Enterprise Products Partners' Offshore Oil Export Terminal to Open by Early 2027

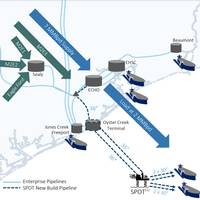

Enterprise Products Partners' Sea Port crude oil export terminal off the coast of Texas could begin operations between the second half of 2026 and early 2027, the pipeline operator's co-CEO said on Thursday. The terminal, planned for about 30 miles (48 km) off the coast of Texas, is one of several deepwater projects proposed at the height of the U.S. shale oil production boom. Enterprise Co-CEO Jim Teague disclosed the proposed Sea Port Oil Terminal's start date at an RBN Energy export conference in Houston.

US Shale Operators Achieves Positive Cash Flow

In a remarkable turnaround, the second quarter of 2019 is the first three-month period on record when US shale operators achieved positive cash flow from operations after accounting for capital expenditures, according to Rystad Energy.Rystad Energy has studied the financial performance of 40 dedicated US shale oil companies, focusing on cash flow from operating activities (CFO). This is the cash that is available to expand the business (via capital expenditure, or capex), reduce debt, or return to shareholders.In the second quarter of 2019, 35% of operators in the peer group balanced their spending with operational cash flow, and reported an accumulated $110 million surplus in CFO versus capex.“That is an industry first,” says Rystad Energy senior analyst Alisa Lukash.

U.S. Shale Oil Production to Grow 16%

United States shale operators are on track to increase oil production by 16 percent in 2019, according to analysis by energy research firm Rystad Energy.The growth in US onshore production from the first quarter through the fourth quarter could come in at around 1.1-1.2 million barrels per day (bpd), or 16% for the full year, according to Rystad Energy.After a paltry first quarter, depressed by weather effects, US shale players have over the past weeks assured investors that they will achieve previously communicated production targets, as well as demonstrate excellent capital discipline and cost control.“Despite temporary challenges faced in the beginning of the year…

Moda Midstream Eyes Second TX VLCC Berth

Moda Midstream LLC is considering building a second berth at its Ingleside, Texas, crude export terminal to accommodate booming shale oil production on the Gulf Coast, the company's chief executive said on Thursday.The expansion to the terminal that loads oil tankers will come as three major pipelines open in the second half of 2019, CEO Bo McCall said in an interview. Moda is also increasing the facility's crude storage capacity to 10 million barrels from 2 million."When these new pipelines come online…

The Tanker Market: 2019 and Beyond

Late 2018 saw the tanker market bubble upwards through late November, with daily vessel hires moving in the direction of, though not yet reaching levels not seen since late 2014-2015, when oil prices were in freefall and inventories building to the brim. A few pundits have suggested that we are seeing a “mini 2014” where lowered oil prices are coaxing another inventory build which would drive tanker capacity utilization, and per diem freight inflows, higher. The oil market has changed over four years…

Shale Growth could Overwhelm U.S. Refiners, Fuel Exports

Rising U.S. shale oil production will overwhelm the nation's refining capacity, with three-quarters of the additional oil produced in the United States by 2023 shipped to Europe and Asia, according to a new study by consultancy Wood Mackenzie. The research points to the continued impact of U.S. shale on global markets and the mismatch between domestic refining capacity and rising crude output. The oil could bottleneck at U.S. Gulf Coast ports unless new infrastructure is built, researchers said. U.S. refineries will absorb between 900,000 barrels per day (bpd) and 1 million bpd of the expected 4 million bpd of additional production to emerge from U.S. oil fields, Wood Mackenzie said in a study released on Monday.

Hedging Energy Bets: The Case for a 2018 Oil Bull Run

Hedge funds gamble OPEC will tighten oil market too much. Hedge funds are the most bullish about oil prices in years, expecting further gains even as prices touch multi-year highs and ignoring the risk linked to such a large concentration of positions. A record net long position has been accumulated by hedge funds and other money managers, amounting to 1,183 million barrels in the five biggest futures and options contracts covering crude, gasoline and heating oil. Portfolio managers held a record 1,328 million barrels of long positions in Brent, WTI, U.S. gasoline and U.S. heating oil on Dec.

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.

Full Tanks & Tankers: A Stubborn Oil Glut Despite OPEC Cuts

After the first OPEC oil production cut in eight years took effect in January, oil traders from Houston to Singapore started emptying millions of barrels of crude from storage tanks. Investors hailed the drawdowns as the beginning of the end of a two-year supply glut - raising hopes for steadily rising per-barrel prices. It hasn't worked out that way. Now, many of those same storage tanks are filling back up or draining more slowly than investors and oil firms had expected, according…

Tanker Market Could See Difficult Q2, Q3

New vessels expected to hit freight rates; new trade route from east U.S. to Asia to meet Chinese demand. The tanker market may face a "difficult" second and third quarter this year after a robust first quarter as supply of newly built vessels loom, Belgian oil tanker operator Euronav said on Tuesday. "The rates today are not the same as what we have seen in previous quarters," Chief Executive Paddy Rodgers told Reuters on the sidelines of a shipping conference. An additional 50 very large crude carriers (VLCCs) are estimated to be added to the global fleet of supertankers this year, putting pressure on freight rates. Still, firm oil demand and a pickup in shale oil production has meant a robust first quarter for the VLCC market. "The first quarter was pretty good..

US Oil Output Seen on the Rise

Large U.S. shale oil companies, flush with cash raised through stock offerings, are gobbling up properties in the Permian Basin straddling Texas and New Mexico, a trend that could boost U.S. oil output in the second half of 2017. Hess Corp and Devon Energy Corp are among oil and gas companies that tapped the equity market in the first eight months of the year, raising a total $20.40 billion. That is the most since at least 1996, barring 2014 when the energy companies raised $20.46 billion in the first eight months of the year. The industry raised $19.78 billion through stock offerings in all of 2015, according to Reuters data, but almost all of this was used to pay off debt.

Nigeria: What are the Implications for Tanker Demand?

Nigeria’s crude oil production and exports have been hit by severe outages as a result of attacks on oil infrastructure by rebel fighters in the Niger River Delta. Various sources report that Qua Iboe Terminal has shut down operations until further notice. All tanks on the facility were emptied of crude, operations have ceased completely and all personnel have been evacuated from the terminal, which is operated by ExxonMobil. Qua Iboe is Nigeria’s largest crude oil stream and exports usually more than 300,000 barrels per day (b/d). Exports of Nigeria’s other large crude oil grades, like Forcados, Bonny Light and Escravos have also been restricted, primarily due to sabotage and attacks on pipelines. As a result of the outages Nigeria’s oil production has dropped below 1.5 mb/d.

Saudi's Rule Out Production Cuts, Oil Drops 4%

Oil prices fell 4 percent on Tuesday after Saudi Oil Minister Ali Al-Naimi ruled out any production cuts, restating the kingdom's rationale for maintaining output was that demand would pick up excess crude that has crushed prices over the past 20 months. Big oil exporters Saudi Arabia and Russia have proposed to freeze output at January levels, which were near record highs, only if other producers also do the same. More meetings on the potential freezes will be held in March, al-Naimi told the IHS CERAweek conference in Houston, adding that he expects most of the countries that count to freeze crude production levels. Analysts remain skeptical that the cuts will be effective in rebalancing the market.

Strong Supply Growth Threatens Rosy Days for Tanker Owners

A surge in crude tanker vessel capacity over the next two years will lead to a fall in ship-owner earnings from current highs, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry. Rising capacity is being driven by anticipated tonnage demand growth in the dirty tanker market, which is expected to gather momentum once US shale oil production starts shrinking. Similarly, tonnage demand in the product tanker market has been increasing with the expansion of refinery capacity in Asia and the Middle East. One of the primary reasons behind the recent surge in tanker freight rates, particularly in the dirty tanker market, has been sluggish fleet growth over the last two years.

Train Lobby Pushes to Weaken Safety Rule

Billionaire investor Warren Buffett is set to be a chief beneficiary of a bid by Senate Republicans to weaken new regulations to improve train safety in the $2.8 billion crude-by-rail industry, a key cog in the development of the vast North American shale oil fields. A series of oil train accidents, including the July 2013 explosion of a train carrying crude in Lac-Megantic, Quebec, that killed 47 people, led U.S. and Canadian regulators to announce sweeping safety rules in May. Among other things, U.S. oil trains are required to install new electronically controlled pneumatic (ECP) brakes. But in late June, the Republican-controlled Senate Commerce Committee approved a measure to drop that requirement, and order years of new research to confirm the safety benefits of ECP brakes.

Tanker Shipping's Fortunes Rest on US Shale Oil Production

How much US shale oil production is taken out of service will be a key driver of future tanker shipping earnings, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry. Tanker operators are pinning their hopes on a rise in US crude oil imports as domestic shale oil extraction becomes increasingly unprofitable. Low oil prices have made crude extraction unprofitable for many US producers, leading to a fall in US rig counts and shrinking exploration and production investment. “Continued expansion of refinery capacity in Asia is likely to maintain growth in the global oil trade over the next five years,” said Rajesh Verma, Drewry’s tanker shipping lead analyst.

The U.S. Maritime Bunker Market: Opportunities Abound

The global shipping industry is no stranger to challenge or change. With responsibility for delivering 90% of global trade, it has had to continually demonstrate an ability to adapt. Now, with the implementation of increasingly stringent environmental regulations, which will increase operating costs and alter the dynamic of fuel procurement, the industry will once again need to evolve. In successfully responding to the introduction of the North American Emission Control Area (ECA) in 2012, shipping has jumped a significant hurdle, but this is just the beginning. The bunker market in the U.S.

Big Data Helps Shippers Cut Fuel Bills, Emissions

By focusing on operational improvements, shipping companies are reducing fuel consumption, saving money and cutting greenhouse emissions, while continuing to increase the amount of freight transported. Maersk Line, the world's largest container carrier, cut fuel consumption by more than 13 percent between 2012 and 2014, while increasing the number of boxes carried by 11 percent, according to company records. Maersk's fuel savings amount to 1.35 million tonnes of fuel per year - and 1.5 million tonnes per year if the increase in freight volumes is taken into account.

US Should Lift Crude Oil Export Ban - Washington Post

The United States should lift its nearly four-decade ban on crude oil exports to help encourage domestic production, the Washington Post said in an editorial on Thursday. Booming shale oil production has led to an intense debate over the moratorium, which was imposed by Congress in 1975 in the wake of the Arab oil embargo. Allowing crude oil exports would help address a mismatch between rising light crude output from U.S. shale formations and Gulf Coast refineries better suited to handle heavy crude, the Post argued in an editorial. "The export ban was a desperate ploy in the 1970s to control commodities markets amid spikes in oil prices induced by the Organization of the Petroleum Exporting Countries," the newspaper said. Earlier this summer, the U.S.

Refiners Seek Jones Act Workarounds as Crude Export Debate Heats Up

As the first U.S. oil condensate exports head to Asia from the Gulf Coast, crude producers and refiners are exploring ways to get around a century-old law that makes it three times more expensive to ship by water between U.S. ports than to sail to a foreign port. The Jones Act, originally passed to protect the U.S. maritime industry, restricts passage between U.S. ports to ships that are U.S.-built, U.S.-flagged and U.S.-crewed. If oil exports pick up pace while the Jones Act is left in place, U.S.

Brent Crude Hits 16-month Low Under US$99

Brent crude dropped to a 16-month low under $99 per barrel on Wednesday, stretching its losses into a fifth session amid continued worries about rising supplies and weak global demand. While a larger-than-expected fall in weekly U.S. crude stocks kept a floor under oil prices, gains were curbed by a firmer U.S. dollar that makes commodities priced in the greenback more expensive for holders of other currencies. The dollar index stood near a 14-month high, with some investors betting the U.S. Federal Reserve would raise interest rates earlier than previously thought. Brent crude was trading down 27 cents at $98.89 a barrel at 0719 GMT, off a low of $98.85 hit earlier in the session - the lowest intraday price since May 1, 2013. U.S. crude was down 21 cents at $92.54 a barrel.

Buckeye Pipeline Quietly Makes Key Acquisition

Houston-based logistic firm Buckeye Partners has spent more than $3.5 billion buying assets since 2010, transforming itself from a quiet regional pipeline utility into an emerging energy powerhouse. But the acquisition that may best symbolize its evolution is one the company didn't tout to investors this summer: a Washington lobbyist. After spending most of the past century pumping fuel from one place to another, the 128-year-old company has become a key player in the import and export of North American oil, with an unrivalled network of East Coast and Caribbean fuel depots and an expanding business loading crude oil from trains to tankers.

BHP to Test U.S. Oil Export Legal Limits

BHP Billiton Ltd is set to be the first company to export lightly processed ultra-light U.S. oil without explicit permission from the government, further testing the limits of an increasingly contentious ban on foreign sales. Eight months after two other U.S. energy firms said they had received the first formal authorization to sell domestic condensate abroad, BHP said it had determined that its oil would also meet the legal criteria for export since it was being minimally processed in distillation towers in South Texas. "We took the necessary time to thoroughly examine the issues involved and ensure that the processed condensate was eligible for export…