Nordic Maritime Takes Majority Stake in Nordic Shipholding A/S

In a major shareholder announcement Nordic Shipholding A/S informs that Nordic Maritime S.à r.l. As a consequence of the restructuring, Nordic Maritime and the Company’s lending banks have converted debt for a total amount of approximately USD 72.1 million into new shares and Nordic Maritime has contributed an additional USD 2 million in cash for new shares in the Company. As announced earlier by Nordic Shipholding, board members Erik Bartnes, Mogens Buschard and Saravana Sivasankaran would resign their position as board members upon completion of the restructuring. Consequently, the board of directors now consists of Knud Pontoppidan (chairman), Kristian V. Mørch, Anil Gorthy, Jon Lewis and Philip Clausius.

Nordic Shipholding Salvation Re-structuring Plan Agreed

Nordic Shipholding has entered a conditional restructuring agreement with Nordic Maritime, who will take over Nordic Ship Holdings debt of about US$ 58,000,000. The company inform that after the restructuring it will be a tonnage provider in the product tanker segment and the objective is to grow the fleet. The five 37,000 dwt handy-size vessels will remain in commercial management with Maersk, where they participate in the Handytankers Pool, while the technical management of these vessels will remain with TB Marine in Hamburg.

FSL Trust Reports $23 Million 1QFY13 Revenue

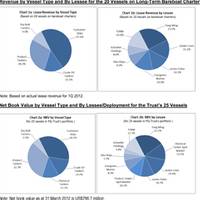

FSL Trust Management Pte. Ltd. (FSLTM), as trustee-manager of First Ship Lease Trust, announced the financial results of FSL Trust for the quarter ended 31 March 2013. Revenue for 1QFY13 declined by 11.6% to $23.0 million (USD) compared to the corresponding quarter last year. In 1QFY13, all the trust’s vessels continued to generate revenue from their respective employments on bareboat charters and time charters as well as in the ‘Nordic Tankers 19,000 Stainless Steel Pool’ (Nordic Pool). On a bareboat charter/bareboat charter equivalent (BBCE) basis, revenue fell 4.0% to $19.9 million compared to 1QFY12. The rentals received from 20 vessels leased on long-term bareboat charters continued to support the overall earnings of FSL Trust.

Singapore's FSL 2012 Profits Slump

Singapore’s First Ship Lease Trust (FSL) report US$ 8.4-million loss for 2012, revenue slipped 4.2%. Philip Clausius, CEO, said: “2012 has been very challenging, but the trust’s disciplined approach and wide network have helped to deploy our spot vessels to longer term arrangements within a relatively short time frame. Mr. Philip Clausius, Chief Executive Officer of FSLTM said: “2012 has been very challenging, but the Trust’s disciplined approach and wide network have helped to deploy our spot vessels to longer term arrangements within a relatively short time frame. This has enhanced our revenue visibility and improved our operational profile. However, the prolonged crisis has taken a toll onmany shipping companies.

FSL Trust Improves Operational Profile

Deploys all redelivered vessels on longer term employment. FSL Trust Management Pte. Ltd. (“FSLTM”), as trustee-manager of First Ship Lease Trust (“FSL Trust” or the “Trust”), has announced the financial results of FSL Trust for the third quarter ended 30 September 2012 (“3QFY12”). In 3QFY12, FSL Trust successfully delivered its three chemical tankers into the ‘Nordic Siva’ pool as well as a second product tanker, FSL Hamburg, to Petròleo Brasileiro S.A. (“Petrobras”) for the commencement of her three-year time charter. Prior to their redeployment, these vessels were trading in the spot market where earnings were more volatile. Revenue declined 6.5% to US$26.7 million against the same period last year.

FSL TRUST: Vessel Portfolio Positioned for Stability, Opportunity

SINGAPORE – FSL Trust Management Pte. Ltd. (FSLTM), as trustee-manager of First Ship Lease Trust, announced the financial results of FSL Trust for the quarter ended 31 March 2012. Revenue for 1QFY12 rose $2.2 million or 9.3% year-on-year to $26.1 million. The net increase in revenue was contributed by the full quarter lease revenue from the two vessels leased to TORM A/S which were acquired in June 2011, as well as higher freight income from the vessels trading in the spot market.

First Ship Lease Closes $100m Mezzanine Financing

First Ship Lease Ltd., a commercial finance company focused on diverse shipping assets, today announced the successful completion of a $100 million mezzanine financing facility. The mezzanine facility, combined with previous equity financing and senior debt to be raised on a transactional basis, allows First Ship Lease to provide in excess of $500 million in operating and finance leases to shipping and industrial companies that meet its credit criteria. The mezzanine financing was fully underwritten by BTM Capital Corporation of Boston, a subsidiary of Japan's premier bank, The Bank of Tokyo-Mitsubishi, Ltd.; Germany-based HSH Nordbank AG, the world's largest ship mortgage lender; and Vereins -und Westbank Group, a subsidiary of Germany's second-largest bank, HypoVereinsbank.