bp's Search for New CEO to Extend into Next Year

bp's search for a new chief executive is set to extend into the first quarter of 2024, three sources told Reuters, while the board's probe into whether previous CEO Bernard Looney breached the code of conduct in his undisclosed personal relationships with staff drags on.The oil company has been in turmoil since Looney's resignation in September, company sources told Reuters, and the share price has underperformed rival Shell since then amid investor uncertainty over bp's future strategy.bp's shares have dropped 9% since Looney's departure, while Shell's have gained 2% over the same period.

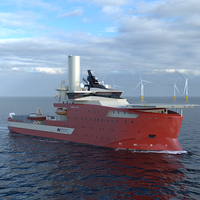

North Star Secures Funding for Offshore Wind Fleet Construction

UK-based offshore vessel operator North Star has secured a £140 million (currently around $171 million) financing package.The company, building a fleet of service operation vessels for offshore wind operations, said Tuesday it would use the funds to support the next phase of its ambitious offshore wind growth plan.The investment includes a £50 million commitment from the Scottish National Investment Bank (The Bank), as well as IFM Investors, Edmond de Rothschild’s BRIDGE, and RBC Capital Markets."The Bank’s investment aligns with its mission to support Scotland’s transition to net zero…

Maritime Partners Agrees to Acquire MG Transport

Maritime Partners, LLC, through its managed funds, has agreed to acquire M/G Transport Holdings LLC, from Auxo Investment Partners LLC and its affiliates. Terms of the transaction were not disclosed, and completion of the acquisition is expected in the third quarter of 2022 subject to customary closing conditions, including receipt of regulatory approvals.Founded in 1968, M/G is a provider of marine transportation services along the West Canal and Lower Mississippi River. Through its fleet of approximately 300 dry cargo barges…

Rio Tinto Sees Soft Iron Ore Shipments in 2022

Rio Tinto forecast slightly weaker-than-expected 2022 iron ore shipments on Tuesday, citing tight labor market conditions and production delays from the new greenfields mine at Gudai-Darri project.The world's biggest iron ore producer said it expects to ship between 320 million and 335 million tonnes (Mt) in 2022 from the Pilbara region in Western Australia, a forecast with a mid-point below RBC estimate of 332 Mt and UBS' estimate of between 330 Mt and 340 Mt.Rio shipped 321.6 Mt of the steel-making commodity last year…

Shipping Costs: Another Danger for Inflation-watchers to Navigate

Much like the coronavirus pandemic, and the economic disruption that it has caused, a global shipping crisis looks set to go on delaying goods traffic and fueling inflation well into 2023.Shipping rarely figures in economists' inflation and GDP calculations, and companies tend to fret more about raw materials and labor costs than transportation. But that might be changing.The cost of shipping a 40-foot container (FEU) unit has eased some 15% from record highs above $11,000 touched in September, according to the Freightos FBX index.

Maritime Partners Acquires J. Russell Flowers

Maritime Partners, LLC, through its managed funds, has acquired from J. Russell Flowers, Inc. and its affiliates, a diversified portfolio of over 1,000 marine vessels operating on bareboat charter. JRF’s fleet includes a variety of towboats, tank barges, hopper barges, and deck barges.With this acquisition, Maritime Partners’ portfolio has grown to approximately 1,600 vessels with an estimated fair market value of $1.2 billion, making the firm the largest lessor of marine equipment in the United States.J. Russell Flowers, Inc.

U.S. Refiners' 2020 Plans Now Uncertain

U.S. refiners had a plan for 2020: use their complex operations to maximize profits by making products that would comply with new international laws capping sulfur content in shipping fuels.But after a series of unexpected market moves, heavy, sour crude oil processed by U.S. refiners has become more expensive, eating up hoped-for profit windfalls before they even materialized, forcing refiners to rethink plans to invest more in heavy crude processing units.New regulations by…

Why is Saudi Arabia Halting Red Sea Oil Shipments?

Saudi Arabia announced last week it was suspending oil shipments through the Red Sea's Bab al-Mandeb strait after Yemen’s Iran-aligned Houthis attacked two ships in the waterway.To date, no other exporters have followed suit. A full blockage of the strategic waterway would virtually halt shipment to Europe and the United States of about 4.8 million barrels per day of crude oil and refined petroleum products.Western allies backing a Saudi-led coalition fighting the Houthis in Yemen expressed concern about the attacks, but have not indicated they would take action to secure the strait.

Equinor Q2 Core Earnings Lag Forecasts

Norwegian oil and gas firm Equinor said on Thursday second-quarter adjusted operating income rose from a year ago but missed forecasts due to higher maintenance costs at its Norwegian fields.The company formerly known as Statoil also said it was too early to follow peers, such as Shell and Total , with share buyback programmes as it had investment plans to fund."We did not feel it was natural in the second quarter (to launch buybacks) because we have big projects and increased working capital.

Big Oil Takes Stage for Post-austerity Beauty Contest

With years of austerity in their rear-view mirrors, the world's biggest oil companies are locked in a beauty contest to lure investors with promises of growth and greater rewards. Royal Dutch Shell and Total are emerging as frontrunners after a three-year slump thanks to strong growth projections but Exxon Mobil, the biggest publicly traded oil company, has largely disappointed with a weaker outlook. Major oil companies slashed spending and cut costs after oil prices collapsed…

Oil Finishes Strong in 2017

U.S. oil prices rose above $60 a barrel on the final trading day of the year and hit their highest since mid-2015, as an unexpected fall in American output and a decline in commercial crude inventories stoked buying in generally thin trading. International benchmark Brent crude futures also rose, supported by ongoing supply cuts by top producers OPEC and Russia as well as strong demand from China. Oil prices are set to close out the year with strong gains. Brent is up 17 percent since the beginning of the year and U.S. West Texas Intermediate is up 12 percent.

Statoil Wins Licences Off UK, 'Resets' Exploration Off U.S.

Norway's Statoil was the second top bidder for 13 oil exploration leases in the U.S. Gulf of Mexico and won six licences offshore Britain, it said on Thursday, in a sign it may be looking to boost reserves after slashing costs. Statoil bid a total of $44.5 million for 13 licences in the U.S. Gulf of Mexico, coming second only to Shell and ahead of Hess Corp, Chevron and Exxon, the latest auction results showed. The company said in a separate statement it had won five new operated licences in the northern North Sea and one in the frontier area west of Scotland, committing to drill at least three wells. Statoil said its bids for licences in the U.S.

Oil Extends Rally on Possible Producer Action

Oil prices were up about 1 percent on Friday, on track for their biggest weekly gains since May, after a short covering rally was triggered by comments from Saudi Arabia's oil minister in the previous session about possible action to help stabilize the market. The market, however, pared some gains after data showed U.S. oil drillers added rigs for a seventh straight week, the longest recovery in the rig count in over two years. They added 17 rigs, the biggest increase since December. Brent crude futures were 56 cents higher at $46.60 at barrel by 1:16 p.m. ET (1716 GMT) after touching a more than three-week high of $46.99 earlier. U.S. crude rose 66 cents to $44.15 after touching its highest level since July 22 at $44.57 per barrel.

WFW Advises Teekay on Major Financing Initiatives

International law firm Watson Farley & Williams LLP (“WFW”) advised long-standing client Teekay on the successful completion of financing initiatives for Teekay Corporation and Teekay Offshore Partners LLP (“TOO”). This included assisting TOO on US$400m of secured bank financing and the raising of US$200m in fresh equity capital along with the deferment of certain bond maturity dates, whilst parent company Teekay Corp completed US$350m of bank financing and raised a further US$100m in equity capital. The transatlantic WFW Maritime team advising Teekay was led by London partner Nigel Thomas and senior associate Patrick Smith, assisted by senior associate George Macheras, associate Natalia Golovataya and trainees Cameron Johnstone-Brown and Tanpreet Rooprai.

Oil Sheds 5% on Brexit Worry, Supply Builds

NEW YORK, July 5 (Reuters) - Oil prices tumbled nearly 5 percent on Tuesday as investors worried that Britain's exit from the European Union would slow the global economy, making it unlikely energy demand will grow enough to absorb a supply glut. Brexit worries hit Britain's property market and drove the pound to a 31-year low. A flurry of data from China in coming weeks is likely to show weaker trade and investments. Traders also cited data from market intelligence firm Genscape showing a build of 230,025 barrels at the Cushing, Oklahoma storage hub for U.S. crude futures, during the week to July 1. "There are risk-off trades across the board," said David Thompson, executive vice-president at Washington-based commodities broker Powerhouse.

Shell Green Lights GoM Field After Cost Cuts

Royal Dutch Shell has given the green light for the development of its largest platform in the Gulf of Mexico after making steep cost cuts which made the deep water project economical despite low oil prices. The decision to pour billions of dollars into the Appomattox project comes as companies have scrapped around $200 billion of mega-projects in the wake of the sharp decline in oil prices over the past year. Shell has operated in the Gulf of Mexico for over 60 years. The region contributes about 17 percent of total U.S. crude oil production according to the Energy Information Administration and was the location in 2010 of the worst offshore oil spill in U.S. history, involving BP's Deepwater Horizon well.

Gibson to Build 900,000b Crude Storage in Alberta

Canadian oil storage and transport company Gibson Energy Inc said on Monday it is building 900,000 barrels of crude oil storage at its terminal in Hardisty, Alberta, after receiving sufficient support from shippers. The company will build a 500,000 barrel tank backed by a long-term contract with Teck Resources Ltd, a partner in the Fort Hills oil sands project and a new customer for Gibson Energy, and another 400,000 tank. The new storage is expected to be in service by mid-2017. RBC Capital Markets strategist Robert Kwan said against the backdrop of weak benchmark crude prices, Gibson Energy's ability to sign long-term contracts with customers to underpin of new storage should be viewed as a positive.

Atlas Resource Partners, L.P. Announces Pricing Of Public Offering Of Common Units

Atlas Resource Partners, L.P. (NYSE: ARP) announced today that it has priced a public offering of 13,500,000 common units representing limited partner interests at an offering price of $19.90 per unit. The underwriters have been granted a 30-day option to purchase up to an additional 2,025,000 common units. ARP intends to use the net proceeds from this offering to fund a portion of its previously-announced acquisition of oil assets in the Rangely Field in NW Colorado. Prior to funding the pending acquisition, ARP may use some or all of the net proceeds for general partnership purposes, which may include repayment of outstanding borrowings under its revolving credit facility. Wells Fargo Securities, Deutsche Bank Securities, Morgan Stanley, BofA Merrill Lynch, Citigroup, J.P.

Victor Technologies Sold to Colfax Corp. in Cash Transaction

Private equity firm Irving Place Capital (IPC) and Victor Technologies (Victor) announce they have entered into a definitive agreement to sell Victor to Colfax Corporation (Colfax), a global manufacturer of gas and fluid-handling and fabrication technology products. Victor is a leading designer and manufacturer of a comprehensive suite of metal cutting, gas control, and specialty welding products. IPC acquired Victor, which was previously named Thermadyne Holdings Corporation, in a take-private transaction in December 2010.

Intelsat Commences Proposed IPO

Intelsat S.A. (formerly known as Intelsat Global Holdings S.A.) announced the pricing of its initial public offering of 19,323,672 common shares at a price of $18.00 per share and concurrent public offering of 3,000,000 Series A mandatory convertible junior non-voting preferred shares (the “Series A preferred shares”) at a price of $50.00 per share. On the mandatory conversion date, May 1, 2016, each Series A preferred share, unless previously converted, will automatically convert into common shares. The Series A preferred shares will have a 5.75% dividend rate and a liquidation preference of $50.00 per share. The Company has granted the underwriters in the initial public offering of common shares a 30-day option to purchase up to an additional 2,898,550 common shares.

Intelsat Proposes Public Offering of Common Shares

Intelsat Global Holdings S.A. announced that it has commenced the distribution of preliminary prospectuses in anticipation of its proposed initial public offering of 21,739,130 common shares and proposed concurrent public offering of 3,000,000 Series A mandatory convertible junior non-voting preferred shares (the "Series A preferred shares"). The offerings are being made pursuant to a registration statement on Form F-1 filed with the Securities and Exchange Commission. The company has granted the underwriters in the initial public offering of common shares a 30-day option to purchase up to an additional 3,260,869 common shares. The company has granted the underwriters in the public offering of Series A preferred shares a 30-day option to purchase up to an additional 450…

R. Thaddeus Vayda Rejoins Transocean Ltd.

Transocean Ltd. has named R. Thaddeus Vayda Vice President, Investor Relations, effective July 20, 2011. Based in Houston, he will report to Transocean Ltd. President and Chief Executive Officer Steven L. Newman. Vayda rejoins Transocean, where he served in various roles from 1995 to 2000 in Marketing, Engineering and Operations and as Director, Corporate Planning and Financial Analysis. From 2000 to 2011, Vayda worked in senior sell-side energy equity research analyst and industry expert roles, covering the energy and oilfield services and equipment industry, most recently for Stifel, Nicolaus & Company, First Albany Capital and RBC Capital Markets. Prior to 1995, Vayda served as Senior Analyst in the Fleet Planning Group of Northwest Airlines, Inc.

Port of Oakland, Public-Private Partnership

O’Melveny & Myers LLP represented the Port of Oakland, the third busiest Port on the U.S. West Coast, in an inaugural bidding process for a long-term concession to operate, maintain and further develop a land water-side site comprising approximately 175 acres of its maritime operations area. The transaction is valued at nearly $700m and marks the first public-private partnership, or P3 arrangement, of its kind in the U.S. ports sector. The successful bidder for the concession is Ports America Outer Harbor Terminal, LLC, a joint venture of Ports America Group and Terminal Investment Limited. As concessionaire, it will have exclusive rights to operate the site for a term of 50 years and maximize the economic use of the area, starting in January 2010 when it will take possession of the site.