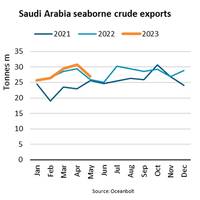

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

US Gives Grace Period to Cargoes Under Russia Oil Product Price Cap

The U.S. Treasury Department said late on Wednesday that shipments facing the G7's upcoming price cap on oil products such as diesel and gasoline from Russia will have a grace period to arrive at their destination.G7 democracies and Australia are planning to cap prices on two oil products from Russia from Feb. 5 as part of their effort to reduce Moscow's export revenues as it wages war in Ukraine. The move will follow the G7's cap on Russia's seaborne crude oil exports that went into effect on Dec. 5.The measures seek to limit Russia's revenues gradually.

US Trade Balance with China Improving on Higher Exports -BIMCO

The trade war continues to rage in the shade of the headline-grabbing supply chain disruptions. The tariffs are still in place and are unlikely to go anywhere despite the change of administration in the United States. While higher exports from the US to China under the Phase One Agreement have added volumes for tanker and dry bulk shipping, containerized imports to the US have shifted from China to other countries in the region. Despite an increase in exports, the commitments made in the Phase One Agreement are a long way off and unlikely to be met…

Profitability Still a Way Off for Tanker Shipping -BIMCO

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

U.S. Crude Oil Exports: When 'Less is More'

Longer sailing distances cushion fall in US crude oil exportsTon mile demand generated by US crude oil exports has fallen by 9.7% in the first two months of 2021 compared with the start of 2020. The fall could however have been much worse; In volume terms, seaborne crude oil exports have fallen by 18.8%, to 20.9m tonnes, a 4.8m tonnes decline compared with last year, according to data from the US Census Bureau.While seaborne crude oil exports to all regions have fallen, those to Asia are among the least affected, down just 1.0%, or equivalent to one Aframax load (101,088 tonnes).

US Seaborne Crude Oil Exports Up 51%

December could boast another all-time high for US seaborne crude oil exports, totaling 13.9 million metric toes and exceeding the previous October record by almost a million metric tons. In 2019, 133 million metric tons of sweet US crude oil was exported by sea, a 51% increase from 2018.Due to the US shale revolution, the country became a net seaborne crude oil exporter in October 2019, and the record-breaking exports in December solidified the trend, as imports for the month amounted to 11.5 million metric tons crude oil.

BIMCO: US Seaborne Crude Oil Exports Hit Record High

US exports of crude oil have, since August 2018, continued to rise every month, with a new record high in January of 9.6 million tonnes. Exports rose in January on the back of increased sales to Europe, which rose from 2.7 million tonnes in December to 4.8 million tonnes in January.A strong end to 2018 meant that volumes for the full year totalled 87.4 million tonnes, 96.7% higher than the 44.4 million tonnes exported in 2017. This is good news for the crude oil tanker sector…

ClassNK Bows to UANI Request to Close its Iran Office

United Against Nuclear Iran (UANI) CEO, Ambassador Mark D. Last week, UANI called on ClassNK, to close its Tehran office and stop certifying Iranian entities. "We applaud ClassNK for pledging to close its Tehran office. Once it follows through on today's announcement to end its work in Iran, ClassNK will have closed yet another avenue for the Iranian regime to circumvent international sanctions. We call on the Korean Register of Shipping and others to follow the lead of ClassNK, Bureau Veritas, Germanischer Lloyd, and others and help impose an international shipping blockade on Iran. UANI has highlighted the shipping industry as an area where the international community can further pressure Iran.

GL to Halt Classification Work on Iran Vessels

United Against Nuclear Iran (UANI) applauded the German shipping service Germanischer Lloyd (GL) for pledging to end its certification of Iranian shipping vessels, specifically those of the Islamic Republic of Iran Shipping Lines (IRISL) and the National Iranian Tanker Company (NITC). Last week, UANI publicly called on GL to do precisely that. In a June 15 letter to UANI, GL informed UANI that: “It is of the utmost importance that we maintain our good reputation. Said UANI CEO, Ambassador Mark D. "We applaud GL for deciding to stop certifying Iranian vessels. We accept GL’s pledge, and we applaud GL for making this swift and responsible decision. The European shipping industry is now set to help deny the Iranian regime critical access to global trade and seaborne crude oil exports.