Eagle Bulk's Scrubbers Investment Pays Off

U.S. shipowner Eagle Bulk's 2018 decision to outfit the majority of its dry bulk fleet with scrubbers has proven to be an environmentally sound and profitable decision, with an expected payback on investment by the end of 2022.The company's CEO Gary Vogel and Chief Strategy Officer Costa Tsoutsoplides said in a recent trade press interview that Eagle Bulk answered the MARPOL 2020 0.5% emissions ceiling with a $100 million investment to equip 47 ships—89% of its fleet of supramaxes and ultramaxes—with CR Ocean Engineering (CROE) scrubbers.Having already recorded $60 million of fuel savings…

Eagle Bulk Buys Two Ultramaxes

Eagle Bulk Shipping has acquired two Ultramax bulk carriers, the U.S.-based dry bulk owner-operator announced Tuesday.The first vessel, which was built in 2015 and will be renamed the Helsinki Eagle, has been acquired for $16.5 million. The second vessel, which was built in 2016 and will be renamed the Stockholm Eagle, has been acquired for $17.65 million. Both SDARI-64 scrubber-fitted ships were constructed at Chengxi Shipyard Co. Ltd.Closings are expected during the first quarter of 2021, with the M/V Stockholm Eagle delivering to Eagle in the Atlantic basin.The sales follow the company’s recently-announced acquisition of a similar specification vessel renamed Oslo Eagle.Gary Vogel…

Chinese Demand Keeping the Dry Bulk Market Going -BIMCO

An impressive recovery in Chinese dry bulk imports has protected the industry from the effects of falling demand in the rest of the world. High deliveries and low contracting have left the orderbook at multi-year lows, but – with the poor outlook – the current influx of new dry bulk ships orders is not what is needed.Demand drivers and freight ratesThe biggest story in the dry bulk industry in recent months has been the strength of the recovery in major Chinese imports. These are up across the board…

Wilhelmsen Bags Stove Shipping Contract

Norway-based Wilhelmsen Ship Management (WSM) announced that we have been selected as the technical manager for the Stove Shipping AS (Stove) vessels, Stove Friend and Stove Tide.The two supramaxes are the newest addition to the Stove fleet built in 2016 by Tsuneishi shipbuilding Co, Ltd. Eastern Bulk Carriers will be the commercial manager of both vessels and technically managed by WSM in Singapore, said a press note from the third-party ship manager with a portfolio of more than 450 vessels and 9 200 active seafarers.“We thank Stove Shipping’s trust in us and this award further seals our long-term relationship. Stove Shipping and WSM have worked hand in hand like partners for the past 10 years."We have been through the market volatilities together and as the market improves…

Shipping Companies: Is Bigger Better?

“If consolidation was the solution to all that ails shipping, then container liner companies would be super profitable. They are not. In ‘commoditized’ sectors of the shipping industry, which by now includes pretty much everything apart from very small niche markets, there is hardly any economies of scale at the company level. As long as bigger is not in fact much better, then meaningful consolidation will not happen.”Dr. Roar Adland, visiting scholar at MIT Center for Transportation and Logistics and Professor at the Norwegian School of Economics (NHH).Like any other business…

Jinhui Buys Two Supramax Vessels

Chinese dry bulk owner Jinhui Shipping and Transportation has acquired a pair of bulk carriers for USS$12mln.The First Vessel is a Supramax of deadweight 50,354 metric tons, built in year 2001. It will be delivered by the First Vendor to the First Purchaser between 2 May 2019 and 7 June 2019.The Second Vessel is also a Supramax of deadweight 50,220 metric tons, built in year 2002. It will be delivered by the Second Vendor to the Second Purchaser between 2 May 2019 and 31 May 2019. The First Agreement and the Second Agreement are not inter-conditional.According to a stock exchange announcement from the company, wach of the purchase prices…

Eagle Bulk Acquires One Ultramax, Sells Two Supramaxes

Connecticut-headquartered Eagle Bulk Shipping announced that it has purchased a high-specification 2015-built SDARI-64 Ultramax bulkcarrier for a purchase price of USD 20.4 million. The ship, which has been renamed the M/V Cape Town Eagle, was constructed at Cosco Zhoushan Shipyard Co. Ltd, and is of the same design as the M/V Hamburg Eagle and M/V Singapore Eagle, said the owner of a fleet of Supramax/Ultramax dry bulk vessels.The M/V Cape Town Eagle has been acquired with an existing time charter that has a remaining term of approximately one year at a variable gross rate of 106% of the Baltic Supramax Index with a floor rate of USD 11…

Seanergy Maritime Holdings Refinances Two Capesize Vessels

Seanergy Maritime Holdings announced that it has successfully completed the refinancing of a previous loan facility secured by M/Vs Lordship and Knightship. Both vessels are Capesize bulk carriers built in 2010 in South Korea, purchased by Seanergy in 2016. The original maturity of the Facility was December 2019. M/V Knightship was refinanced in June 2018 through a sale and leaseback transaction with AVIC International Leasing Co., Ltd., a major Chinese state-owned financing institution. Seanergy sold and chartered the vessel back on a bareboat basis for an eight year period, having a purchase obligation at the end of the eighth year. The Company has the option to repurchase the vessel at any time following the second anniversary of the bareboat charter party.

Pacific Basin Acquires Four Vessels

Hong Kong-based dry bulker company Pacific Basin Shipping has decided to acquire four bulkers with 50% equity funding. "On May 14, 2018, PB Vessels Holding Limited, a subsidiary of the company, entered into four separate ship contracts for the purchase of vessels," said a press statement. The four bulkers are a 58,000 dwt Supramax built in 2010, a 64,000 dwt Supramax resale newbuild, a 37,000 dwt Handysize constructed in 2015 and a 37,000 dwt Handysize resale newbuild. The consideration payable to sellers will be satisfied in a combination of (i) a conditional issue to such Sellers (or their nominees) of 170,760,137 New Shares in aggregate at HK$2.036 per Share under the General Mandate amounting to HK$347…

Baltic Index Gains for Third Consecutive Session

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, edged up on Friday for a third straight session as rates for capesizes and supramaxes remained firm. The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, was up 8 points, or 0.6 percent, at 1,384 points its highest since Jan. The capesize index rose 29 points, or 1.3 percent, to 2,337 points, its highest in over 16 weeks. Average daily earnings for capesizes, which typically transport 170,000-180,000 tonne cargoes such as iron ore and coal, were up $182 at $18,308. The panamax index was down 1 point, or 0.1 percent, at 1,265 points.

Oldendorff Revives Newbuild Contracts at Samjin

Last month saw the resurrection of two newbuilding contracts, which Oldendorff had concluded originally in June 2012 with Weihai-based Samjin Shipbuilding Ind. Co Ltd (SSI), at the time controlled by Korean shareholders. The initial order was for four 36,000 dwt Handysize newbuildings of the Korean designed FESDEC-36k eco type. The yard went through financial restructuring due to the problems of its Korean parent, leading Oldendorff to cancel all four ships and recollect its down payments in 2014 and 2015 after excessive delays.

Pacific Basin Acquires Five Bulkers

Pacific Basin Shipping Limited has announced its conditional agreement to acquire five dry bulk vessels for a total consideration of US$104.6 million. The consideration will take the form of 216,903,274 new Pacific Basin shares to be issued to the ships’ sellers amounting to US$46.1 million in aggregate, cash of US$38.0 million in aggregate, conditionally raised through a placing of new Pacific Basin shares to institutional investors, with HSBC as placing agent and US$20.5 million to be funded from the Group’s cash. The acquisition of the ships and the share placing are all conditional upon the Hong Kong Stock Exchange’s approval of the listing of the vessel consideration shares and the placing shares respectively, which we expect to be granted within several days.

Seanergy Time Charter Contract for Partnership

Greece-based Seanergy Maritime Holdings announced that it has entered into a time charter contract with a major European utility and energy company for its recently delivered Capesize vessel. The 2012-built M/V Partnership will commence a period employment of about twelve to eighteen months and is expected to generate approximately $8.8 million of gross revenue, assuming the full 18 months employment. Stamatis Tsantanis, the Company’s Chairman & Chief Executive Officer, said: “We are pleased to announce a period employment contract for our most recent Capesize acquisition. The strong rate achieved supports our projections for continued improvement in the Capesize market and overall dry bulk sector.

Essar Acquires Panamax Vessel

The Ruia brothers-led Essar Shipping Limited (ESL) of India has added a Panamax vessel of 74,005 Deadweight Tonnage (DWT) to its fleet of vessels. With this new induction, Essar Shipping now has a fleet of 14 vessels that include VLCCs, Capesizes, Mini-capes, Panamax, Supramaxes and Handysize bulk carriers. Essar Shipping’s total DWT capacity now stands at 1.6 million and its average fleet age has fallen to 12 years from erstwhile 13.5 years, according to a company statement here on Tuesday. This 2000-built Panamax bulk carrier, rechristened 'MV Mahavir', will be deployed for transporting pellets, coal and limestone from Essar Steel's pellet plant in Paradip to the steel plant in Hazira, the statement said.

Jinhui Shipping Sees Bumpy Road to Recovery

Oslo-listed dry bulker Jinhui Shipping sees a bumpy road ahead despite signs of a recovery in the dry bulk market. The road to recovery will be challenging and the market will remain volatile, vice president Raymond Ching told the Q1 conference call on Monday. "To be honest it's very hard to pin down what will happen, this industry has been characterized by high volatility," Ching said. Q1 net loss $8 mln includes a non-cash impairment on disposed vessels of $6 million vs net loss of $18 mln in Q1 2016. Q1 average daily timecharter $5,925 per vessel vs $2,934 in Q1 2016. Jinhui Shipping owns two modern post-panamaxes of size of 93,000 dwt…

Seanergy Bags Time Charter for Capesize Bulker

Seanergy Maritime Holdings Corp has entered into a time charter contract (T/C) with a major European charterer, for one of its Capesize dry bulk vessels, for a period of about 18 months to about 22 months. The T/C is for the 180,000 dwt Capesize vessel M/V Lordship and is expected to commence in June 2017, upon expiration of the vessel's current T/C with the same charterer. The net daily charter hire is index-linked rate based on the 5 T/C route rate of Baltic Capesize Index (BCI). In addition, the charter contract provides the option to Seanergy to convert at any time and for a period of minimum three months to maximum 12 months the index-linked rate into a fixed rate corresponding to the prevailing value of the respective Capesize FFA.

Dry Bulk Back from the Brink

While the tanker industry worries about OPEC reducing output and the container industry rushes to consolidate, dry bulk values have been quietly increasing. VesselsValue senior analyst William Bennett digs through the data to uncover the reasons why. Bulker values in the last 12 months have hit rock bottom and are now looking to show considerable promise. Five-year-old handysize values are up by over 40 percent; as are 15-year-old Panamax and Supramax asset prices. Pre-2002 built Capes are up by around 35 percent since February 2016.

GE Shipping Contracts to Buy 2 Suezmax Crude Carriers

The Great Eastern Shipping Company Limited (GE Shipping) has signed contracts to buy 2 Suezmax crude Carriers of about 157,000dwt each. The 2010 and 2011 built vessels are expected to join the company's fleet in Q4 FY17. Last week, the company had inked a pact to buy another Suezmax Crude Carrier of about 1,50,000 dwt. The Company’s current fleet stands at 38 vessels, comprising 24 tankers (7 crude carriers, 15 product tankers, 2 LPG carriers) and 14 dry bulk carriers (1 Capesize, 7 Kamsarmaxes, 6 Supramaxes) with an average age of 9.89 years aggregating 2.94 mn dwt. Additionally, the company has 2 Secondhand Aframaxes, 1 Secondhand Suezmax & 1 Newbuilding Kamsarmax on order. After delivery of these 6 contracted vessels, the company will have a fleet of 44 vessels.

Seanergy Maritime Takes Delivery of MV Knightship

Seanergy Maritime Holdings Corp. has taken delivery of a 178,978 dwt Capesize dry bulk vessel, renamed to M/V Knightship and built in 2010 by Hyundai Heavy Industries in South Korea. Stamatis Tsantanis, CEO of Seanergy commented, "We are very pleased to announce the delivery of the second of the two Capesize vessels that we agreed to acquire in September 2016. Stamatis added, "We expect to continue the implementation of our business plan and grow our fleet even further. The company currently owns a fleet of 10 dry bulk carriers, consisting of eight Capesizes and two Supramaxes, with a combined cargo-carrying capacity of approximately 1,503,369 DWT and an average fleet age of about 7.9 years.

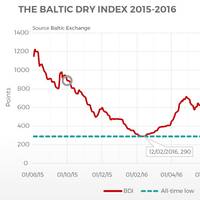

Dry Bulk’s Biggest Spenders

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels. In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price. This article takes a look at which dry bulk owners have been buying the most in the last year.

Baltic Index Down as Rates for Large Vessels Stay Weak

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, fell on Wednesday on weaker rates for larger vessels and supramaxes. The overall index, which factors in rates for capesize, panamax, supramax and handysize shipping vessels, was down 17 points, or 2.44 percent, at 679 points. The capesize index fell 38 points, or 4.52 percent, to 803 points. Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $336 at $5,723. The panamax index was down 32 points, or 4.08 percent, at 752 points. Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000-70,000 tonnes, decreased $256 to $6,020.

Shift in Shipping Market Direction

It has been a year full of turmoil and poor market performance in the shipping markets, yet over the past couple of months both sentiment and real market direction has shifted and along with this so have asset prices of secondhand tonnage, says Allied Shipbroking Weekly Market Report. During this course we have seen some of the lowest levels being reached in the dry bulk market, with asset prices touching close to absolute bottom. Yet since the shift in the freightmarket noted in April/May, we were put on an upward course in terms of asset prices as a large number of buyers with financial backing flocked to take on tonnage at these highly competitive levels. As this developed we started to see a quick shift in pricing, and each deal started to indicate an ever higher price than the last.

Jinhui Sells Supramax

Jinhui Shipping and Transportation has agreed to sell another supramax dry bulk carrier, having just made a similar deal earlier this month. The purchaser is a company incorporated in Hong Kong. The bulk carrier will be delivered to the new owner between 29 July to 30 August 2016. The 2000-built, 50,236 dwt Jin Rong will be sold to China-based Ningbo Tiansheng Shipping for $3.4m, less than half of its book value, leading to a book loss of around $4.1m. "The Vessel has been owned by the Group since year 2006, and its net book value as at 31 March 2016 was US$7,475,000. The net loss both before and after taxation and extraordinary items attributable to the Vendor for the financial years ended 31 December 2015 and 2014 were US$13…