Saltchuk Takes Anther Run at OSG Takeover

Seattle-headquartered Saltchuk Holdings has renewed its bid to take over Overseas Shipholding Group (OSG), a New York-listed marine transportation company based in Tampa, Fla.Privately-held Saltchuk—OSG’s largest shareholder—had previously offered to acquire OSG in June 2021 but suspended those discussions several months later, citing pandemic-related market uncertainties.OSG, which operates U.S.-flag tankers and articulated tug barges (ATB), on Monday confirmed its board of directors…

OSG Pledges $90,000 to Mass. Maritime Academy Foundation

Overseas Shipholding Group (OSG) announced a three-year pledge in the amount of $90,000 to the Massachusetts Maritime Academy as the US. shipping company continues to promote women to receive training to enter the maritime industry.OSG said its pledge will go to undergraduate and sea term scholarships and sponsorship of the Academy’s Women’s Network and Sea, Science and Leadership Career Exploration Program. Scholarship recipients will have ongoing interaction with OSG and the opportunity to become familiar with OSG’s business and fleet of vessels.

Workboat Power: Alternatives Join Diesel to Power Current—and Future—Vessels

Analysts and commentators are quick to point out that fossil fuels will power maritime equipment, and indeed dominate the fueling marketplace, well into the future. However, they will do so alongside new fuels, and new technologies, that will be introduced to the maritime sector in the coming years. In its September, 2023 report “Beyond the Horizon: View of the Emerging Energy Value Chains”, the American Bureau of Shipping (ABS) explains that, “During the recent 80th meeting of the Marine Environment Protection Committee (MEPC 80)…

OSG to Install Starlink Fleetwide

U.S. shipping company Overseas Shipholding Group (OSG) announced it will equip all vessels in its fleet with Space X’s Starlink satellite internet service in a move that aims to enhance onboard connectivity for seafarers.Since the introduction to the market of Starlink’s Global Maritime service earlier this year, OSG’s IT department has worked to substantially complete installation of Starlink equipment on every vessel in the fleet of OSG and ATC, with full installation expected by year end…

Ask What Your Government Can Do For Your Industry (A 2023 Retrospective)

John F. Kennedy’s famous locution, “Ask not what your country can do for you, but you can do for your country” remains the rallying call for civic action and public leadership. The message remains foundational to the success of the United States, particularly as we head into an election year that once again appears to be filled with divisiveness and vitriol. That said, before we flip the calendar, it is important to set JFK’s message aside for a moment and reflect upon what our political leadership in Washington…

OSG to Upgrade Engines on Its Alaska Class Tankers

U.S. shipping company Overseas Shipholding Group announced it will upgrade all four vessels in its Alaskan Class fleet with new methanol-ready engines from MAN Energy Solutions.The vessels Alaskan Explorer, Alaskan Frontier, Alaskan Legend and Alaskan Navigator, all approaching 20 years in age, will receive significant engine and operational improvements, resulting in environmental benefits as well as extending their commercially useful life, OSG said.The lifecycle engine upgrades involve a series of technical and commercial enhancements…

OSG Buys Laid Up Jones Act Tanker from BP

U.S. shipping company Overseas Shipholding Group, Inc. (OSG) on Thursday announced it has reached an agreement with BP Oil Shipping Company to purchase the Jones Act compliant crude oil tanker Alaskan Frontier.Built by General Dynamics NASSCO in 2004, the 1.3-million-barrel capacity tanker is a sister to three other Alaskan Class vessels operated by OSG’s wholly owned subsidiary, Alaskan Tanker Company. It was part of Alaska Tanker Company's active fleet until 2019 when the vessel was placed in cold lay-up in Labuan, Malaysia.OSG said it expects the transaction will be completed in early November. Afterward, the company intends to reactivate the tanker…

OSG Pledges $30,000 for Women Offshore Scholarships

Tampa, Fla. based shipping company Overseas Shipholding Group, Inc. (OSG) continues its efforts to remove financial barriers for women entering the maritime industry with a scholarship pledge in the amount of $30,000. The scholarship funds will be used to support the Women Offshore Foundation’s 2024 Summer Sea Term Scholarship Program that is designed to help women+ enrolled at a U.S. maritime academy with financial support while they pursue a career on the water. This scholarship pledge is in addition to the $30…

Port of Los Angeles Pays Tribute to Shipping Lines That Reduced Emissions

The Port of Los Angeles has recognized the achievements of more than two dozen shipping lines and carriers for participating in the Port’s Vessel Speed Reduction Program (VSRP), an air quality and annual incentive program for vessel operators who reduce their speed as they approach or depart the port.The voluntary program is one of many sustainability efforts currently underway at the Port to reduce emissions and decarbonize operations.Emission reductions are achieved under the…

MARAD Announces First Ships Enrolled in the Tanker Security Program

The U.S. Department of Transportation’s Maritime Administration (MARAD) announced on Tuesday that nine ships have been enrolled in the Tanker Security Program (TSP), a newly created public-private partnership program that makes U.S.-flag commercial product tankers available to support U.S. armed forces and national economic security.“Today we are announcing the first ships to join the Tanker Security Program, which will help strengthen both our supply chains and our national security…

OSG Pledges $90,000 for Women at SUNY Maritime College

U.S.-based shipping company Overseas Shipholding Group (OSG) announced its support for women at SUNY Maritime College with a three-year pledge totaling nearly $90,000, in an effort to make strides in reducing the gender gap in the maritime industry and create equal opportunities for all. The funding will go towards scholarships for women and a student government organization at the college, Women of Maritime, which cadets launched to build community and bring more awareness to…

Military Sealift Command Awards Time Charter to Overseas Mykonos

Florida-based Overseas Shipholding Group, Inc. (OSG) has announced that the Military Sealift Command has awarded the Overseas Mykonos a time charter contract to provide ongoing fuel transportation services.The Overseas Mykonos will be delivered to the Military Sealift Command at Pearl Harbor in August. The time charter awarded is for a one-year base period with the option to extend the contract out to a maximum period of five and a half years.The vessel, built in 2010, is a medium range product tanker with 12 cargo tanks and a cargo capacity of 333,000 barrels. The ship has the ability to perform consolidated cargo replenishment at sea operations, providing flexibility and options for refueling the U.S. military fleet while underway.

OSG Crews Make Two At-sea Rescues in 18-hour Span

U.S. based shipping company Overseas Shipholding Group (OSG) said crews aboard two of its vessels rescued a total of six individuals in two separate incidents occurring within 18 hours of each other.On the evening of May 30, 2023, the crew of the Overseas Santorini, as well as two other vessels, were notified by U.S. Coast Guard Norfolk of a sailing vessel in distress in the middle of the Atlantic Ocean. The closest point of land was the Azores approximately 800 miles to the East.

MARAD Approves First Ships for Its Tanker Security Program

The U.S. Maritime Administration (MARAD) has approved the first vessels for participation in its Tanker Security Program (TSP), a newly created public-private partnership program that makes U.S.-flag commercial product tankers available to support U.S. armed forces.Modeled from MARAD's Maritime Security Program (MSP), the TSP assures the Department of Defense has access to U.S.-registered product tankers that may be used to supply the armed forces with fuel during times of armed conflict or national emergency.

OSG Crew Rescues 12 people in Gulf of Mexico

Florida’s Overseas Shipholding Group (OSG) has applauded the efforts of the crew of its vessel the Overseas Long Beach in rescuing 12 people on a vessel in distress.The Overseas Long Beach was on a voyage from Corpus Christi to Jacksonville when it found the boat. The people appeared to be out of food, water, and fuel and in need of medical assistance. In coordination with the U.S. Coast Guard (USCG) Sector New Orleans, the Master and crew of the Overseas Long Beach established communication with the distressed vessel…

Op-ed: Jones Act Waivers Do Little as Disaster Relief

Like swallows arriving in the spring, a chorus for Jones Act waivers can reliably be anticipated to accompany the annual parade of hurricanes across the geographical region covered by the Act. The logic: emergency situations dictate maximum emergency relief, and the Jones Act is perceived to be an obstacle to providing that relief. That perception is wrong.A review of hurricane induced disaster situations over recent years reveals that maritime supply chains into affected ports are rarely a problem.

Saltchuk Makes Bid for Overseas Shipholding Group

Seattle-headquartered Saltchuk Holdings informed the U.S. Securities and Exchange Commission (SEC) that it has proposed to buy the Overseas Shipholding Group (OSG) shares it doesn't already own for $3 each, lifting shares of the Tampa, Fla.-based marine transportation company on Friday.As of June 29, Saltchuk beneficially owned 15.2 million (17.5%) of OSG's outstanding shares, Saltchuk said in the SEC filing. The unsolicited bid reflects a premium of 43% to OSG's closing price of $2.10 on June 29.

US Fuel Supply Response Slowed by Mothballed Oil Tankers

Efforts to get fuel supplies to areas in the United States facing shortages have been slowed because shipowners have mothballed U.S.-flagged oil tankers that can make coastal voyages, shipping sources said on Wednesday.The shutdown of the Colonial Pipeline network to thwart a cyber attack has disrupted nearly half the East Coast's fuel supply and left parts of the southeast facing a severe shortage of gasoline and diesel. Colonial said it began to restart on Wednesday but warned it would take several days for fuel supply chain to return to normal.Pump prices have risen to a seven-year high as motorists rush to fill their tanks.One way…

New Tank Barge Delivered to OSG

Greenbrier Marine, a division of The Greenbrier Companies, Inc. announced the delivery of OSG 205, a 204,000-barrel capacity oil and chemical tank barge for dual-mode ITB service pursuant to U.S. Coast Guard NVIC 2-81, Change 1. The barge was delivered to Overseas Shipholding Group, Inc. (OSG), a provider of energy transportation services delivering crude oil and petroleum products throughout the U.S. and internationally. OSG 205 was paired with existing tug OSG Courageous.The new tank barge is the second that Greenbrier Marine has delivered to OSG this year…

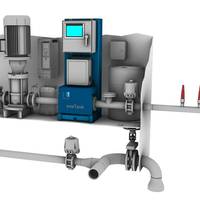

OSG Taps oneTank for BWT Solution for Fleet

Jones Act tanker and ATB operator Overseas Shipholding Group (OSG) selected oneTank, a Seattle-based ballast water treatment system manufacturer, to provide an aftpeak ballast water treatment solution for vessels in their fleet.oneTank gained IMO BWMS Code approval in July 2020 and U.S. Coast Guard Type Approval in September 2020. Engineered as a low-cost ($65,000 per system) treatment option intended for vessels that do not need a complex solution, it is light and compact; the system has a footprint of just four square feet and requires only 15 amps of electrical power.

Volvo Penta Navigating an Emerging Landscape

The past few months have been full of uncertainties and even as we look ahead, we don’t know exactly what the future will hold. But we do know that as an industry, we’ll need to prioritize and plan differently. Within the Volvo Penta organization, the team is working hard to understand how to adapt our business as the world around us continues to adjust to a changing economic and societal landscape.As I reflect on what’s transpired since the start of the pandemic, I’m proud of the professionalism and creativity shown by our Volvo Penta team in rising to the challenges.I’ll give you an example.

Greenbrier Delivers New Tank Barge to OSG

Greenbrier Marine announced Tuesday it has delivered OSG 204, the first of two new 581-foot, 204,000-barrel-capacity oil and chemical tank barges for Overseas Shipholding Group, Inc. (OSG). The second barge is schedule to be delivered during the fourth quarter of 2020.The new barge OSG 204 will be operated for dual-mode integrated tug-barge (ITB) service pursuant to U.S. Coast Guard NVIC 2-81, Change 1. The unit is paired with an existing tug within the OSG fleet, the OSG Endurance, and will travel to the Gulf of Mexico to service the Jones Act trade.

Marine News' 2020 ATB Report

There’s a barge full of reasons why many operators turn to ATBs.A mainstay of the U.S. coastwise dirty and refined products trades, articulated tug barges (ATB) have increasingly filled a void left as the fleet of Jones Act tankers (with crew complement requirements exceeding that of tugs) has aged out. With the cargo capacity of the larger ATBs – some with barges exceeding 300,000 barrels capacity – rivalling that of workhorse tankers that had served oil consuming regions, the concept certainly makes sense from a supply and distribution perspective.With 50…