Star Bulk Completes Eagle Bulk Acquisition

Star Bulk Carriers Corp. on Tuesday announced that it has completed its merger with fellow dry bulk shipping company Eagle Bulk Shipping Inc.Eagle Bulk shareholders this week voted to approve the $2.1 billion deal, which was first announced in December 2023.Under the terms of the merger agreement, each Eagle shareholder received 2.6211 shares of Star Bulk common stock for each share of Eagle common stock owned. Eagle common stock has ceased trading and will no longer be listed on the New York Stock Exchange.Petros Pappas…

Euronav Seeks Urgent Arbitration over Frontline's Unilateral Merger Termination

Belgian tanker operator Euronav has filed an application for urgent arbitration in relation to tanker firm Frontline’s unilateral termination of the previously proposed merger agreement.Frontline on January 9 said that a $4.2 billion deal to merge with rival Euronav NV was terminated, a combination that would have created the world's largest publicly listed tanker company."Euronav is requesting to suspend such termination pending a determination on the merits pursuing primarily the specific performance of the combination agreement.

Belgian Oil Tanker Firm Euronav Disputes Frontline's Right to Break up Merger

Belgian oil tanker and storage company Euronav said on Wednesday it disputed Frontline's right to end a merger agreement between the two firms and was considering options, including arbitration and legal action. Oslo-listed oil transporter Frontline said on Monday it was canceling the $4.2 billion merger deal. "Euronav has determined that Frontline's unilateral action in pursuing the termination of the combination agreement has no basis under (its) terms (...), and that Frontline failed to provide a satisfactory reason for its decision," the Antwerp-based group said in a statement.

Two Offshore Drilling Firms Set to Merge

Offshore drilling firms Seadrill Limited and Aquadrill (ex-Seadrill Partners) on Thursday announced a definitive merger agreement under which Seadrill will acquire Aquadrill in an all-stock transaction. When the transaction is completed, Seadrill shareholders and Aquadrill unitholders will own 62% and 38% of the common shares in the new company, respectively. Based on Seadrill's 30-day volume-weighted average share price of US$31.25 on the NYSE as of December 22, 2022, the deal…

Oil Tanker Players Euronav, Frontline Plan $4.2B All-stock Merger

Belgian oil tanker group Euronav and smaller Oslo-listed rival Frontline plan to merge in an all-stock transaction valued at $4.2 billion that they said would cut costs and help in their low-carbon transition.Euronav shareholders will own 59% of the combined group and will also receive a cash dividend before the deal closes, while Frontline owners will hold the remaining 41%, the companies said in a statement on Thursday.The merged company will use the Frontline name and will…

Teekay LNG Rebrands as Seapeak

Shipping company Teekay LNG has rebranded as Seapeak following the completion of its acquisition by U.S.-based investment firm Stonepeak.One of the world’s largest independent owners and operators of liquefied natural gas (LNG) carriers, Teekay LNG announced in October that it entered into a merger agreement that would see Stonepeak acquire all issued and outstanding common units representing limited partner units in Teekay LNG, and its common un it holders voted to approve the deal in December.

SPII Holdings Acquires DryShips

The dry bulk shipping company based in Athens DryShips Inc. will be acquired by SPII Holdings Inc. a company controlled by George Economou, under which SPII will acquire the outstanding shares for $5.25 per share in cash, without interest.As previously disclosed, DryShips is to be merged into a subsidiary of SPII Holdings, a company controlled by DryShips’ chairman and CEO George Economou.The deal is expected to close in the fourth quarter of 2019. The $5.25 per share price represents a premium of approximately 66% over the company's $3.16 closing stock price on June 12.The $5.25 per share price reflects an increase of approximately 31% over the purchase price of $4.00 per share proposed in the Initial Offer.The company’s board of directors…

C&J Energy, Keane Merge in $1.8bln Deal

Oilfield services firms C&J Energy Services and Keane Group, said that they will merge in an all-stock deal valued at about $1.8 billion.C&J Energy, which offers a suite of oil and gas production services, and Keane, which specializes in well completions would combine in what the companies described as a merger of equals. The deal would create a company with more than $4 billion in annual revenues.Under the terms of the merger agreement, which has been unanimously approved by the Boards of Directors of both companies and the Special Committee of the Keane Board, C&J shareholders will receive 1.6149 shares of Keane common stock for each share of C&J common stock owned. The merger agreement permits C&J to pay its shareholders a cash dividend of $1.00 per share prior to closing.

Transocean Shareholders OK Ocean Rig Acquisition

Transocean, international provider of offshore contract drilling services for oil and gas wells, has announced that its shareholders approved the acquisition of Ocean Rig UDW, by approving the proposals presented at Transocean’s Extraordinary General Meeting. Switzerland-based offshore drilling contractor quoted its President and CEO Jeremy Thigpen in a press release, as saying: "We are extremely pleased that our shareholders have overwhelmingly approved our acquisition of Ocean Rig. Through this combination, Transocean further enhances our industry-leading fleet of high specification floaters, thus improving our competitive position."Thigpen…

Poseidon Containers Inks TC with CMA CGM

The containership charter owner Global Ship Lease (GSL) announced that Poseidon Containers, with which it has entered a definitive merger agreement, has agreed five-year time charters with CMA CGM for four of its 6,927 TEU containerships, Mary, Kristina, Katherine and Alexandra.The charters will deliver incremental annualized EBITDA of approximately $11.0 million compared to third quarter 2018 contracted rates. The new charter for Mary commenced recently, and the remaining three new charters will commence upon expiry of their existing charters during the first half of 2019. The new five-year charters are expected to generate total EBITDA of approximately $135 million over the five-year contract period.Ian Webber…

Encana Acquires US Shale Producer Newfield Exploration for USD 4.1 billion

Canadian oil and gas producer Encana has signed a deal to acquire all of the outstanding shares of common stock of Newfield Exploration Company in a USD 4.1 billion deal that will provide the former with significant positions in some of North America’s biggest oilfields.In addition, Encana will assume CAD 2.2 billion of Newfield net debt. The strategic combination will create a leading multi-basin company and has been unanimously approved by the Boards of Directors of both companies.Subject to receipt of regulatory and shareholder approvals by both companies, the transaction is expected to close in the first quarter of 2019.Under the terms of the merger agreement…

Navios Maritime Acquisition to Take Over Navios Maritime Midstream

Greece-based owner and operator of tanker vessels Navios Maritime Acquisition agrees to merge with Navios Maritime Midstream Partners.Under the transaction, each Navios Midstream unitholder will receive 6.292 newly issued Navios Acquisition share; or 1.0 share of a newly issued preferred stock of Navios Acquisition convertible into 5.1 shares.Navios Midstream publicly held units for which no election is made will be deemed to have elected the form of consideration most elected by holders of publicly held units of Navios Midstream. In addition, if holders representing 80% or more of the publicly held units of Navios Midstream elect (or are deemed to have elected) to receive Navios Acquisition common stock consideration…

Bergen Group Merges with Endúr Fabricom

A merger agreement between Bergen Group ASA and oil service company Endúr Fabricom will create an industrial group based in western Norway with close to 400 employees and an order book exceeding NOK 1 billion. The combined company will have considerable presence in both the oil and gas markets, in maritime service and towards the aquaculture industry.Hans Petter Eikeland, Chairman of the Board at Bergen Group ASA, states that the merger agreement has full support from the company's main shareholders…

Harvey Gulf Proposes Merger with GulfMark

New York listed offshore services provider GulfMark Offshore, Inc. said it is reviewing an unsolicited merger proposal from rival HGIM Corp. (Harvey Gulf), just weeks after entering a definitive agreement to merge with larger rival Tidewater Inc.Harvey Gulf’s nonbinding competing offer submitted August 1 proposes that it be acquired by GulfMark and the combined company remain publicly listed. GulfMark common stockholders would own 41.2 percent and Harvey stockholders would own 58.8 percent of the combined company…

Ensco Completes Acquisition of Atwood Oceanics

Ensco plc announced today that Ensco shareholders voted to approve the allotment and issuance of Ensco Class A ordinary shares to shareholders of Atwood Oceanics in connection with the all-stock acquisition of Atwood at the Company’s general meeting of shareholders on 5 October 2017. The final results of the general meeting of shareholders held today indicate that 65% of the shares cast at the meeting voted in favor of this proposal. Carl Trowell, Ensco’s President and Chief Executive Officer, said, “We are extremely pleased that Ensco shareholders recognized the strategic and financial merits of our combination with Atwood. "By acquiring Atwood at a pivotal time in the market cycle…

Scorpio Tankers Merges with Navig8 Product Tankers

Scorpio Tankers has entered into definitive agreements to merge with Navig8 Product Tankers and acquire Navig8’s 27 operating product tankers. Subject to the terms and conditions of these agreements, Scorpio will acquire four LR1 tankers prior to the closing of the Merger (the LR1 Vessel Acquisitions) and the remaining 23 tankers upon the closing of the merger in exchange for the issuance of 55 million shares of Scorpio common stock to the Navig8 shareholders. In connection with the LR1 vessel acquisitions, Scorpio will pay cash consideration of $42.2 million, which is net of assumed debt. This cash is expected to remain with Navig8 through closing and will form part of the balance sheet of the combined company, subject to the terms and conditions of the merger agreement.

Consolidated Container Fleets Worth $33.4 Billion

Following the sale of Hamburg Süd to Maerskfor $4 billion, VesslesValue senior analyst William Bennett has compiled a report on the top consolidated container fleets. Currently these top five fleets are worth $33.4 billion and account for 33 percent of the entire container fleet. Maersk have confirmed rumors that they will acquire German container shipping line Hamburg Süd. Hamburg Süd’s strong position in north-south trades will complement Maersk's current business. Maersk is thought to have paid roughly $4 billion for Hamburg Süd whose fleet is worth $1.5 billion.

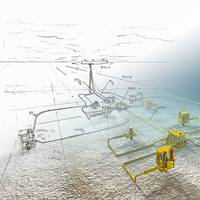

TechnipFMC Begins Operations Post-merger

TechnipFMC has begun operating as a unified oil and gas services company following completion of the merger of Houston-based FMC Technologies and paris-based Technip. Now with a combined 44,000 employees, the new TechnipFMC will work on oil and gas projects, technologies, systems and services “from concept to project delivery and beyond” with headquarters in Houston, London and Paris. A key focus for TechnipFMC will be project economics across subsea, onshore/offshore and surface, the company said in a press release.

Baltic Trading Reports Loss

Baltic Trading Limited, a Marshall Islands company formed by Genco Shipping & Trading Limited, reported a loss of $42.4 million in its first quarter. The New York-based shipping company focused on the drybulk industry spot market said it had a loss of 75 cents per share. Losses, adjusted for asset impairment costs, came to 21 cents per share. The results fell short of Wall Street expectations. The average estimate of five analysts surveyed by Zacks Investment Research was for a loss of 19 cents per share. The ship owner posted revenue of $6.9 million in the period, also falling short of Street forecasts. Three analysts surveyed by Zacks expected $8.9 million.

Hapag-Lloyd, UASC Signs Merger Agreement

Hapag-Lloyd AG (Hapag-Lloyd) and United Arab Shipping Company S.A.G. (UASC) have signed a Business Combination Agreement (BCA) to merge both companies, subject to the necessary regulatory and contractual approvals. Besides the Business Combination Agreement (BCA) between the two companies, the controlling shareholders, namely CSAV Germany Container Holding GmbH, HGV Hamburger Gesellschaft für Vermögens- und Beteiligungsmanagement mbH and Kühne Maritime GmbH on the side of Hapag-Lloyd, and Qatar Holding LLC on behalf of the State of Qatar and The Public Investment Fund of the Kingdom of Saudi Arabia on the side of UASC, have assumed certain commitments with regard to the merger and the future equity funding of the company in a separate agreement…

Merger Unites Canada/US Shipping Voices

The Chamber of Marine Commerce will assume the assets, liabilities and staff of the Canadian Shipowners Association (CSA) following a new merger agreement that aims to create a united voice for commercial shipping in Canada and the United States. “We’re uniting two organizations that have successfully promoted the interests of commercial marine shipping for many decades,” said Wayne Smith, Chairman of the Chamber of Marine Commerce. “One of our common objectives is to foster a harmonized and efficient regulatory climate throughout the bi-national Great Lakes and St.

Chamber of Marine Commerce Taps Johnston as Interim President

The board of directors of the Chamber of Marine Commerce has appointed Raymond Johnston as interim President, effective October 1, 2016. Johnston will oversee the implementation of the merger between the Chamber of Marine Commerce and the Canadian Shipowners Association (CSA) announced last week and will lead the association until the recruitment process for a new president is completed. Under the terms of the merger agreement, the Chamber of Marine Commerce and the CSA will be…

Frontline Reports Strongest 3Q

* Frontline achieved net income attributable to the Company of $17.4 million, or $0.09 per share, for the third quarter of 2015 and net income attributable to the Company of $65.9 million, or $0.42 per share, for the nine months ended September 30, 2015. * The long-term charters for the 1995-built Suezmax tankers, Front Glory and Front Splendour, were terminated in September and October, respectively. The Company received compensation payments of $2.2 million and $1.3 million, respectively, for the termination of the charters. * In November, the Company agreed to terminate the long-term charter for the 1998-built Suezmax tanker, Mindanao. The charter is expected to terminate in the fourth quarter of 2015.