'Mega Green Port' Project Planned in Åland

OX2 and the Bank of Åland’s mutual fund subsidiary Ålandsbanken Fondbolag, which are developing the Noatun North and Noatun South offshore wind power projects near Finland’s Åland archipelago in the Baltic Sea, have initiated a feasibility study for the planning and establishment of a “Mega Grön Hamn” (Mega Green Port) with a location coexisting with the port of Långnäs in Åland. The project is part of an effort to create a green hub in Åland, with an extra focus in this project…

GRSE Announces Public Offer

Garden Reach Shipbuilders & Engineers Limited, proposes to open on September 24, 2018, an initial public offering of equity shares of Face Value of Rs. 10 each (“Equity Shares”) for cash at a Price per Equity Share (including a Share Premium) (“Offer”) comprising a offer for sale 29,210,760 Equity Shares by the Promoter, The President of India, acting through the Ministry of Defense, Government of India (“The Selling Shareholder”).The offer includes a reservation of up to 572,760 equity shares for subscription by eligible employees (as defined herein) (“Employee Reservation Portion”).

APM Terminals Pipavav Reaches Out to the Physically Challenged

APM Terminals Pipavav one of Western India’s gateway ports, in association with Shri Bhagwan Mahavir Viklang Sahayata Samiti (BMVSS), Ahmedabad; SBI Mutual Fund and Shri Somnath Trust successfully organized a camp for the physically challenged individuals of Amreli of Rajula, Jaffrabad, Khamba, Savarkundla and Mahua villages. The camp was inaugurated by Mrs. Heenaben Shah, Director, APM Terminals Pipavav, Mr. P.K. Lehri, Director, APM Terminals Pipavav and Mr. Lalitbhai Jain, Chairmen BVMSS. APM Terminals Pipavav employees volunteered to run a help desk at the camp site to guide the villagers and also helped the doctors and nurses throughout the program.

U.S. Commodity ETFs Fall for Fifth Quarter

U.S. retail and institutional investors pulled cash from broad commodity exchange-traded funds for a fifth straight quarter even as coffee, natural gas and hogs prices had their best run in years, data from Thomson Reuters Lipper showed on Wednesday. Lipper, which tracks nearly 270 U.S. exchange-traded commodity funds and products worth about $240 billion, noted a net outflow of nearly $2.7 billion in the first quarter of this year. The data contrasts with positive flows for broad commodity exchange-traded products tracked by BlackRock for the same quarter. With the Lipper data, the outflows were largely in two commodity ETFs run by Boston-based mutual fund manager Fidelity Investments. The outflow appears to be slowing from the $16 billion outflow in the fourth quarter of 2013.

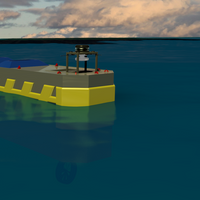

Airborne Oil Spill Response System May Take Off

An investment research report draws attention to Scout Exploration, Inc. developers of a unique airborne oil spill technology response system. The system is designed to contain offshore and shoreline oil spills, of which there are hundreds every year, ranging from tens of millions of gallons to millions of barrels of oil in size, causing up to tens of billions of dollars' worth of ecological and business damages. Through a recent transaction, Scout has acquired the rights to what may be the most effective method of oil spill containment and remediation.

Pipavav Shipyard in Talks to Set Up Diesel Engines Factory

India’s newest private shipbuilding firm,Pipavav Shipyard Ltd, is the latest in a growing list of firms looking to enter the business of making diesel ship engines in an attempt to meet growing demand for these in India and in other parts of the world, and is talking to two multinational firms for a partnership. Last week, Pipavav Shipyard started work on the first four of 26 Panamax bulk carriers that have been ordered by Norwegian, French and Greek fleetowners for a total of $1.1 billion (Rs4,360 crore). The contract makes Pipavav the world’s second biggest Panamax size shipbuilder by order size after Japan’s dry bulk cargo shipbuilding specialist Oshima Shipbuilding Co. Ltd.

Golden Ocean Resells Six Bulk Carriers

A multinational shipping firm that has signed a deal to have its ships built at an Indian shipyard, which is still under construction, has already sold the ships, an indication of growing demand for ocean-going vessels. This is the first time such a thing is happening at an Indian shipyard. The yard, Pipavav Shipyard Ltd, is under construction and will not start building ships before February 2008. On 19 March, the Bermuda-based Golden Ocean Group Ltd.—the dry bulk cargo ship operating firm controlled by Norwegian shipping tycoon John Fredriksen—had placed orders with Pipavav Shipyard to build four Panamax bulk carriers, each with a cargo carrying capacity of 75,000 tonnes. The agreed price of each vessel was $35.5m. The company also placed an "optional" order for two more Panamax vessels.

MFs Lukewarm Over Offshore Investments

The domestic mutual fund industry has raised only about $400-500m from local investors for offshore investment schemes, indicating that the hike in the overall limit for such schemes by $1b to $5b by the Reserve Bank of India (RBI) was just an enabler for the industry to offer global diversification for investors and there was no pressing requirement, say analysts. The regulations, which also hiked the individual cap on mutual funds to $300m for offshore schemes, have never been a hurdle for the industry, they say. Fund managers have been making a case for diversification, but going by the trend of some recently launched offshore funds, they are not appropriately diversified. Most of the funds have been investing into emerging markets across Asia, where there is concern about volatility.

NOL Management Changes Causes Shares Rally

Shares of shipping and logistics group Neptune Orient Lines Ltd. (NOL) surged almost 10 percent last Tuesday on optimism over recent management changes, dealers said. "We are buying on the back of increasing confidence in the market, higher assurance that the Fed will not be doing anything drastic and hope that NOL's new management would bring positive changes," said one dealer. In late September, NOL announced the hiring of more senior executives from Sea-Land Services as senior officials for its container transportation arm, APL, including Fleming Jacobs as the new chief executive officer. The moves were seen as positive and reinforced the shipping group's commitment to grow its European and North American presence.