SSI: Green Steel Could Be Added to Decarbonization Targets

The Sustainable Shipping Initiative (SSI) has published a green steel and shipping report calling for circularity in shipbuilding. Steel is the primary shipbuilding material, making over 75% of a vessel by weight, and the steel industry is responsible for 7-9% of global GHG emissions. Addressing steel emissions is critical to decarbonizing across the ship lifecycle, says SSI, and provides opportunities for collaboration with the steel sector and other steel demand sectors. The report identified drivers and barriers to closing the loop on steel in shipping…

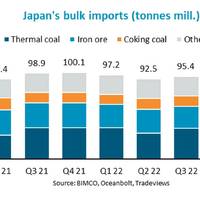

Japan’s Dry Bulk Imports Fall 4%, says BIMCO

“Having narrowly avoided a recession in the fourth quarter of 2022, the Japanese economy appears to be recovering. However, Japan’s demand for steel remains weak and as a result, the country’s bulk imports are estimated to have fallen by 4% y/y in the first quarter of 2023,” says Filipe Gouveia, Shipping Analyst at BIMCO.The steel industry in Japan relies on iron ore and coking coal imports, which combined account for 41% of the country’s bulk imports. Due to lower steel production in Japan…

Iron Ore Stumbles as Rising Supply Runs into China Steel Discipline

Iron ore prices have suffered their worst week for nearly 18 months amid signs that the two factors needed for a sustained correction may be coming into play - Chinese steel producer discipline and a recovery in supply of ore.The main Chinese domestic iron ore benchmark, the Dalian Commodity Exchange contract, dropped around 10% in the week to July 23, the worst weekly performance since February last year.The contract ended the week at 1,126 yuan ($173.77) a tonne, and has now slid about 17% from its record high in May.Benchmark spot 62% iron ore for delivery to north China , as assessed by co

Great Lakes-St. Lawrence Seaway System Sees Surge in Construction Material Shipments

U.S. Great Lakes ports and the St. Lawrence Seaway have experienced a rise in cargo shipments to feed domestic construction and manufacturing activity and global export demand, according to the latest June figures.The Great Lakes-Seaway System serves a region that includes eight U.S. states and two Canadian provinces, and is seen as a marine highway that extends 2,300 miles from the Atlantic Ocean to the Great Lakes, supporting more than 237,868 jobs and $35 billion in economic activity.If the region were a country…

US Hits Iran With Fresh Sanctions

The United States on Tuesday blacklisted a Chinese company that makes elements for steel production, 12 Iranian steel and metals makers and three foreign-based sales agents of a major Iranian metals and mining holding company, seeking to deprive Iran of revenues as U.S. President Donald Trump's term winds down.In a statement, the U.S. Treasury Department named the China-based company as Kaifeng Pingmei New Carbon Materials Technology Co Ltd.

EU Takes Aim at Turkish Steel Sector Buckling Under Trump Tariffs

The European Commission's move to extend its steel import restrictions threatens to force Turkish mills, already buckling under the weight of U.S. tariffs, to cut production further or in some cases close down, sources said.The Commission said on Wednesday it will extend and beef up its existing "safeguard" steel import caps until July 2021 to counter concerns that European Union markets are being flooded with steel no longer being exported to the United States.For Turkey's vast steel sector, the fourth largest contributor to the country's economy, the caps could prove particularly painful as the EU has given it additional "country-specific" quotas.Under the safeguards…

China June Seaborne Iron Ore could Set Record

June seaborne iron ore imports to reach 98.22 mln Tons; local mills to ramp up output to reap large margins. China's June seaborne iron ore imports are on track to rise to a record high, data on Thomson Reuters Eikon showed, stoking concerns of oversupply as hundreds millions of iron ore are being stockpiled at Chinese ports. Iron ore arrivals for June are set to be 98.22 million tonnes according to vessel-tracking and port data compiled by Thomson Reuters Supply Chain and Commodity Forecasts. That would be the highest ever for the Supply Chain data going back to February 2016. The iron ore consumed by the world's biggest steelmaker mainly arrives by ship from miners in Australia and Brazil.

China and Shifting Seaborne Iron Ore Dynamics

The seaborne iron ore market appears to be in something of a sweet spot currently, with largely steady demand and prices that have been flatlining for the past couple of months. Of course, another way of saying that a market is enjoying relatively stable and good times is that it's boring, but in iron ore there is plenty of action bubbling beneath the seemingly calm exterior. It's not so much that iron ore prices or volumes are expected to shift dramatically in the coming months, it's more that structural changes in the world's biggest importer, China, are re-shaping how the industry works.

Essar’s Vizag Port Terminal Boost Third Party Business

Post the taking over of Vishakhapatnam Port Trust’s (VPT's) Iron Ore Handling Complex (OHC) on a Build-Operate-Transfer (BOT) basis for a period of 30 years in May’ 15, Essar Vizag Terminals Limited (EVTL), a wholly owned subsidiary of Essar Ports Limited (EPL) has boosted the EPL’s strategy of diversifying its customer profile. Through addition of this facility EPL has seen its third party cargo share jump to more than 8% in FY 16 alone with the likes of JSW, NMDC/ MMTC etc. Once upgraded the mechanized system will be able to reach a capacity of 8000TPH, which will be one of the highest cargo-handling rate in Indian Major Ports. During QI FY 17…

Dry Bulk Facing Slow Recovery, Consolidation -Dreyfus

The dry bulk shipping industry may not emerge from a protracted downturn for another two years and some smaller firms will be squeezed out, the chairman of France's Louis Dreyfus Armateurs said on Tuesday. The dry bulk sector that transports commodities like coal and iron ore has suffered from oversupply of vessels and faltering global industrial demand, pushing freight rates to a record low this year. Some ship operators had taken heart from signs of a pick-up this year in the Chinese steel sector, but the dry bulk industry needs to be prudent given the overcapacity to be cleared, Philippe Louis-Dreyfus told Reuters. "I don't see the end of the tunnel for another 18 months to two years," he said on the sidelines of a shipping conference.

US Says China to Scrap Some Export Subsidies

China has agreed to scrap export subsidies on a range of products from metals to agriculture and textiles, the United States said on Thursday, in a step by Beijing to reduce trade frictions with Washington. China is to end a program known as its "demonstration bases-common service platform," which provides export subsidies to Chinese companies in seven economic sectors, the U.S. trade representative's office said. Some industry figures were skeptical about the deal's impact, especially regarding steel, which has been a flashpoint with Chinese overcapacity pressuring U.S. suppliers. One source knowledgeable about the agreement said it was not comprehensive enough to do much to help the U.S. steel industry, given its focus was only on specialty products.

Robust Commodity Imports Don't Tell the Whole China Story

The improved sentiment surrounding the outlook for China's demand for natural resources is being reflected by rising imports for some major commodities, but as usual it pays to be wary when interpreting the numbers. Customs data released this week shows strong import growth in the first two months of the year in copper and crude oil, a more modest expansion in iron ore and a surge in imports of alumina and bauxite, the main raw materials used to make aluminium. Taken at face value this lends support to the view that China is heading for a better spring season after a gloomy autumn and winter cast a pall over the outlook for demand in the world's largest consumer of commodities.

Commodities Hit 2002 Lows Before Rebounding on Oil

Commodities hit 13-year lows before rebounding on Monday after Saudi Arabia's pledge to work toward crude price stability bolstered oil and France's first wheat exports to Indonesia in more than six years helped lift grains markets. Base metals settled near multi-year lows hit while gold traded close to a 6-1/2-year trough. Crude prices rose more than 1 percent after Saudi Arabia said it was ready to work with other oil producing and exporting countries, lending recovery hope to a market that has lost half of its value over the past year. Despite pledges in the past that they would try and steady prices, Saudi Arabia and other big OPEC producers have kept their oil output high to maintain market share. Monday's remarks came as oil prices barely held above 2-1/2-month lows.

Diverse Seaway Cargoes Keep U.S. Ports Bustling in July

While July Seaway traffic fluctuated across the various categories, U.S. ports handled a wide range of cargoes in July. “It was a solid month for our U.S. Great Lakes St. Lawrence Seaway System ports with more ships entering the Seaway System with aluminum, iron ore and salt,” said Betty Sutton, Administrator of the Saint Lawrence Seaway Development Corporation. Also notable was the increase in containers to the Ports of Detroit and Cleveland, wind turbines to the Port of Monroe and outbound shipments of grain from Duluth. “Short sea shipping is alive and well at the Port of Toledo,” said Joe Cappel, Vice President of Business Development for the Toledo-Lucas County Port Authority.

Port of Rotterdam Throughput Up by 0.6%

The port of Rotterdam achieved steady results in the first half of the year. Total throughput increased by 0.6% compared to the first half of 2013. The throughput of crude oil increased by 3.3% while that of mineral oil products decreased by 13.5%. The throughput of coal grew by 9.5%, while ore throughput stayed virtually the same. Container throughput, measured in tonnes, increased by 2.7% or 1.9% when measured in TEUs. Throughput saw a small decrease of 0.2% in the first quarter, but was slightly positive in the second quarter, causing throughput in the first half of the year to increase by 0.6%. A further recovery of the European economy is expected for the second half of the year, so that the port is on track in terms of achieving approximately 1% growth for all of 2014.

Panamax Rates Likely To Ease

Asian Panamax rates for dry bulk cargo are likely to ease further this week on soft demand for mineral and grain shipment, with many spot vessels available for hire in the market. "There have been few fresh spot inquiries by charterers," said a shipping broker. Panamax rates for freights from the U.S. Gulf to Japan were indicated at $21.50-$22.00 a ton for March shipment, against $23.00 from a week ago, he said. The broker also put indication rates for April shipment around $22.50-$23.00 on hopes of a rise in vessel demand, as the South American grain export season starts in the same month. But no fixtures have been reported. In the market, one Japanese trading house was said to have fixed a Panamax vessel last week at $21.25 a ton to carry about 54,000 tons of heavy grain from the U.S.

Merger Throws European Steel Sector In Spotlight

Confirmation of merger talks between British Steel and Dutch group Hoogovens reportedly threw Europe's struggling steel sector into the spotlight as investors bet on the next takeover targets.