Basic Design Completed for Conversion of Old LNG Carriers

NYK Line, Namura Shipbuilding and Sasebo Heavy Industries are collaborating to replace the main propulsion on steam turbine driven Moss-type LNG carriers to dual-fuel diesel engines and have now completed the basic design step.In October 2023, NYK was granted Approval in Principle (AiP) from ClassNK for the concept, and the three companies will now proceed with a detailed design.The aim is to improve environmental performance, make efficient use of existing vessels and contribute…

Nippon Yusen to Invest in Pertamina's Shipping Unit

Japan's Nippon Yusen said on Wednesday it will invest in Pertamina International Shipping (PIS), a unit of Indonesia's state energy firm Pertamina, without disclosing terms of the deal. ,The move by Japan's biggest shipping company is aimed at expanding business in Indonesia, where energy and energy transportation demand are expected to increase in tandem with the country's economic growth, a spokesperson for Nippon Yusen said. Nippon Yusen plans to complete the deal by the end of 2022.

China’s One-sided Recovery Drives Iron Ore Market Back Up -BIMCO

In the first two months of 2021, Brazilian iron ore exports have risen by 9.1% to 53 million tonnes, driven by China. So far this year, 35.2 million tonnes of iron ore has been exported to China, representing a 15.2% increase from the same period last year and standing in contrast to slightly declining exports to all other countries: down 1.2% to 17.8 million tonnes, continuing the trend from 2020.Despite the strong growth rates in the first months of this year, total exports of iron ore have failed to recover to 2019 levels following the 21.8% drop in volumes in 2020.

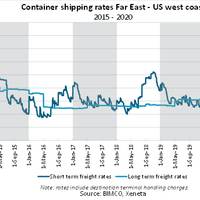

Container Shipping Rates Continue to Deliver 'Positive Surprises', BIMCO says

Trans-Pacific short vs long contract freight rate gap hits record $2,400 per FEUAs the year 2020 continues to deliver positive surprises for the container shipping sector, the gap between short and long term contract freight rates on the Trans-Pacific trade lane has never been wider, according to a recent market note from BIMCO, noting that conditions are right for carriers to achieve higher long term contract rates.On 17 September, for containers shipped from the Far East into the US west coast…

BIMCO Revises 2020 Forecast

The coronavirus pandemic is impacting global shipping demand for 2020 negatively. The speed of the virus spread makes it difficult to assess the full consequences. Nevertheless, we see a need to update our 2020 forecast to make some of this massive uncertainty tangible.What is going on in addition to the coronavirus pandemic?Geopolitical tensions that made the OPEC+ alliance break down, has subsequently made the crude oil tanker spot freight market erupt. The events that followed the breakdown - and those that are likely to follow…

“It’s the steel production, stupid!”

BIMCO's Peter Sand, in a new report, weighs in on the implications for the Dry Bulk sectors.Chinese imports of iron ore keep falling, while its crude steel production keeps growing. China’s increased use of scrap metal for its production of crude steel is fundamentally critical to the dry bulk shipping industry. Mostly Capesize ships are impacted by this, way beyond the temporary iron ore export disruptions in Brazil and Australia.Chinese steel production grew by a massive 12.6 million tonnes (+9.2%) in the first two months on 2019 as estimated by China Iron and Steel Association (CISA).

Frontline Predicts Tanker Market Volatility

The tanker market improved significantly in the fourth quarter ended December 31, 2018 driven by continued strong oil demand, said Bermuda-based tanker shipping company Frontline Ltd.According to the world's largest oil tanker shipping company, crude inventory draws reversed in the quarter, after having fallen below five-year levels and reduced the demand for crude tankers in the process.There is a historical correlation between inventory cycles and tanker rates, it said. Crude oil supply / demand forecasts from the IEA imply that inventories will remain relatively stable over the next several quarters, which in turn should create a…

International Seaways to Install Scrubbers in VLCC Fleet

International Seaways announced that it has signed contracts with Clean Marine AS of Norway and a qualified system installer for the purchase and installation of exhaust gas cleaning systems (scrubbers) on seven of its modern VLCCs, with an option for a further three systems covering the remaining three modern VLCCs in its fleet.The tanker company providing energy transportation services for crude oil, petroleum products and liquefied natural gas (LNG) said in a press release that the seven scrubbers are all to be installed prior to January 1, 2020, when the new 0.5% IMO sulfur emission cap goes into effect.Clean Marine AS is a leading…

Wilhelmsen Reports Positive Results

2016 ended for Wilh. Wilhelmsen with an improvement in transported volumes, which had a positive effect on total income for the fourth quarter. Adjusted for non-recurring items, WWASA also recorded an uplift in operating profit. Rate pressure continues, but the group expects soft volume recovery in the first half of 2017. Total income for the fourth quarter was USD 450 million, up 8% from USD 418 million in the third quarter. The operating profit ended at USD 4 million due to non-recurring items, down from USD 32 million in the previous quarter. “The third quarter, which is usually negatively affected by seasonality, was impacted additionally by comprehensive strikes in Korea.

Tanker Rates: Glass Half-Full Or Half-Empty?

The tanker market has been suffering from rather severe summer doldrums, says Weekly Shipbrokers Reports published by Poten and Partners. Earnings across all tanker sectors, from VLCCs down to MRs are at levels not seen since September 2014, the period right before the most recent tanker bull market. While the summer period is historically a slow period of the year and tanker rates typically stage a recovery going into the northern hemisphere winter months, some people are concerned that this might not happen this year, at least not to the same extent. However, as is the case in almost every market, whether the glass is half-full or half-empty depends very much on your perspective and what you see as the main drivers of the market for the future.

Evergas & INEOS Expand Dragon Vessel Series

Evergas has reached an agreement with INEOS to expand its new-building series of ethane/multigas vessels from six to eight units. In January 2013, Evergas announced for the first time that it had secured shipping agreements of up to 15 years with INEOS for the worlds’ first transatlantic shipments of ethane with commencement in 2015. The fleet of eight vessels will bring US ethane from shale gas to INEOS’ manufacturing sites in Grangemouth, Scotland and Rafnes, Norway. This advantageously priced feedstock will have a highly positive impact for the company’s European operations that so far have relied on declining and expensive volumes from the North Sea. Furthermore it will support the company’s longevity of being a leading and cost-efficient petrochemical producer.

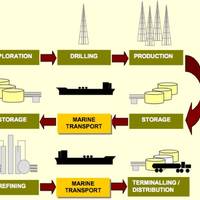

Tankship Ocean Transportation Demand: Forecasting Essentials

Marine transport advisors, McQuilling Services, give an insight into how they forecast the development of tanker demand, which is a constituent part of their recently published '2014-2018 Tanker Market Outlook' report. At a global level, marine transportation demand is related to world trade, which is directly related to the state of the world economy. This means that demand for crude oil and petroleum products grows with an expanding global economy. Marine transportation demand for tankers is a derived demand. It arises from the energy consumption requirements of regional economies.

Global Oil Transportation System Imperfect, Explains Forecaster

In the second of a four part series of explanatory notes to McQuilling Services '2014-2018 Tanker Market Outlook' an important element of the company's forecasting process regarding fleet utilization and availability (included for the first time in the current report) is discussed in the following brief excerpt. The marine transportation system described by the global carriage of crude oil and petroleum products is by nature imperfect and highly inefficient. If it were perfectly efficient…

Tsakos Energy Financial Results

$11.9 million in operating income vs. 24% improvement in the net results, ($24.9) million loss vs. Constant quarterly dividend payments ($0.50 per share in 2012). Tsakos Energy Navigation Limited (TEN or the “Company”) (NYSE: TNP) has reported results (unaudited) for the first nine months of 2012 and third quarter. Revenues, net of voyage expenses and commissions, in the first nine months of 2012, totaled $202.4 million, an improvement of $10.6 million over the first nine months of 2011. TEN operated an average of 48.0 vessels as compared with 47.7 vessels in the first nine months of 2011, although the VLCC La Prudencia did not operate in the first nine months of 2012, and the La Madrina operated only for five months.

Winland Wins Steel Transport Contract

Winland Ocean Shipping Corp., a global shipping Company, announced a new US$ 2.88 Million Contract to transport steel product from the Black Sea to Far East. To better fulfill the demand of the cargo owner, the company chartered in a 57,000 DWT bulk cargo vessel from a European ship owner to carry the contracted cargo, it took less than two month to carry out the contract and earned US$ 2.88 Million in revenue. "We are very pleased to enter this contract in such a market downturn," Ms. Xue Ying, CEO, said. "Shipping capacity has continued to increase in recent years while cargo transportation demand is still depressed. The signing of this contract reflects our high-level operation and wide client base.

Kirby Q2 2009 Results

Kirby Corporation (NYSE:KEX) announced net earnings for the second quarter ended June 30, 2009 of $33.7 million, or $.63 per share, compared with net earnings of $40.3 million, or $.74 per share, for the 2008 second quarter. Kirby's published 2009 second quarter guidance range was $.52 to $.62 per share. Consolidated revenues for the 2009 second quarter were $272.7 million compared with $348.3 million reported for the 2008 second quarter. Joe Pyne, Kirby's President and Chief Executive Officer, commented, "The decline in our marine transportation and diesel engine services demand reflects a difficult economic environment. Our 2009 first quarter actions focused on early retirements, staff reductions, cost reductions and efficiency initiatives.

Wärtsilä New Services for Ship Lay-Ups

Wärtsilä introduces a new, comprehensive package of services, designed to cost efficiently manage hot and cold vessel lay-ups. Reduced transportation demand, over-capacity, and low freight and charter rates have become a major concern throughout the marine industry. The laying-up of ships is one option available to ship owners for meeting these challenges. However, when laying-up, it is of the utmost importance that the vessel's machinery be kept in good condition. This is achieved through professional management of the de-activation and re-activation phases, and by regular inspections and maintenance during the interim period. Wärtsilä's lay-up services will be available for engine room equipment covering 2-stroke & 4-stroke engines…

EIA: Short-Term Energy Outlook

Average crude oil prices for July were little changed from June. The West Texas Intermediate (WTI) spot average for July was $30.75 per barrel compared to $30.66 in June. EIA’s Outlook is for prices to remain firm through the rest of 2003, or at least until autumn, when OECD oil inventories may rebuild above observed 5-year lows. Once inventories have been rebuilt, WTI oil prices may slide gradually to $26 per barrel during 2004, as Iraqi oil exports return to near pre-war levels. U.S.

Leaders of the Pack

MarineNews is pleased again this year to showcase the thoughts and opinions of workboat industry luminaries and executives, including: Terry Becker, President, Riverway Co.; Larry Daily, President, Alter Barge Line, Inc.; Cherrie Felder, Vice President, Channel Shipyard Companies; William D. Friedman, Executive Director, Ports of Indiana; Berdon Lawrence, Chairman, Kirby and Peter H. Stephaich, Chairman of Campbell Transportation Company, Inc., and C&C Marine Maintenance, Inc. President Riverway Co. For those who may not be familiar with Riverway Co., we are a "medium" sized barge line that operates approximately 500 barges and eight line haul towboats, moving dry bulk commodities primarily on the Mississippi River and Illinois Waterway.

Strong OPEC Discipline Continues Rate Depression

As a consequence of low crude oil volumes out of the Middle East - caused by OPEC restrictions and Iraq's stoppage of exports after rejecting to extend the "Oil for Food" program - tanker rates have been at very low levels, with older VLCCs being obtained at only $2,000-$4,000 a day and modern vessels being fixed at $12-$14,000 a day, according to the November monthly report issued by R.S. Platou Shipbrokers a.s. In addition to the low volumes, there has also been a shift toward eastern destinations, resulting in a sharp drop in transport distances. The recent build-up of oil stocks in tankers has not compensated for the negative trend in VLCC transportation demand, the report said. Because of this situation, tanker owners must wait for OPEC to ease production restrictions.