Chinese State Shipping Giant COSCO Holds Stake in Bank of Kunlun

Chinese state-run shipping giant COSCO Shipping Development Co said on Tuesday that it holds a 3.74% stake in Bank of Kunlun, which has acted as a key official channel for money flows between China and Iran.The statement was made by the shipping firm on the e-interview platform of the Shanghai Stock Exchange, in response to an investor question on whether it held a stake in the bank.COSCO did not elaborate on when it acquired its holding, although the bank had disclosed the shipping firms stake in its 2019 annual report.COSCO’s comments come days after China and Iran, both subject to U.S.

CSSC Listed Businesses to Get Capital Injections for Shipyards

China State Shipbuilding Corporation's listed units CSSC Holdings and CSSC Offshore & Marine plan to bring in major investors to inject about 10.2 billion yuan ($1.6 billion) of capital into four shipyards. China's shipyards have been suffering from a prolonged downturn in the shipping industry and both companies said the planned capital increases were part of the government's wider "supply-side structural reform policy". China CSSC Holdings Ltd is bringing in investors, such as China Life…

CSSC to Restructure

The primary contractor for China's naval force China State Shipbuilding Corp (CSSC) is preparing a major asset reorganization involving its two subsidiaries, reported China Daily. The companies have halted stock trading on the Shanghai Stock Exchange The announcement said that whether the reforms take place would be decided in the next 10 trading days. CSSC Holdings Ltd and CSSC Offshore and Marine Engineering Co Ltd both acted upon the notices from their parent company about the potential asset reform by suspending their stock trading. The CSSC group is the parent of three listed companies. CSSC Science and Technology Co Ltd didn't respond to the notice.

The (Really) Big Lift

Cranes: much more than just critical equipment. At ZPMC, it means the supply chain itself. In post-Panamax world – that is to say one which includes an expanded, deepened and improved Panama Canal – there are many layers to the logistics onion. These include reinforced and improved berths and bollards, deepened blue water harbors, improved intermodal connections ashore and a reshuffling of ever larger tonnage for ports that can handle those ships. All of that is important, of course, but it is the post-Panamax sized cranes which may be the hottest commodity on the water as the race for the cargo reaches full speed. How those cranes are sourced and acquired may surprise you. It turns out that the global crane business is very much a ‘turnkey’ operation.

Tangshan Port Shares Soar on Coal Clampdown Rumors

Shares of Tangshan Port Group Co Ltd soared 7 percent on Tuesday, to post their biggest daily percentage gain in nine months, as investors bet the small port would benefit from a major clampdown on coal transportation at its larger rival. Shares in the Hebei-based company trading on Shanghai stock exchange jumped to 4.6 yuan ($0.67), their highest since Nov. 15, on Tuesday before ending the session at 4.52 yuan. Trading volume was also higher than usual with 121 million shares, the highest in a year. The stock posted its biggest daily percentage gain since May 13 last year. The buying spree came after Reuters reported on Monday that China's Ministry of Environment is considering stopping Tangshan's neighbouring rival Tianjin Port Co Ltd…

China COSCO Falls to H1 Net Loss

China COSCO Holdings Co Ltd fell to a first-half loss hurt by a persistent slump in the global container market, the world's fourth largest container shipper said on Thursday. COSCO Shipping reported a first-half loss of 7.2 billion yuan ($1.08 billion yuan) versus a profit of 1.9 billion a year earlier, the company said in a filing to the Shanghai stock exchange. COSCO is grappling with weak global demand that has dragged down the sector. In the first quarter, it reported a net loss of 4.5 billion yuan. China COSCO is part of China Cosco Shipping Corporation (COSCOCS), a shipping giant created earlier this year from the state-driven merger of former rivals China Ocean Shipping (Group) Company and China Shipping Group.

Shanghai Port Logs Quarterly Profit Fall

Shanghai International Port Group Co Ltd, the operator of the world's busiest container port, reported its first fall in quarterly net profit in over a year, providing evidence of China's economic slowdown. China, the world's second largest economy, grew 6.9 percent in the third quarter, dipping below 7 percent for the first time since the global financial crisis due to cooling trade and investments. Shanghai Port recorded a third quarter net profit of 1.4 billion yuan ($220.29 million), down 18.3 percent from the same period a year earlier, it said in a filing on the Shanghai stock exchange. That marked the first decline since the second quarter of 2014, Eikon data based on company data showed. In the first nine months, Shanghai Port's net profit dropped 3.3 percent to 4.5 billion yuan.

China Shipping and Cosco Near Mega Merger Deal

State-owned shipping giants China Ocean Shipping Co. (Cosco Group) and China Shipping Group (CSG) are in advanced negotations on combining their container shipping businesses, reports WSJ. Rumors of a merger deal between the two have been floating for half a year. Both companies suspended trading their shares at the start of August. Discussions are complex and would require government and regulatory approval that has proved difficult to predict. If successful, the deal would create the world’s fourth largest container operator by capacity. In a statement to the Shanghai Stock Exchange, China COSCO said after market close on October 13 that its trading halt would not last more than another month and it will announce important strategic developments within five trading days.

Cosco's Ambitious $1.5Bln Megaship Plan

Chinese shipping behemoth Cosco Holdings has confirmed it will order 11 container megaships for $1.5 billion, despite an estimated 30 percent overcapacity in container shipping having sent freight rates to levels that at times don't even cover the fuel cost of moving containers across oceans, The Wall Street Journal reported. It has placed an order for 11 19,000 TEU containerships at four domestic shipyards. This is the largest single order for container ships Chinese yards have ever received. When fully-loaded, such ships cut that cost by about 25 percent compared to smaller vessels. China COSCO stated in its filling to the Shanghai Stock Exchange on September 9 that it has ordered two container ships at Dalian COSCO Khi Ship Engineering (DACKS) for $270.6 million…

China Merchants Group, Sinotrans Deny Merger

China Merchants Energy Shipping Co., Ltd, a subsidiary of China Merchants Group, on Friday denied media reports that China Merchants Group would merge with Sinotrans & CSC Holdings Co., Ltd. CMES, an ocean transporter of crude oil and other energy sources, filed a statement with the Shanghai Stock Exchange (SSE) on late Friday, saying that the company and its parent have not yet received any notice from authorities about the merger. Sinotrans Air Transportation Development Co. Ltd also filed a clarification to the SSE on Friday, denying the report on the merger of its actual controller Sinotrans & CSC with China Merchants Group. The companies have yet to receive any notices regarding their merger, and there are no important announcements that need to be made public as yet.

Drewry: Cosco, CSCL Merger to Shake up Container Shipping

Industry analyst Drewry believes that the proosed merger between Chinese state-owned companies, Cosco and China Shipping Container Lines (CSCL), could cause a domino effect on existing carrier alliances and further carrier mergers in Asia damaging to industry competition. China is said to be planning to merge is two container shipping majors China Cosco and CSCL within efforts to consolidate state owned enterprises. Although merger talks between the world’s fourth and eighth largest container carriers are unlikely, Drewry expects that both will have to take radical remedial action this year. After two consecutive years of losses, ‘special treatment’ was enforced last week on China Cosco Holding’s A shares by the Shanghai Stock Exchange.

CSIC, CSSC Dismiss Shipbuilder Merger Rumors

China's state-backed shipbuilding giants said they have not received any merger-related information from authorities, after an executive swap between the firms sparked a market rally in their shares. The pair are the latest state firms to see merger rumours trigger jumps in their share prices, as investors expect the government to unleash a fresh round of industrial consolidation as part of reform of its state-owned enterprises. Shares in China CSSC Holdings Ltd and China Shipbuilding Industry Co Ltd (CSIC) reached their 10 percent trading limit on Thursday after their parent firms announced that CSSC chairman Hu Wenming will now head CSIC among other management changes.

COSCOL Profit Jumps

Shanghai Stock Exchange-listed COSCO Shipping Company Limited (COSCOL) says its profits shot up 491% year on year (y/y) to CNY193M ($31M) in 2014. Revenue improved 3% year-on-year. The results also boosted by government subsidies and benefitted from cost cutting measures. On 30 September the company received a total of CNY183M in government subsidies for scrapping old tonnage and replacing them with new building orders. In 2013, the Chinese government introduced policies with subsidies to encourage Chinese ship-owners to scrap older Chinese-flagged vessels. The subsidies would be doubled if the ship-owners then ordered new tonnage at Chinese shipyards to replace the scrapped tonnage.

Shanghai Port's Q2 Profit Down; China Trade Flagging

Shanghai International Port , the operator of the world's busiest container port, reported earnings on Wednesday that showed its second-quarter net profit fell 2.5 percent in a sign of slowing trade in China. Shanghai Port said in a Chinese-language filing on the Shanghai stock exchange that net profit for the first half was 2.93 billion yuan ($477 million). That was up from 2.55 billion yuan for January-June a year earlier. But second-quarter net profit totalled 1.49 billion yuan, down from 1.53 billion yuan a year ago, according to Reuters' calculations based on company data. That showed a sharp slowdown from the first quarter's 41 percent rise, though it was better than the 10.5 percent fall seen in fourth-quarter 2013, based on Reuters data.

China's "Ordinary" Billionaire Behind Nicaragua Canal Plan

Wang Jing, the enigmatic businessman behind Nicaragua's $50 billion Interoceanic Grand Canal, shrugs off scepticism about how a little-known entrepreneur can be driving a huge transcontinental project, insisting he's not an agent of the Beijing government. "I know you don't believe me," said Wang, who reckons that he's forked-out about $100 million in canal preparation work, and is burning as much as $10 million a month on the project. "You believe there are people from the Chinese government in the background providing support. High-ranking Chinese officials including President Xi Jinping, Premier Li Keqiang and former leaders Jiang Zemin and Wen Jiabao have all visited the state-connected wireless communication technologies company Wang took control of four years ago.

Nanjing Tanker To Be Delisted, First By Central Gov't Backed Firm

Loss-making shipping company Nanjing Tanker Corp will be delisted from the Shanghai Stock Exchange after a five-day grace period, marking the first time for a company backed by the central government to be dropped from a domestic exchange. The delisting comes after the government allowed China's first-ever public bond default in March and underscores the difficulties facing domestic companies saddled with record debt in a slowing economy. The delisting had been widely anticipated after the company said in January it was poised to post its fourth straight year of loss, breaching exchange rules. A statement carried on the Shanghai exchange's official microblog on Friday said Nanjing Tanker will be delisted after booking losses from 2010 to 2013.

China COSCO Turns its Financial Ship Around in 2013

China COSCO Holdings Co. Ltd, the country's largest shipper, indicates a profit turnaround in 2013 after suffering heavy losses for two consecutive years, reports Xinhau. According to COSCO's earlier, 2013, financial report, the Shanghai-listed company made cutting operational costs a major task for 2013. The Group carried out various measures to overcome the difficulties, including the disposal of its interest in COSCO Logistics and COSCO Container Industries and stringent cost control.

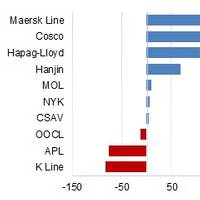

Big Carriers Gain Market Share

Drewry’s analysis of ocean carriers’ latest financial results shows significant changes in cargo market shares, but how much of it is due to service differentiation is unclear. Ocean carriers’ third quarter financial results reported so far reveal that the largest are growing faster than the smallest. Maersk’s year-on-year cargo growth of 9.5% in 3Q13 was over double the global average of 4.2%, Hapag-Lloyd’s cargo increased by 8.7%, Cosco’s rose by 7.8%, and Hanjin’s was 5.8%.

China's Leading Shipbuilder Profit Plummet

China CSSC Holdings Ltd announce net profit shrank by 62.91 percent year-on-year in first half 2012. The Shanghai-based firm said in a report filed to the Shanghai Stock Exchange that its business revenue totalled 13.14 billion yuan in the first six months, accounting for 51.75 percent of the annual plan. Earnings per share stood at 0.345 yuan, down from 0.93 yuan in the first six months of 2011, said the company. CSSC attributed the profit slump to a decline in ship prices and a relatively narrower decline in production costs, as well as losses from ship alterations and lower diesel engine prices. Due to a significant decrease in the prices of shipping products this year…

CNOOC Changes to Senior Management

The board of directors of CNOOC Limited announced that Mr. Fu Chengyu, an Executive Director of the Company, will be re-designated as a Non-executive Director of the Company. Mr. Fu remains the Chairman of the Board. Mr. Li Fanrong, a Non-executive Director of the Company, will be re-designated as an Executive Director of the company. The re-designations of Mr. Fu and Mr. Li will become effective from 16 September 2010. Born in 1951, Mr. Fu received a B.S. degree in geology from the Northeast Petroleum Institute in China and a master degree in petroleum engineering from the University of Southern California in the United States. He has over 30 years of experience in the oil industry in the PRC. He previously worked in China’s Daqing, Liaohe and Huabei oil fields.

China Shipping Buys 14 Bulk Ships After Profit Jump

According to an August 18 report from Bloomberg, China Shipping Development Co., part of China’s second-biggest sea-cargo group, ordered 14 dry-bulk ships after rebounding rates helped it report a 60% jump in first-half profit. The company will pay $424m for the vessels, according to a Shanghai Stock Exchange statement today. The shipping line said late yesterday that first-half net income rose to $144m from $90.2m a year earlier. The result was in line with analysts’ estimates. (Source: Bloomberg)

Sinopacific Shipbuilding Plans Shanghai Listing

Sinopacific Shipbuilding Group Co. Ltd. plans to list on the Shanghai Stock Exchange in June 2008, raising about $670.6m, a source close to the matter told XFN-Asia. The source said the company has filed its listing application with the securities regulator, with CITIC Securities expected to underwrite the issue. In addition, the company also plans to introduce AXA Group and Bank of China International (BOCI) as strategic investors, the source added. [Source: http://www.forbes.com]

Share Offer Will Fund Shipping Expansion

China State Shipbuilding Co. said it has completed a private offer of $1.6b worth of new shares to strategic investors to fund expansion. The company sold 400 million new shares to eight investors including its state-owned parent at $3.99 a piece, less than one-eighth of its current share price, according to a filing to the Shanghai Stock Exchange. The share placement was initially announced in January by Hudong Heavy Machinery Co, which in August changed its name to China State Shipbuilding. In January, its shares were quoted around $3.99. But the stock has since rocketed, becoming the most expensive on the mainland market, amid fund buying and an injection of assets by its parent. The company has said it will acquire more assets from its parent.