2023 Outlook: The Offshore Service Vessel Market

The market for offshore support vessels has been through a rather rough few years since offshore exploration and production activity took a nose-dive in 2015 following the oil price crash the year before.The newbuild order boom that came with the ever-greener pastures imagined in the industry ensured that not only was the supply- and demand balance off by an insurmountable degree in the years that followed, but at its peak, in 2017, the oversupply of anchor handling tug supply…

2021: A Year of Offshore Energy Potential

After what has seemed like the longest year ever, the offshore energy sector is emerging from a position of strength, from the standpoint of both economics and sustainability. Between the lockdowns implemented to reduce COVID-19, which reduced energy demand, to the oil price war between state-backed producers, 2020 was an unprecedented storm that hit the American offshore energy market. Now, there are unmistakable signs of a recovery, and policy makers in Washington, D.C. should embrace the opportunity before us to for sustained economic…

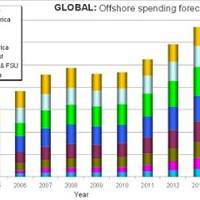

Offshore Spend to Rebound after 2009-10 Lows

Despite the global recession, offshore spend is expected to grow strongly – from $578b Capex and $379b Opex over the last five years to $807b Capex and $549b Opex over the period to 2013. Exploration for fresh oil & gas supplies and development of existing and newly found accumulations from ever more demanding reservoirs in new extremes of environment, are expected to drive offshore industry spends. These headline forecasts appear in the new, fully updated edition of the “World Offshore Oil & Gas Production and Spend Forecast 2009-2013” published by Douglas-Westwood and Energyfiles.

Crowley Moves ExxonMobil Concrete Island Drilling

Crowley Marine Services' Energy and Marine Services business unit has successfully moved the 312-ft. square concrete island drilling structure Orlan from Prudhoe Bay, Alaska, to Sovietskaya Gavan in the Russian Far East for Sakhalin I Project operator, Exxon Neftegas Limited (ENL), a subsidiary of Exxon Mobil Corporation. The Orlan (ex Glomar Beaufort Sea I) Concrete Island Drilling System (CIDS) was purchased from Global Marine Drilling Company and will be used for oil production as part of the Sakhalin 1 project, offshore Russia. It was moved from its stack site near Northstar Island, off Prudhoe Bay using two Crowley Sea Victory Class 7,200 bhp twin screw oceangoing tugs with more than 110 tons bollard pull each.

Seabulk Reports 4Q Results

Seabulk International, Inc. has reported a net loss of $6.3 million for the quarter ended December 31, 2001. Included in the loss for the quarter is a writedown of $1.4 million or $0.13 per diluted share on the planned disposal of the company's inland barge and shipyard operation, part of an ongoing program to refocus the company on its core business. $9.6 million or $0.96 per diluted share. current quarter were up 5% from $80.0 million a year ago. from $8.1 million in the year-earlier period. of $7.9 million on revenues of $346.7 million. "The fourth quarter saw a falloff from our strong second and third quarter results as drilling activity in the Gulf of Mexico -- and hence the demand for vessels -- fell sharply on the heels of lower natural gas prices and reduced energy demand…