Scorpio Tankers Wins $1 Billion Credit for New Vessels

Scorpio Tankers has received commitments from a group of financial institutions for a previously announced $1.0 billion term loan and revolving credit facility.The over-subscribed Credit Facility was capped at an amount of $1.0 billion, and is expected to be used to finance 45 product tankers. Scorpio Tankers currently owns, lease finances or bareboat charters-in 113 product tankers (39 LR2 tankers, 60 MR tankers and 14 Handymax tankers) with an average age of 7.4 years.The Credit Facility is expected to consist of a 50% term loan and a 50% revolving loan, and has a final maturity of five years from the signing date (but not later than June 30, 2028).Emanuele Lauro, Chairman and CEO of the company, said: “We appreciate our lenders and their commitment to the company.

Matson Orders Three LNG-fueled Containerships from Philly Shipyard

U.S.-based ocean carrier Matson announced it has placed a $1 billion order with Philly Shipyard for the construction of three new 3,600 TEU Aloha Class containerships.The first vessel is expected to be delivered in the fourth quarter of 2026 with subsequent deliveries in 2027.Matson, which aims to achieve a 40% reduction in Scope 1 fleet emissions by 2030 and net-zero Scope 1 by 2050, said the three newbuilds will be equipped with dual fuel engines that are designed to operate on either conventional marine fuels or liquefied natural gas (LNG).

Gulf of Mexico: Helix Energy Solutions Buys Alliance Group of Companies

U.S. based offshore well services company Helix Energy Solutions Group has finalized the previously announced acquisition of the Alliance group of companies, bolstering its decommissioning footprint in the Gulf of Mexico.Alliance is a Louisiana-based privately held company that provides services supporting the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil field decommissioning and reclamation, project management, engineered solutions, intervention…

Cadeler Secures $192,3M Loan to Fund New Offshore Wind Vessels

Offshore wind installation contractor Cadeler has entered into a Senior Secured Green Revolving Credit Facility (“RCF”) of a 3-year term loan of EUR 185 million (around $192,3 million). Together with the company’s cash and cash equivalents, the RCF facility will be used to finance Cadeler's newbuild offshore wind turbine and foundation installation vessels, and acquisitions as well as for general corporate purposes."The RCF is secured by customary securities (inter alia) first priority ship mortgages on the company’s vessels…

'World's Largest OSV Fleet': Tidewater to Buy Swire Pacific Offshore

U.S.-based offshore support vessel owner Tidewater said Wednesday it had agreed to acquire Swire Pacific Offshore Holdings Limited (SPO), a subsidiary of Swire Pacific Limited for around $190 million. Tidewater said the transaction would create the industry’s largest fleet of offshore support vessels with 203 vessels in total, including crew boats, tug boats and maintenance vessels. "SPO’s fleet of 50 OSVs consists of 29 AHTS vessels and 21 PSVs; pro forma for the transaction…

MPC Container Ships Refinances Debt

Container ship opertor MPC Container Ships has entered into a $70 million three-year revolving credit facility agreement with CIT Group. The company said the loan had attractive terms.MPC Container Ships, registered in Oslo, Norway, said it had already made an initial drawdown of $40 million to refinance existing debt, and the rest would be used for vessel upgrades and other general purposes."As a consequence, the previous term loans with Beal Bank and CIT have been repaid in full. Further drawdowns under the facility will strengthen the free liquidity and may be used for vessel upgrades, investments or general corporate purposes," MPC Container Ships said.MPC Container Ships CEO Constantin Baack said: "Having secured significant charter backlog…

SEACOR Marine Completes Sale of Windcat to CMB

New York-listed offshore vessel owner SEACOR Marine has completed the previously announced sale of its offshore crew transfer subsidiary Windcat Workboats to the Belgian shipping and logistics group Compagnie Maritime Belge (CMB).Windcat is headquartered in Lowestoft, United Kingdom and IJmuiden, the Netherlands and has joint ventures with two local partners, FRS Windcat Offshore Logistics in Germany and TSM Windcat in France. Windcat employs approximately 180 shore-based and sea-going personnel.The sale was completed on January 12…

SEACOR Marine Sells Windcat Workboats to CMB

New York-listed offshore vessel operator SEACOR Marine has agreed to sell its Windcat Workboats and its crew transfer vessel (“CTV”) business to the Belgian shipping and logistics group Compagnie Maritime Belge (CMB).Windcat Workboats owns and operates a fleet of 46 offshore crew transfer vessels, mainly in the European offshore wind sector, but also in the oil and gas industry and outside Europe. At the closing of the transaction, CMB will pay SEACOR Marine £32.8 million in cash…

TGS Makes Surprise $600 Mln Offer for Part of Rival PGS

Seismic surveyor TGS, a supplier of geological data to the global oil industry, on Thursday said it had made an unsolicited cash offer of $600 million for a key part of rival PGS.If successful, the offer to buy PGS's so-called multi-client library would significantly broaden TGS's worldwide geophysical data offering, the company said.PGS did not immediately respond to a request for comment from Reuters.In addition to spending cash from its current holding, TGS said it will borrow $200 million and also conduct an equity issue to pay for the transaction.While TGS' strategy has been one of rentin

Noble Corp. Files for Bankruptcy

Offshore oil and gas driller Noble Corp said on Friday it had filed for chapter 11 bankruptcy protection to restructure debt, following a historic fall in energy prices.The company said it would swap all its bond debt, which accounts for more than $3.4 billion of its total debt, with equity in the restructured company.Companies that operate offshore drilling rigs for major oil producers are facing a second wave of bankruptcies in four years, amid a historic drop in energy prices that will likely leave surviving drillers more closely tied to big oil firms.Noble expects to emerge with a new $675 million secured revolving credit facility…

Trafigura Offers COVID-19 Premium

Commodities trader Trafigura Beheer has become the first company to offer a defined Covid premium on an Asian syndicated loan, paying up to an extra 20bp all-in on its latest US$1bn-equivalent financing.The novel pricing structure is a first for Asia, if not globally, and could set a precedent for other price-sensitive borrowers looking to limit the long-term effects of the pandemic on their funding costs.Without the Covid premiums, the terms of Trafigura's new deal are little…

Klaveness Lines Up Sustainability-linked Newbuild Financing

Norwegian shipping company Klaveness Combination Carriers (KCC) said it has secured a $60 million sustainability-linked term loan and revolving credit facility for the financing of the seventh and eighth CLEANBU vessels with delivery in 2021, reportedly a first within the maritime industry. Nordea is acting as coordinator and bookrunner and Credit Agricole CIB as sustainability agent.The credit margin will be adjusted, up or down, based on KCC’s sustainability performance, as…

Maersk Drilling to Mothball Several Rigs, Reduce North Sea Headcount

Danish offshore drilling contractor Maersk Drilling is set to mothball several offshore drilling rigs, and as a consequence, reduce the number of offshore workers, citing low oil prices and the impact of COVID-19 pandemic as the reason."The COVID-19 pandemic and the lower oil price environment are impacting offshore drilling activity. Some tenders and projects are being delayed or canceled which adversely affects commercial prospects," Maersk Drilling said Friday.As previously reported, Tullow Oil in March sent an early termination notice for the Maersk Venturer drillship in Ghana.

PGS Cold Stacks Two Seismic Vessels in Response to Low Oil Price

Norwegian offshore seismic surveyor PGS has said that the coronavirus pandemic and the disruption in the oil market present unprecedented challenges for the offshore services industry, including the marine seismic industry.PGS expects the low oil price will have a material adverse impact on demand for seismic services and activity levels.Brent crude futures fell 3.2%, or 97 cents, to $28.97 per barrel as of 0636 GMT, after having risen 21% on Thursday.While oil companies have recently canceled several seismic survey contracts…

International Seaways Signs Refi Deal

New York-headquartered product tanker company International Seaways has closed on senior secured credit facilities worth a total of USD 390 million.The crude oil and petroleum product tanker company said that the facilities consists of a 5-year USD 300 million senior secured term loan facility, a 5-year USD 40 million revolving credit facility, of which USD 20 million has been drawn, and a 2.5-year USD 50 million senior secured term loan credit facility.The NYSE-listed ship owner and operator said that the proceeds from the loans were used to refinance USD 385 million existing high-cost secured and unsecured debt of the company and its subsidiaries.Jeffrey Pribor…

Teekay Tankers Closes $533M Credit Facility

Bermuda-based operator of mid-sized tankers Teekay Tankers has closed a new five-year, $533 million revolving credit facility to refinance 31 vessels.The size of the new debt facility was reduced since announcing the term sheet signing in November 2019 as a result of excluding five vessels from the new facility, including the three vessel sales noted above and a potential for further opportunistic vessel sales.The proceeds from the new debt facility will be used to repay approximately $455 million of the company’s existing debt. The new debt facility has substantially similar terms and extends balloon maturities from 2020/2021 until the end of 2024.Including the agreed asset sales and the new debt facility…

Safe Bulkers Sells, Leasebacks 8 Vessels

The Monaco-headquartered provider of marine drybulk transportation services Safe Bulkers Safe Bulkers has sold and leased back eight ships to refinance $105.2m in loans coming due in 2023 and 2025.The New York-listed bulker owner said that it will receive $158.3m in proceeds from the transaction.Under the arrangements, two vessels were leased back, under bareboat charter agreements, for a period of six years and six vessels were leased back under bareboat charter agreements, for a period of eight years.Four of such arrangements contemplate a purchase obligation at the end of the bareboat charter period and purchase options commencing three years following commencement of the bareboat charter period…

Höegh LNG Secures $80M Loan

Norway-based floating liquefied natural gas (LNG) giant Höegh LNG said it has secured $80 million to refinance an existing bond loan maturing in June 2020."The facility is provided by three of the company’s relationship banks and will be used to refinance part of the HLNG02 bond loan which matures in June 2020 and general corporate purposes," the Norwegian shipowner said in a press note.The facility has a tenor of 2 years and an estimated interest rate of about 5.2% for drawn amounts based on the current floating interest rates. The facility is subject to final documentation, which is expected to be completed during first quarter of 2020.Sveinung J.

OET Acquires ECO Suezmax Tanker Pair

Greek shipping company Okeanis Eco Tankers (OET) intends to exercise an option to acquire two ECO scrubber-fitted Suezmax tankers under construction at South Korean Hyundai Samho Heavy Industries.Okeanis will spend almost $130m to buy the two 158,000 dwt scrubber-fitted vessels from its chief executive Ioannis Alafouzos' private company.As Suezmax values have risen and newbuilding delivery timelines extended into 2021 in the period since its granting, the option is presently well in-the-money and accretive to NAV.In addition, with the recent dramatic firming of the tanker spot and time charter markets and the availability of low cost…

KPI Bridge Oil: More 2020 Compliant Fuel Sold Than HSFO

Søren Høll, CEO of KPI Bridge Oil, has disclosed that the group’s sale of 2020 compliant fuels now exceeds sale of high sulphur fuel oils for the first time.Høll comments: “We started fixing 0.5% sulphur contracts in flow ports at the beginning of Q2 and, as expected, the demand from business partners looking to secure availability of 2020 compliant fuels has steadily increased since. In this final stage of the switch to 2020 compliant fuels we’re experiencing significant price and availability fluctuations in most ports around the world as the market adjusts.

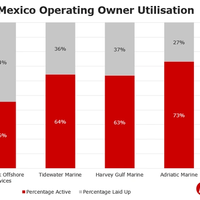

BY THE NUMBERS: the OSV Markets

US Offshore Support Vessel Analysis 2018 and 2019. The US GOM Offshore Support Vessel (OSV) market is suffering, utilization remains poor, and many owners are still squeezed financially. However, a poor market forces people to adapt and for those willing to take risks, the upside can be extremely large.US Owners 2018 vs. 2019: Within the US GOM, 2018 saw a period of strategic thinking and tactical business decisions. Tidewater Marine completed their merger with GulfMark Offshore to create the world’s largest OSV player.

Seacor Borrows $200M for SEA-Vista

Florida-based marine services company Seacor Holdings said that its indirect wholly-owned tanker subsidiary SEA-Vista entered into an amended and restated $200 million credit agreement, which refinanced its existing credit facilities, with a syndicate of lenders led by JPMorgan Chase.The agreement provides for a $100 million revolving credit facility and a $100 million term loan facility, both of which mature in December 2024. The agreement allows SEA-Vista to use the borrowings for general corporate purposes, including acquisitions, and contains a $50 million accordion feature subject to lender approval.At closing, the revolving credit facility remained undrawn, and approximately $76 million of the term loan proceeds were used to fund the repayment of SEA-Vista’s original credit facility.

TORM Secures $496M for Debt Refinancing

Denmark-based product tanker company TORM has obtained a commitment for a total of USD 496 million from a syndicate of lenders to refinance its debt and bolster its capital structure.The carrier of refined oil products said the total amount is a combination of two separate term facilities and a revolving credit facility, which will be used to refinance the company’s debt covering a total of USD 502 million.Following the refinancing, TORM does not have any major debt maturities until 2026 which supports TORM’s strong capital structure, it said.“I am very pleased that we have been able to utilize TORM’s strong relationship with our lenders to remove all major near- and medium-term debt maturities with the financing of USD 496m in debt facilities at attractive terms.