Capesize Spot Rates Hesitant Despite 5% Rise in Demand -BIMCO

“During the first five months of 2023, demand for Capesize ships increased 5% y/y while supply increased 3% y/y. Nonetheless, spot rate increases remain hesitant, largely due to concerns over China’s fragile economic recovery,” says Filipe Gouveia, Shipping Analyst at BIMCO.Demand growth was supported by a 4% increase in average haul while cargo volumes increased only marginally. Average haul increased due to higher exports from Brazil and Guinea and higher volumes of long-haul Russian coal.Supply rose due to a 2% y/y increase in the Capesize fleet and a 1% increase in fleet productivity.

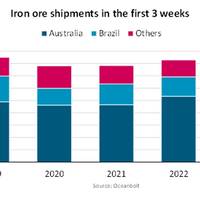

Iron Ore Shipments Drop 13.1% to Start 2023

2023 has so far been a disappointment for the dry bulk shipping sector, despite hopes that a quick economic recovery in China would boost iron ore demand,. During the first three weeks of the year, iron ore shipments fell 13.1% year on year, the lowest volume since at least 2019, worsening conditions for capesizes. In this period, the Baltic Dry Index (BDI) declined by almost 500 points to 763 on 20 January, its lowest point since June 2020.It is not unusual for the bulk market to cool during the first quarter when demand weakens during the Lunar New Year celebrations.

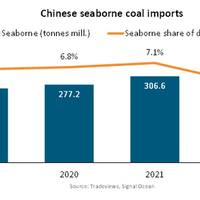

Chinese Inbound Coal Shipments Plummet 12.2%, Says BIMCO

Weak economic activity, a 10.5% increase in domestic coal mining, and a recovery in coal imports from Mongolia via rail alleviated coal shipments to China in 2022. However, the end of China’s zero Covid policy and an anticipated recovery of the Chinese economy have strengthened expectations for the country’s coal imports in 2023. A return of import tariffs, the end of China’s unofficial ban on Australian coal, and the energy transition in China could shape the coal shipment outlook.Coal shipments fell 12.2% in 2022…

Dry Bulk: Panamax Rates Hit Lowest in Two Years

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, slipped on Tuesday, on lower rates for all vessel segments as panamaxes hit their lowest level in two years.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was down 43 points, or 3.8%, to 1,096.The capesize index lost 60 points, or 3.8%, to 1,536.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $496 at $12,741.The panamax index extended its fall for the 12th consecutive day

Baltic Index Hits Over One-week Low

The Baltic Exchange's dry bulk sea freight index slipped to its lowest in more than a week on Monday, pressured by declines in the capesize and supramax segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, dropped 30 points, or about 2.2%, to 1,325, its lowest since November 4.The capesize index lost 98 points, or about 6.4%, to 1,446.Average daily earnings for capesize, which typically transport 150,000-tonne cargoes of coal and steel-making ingredient iron ore, decreased $812 to $11,995.Meanwhile, iron ore futur

St. Louis Regional Freightway: The Year in Review

The St. Louis Regional Freightway has compiled a summary of the major developments over the past year that either elevated the St. Louis region’s global status as a world-class freight hub or will help to advance the region’s position as the country’s freight nexus in the year ahead.“From mega projects breaking ground and global companies choosing to invest here, to newly formed partnerships that strengthen the bi-state region’s role in national and global supply chains, there was much to be excited about in 2019…

Empty Shipyard: "Hyundai Town" Grapples with Uncertain Future

Hyundai has outsized influence over town's economy, population; Ulsan could be South Korea's Rust Belt in the making.When Lee Dong-hee came to Ulsan to work for Hyundai Heavy Industries five years ago, shipyards in the city known as Hyundai Town operated day and night and workers could make triple South Korea's annual average salary.But the 52-year-old was laid off in January, joining some 27,000 workers and subcontractors who lost their jobs at Hyundai Heavy between 2015 and 2017 as ship orders plunged.To support their family, Lee's wife took a minimum wage job at a Hyundai Motor supplier.

'Hyundai Town' Grapples with Slowed Shipyard and Grim Future

When Lee Dong-hee came to Ulsan to work for Hyundai Heavy Industries five years ago, shipyards in the city known as Hyundai Town operated day and night and workers could make triple South Korea's annual average salary.But the 52-year-old was laid off in January, joining some 27,000 workers and subcontractors who lost their jobs at Hyundai Heavy between 2015 and 2017 as ship orders plunged.To support their family, Lee's wife took a minimum wage job at a Hyundai Motor supplier.

Sembcorp Marine Results Drags Singapore Index Lower

Singapore shares edged lower on Monday, dragged down by losses in Sembcorp Marine Ltd which hit a six-week low after posting lower-than-expected first-quarter earnings. The benchmark Straits Times Index was down 0.2 percent at 3,245.69 by 0506 GMT. MSCI's broadest index of Asia-Pacific shares outside Japan dipped 0.3 percent. Shares of Sembcorp Marine fell 2.5 percent to an intra-day low of S$3.96, their lowest since March 21, after the offshore drilling rig builder posted a 3.1 percent increase in first-quarter net profit, which nonetheless undershot market expectations. CIMB downgraded its rating on Sembcorp Marine to "hold" and cut its target price to S$4.30 from S$5.10, citing a shortfall in ship repair and rig building revenue.

DMC Business, Commercial OpsThrive in 2012

Dubai Maritime City (DMC), the world class maritime cluster built to further maritime activity in the Middle East, saw an increase in business and commercial activity in 2012. The City’s Industrial Precinct has tailor-made solutions for maritime industrial, commercial and trading companies and offers facilities such as large and small workshops, warehouses, ship repair plots, shops and canteens. Over 55 local and international organizations involved in the maritime sector and hospitality services have set up base here.

Seaport Real Estate Continues to Outperform Overall Industrial Market

Jones Lang LaSalle’s third annual Port, Airport and Global Infrastructure (PAGI) report published today, reveals that even amid economic volatility, real estate in the markets surrounding the country’s seaports is leading the U.S. industrial real estate recovery. Overall vacancy rates for seaports have dropped from last year by 1.4 percent to 8.5 percent, outperforming the 9.7 percent vacancy rates held by the general industrial real estate sector. “Even with a myriad of global economic challenges, seaport industrial real estate has continued to retain its premium value over inland industrial locations,” said John Carver, head of Jones Lang LaSalle’s Ports Airports and Global Infrastructure team.