which 23 operate as terminals; presently ten units are under construction. Forecasters estimate that by 2025 the number of FSRUs would be close to 50.

LNG: Lagging, Not Gone

Low energy prices, depressed day rates and slow growth of bunkering infrastructure has dampened progress for the marine industry’s ‘white knight’ of environmentally friendly fuels. LNG, nevertheless, is here to stay. Liquified Natural Gas (LNG) is a clean fuel in abundant supply. The green advantages of LNG are well known: Class Society DNV-GL, a pioneer in the commercialization of LNG fueling for maritime applications, offers that use of LNG fuel provides “the complete removal of SOX and particle PM emissions and a reduction of NOX emission of up to 85 percent ...

Can Domestic Shipping Become Our Industry’s Farmer’s Market?

Arriving at the Farmer’s Market this morning I made the decision to grill some hand cut rib eye with fresh vegetables and potatoes later that evening. I searched several of the local farm kiosks to find the mix I wanted and then reached into my pocket to pay for my choices. The price for all this local fare is not competitive with Cosco or Walmart, but I know the vegetables are organically grown without chemicals and the local beef is grass fed. The price point may not be right but the effort supports local business and the farmers who work hard to provide us sustainable products and quality.

Boskalis Posts Highest Profit

Royal Boskalis Westminster N.V. (Boskalis) achieved a very busy first half year with historically high profit and realized a net profit of EUR 306.5 million in the first half of 2015, a rise of 21% (H1 2014: EUR 253.0 million). Revenue in the first half of the year rose 1.6% to EUR 1.57 billion (H1 2014: EUR 1.55 billion). Adjusted for (de)consolidation and currency translation effects, revenue was stable. EBITDA in the first half of the year amounted to EUR 500.1 million (H1 2014: EUR 466.4 million) and the operating profit (EBIT) was EUR 359.3 million (H1 2014: EUR 338.3 million). Results in all three segments were good in addition to which there were a number of (positive) exceptional items. Dredging & Inland Infra had an exceptionally busy first half from an operational point of view.

LR: Flexible Ships Needed in Volatile Times

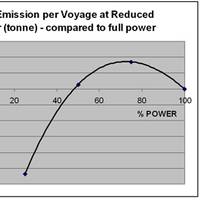

High or volatile oil prices and environmental concerns, point to the need for new designs capable of operating efficiently at different speeds. Lloyd’s Register warns that care needs to be taken when running at reduced power outputs. Most container ships trading today, and on order, were designed for a world of relatively low energy prices. With oil at recent high levels many owners have been implementing or considering slow steaming strategies. Slow steaming may also be seen at present as an answer to over-capacity.

Oil Producers Left Out of Emergency Spending Bill

U.S. Senate and House negotiators have left out several programs in a nearly $15 billion emergency spending bill that would have helped U.S. oil and natural gas producers. While language was left in the spending measure to delay new royalty valuation rules on crude oil production, lawmakers rejected separate programs to provide emergency loans and other royalty relief to small oil and natural producers. Negotiators also turned down a proposal to allow natural gas producers to forgo paying hundreds of millions of dollars in interest due on refunds to customers. The original intent of the emergency spending bill, which will be voted on by the full Congress and then sent to President Clinton for his approval, was to provide money to fight the war in Yugoslavia. Oil Royalties: Sen.

Texaco Announces $600 Million Reduction in Plan

Texaco Inc. announced a revised 1999 capital and exploratory (capex) plan of $3.7 billion, including subsidiaries and affiliates, down $600 million from its original $4.3 billion plan. Texaco will also accelerate its $650 million cost and expense reduction program announced in December 1998. Commenting on the revised capex plan, Texaco Chairman and CEO Peter I. Bijur stated, "Given this period of low energy prices, our revised spending plan together with our cost and expense reduction program are appropriate actions. We are strategically focusing capital on the key projects that represent optimum long-term growth opportunities, and at the same time continuing our effort to drive down costs. These measures will assist Texaco in weathering this extended period of low prices."