Crude Tanker Rates Expected to Stay Strong Despite Russia Turmoil

Prospects for the crude oil tanker market are expected to stay strong for at least the next year helped by low ship ordering, despite the loss of some trade from Russia due to Western sanctions, leading ship operators say.Russia has increased exports to Asia, Africa and South America following the imposition of Western sanctions for its invasion of Ukraine.

Performance Shipping Adds Secondhand Aframax Tanker

Greek tanker owner Performance Shipping announced it has taken delivery of the a 2009-built 105,071 dwt Aframax tanker that it agreed to purchase in June 2022.The vessel, formerly known as Maran Sagitta, has been renamed P. Sophia. It was built in 2009 by Hyundai Heavy Industries Co., Ltd. in Ulsan, South Korea. Performance Shipping acquired the vessel for a gross purchase price of $27,577,320.Andreas Michalopoulos, Performance Shipping’s chief executive officer, said the delivery increases the company’s fleet to a total of six Aframax tankers, all currently operating in the firm spot charter market. “The addition of this high specification vessel…

Oil Tanker Market Set to Endure Low Earnings for Another Year -BIMCO

The global oil tanker market faces another year of low earnings as the coronavirus pandemic and vaccine inequalities disrupt demand and producers limit output of crude, a shipping analyst said on Wednesday.The earnings of very large crude carriers (VLCCs) that carry the bulk of crude stand at about $10,000 a day, down from 2020 record highs of more than $240,000, after the pandemic battered demand, creating an oil surplus and a scramble for storage.Despite a patchy recovery in global oil demand and some easing of output cuts…

Oil Tanker Market Facing Rougher Seas

A plunge in the volume of crude oil stored on ships combined with unexpected cuts from top producer Saudi Arabia have created a glut of vessels available for hire, pressuring the outlook for supertankers this year.Earnings for very large crude carriers (VLCCs) in 2020 reached record highs of more than $240,000 a day as the coronavirus battered demand, creating an oil surplus and a scramble for storage on land and sea. Rates have since dropped to $7,000 a day.“Right now, it is really as bad as it gets for the VLCC market.

BIMCO: Oil Tanker Market Recovery Will be Slow and Gradual

The recovery of the global oil tanker market will be slow and gradual. We have forecast this many times during 2020, as the COVID-19 pandemic wreaked havoc on past, present and future oil consumption.On 8 December, the U.S. Energy Information Administration (EIA) estimated that the global consumption of oil will reach 98.2 million barrels per day (m b/p) in 2021, a 6.3% rise, 5.8m b/d on average, compared with the same figure in 2020. The good news is quickly soured, however, as the 2021-level will fall short of the 2019 oil demand by 3 million barrels per day.

NAT Expects Tanker Market Lull Will Be Short Term

The recent slowdown in the oil tanker market is expected to be short-lived, shipowner Nordic American Tankers (NAT) said Friday in a letter to shareholders.NAT, which owns 25 suezmaxes including the two newbuilds on order from South Korean shipbuilder Samsung Heavy Industries for delivery in 2022, said it has been receiving many comments and questions regarding the current market situation."There has been a certain lull in the market recently, which we regard as a short term phenomenon," the company said. "NAT is in a positive phase of development."NAT, which is preparing to publish its results on November 16, said, "A company can go three ways: sideways, downwards or upwards.

Geopolitics Dominate the Oil Tanker Market -BIMCO

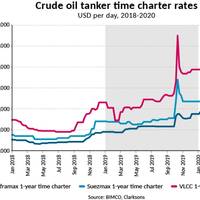

Developments in the oil tanker market in the past decade dominated by geopolitics, says shipping association BIMCO.Crude oil and product tanker markets alike have faced high volatility in recent weeks and months, largely due to geopolitics and the constantly evolving situation in the global oil markets. The first major disturbance since the fall in the oil price between the fourth quarter of 2104 and first quarter of 2016 came in the fourth quarter of 2019, after which freight rates have bounced back despite a collapse in demand.In these extraordinary times…

Oil Tankers Turn Away From Venezuela as More Sanctions Loom

Oil tankers that were sailing toward Venezuela have turned around and others have left the country’s waters as the United States considers blacklisting dozens of ships for transporting Venezuelan oil, according to shipping data and industry sources.The threat of tighter sanctions is already disrupting the global shipping market. Chinese oil firms are considering whether to decline to charter any tanker that has visited Venezuela in the past year, no matter where the ship is now or for what voyage, four shipping sources told Reuters on Tuesday.Washington is seeking to oust the socialist government of President Nicolas Maduro by choking the oil exports that provide its main source of income.

Chinese Firms May Avoid Tankers That Have Carried Venezuelan Oil

Chinese oil companies may soon decline to charter any tanker that has visited Venezuela in the past year to avoid disruption to operations if the United States blacklists more ships for trading with Caracas, four shipping sources told Reuters on Tuesday.The U.S. government is seeking to choke Venezuelan oil exports to starve the government of socialist President Nicolas Maduro of its main source of revenue. Existing sanctions have cut Venezuelan exports sharply, but Maduro has held on.Washington may tighten sanctions by adding dozens more tankers to an existing blacklist, U.S.

Crude Oil Tanker Earnings Drop 68% in Nine Days -BIMCO

Crude oil tanker earnings have come down sharply in recent weeks with very large crude carrier (VLCC) earnings from the Middle East Gulf to China dropping 68% in just nine days (from $222,591 per day on April 22 to $71,885 per day on May 4), according to BIMCO. In the same period, daily VLCC earnings from the Middle East Gulf to the U.S. Gulf have plunged nearly 80% (from $162,433 per day to $36,249).The window of extraordinary earnings closed at the end of April with the OPEC+ oil production cuts of 9.7 million barrels per day (bpd) on May 1, reducing the flood of oil in the market.

Jones Act Tankers Booked for Storage, Foreign Trips Amid Oil Glut

Oil traders are hiring expensive U.S. vessels, normally only used for domestic shipments, to store gasoline or ship fuel overseas, five shipping sources said, in a sign of the energy industry's desperation for places to park petroleum amid a 30% drop in worldwide demand.Billions of people worldwide are living under confinement rules due to the coronavirus pandemic, destroying demand for gasoline and other fuels and creating a supply glut. Storage tanks onshore and floating storage in tankers on the water are rapidly filling, leaving fewer options for traders looking to sock away oil.Several shippers said they have started to book Jones Act (JA) vessels for foreign voyages or to store refined products.

While Oil Prices Plummets, Tanker Rates Fly High

If one ever needed proof that, no matter how dire the situation, there is always a silver lining, look no further than the crude tanker market, which has seen it day rates skyrocket in the face of a global pandemic that has effectively ground world commerce to a crawl.As is the case with other gravity defying business phenomena, geopolitics is a central factor, in this case a battle between Russia and Saudi Arabia to flood the world with oil in the face of declining demand and…

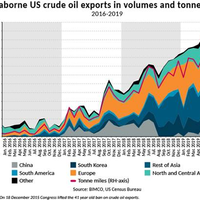

US Seaborne Crude Oil Exports Up 51%

December could boast another all-time high for US seaborne crude oil exports, totaling 13.9 million metric toes and exceeding the previous October record by almost a million metric tons. In 2019, 133 million metric tons of sweet US crude oil was exported by sea, a 51% increase from 2018.Due to the US shale revolution, the country became a net seaborne crude oil exporter in October 2019, and the record-breaking exports in December solidified the trend, as imports for the month amounted to 11.5 million metric tons crude oil.

Norsepower, SWS Complete VLCC Project

Finnish provider of auxiliary wind propulsion systems for ships Norsepower has completed a joint project with China’s Shanghai Waigaoqiao Shipbuilding (SWS) for the development of an energy-efficient dual-fuel 300,000 dwt very large crude carrier (VLCC) design.The design has already received an approval in principle (AiP) from classification societies Lloyd’s Register and ABS.Under the agreement, Rotor Sails were implemented in the VLCC design for improving the fuel efficiency and reducing emissions, the engineering company said.The impact of the installation of Norsepower’s Rotor Sail solution, including a review of structural reinforcement and visibility calculation…

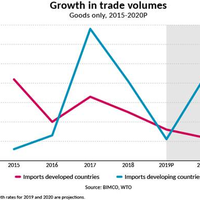

BIMCO: Tanker Shipping and Macroeconomics Outlook

World growth and trade volumes under pressure, but still positive. A continued slowdown in global growth, as well as a lower trade multiplier will reduce overall demand for shipping for the rest of this year and through 2020.Expectations for global trade growth have also been lowered for 2020; this is now forecast at 2.7%, down from 3%. The WTO cautions that risks to these forecasts are weighted to the downside, with these risks including a potential deepening of trade tensions…

OGCI Invests in Wind Power for Ships

OGCI Climate Investments has led an EUR 8 million investment round in Norsepower, along with current investors, to accelerate Norsepower’s growth on global markets.The investment enables Norsepower to scale up production at its manufacturing facilities as part of a next phase of commercialization triggered by demand for its renewable wind energy propulsion systems, said a press release from Norsepower Oy Ltd., the provider of low maintenance, software operated, data verified auxiliary renewable wind energy propulsion systems.The increased take-up comes at a time when the international shipping industry looks to offset expensive fuel…

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high volume of 2.3m tonnes.1.2m tonnes were shipped to China between June 1, and June 30, , up from 1m tonnes in May and worlds apart from no exports at all in the months of August through October in 2018…

BIMCO: US Seaborne Crude Oil Exports Hit Record High

US exports of crude oil have, since August 2018, continued to rise every month, with a new record high in January of 9.6 million tonnes. Exports rose in January on the back of increased sales to Europe, which rose from 2.7 million tonnes in December to 4.8 million tonnes in January.A strong end to 2018 meant that volumes for the full year totalled 87.4 million tonnes, 96.7% higher than the 44.4 million tonnes exported in 2017. This is good news for the crude oil tanker sector…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Jefferies Upbeat on LNG, LPG and Dry Bulk Shippers

Jefferies optimistic on stocks of LNG, LPG and dry bulk shippers With spot rates at 4-year highs, brokerage says, "we believe additional LNG liquefaction terminals will continue to stimulate LNG shipping demand above and beyond LNG shipping supply growth" All shipping sectors to improve through 2018, 2019; "seasonal patience will be required in the dry bulk, refined products and crude tanker sectors" - Jefferies Improvement in global economic conditions and Chinese preference for high-quality dry bulk commodity imports will help dry bulk carriers Refinery capacity additions to

Second-hand Ship Sales Reach 10-year High

Shipping struggles to recover from worst crisis in 30 years; market for new ships remains weak. Sales of second-hand ships reached a 10-year high on cautious optimism that one of the shipping industry's worst ever downturns is nearing an end. An increase in cargo demand has helped revive confidence this year in a sector that is starting to emerge from a 10-year slump fueled by owners splurging on thousands of new ships. "Second-hand purchases go up when optimism is thriving. 2017 has certainly been a year that has lent optimism a hand," said Peter Sand, chief analyst at shipping industry group Bimco. Some 1,630 ships worth $19 billion were sold in the year up to Dec. 15, the highest since 2007 when sales hit a record 1,894, according to shipping services firm Clarkson.

Bahri Optimistic of Oil Tanker Market

Bahri, a global leader in transportation and logistics, is very optimistic about the future of the oil tanker market and it believes that there will continue to be demand for this market, said Mohammed Al-Sarhan, Vice Chairman of Bahri, who possesses extensive experience in oil and gas, transportation and logistics, and other sectors. He was talking in the annual Bahri Oil Transportation Forum, which was held in Dubai last week. John Angelicoussis, Chairman of Angelicoussis Shipping Group Limited, said: “Markets where the population is high and where there is a very high GDP growth, for instance China and India, are markets that are immensely helping our industry.

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.