US Leads World Oil Reserves

The United States has a world-leading 293 billion barrels of recoverable oil resources, which is 20Bbbl more than Saudi Arabia and 100Bbbl more than Russia, with the Permian Basin leading that charge.Rystad Energy’s estimate of US recoverable oil is also five times more than officially reported proven reserves as published in the BP Statistical Review of World Energy 2019.Tight oil plays in the Permian Basin in Texas and New Mexico now hold 100 billion barrels of recoverable oil resources, according to Rystad Energy’s analysis. Shale/tight resources in the Permian thus remain largely flat from the previous year, as production has been replaced through improvements in well configuration…

Energy Outlook Lowers Crude Price Forecast

The Short-Term Energy Outlook (STEO) released on August 11 forecasts that North Sea Brent crude oil prices will average $54 per barrel (b) in 2015 and $59/b in 2016, which is $6/b and $8/b lower than projected in last month’s STEO, respectively (Figure 1). The price decline reflects concerns about lower economic growth in emerging markets, expectations of higher oil exports from Iran, and continuing growth in global inventories. WTI prices are expected to average $5/b below Brent in both 2015 and 2016. EIA’s updated projection remains subject to significant uncertainties as the oil market moves toward balance. During this period of price discovery, oil prices could experience periods of heightened volatility.

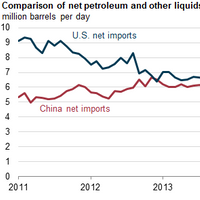

China Now World's Largest Liquid Fuels Importer

U.S. Energy Information Administration, Short-Term Energy Outlook, March 2014 reveals that in September 2013 China's net imports of petroleum and other liquids exceeded those of the United States on a monthly basis, making it the largest net importer of crude oil and other liquids in the world. The rise in China's net imports of petroleum and other liquids is driven by steady economic growth, with rapidly rising Chinese petroleum demand outpacing production growth. U.S. total…

Continued Growth for Statoil in North America

Statoil's oil and gas production in North America continues to show strong growth. In the last decade, Statoil's North American portfolio had a Compound Annual Growth Rate of more than 20% and the company projects a strong growth rate also going forward. "Average production from our US and Canadian fields in the first quarter 2012 was 149,000 barrels of oil equivalent (boe) per day – up as much as 75% compared to the corresponding quarter in 2011. We are on track to reach our ambition of producing above 500…