Profitability Still a Way Off for Tanker Shipping -BIMCO

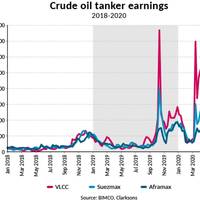

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the National Bureau of Statistics China.Despite the 12.0% growth in crude oil processing, Chinese crude oil supply, which includes imports and domestic production, has only grown by 2.3% in the first five months of this year.

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

Coronavirus Leaves China-bound Tankers Stranded

The coronavirus's effect on energy markets is worsening, as the sharp fall in demand in China, the world's largest importer of crude, is stranding oil cargoes off the country's coast and prompting shippers to seek out other Asian destinations.More than 1,360 people have died from the coronavirus in China, which has disrupted the world's second largest economy and shaken energy markets, with international benchmark Brent crude oil down 15% since the beginning of the year.Major international energy forecasters expect demand to fall in this quarter…

US Refiners Grab HSFO on Back of IMO 2020

U.S. refiners are scooping up cheap high-sulfur fuel oil for processing from Russia and the Baltic states as they take advantage of new shipping rules that have cut demand for the dirtier marine fuel, according to oil traders and shipping data.U.S. refiners Valero Corp, Chevron Corp and Phillips 66 have been buying HSFO, traders said, taking advantage of their complex operations to turn HSFO blended with crude oils into products like diesel, gasoil and gasoline.This month, 2.2 million tonnes of fuel oil…

Vens Pledge Funds for Argentine Shipyard to Finish PDVSA Tankers

Venezuelan President Nicolas Maduro on Sunday pledged funds for a state-owned Argentine shipyard to finish building two long- overdue tankers for state oil company Petroleos de Venezuela, which is struggling with a diminished tanker fleet.Maduro, a socialist who has overseen a drastic economic collapse in the once-prosperous OPEC nation and stands accused of corruption and human rights violations, did not say how much money Venezuela would provide or when it would be disbursed.But the statement suggests he sees left-leaning Alberto Fernandez' victory in last month's Argentine presidential election as an opening to revive the construction.

Concordia Expects Stong Tanker Market

During the first half of 2019, the tanker markets produced voyage result per day levels that exceeded the corresponding period in the slump year 2018 by 50-100 percent, said Concordia Maritime.The Swedish international tanker shipping company's view of market development going forward is largely unchanged.Several factors still point to a gradually stronger market in autumn, it said. In addition to positive fundamentals in the form of sustained high demand for oil, seasonality and declining net tanker fleet growth, US exports of crude oil and oil products and the consequences of IMO 2020 are also helping to create exciting conditions."With regard to OPEC’s production, we had expected a decision on a gradual return to normal production rates at their July meeting.

US to Overtake Saudi in Oil Exports

United States will soon export more oil and liquids than Saudi Arabia, thanks to the continued rise in oil production from US shale plays and the increased oil export capacity from the Gulf Coast.According to Rystad Energy, energy research and business intelligence company, it is a a pivotal geopolitical shift. The US has for decades relied on large-scale imports to satisfy its thirst for oil, but this is about to change.The Energy Information Administration (EIA) reported last week that the United States exported more crude and petroleum products than it imported. Granted, the EIA followed up with a report this week that US crude oil stocks had risen by 7.1 million barrels in a week…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Hedge Funds Watch U.S. Refinery Restarts

Hedge funds are betting crude oil stocks will adjust quickly to the aftermath of Hurricanes Harvey and Irma but gasoline and distillate inventories may take more time to normalise. Hedge funds and other money managers increased their combined net long position in the five major petroleum contracts linked to crude, gasoline and heating oil by 46 million barrels in the week to Sept. 5, according to the latest regulatory and exchange data. Fund managers recovered some of their pre-hurricane bullishness after cutting net long positions in the petroleum complex by a total of 116 million barrels over the previous two weeks (http://tmsnrt.rs/2jhR0sX).

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.

Oil's Price Fall Stalls Despite Supply Glut

Brent down 12 pct since OPEC-led production cut extension. Oil prices steadied on Friday after steep falls earlier in the week under pressure from widespread evidence of a fuel glut despite efforts led by OPEC to tighten the market. Brent crude oil was up 10 cents at $47.96 a barrel by 1130 GMT, but still 12 percent below its opening level on May 25, when an OPEC promise to restrict production was extended into 2018. U.S. crude was 10 cents higher at $45.74. The Organization of the Petroleum Exporting Countries and other big producers have agreed to pump almost 1.8 million barrels per day (bpd) less than they supplied at the end of last year, and hold output there until the first quarter of 2018. But world markets are still awash with oil.

Full Tanks & Tankers: A Stubborn Oil Glut Despite OPEC Cuts

After the first OPEC oil production cut in eight years took effect in January, oil traders from Houston to Singapore started emptying millions of barrels of crude from storage tanks. Investors hailed the drawdowns as the beginning of the end of a two-year supply glut - raising hopes for steadily rising per-barrel prices. It hasn't worked out that way. Now, many of those same storage tanks are filling back up or draining more slowly than investors and oil firms had expected, according…

Aframaxes Taken for Short-term Time Charters in Asia

The Asian Aframax market is currently stable but seems to be facing a more positive outlook on the back of short-term time charters as well as an increase in third decade cargoes. Rates for an Indonesia/Japan run basis 80 kt are hovering around w100 to w102.5, while rates for the AG/East route basis 80 kt stand at w115. Reflecting firmer owner sentiment, TD14 inched up steadily w-o-w to w100.78 which translates into daily earnings of around $8,700/day. At least three Aframaxes…

Bimco Expects 'Die-hard Competition' to Continue in 2017

2017 will see another year of die-hard competition, which now includes tankers, says International shipping association Bimco. The shipping industry has its work cut out going forward in 2017 as the International Monetary Fund (IMF) forecast the lowest level of global GDP growth since 2009. In 2016, the container shipping industry bit the bullet in terms of demolition and consolidation to help the market to recover. The dry bulk sector needs to copy that approach«. Bimco said in market outlook released today. Looking forward to 2017, Bimco said that it is vitally important that shipowners handle the supply side of the market 'with great care'. A continuance of the alarmingly low level of demolition activity in the second half of 2016 simply would not deliver the needed zero fleet growth.

BIMCO: What Shipping Market can Expect for 2017

The shipping industry has its work cut out going forward in 2017 as the International Monetary Fund (IMF) forecast the lowest level of global GDP growth since 2009. 2017 will see another year of die-hard competition, which now includes tankers. In 2016, the container shipping industry bit the bullet in terms of demolition and consolidation to help the market to recover. The dry bulk sector needs to copy that approach. The longer global economic growth remains weak and lacks investment, the lower future growth potential for shipping. For eight years, the world has struggled to cope with huge changes and challenges brought around by the crash of the financial market in 2008.

US Crude Stocks up, Product Inventories Fall -EIA

U.S. crude oil stocks unexpectedly rose last week, while gasoline and distillate product inventories dropped, the U.S. Energy Information Administration said on Thursday. Crude inventories were up 614,000 barrels in the week to Dec. 23, compared with expectations for a decrease of 2.1 million barrels. Oil prices were little changed on the news after a bit of volatility immediately following the release. U.S. crude oil futures were up 1 cent to $54.08 a barrel at 11:38 a.m. EST (1638 GMT), leaving the benchmark just shy of the year high of $54.51 reached on Dec. 12. "What seems to be giving this report kind of a bullish tilt is the fact that we saw pretty a good drawdown in both gasoline and distillate inventories," said Phil Flynn, trader at Price Futures Group in Chicago.

What’s New in Floating Production? December 2016

The December WER report examines whether OPEC’s decision to limit crude production will accelerate deepwater project starts over the next 12 to 24 months, given 3 billion barrels of oil stocks in global inventory, 5,000+ drilled-but-uncompleted shale wells in the U.S. ready to be fracked and likelihood that producers will cheat on output quotas. As we discuss in the report, the output cut could stimulate deepwater orders – but with a time lag. We also assess whether Hoegh and Maran’s orders for seven speculative FSRUs (two firm…

Nigeria: What are the Implications for Tanker Demand?

Nigeria’s crude oil production and exports have been hit by severe outages as a result of attacks on oil infrastructure by rebel fighters in the Niger River Delta. Various sources report that Qua Iboe Terminal has shut down operations until further notice. All tanks on the facility were emptied of crude, operations have ceased completely and all personnel have been evacuated from the terminal, which is operated by ExxonMobil. Qua Iboe is Nigeria’s largest crude oil stream and exports usually more than 300,000 barrels per day (b/d). Exports of Nigeria’s other large crude oil grades, like Forcados, Bonny Light and Escravos have also been restricted, primarily due to sabotage and attacks on pipelines. As a result of the outages Nigeria’s oil production has dropped below 1.5 mb/d.

Dark Cloud of Offshore Storage Looms

Glencore books the STI Grace tanker to store fuel at sea-traders. This has not been the summer many oil traders had expected after last year's bumper profits. Banking on more of the same, the world's refineries have churned out more diesel, gasoline and jet fuel than eager drivers and holiday makers have been able to consume even over the summer travel season. Fuel inventories in the United States, Europe and Asia are brimming despite the height of peak summer driving. European traders are now moving to store diesel on tankers at sea as on shore storage tests its limits yet again. At least one vessel, the 90,000 tonne STI Grace has dropped anchor off the chic holiday town of Southwold on England's east coast in what traders said was floating storage. The vessel was chartered by Glencore.

2016 VLCC Earnings Will Surpass 2014 -BIMCO

Lower growth rates for refinery throughput and drawdowns on swollen oil stocks has impacted the seaborne tanker market negatively. BIMCO expected this to happen. BIMCO has reduced its forecast for crude oil tanker demolition in 2016: from 5 million DWT to 3 million DWT. By mid-August, only 0.76 million DWT of crude oil tanker capacity proved to be in such poor condition that it could no longer be traded in the strong freight market. Limited fleet growth is key to keeping freight rates at a profitable level. This lack of demolition means the supply of new tonnage weighed down the market, making the shift to a fundamental imbalance quicker and harder felt. Especially as the growth rate on the demand side is coming down from last year’s peak.

Low Tanker Rates Boost Long-distance Trade -EIA

Recent expansion of the global crude oil and petroleum product tanker fleet has resulted in falling or lower tanker rates for much of 2016 that have widened the geographic scope for economically attractive trade at a time when inventories of both crude oil and petroleum products are at high levels, according to the U.S. Energy Information Administration (EIA). In recent years, growing global oil production and growth in global refining capacity in markets distant from crude sources led to an increase in orders for new vessels in anticipation of an increasing need for tanker transportation.

LNG Prices Rise as South Korea to Wrap Up Major Tender Award

Asian spot liquefied natural gas (LNG) prices rose this week as strong expected demand from South Korea added to appetite from India and Taiwan, while supply from the United States was slow to return from maintenance. The price of LNG for December delivery was $6.95 per million British thermal units (mmBtu), up around 15 cents from a week earlier. Attention was on a tender by Korea Gas Corp which has by all accounts exceeded its initial scope and drawn bids by 25 companies offering to supply around 50 cargoes in total - even though it only advertised demand for four shipments. In reality, though, Korea Gas Corp is expected to purchase up to 15 or more cargoes to cover strong winter needs as nuclear outages and low LNG stocks prompt a buying spree.