Drewry Cuts Global Port Throughput Forecast

Drewry Shipping Consultants has revealed that it now expects global port throughput to rise by 2.6% in 2019, down from the previous 3.0% expectation.The mood-music surrounding the container market has deteriorated further in the last three months, resulting in Drewry downgrading its outlook for world container port throughput for the current year and the rest of the five-year horizon in the Container Market Annual Review and Forecast.The weight of risks pressing down on the container market seems to be getting heavier by the day,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

Container Market Challenges Likely as Uncertainty Mounts

Today’s container market is confronting more than its fair share of headwinds.The recently published Container Forecaster from global shipping consultancy, Drewry, highlights concerns of a slowing global economy stoked by the ongoing US-China trade war (albeit paused for the moment), escalating geo-political tension in many regions of the world and an industry grappling with challenging new emission regulations. Beyond these, however, a series of existential fears are also beginning to present themselves that could dent demand for shipping in the future…

Drewry Cautiously Optimistic on Container Shipping

The container Shipping industry is facing an exceptionally high level of uncertainty, ranging from the extra cost associated with IMO 2020 and how much carriers will recover from shippers, to the possibility of a trade recession and unknown future engagement by shipowners in large vessel building programmes.According to the recently published Container Forecaster from global Shipping consultancy Drewry, every region is expected to see container port handling growth in each and every year of the five-year forecast, albeit at a slightly slower pace than Drewry was previously anticipating.Moreover, supply growth is expected to be below that of demand through 2023…

Drewry Sees Balanced Supply-Demand in ULCVs

Maritime research consultancy Drewry believes that the industry’s supply-demand balance will benefit from a reduced appetite for Ultra Large Container Vessels (ULCVs) among the major carriers, some of which now have their eyes fixed on a bigger prize of becoming global logistics integrators."Aside from feeder ship replenishment, there has been no reaction from other lines to HMM’s mega-ship order and as such we have greatly reduced our projected new orders for 2020 onwards,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster."This subsequently feeds into a much brighter supply-demand index forecast for carriers through 2022…

Drewry Predicts Better Freight Rates and Profits

The shipping industry’s supply-demand balance will benefit from a reduced appetite for Ultra Large Container Vessels (ULCVs) among the major carriers, some of which now have their eyes fixed on a bigger prize of becoming global logistics integrators, said Drewry.Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster said: "Aside from feeder ship replenishment, there has been no reaction from other lines to Hyundai Merchant Marine (HMM)’s mega-ship order and as such we have greatly reduced our projected new orders for 2020 onwards."“This subsequently feeds into a much brighter supply-demand index forecast for carriers through 2022…

Drewry Downgrades Forecast for Container Demand

A gloomier world economic outlook and rising trade tensions have forced Drewry to downgrade its forecast for container demand over the next five years, according to the global shipping consultancy’s latest edition of the Container Forecaster.Drewry’s long-term supply and demand prognosis for carriers has deteriorated since the last report. Previously, the company’s global supply-demand index was expected to take incremental steps upwards through 2022, by which time the industry would at long last be close to equilibrium.However, the new forecasts suggest that the industry now faces being stuck with the current over-supplied situation for several more years.“The anticipated re-balancing of the container market looks to have been postponed.

Trade Wars Threaten to Derail Container Revival: Drewry

The risk to container shipping from US-led trade wars is currently low, but potentially very damaging, according to the latest edition of the Container Forecaster published by global shipping consultancy Drewry. “In the March report we said that we were hopeful of a peaceful resolution, but at this point in time we must accept that tariffs are going to become a reality. The only question now is: how severe will they be?” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster. Additional tariffs of 25% on the first list of 818 Chinese products, worth approximately $34 billion, are scheduled to be collected by US Customs from Friday 6 July.

Trade War All About the Eastbound Transpacific -BIMCO

When two of the world’s top trading partners get entangled in a stand-off, where the outbreak of a trade war could become the extended tool of intense negotiations, BIMCO says we’d better prepare for what may come while hoping that it will never take place.The U.S. is China’s largest trading partner measured by value – and China is the largest one-country trading partner that the U.S. has.“The global shipping industry naturally gets concerned when two nations of huge importance to most shipping sectors get in the ring to fight a trade war – gloves off…

Drewry Predicts Modest Growth for Container Shipping

The outlook for the container shipping market in 2018 and 2019 is a combination of healthy demand growth that will outpace the fleet; resulting in a better supply-demand balance and slightly higher freight rates and profits for carriers, according to the latest edition of the Container Forecaster published by global shipping consultancy Drewry. “The bad news for carriers is that they are unlikely to see the very strong demand growth rates of early 2017 for the foreseeable future. The good news is that while port handling growth may have peaked, they can still expect more than adequate volumes for at least the next two years,” said Simon Heaney, senior manager, container research at Drewry and editor of the Container Forecaster.

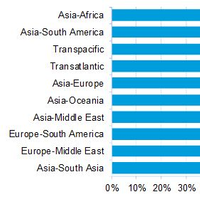

Six-Month High for Service Reliability

Ocean carriers achieved a six-month high for liner service reliability in May, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The on-time average of 76.0% for the 10 trades covered was a 4.1 point improvement on April, representing the third straight month-on-month rise. Along with the better on-time performance so to there was an improvement for the average deviation from the expected arrival at port, which came down from 0.9 days in April to 0.8 days in May, the lowest it has been since December 2015. Eight of the 10 routes covered recorded month-on-month increases in May, the exceptions being Asia-Africa, down by 11.9 points to 772.5%, and Asia-South America that dropped by 1.5 points to 75.7%.

Liner Reliability Bucks Downward Trend

Ocean carriers bucked a five-month downwards trend by improving container service reliability in March, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The average on-time performance in March gained 5.5 points against February to reach 68% with an average deviation from the expected arrival at port of 1.0 days. The improvement seen in March was expected as services returned to closer to operational normality after Chinese New Year in February when carriers tinkered with ever more void sailings to mitigate weaker demand. Indeed, eight of the 10 trades covered reported monthly improvements in reliability with the biggest seen in the Asia-Oceania and Europe-Middle East trades…

Liner Reliability Bucks Downward Trend - Drewry

Ocean carriers bucked a five-month downwards trend by improving container service reliability in March, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The average on-time performance in March gained 5.5 points against February to reach 68% with an average deviation from the expected arrival at port of 1.0 days. The improvement seen in March was expected as services returned to closer to operational normality after Chinese New Year in February when carriers tinkered with ever more void sailings to mitigate weaker demand. Indeed, eight of the 10 trades covered reported monthly improvements in reliability with the biggest seen in the Asia-Oceania and Europe-Middle East trades…

Drewry: Container Reliability Stable in November

Containership reliability was broadly unchanged in November as the average on-time performance across all trades slipped by just 0.8 percentage points against October to 77.2%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. Six of the 10 trades covered recorded month-on-month on-time improvements in November, but worse performances in each of the three East-West trades and in the Asia-South America route – the only North-South trade to decline – dragged down the overall reliability performance. The average deviation from the sailing schedule was 0.8 days. Eight of the 19 “Top 20” carriers measured scored an average on-time performance of 80% or higher in November.

Drewry: Container Reliability Stable in November

Containership reliability was broadly unchanged in November as the average on-time performance across all trades slipped by just 0.8 percentage points against October to 77.2 percent, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. Six of the 10 trades covered recorded month-on-month on-time improvements in November, but worse performances in each of the three East-West trades and in the Asia-South America route – the only North-South trade to decline – dragged down the overall reliability performance.

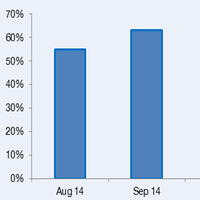

Drewry: Container Service Reliability Falls

Containership reliability took a small step backwards in October as the average on-time performance across all trades reached 77.9%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The latest result is based on reliability across 10 deep-sea container trades, instead of the three East-West trades as was previously measured up to and including September 2015, when the aggregate on-time result was 79.9%. The expanded coverage is part of an upgrade to Drewry’s Carrier Performance Insight, which now covers 69 ports and 809 port pairs, and also includes new functionality to download data from the monthly release in both Excel and PDF formats.

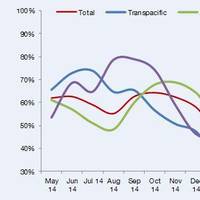

Liner Reliability Slips for First Time in 6 Months

Breaking a run of six consecutive months of improvement, container service reliability across the three main East-West trades declined in July, falling by 4.0 percentage points from June to 73.3%, according to Carrier Performance Insight, the online schedule reliability tool provided by Drewry Supply Chain Advisors. The latest overall monthly performance was the result of lower reliability scores in the Asia-Europe and Transpacific trades, although service punctuality for the far smaller Transatlantic route was raised to a new data series high.

Carrier On-Time Percentage Increased in Feb

The on-time percentage of liner services improved slightly in February, but the ships that missed their berthing window missed it by a wider margin due in large part to labor strife at West Coast U.S. ports, according to this month's Carrier Performance Insight from Drewry. 55% of ships in the three key East-West trades arrived within +/- 24 hours from the advertised ETA, up 6.6% against January’s historic low of 49%. The average deviation from the ETA to actual arrival, however, extended from 1.9 days in January to 2.1 days in February.

Freight Rate Trends: Upcoming Free Supply Chain Webinar

Drewry Maritime Research says it is hosting a free webinar for supply chain professionals to explain recent trends in ocean & air freight rates and provide an outlook for the future. The event will be hosted by Simon Heaney, Senior Manager, and Philip Damas, Director Drewry Supply Chain Advisors. Both executives will be available to take questions following a 20 minute presentation. This analysis will be provided by reference to information available in Drewry's Sea & Air Shipper Insight report. Drewry will be hosting this webinar on Tuesday, 1, July 2014, at either 0900 UK time or 1630 UK time to take account of different time zones.

Liner Service Reliability Jumps to 64%

According to Drewry Supply Chain Advisors, liner shipping service reliability on the three East-West trades showed an aggregate on-time performance of 64% in March - a five-month high. According to Carrier Performance Insight, the online schedule reliability tool provided by Drewry, this was 8.5% up on the February figure - and the second best aggregate since the new data series begun last May. The latest result represents an 8.5 percentage point gain over February and is the second best average (after October 2014) since the start of the new data series in May 2014. Drewry attributed the improvement to better services on the Asia-Europe trade and slowly improving congestion conditions after the labour go-slow on the US West Coast was settled.

Containership Reliability Reaches New High

Container service reliability reached a data-series high in April with the aggregate on-time performance for the three key East-West trades rising to 67.6%, up by 4.1 percentage points on March, according to Carrier Performance Insight , the online schedule reliability tool provided by Drewry Supply Chain Advisors. The previous best since Drewry’s new data series started in May 2014 was achieved in October last year (64.3%) after which the industry struggled to cope with heavy port congestion on the US West Coast and the implementation of new alliance partnerships and services.

Carrier Schedule Reliability Improves in April

Transport consultant Drewry’s Carrier Performance Insight (CPI) for April records 67.6%, up by 4.1 percentage improvement on the previous month in the aggregate reliability of ships on the main Asia-Europe, transpacific and transatlantic trades. The previous best since Drewry’s new data series started in May 2014 was achieved in October last year (64.3%) after which the industry struggled to cope with heavy port congestion on the US West Coast and the implementation of new alliance partnerships and services. Drewry attributes the upswing to a return to “normal” operations at US west coast ports after the agreement of a new labour contract, and the bedding in of the new and upgraded vessel sharing alliances.

Chinese Slowdown Hitting Container Shipping

The slowdown in China’s economy poses some risks for container shipping, according to Drewry Maritime Research. According to a new report from Drewry Shipping Consultants Ltd, the risks from a slowdown in Chinese consumption to container shipping are far smaller than for the dry bulk sector, but they are not inconsiderable and will contribute to slowing world box growth. Container-shipping lines, already concerned about demand from struggling economies in Europe and many emerging markets, can now add China to their list of problems. The analyst is now predicting a growth in Chinese container throughput of 4.9%, down from 5.8%. This shortfall accounts for around 1.85m teu, roughly 1% of world traffic in 2014.

Maersk, Hamburg Sud Lead Reliability Rankings

Maersk Line and Hamburg Sud are ranked as the two most reliable container shipping carriers, according to performance rankings published in the new online version of the Carrier Performance Insight (http://cpi.drewry.co.uk) published by shipping consultancy Drewry. Maersk Line and Hamburg Süd were by far the most reliable carriers in the three months to October 2014 with overall on-time performances of 80.4% and 78.5% respectively. The next best performing carrier was Cosco at 69.9%…