As Shale Oil Gains Slow, Deepwater Port Struggles for Customers

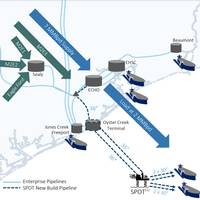

As U.S. shale oil boomed last decade, an oil pipeline company pitched an ambitious multi-billion-dollar export port off the Texas coast to ship domestic crude to buyers in Europe and Asia.In April, Enterprise Products Partners' SPOT became the first project to receive a license from the U.S. maritime regulator for a deepwater port that could load two supertankers, each of which can carry up to 2 million barrels of oil at a time.But multi-year regulatory delays, a loss of commercial backers and slowing U.S.

Corpus Christi Crude Oil Exports Up 6.9% in Q1

The port of Corpus Christi, Texas, the top U.S. oil export hub, said it exported 6.40 million barrels per day of crude oil in the first quarter, up 6.9% from the same period a year ago.The U.S. Gulf Coast port handles more than half the nation's oil exports, benefiting from its pipeline ties to South and West Texas shale fields. Its volumes have risen along with shale oil production.Overall, the port has moved nearly 48.9 million metric tons of goods through the Corpus Christi Ship Channel in the first quarter.

Enterprise Products Partners' Offshore Oil Export Terminal to Open by Early 2027

Enterprise Products Partners' Sea Port crude oil export terminal off the coast of Texas could begin operations between the second half of 2026 and early 2027, the pipeline operator's co-CEO said on Thursday. The terminal, planned for about 30 miles (48 km) off the coast of Texas, is one of several deepwater projects proposed at the height of the U.S. shale oil production boom. Enterprise Co-CEO Jim Teague disclosed the proposed Sea Port Oil Terminal's start date at an RBN Energy export conference in Houston.

Gas Gap in Europe Drives US LNG Exports to Record High

Sky-high European demand drove U.S. liquefied natural gas (LNG) exports to a record in December, Refinitiv data showed, with winter supply worries set to sustain orders for the fuel.About half of the record U.S. LNG volumes shipped last month went to Europe, up from 37% earlier in 2021, data from Refinitiv and the U.S. Energy Information Administration showed.The gains reflected soaring demand for the home heating and industrial fuel that pushed prices in Europe and Asia to record highs.

U.S. Crude Oil Exports: When 'Less is More'

Longer sailing distances cushion fall in US crude oil exportsTon mile demand generated by US crude oil exports has fallen by 9.7% in the first two months of 2021 compared with the start of 2020. The fall could however have been much worse; In volume terms, seaborne crude oil exports have fallen by 18.8%, to 20.9m tonnes, a 4.8m tonnes decline compared with last year, according to data from the US Census Bureau.While seaborne crude oil exports to all regions have fallen, those to Asia are among the least affected, down just 1.0%, or equivalent to one Aframax load (101,088 tonnes).

US Sanctions: Spotlight on Russia

This article will focus on U.S. sanctions on Russia/Ukraine. The Russia/Ukraine sanctions program is a complex mix of comprehensive, noncomprehensive and “sectoral” sanctions. It includes both primary sanctions aimed at U.S. persons and secondary sanctions aimed at non-U.S. persons. It encompasses broad sectors of the Russian economy and significant dealings with sanctioned individuals and entities, while generally permitting most transactions with Russia. Accordingly, it stands alone in U.S.

US Gulf Platforms Shutting as Hurricane Delta Strengthens

Energy companies were securing offshore production platforms and evacuating workers on Tuesday, some for the sixth time this year, as a major hurricane took aim at U.S. oil production in the Gulf of Mexico.Hurricane Delta, the 25th named storm of the 2020 Atlantic Hurricane season, was churning in the Caribbean with sustained winds of 140 miles per hour (225 kph), already a dangerous Category 4 storm that is expected to scrape across Mexico's Yucatan peninsula and re-enter the…

Saudi, Russia Closing in on Record Oil Cut Deal

OPEC and it allies held talks on Thursday on record oil output curbs of about 15 million barrels per day (bpd) or more, roughly 15% of global supplies, to support prices hammered by the coronavirus crisis, sources involved in the discussions said.They said the plan included cuts of about 5 million bpd from producers outside the group known as OPEC+ and could be made gradually, as the group seeks to overcome resistance from the United States whose involvement they see as vital to a deal.Talks have been complicated by friction between OPEC leader Saudi Arabia and non-OPEC Russia…

US Nearing Energy Independence

In just a few months, the U.S. will be fully energy independent and by 2030, the country's total primary energy production will outpace primary energy demand by 30 percent.According to the Norwegian market research consultancy Rystad Energy, this milestone follows a strong period of growth in both hydrocarbon and renewable resources."We forecast that the US will have primary energy surplus – and not a deficit – by February or March 2020, depending on the intensity of the winter season,” says Sindre Knutsson, vice president on Rystad Energy’s gas markets team.“Going forward, the United States will be energy independent on a monthly basis, and by 2030 total primary energy production will outpace primary energy demand by about 30%,” Knutsson added.These developments are already in full swing.

First Commercial Cargo Loaded from Tango FLNG

Argentine oil company YPF SA has loaded its first commercial liquefied natural gas (LNG) cargo for export from a new floating facility, trade sources said on Friday.Argentina's export joins a wave of new supply flooding the spot market which has depressed Asian spot prices to their lowest in a decade for this time of the year.The state-owned firm issued a tender which closed on Nov. 6 to sell 2.1 trillion British thermal unit (Tbtu) of LNG for loading from FLNG Tango, the liquefaction vessel off Bahia Blanca…

US Eyes India for Quantum Leap in LPG Exports

Trump administration trade tariffs on China will need to cease and India will have to rely more on U.S. LPG supplies for the world to clear the quantum leap expected for U.S. LPG exports, says a study.The study of global seaborne LPG trade flows using Kpler LPG cargo tracking data questions the global LPG market’s ability to grow fast enough to handle the tsunami wave of new LPG production expected from the United States in 2020 and 2021."The U.S. has become the largest LPG exporter in the world and now exports more LPG than the U.A.E., Qatar and Saudi Arabia combined. Enterprise Products alone exports more LPG than any other country…

US Shale is Not Doomed, Says Rystad Energy

Though bankruptcies among U.S. onshore exploration and production (E&P) companies are on the increase during these days, Rystad Energy doesn’t believe this indicates doom for the shale industry.“In a nutshell, we do not believe the recent bankruptcies that have beset a number of shale players are indicative of an industry-wide epidemic,” says Alisa Lukash, a senior analyst on Rystad Energy’s North American Shale team.During the next seven years, the top 40 US shale oil producers are expected to spend about $100 billion on debt instalments and interest unless further debt refinancing is applied.These drillers, which accounted for nearly half of US shale crude production in 2018…

US Shale Operators Achieves Positive Cash Flow

In a remarkable turnaround, the second quarter of 2019 is the first three-month period on record when US shale operators achieved positive cash flow from operations after accounting for capital expenditures, according to Rystad Energy.Rystad Energy has studied the financial performance of 40 dedicated US shale oil companies, focusing on cash flow from operating activities (CFO). This is the cash that is available to expand the business (via capital expenditure, or capex), reduce debt, or return to shareholders.In the second quarter of 2019, 35% of operators in the peer group balanced their spending with operational cash flow, and reported an accumulated $110 million surplus in CFO versus capex.“That is an industry first,” says Rystad Energy senior analyst Alisa Lukash.

U.S. Refiner Phillips 66 Enters Offshore Oil Export Race

U.S. oil refiner Phillips 66 is proposing a deepwater crude export terminal off the U.S. Gulf Coast, challenging at least eight other projects aiming to send U.S. shale oil to world markets, according to a memo and a source who asked not to be named.The project, called Bluewater Texas Terminal LLC, signals another major expansion of its logistics operations. The fourth largest U.S. refiner last week formed joint ventures to build pipelines linking shale fields in West Texas and North Dakota to the Cushing, Oklahoma, oil hub and the U.S.

Only 10% of Shale Firms Reports Positive Cash Flow

Only four, out of the financial performance of 40 dedicated US shale oil firms under study, reported a positive cash flow balance in the first quarter of 2019, bringing down the share of companies with a positive cash flow balance from the recent norm of around 20% to just 10%.Nine in ten US shale oil companies are burning cash, according to Rystad Energy.Total cash flow from operating activities (CFO) fell from $14 billion in the fourth quarter of 2018 to $9.9 billion in the first quarter of 2019.“That is the lowest CFO we have seen since the fourth quarter of 2017,” says Alisa Lukash, Senior Analyst on Rystad Energy’s North American Shale team.“The gap between capex and CFO has reached a staggering $4.7 billion.

U.S. Shale Oil Production to Grow 16%

United States shale operators are on track to increase oil production by 16 percent in 2019, according to analysis by energy research firm Rystad Energy.The growth in US onshore production from the first quarter through the fourth quarter could come in at around 1.1-1.2 million barrels per day (bpd), or 16% for the full year, according to Rystad Energy.After a paltry first quarter, depressed by weather effects, US shale players have over the past weeks assured investors that they will achieve previously communicated production targets, as well as demonstrate excellent capital discipline and cost control.“Despite temporary challenges faced in the beginning of the year…

Marine Fuel Rules to Disrupt Markets for 1-5 years

The marine industry's January 2020 shift to using very low sulfur fuel oil (VLSFO) to power ships worldwide will launch a one- to five-year disruption in oil and refined products markets, according to a study released Thursday by Boston Consulting Group.The International Maritime Organization (IMO)'s mandated switch will require fuels to have a sulfur content below 0.5%, compared with 3.5% now. It aims to improve human health by reducing air pollution from sea-going vessels.The changeover may increase profits for refiners, especially on the U.S.

U.S. Shale: World’s 2nd Cheapest Source of Supply in Oil

North American tight oil is emerging as the second cheapest source of new oil volumes globally, just shy of the Middle East onshore market, Rystad Energy said.The U.S. shale oil was the world’s second most expensive oil resource just four years ago, the energy research and business intelligence company pointed out.“As the majors are struggling to replace conventional liquids, a wealthy source of additional resources is tight oil,” says Espen Erlingsen, Head of Upstream Research at Rystad Energy.Tight oil – such as onshore shale oil in the US – has witnessed an impressive turnaround over the last few years. In 2015, North American shale ranked as the second most expensive resource according to Rystad Energy’s global liquids cost curve…

Highlands Natural Resources Completes Six Well

Highlands Natural Resources said six new wells on the East Denver shale oil and gas project in Colorado have been completed, with flowback starting on three of the six.The London-listed natural resources company said in a stock exchange annoucement that the existing Powell well has started production, and the Wildhorse well is being prepared to resume production in the near future.Provisional data from the three new wells flowing back, Buckskin, Grizzly and Ouray, indicate that these wells should perform in line with the existing two wells drilled by Highlands, which have been ranked in the top 3% of all Niobrara wells in the Denver Julesburg basin.Flowback from the remaining three new wells…

The Tanker Market: 2019 and Beyond

Late 2018 saw the tanker market bubble upwards through late November, with daily vessel hires moving in the direction of, though not yet reaching levels not seen since late 2014-2015, when oil prices were in freefall and inventories building to the brim. A few pundits have suggested that we are seeing a “mini 2014” where lowered oil prices are coaxing another inventory build which would drive tanker capacity utilization, and per diem freight inflows, higher. The oil market has changed over four years…

BY THE NUMBERS - Offshore Supply Vessels: Balanced Continued Pressure with Gradual Recovery

Global consulting firm AlixPartners, in a new paper entitled, “Too many ships, too few rigs: why recovery is still a distant dream for the OSV sector,” warns that companies counting on a quick return to stability in the OSV sector are in for a rude awakening.The September report goes on to say that OSV companies continue to face pressure due to a radically changed oil industry and must take quick and decisive action in order to survive in what should be considered the ‘new normal.’Separately, VesselsValue.com’s Head of Offshore, Charlie Hockless told MarineNews, “I would agree that there are murmurs of a potential market recovery brewing…

Moda Midstream Eyes Second TX VLCC Berth

Moda Midstream LLC is considering building a second berth at its Ingleside, Texas, crude export terminal to accommodate booming shale oil production on the Gulf Coast, the company's chief executive said on Thursday.The expansion to the terminal that loads oil tankers will come as three major pipelines open in the second half of 2019, CEO Bo McCall said in an interview. Moda is also increasing the facility's crude storage capacity to 10 million barrels from 2 million."When these new pipelines come online…

Size Matters in Shale Industry

Having taken a closer look at the detailed economics of the most recent 1,000 wells drilled in the most popular shale hotspot – the Wolfcamp A zone of the Permian Delaware basin – Rystad Energy can see a clear pattern emerging that favors large players.As US crude production is set to grow significantly over the next decade, analysts still debate whether shale drilling is actually a profitable endeavor. Some skeptics claim operators overstate their well production profiles, while others say operational cash flow from shale wells will never be sufficient to cover corporate costs and old debt.Analysts and investors are now waiting to see…