LNG Infrastructure Needs More Money: DNV GL

The vast majority (85%) of professionals working in the liquefied natural gas (LNG) sector believe that more investment is needed in LNG infrastructure to satisfy forecasts for growing global demand after 2025.However, more than two-thirds (69%) stated that uncertainty over prices is limiting spending in the megaprojects needed to feed the world’s growing appetite for LNG.A new report published by DNV GL has revealed that the vast majority (85%) of LNG professionals believe several new infrastructure projects will need to be initiated in 2019 to ensure LNG supply can meet demand post-2025. Price uncertainty is limiting investment in LNG megaprojects…

MENA Region to Lead Global Oil and Gas for Decades to Come: DNV GL

The world will need less energy from the 2030s onwards, but it will still require a significant amount of oil and gas in the lead-up to mid-century according to DNV GL’s 2018 Energy Transition Outlook, an independent forecast of the world energy mix in the lead-up to 2050.The report says, the Middle East and North Africa (MENA) region will remain the main global supplier of oil and gas for decades to come."Among its forecasts for 10 global regions, DNV GL’s Outlook sees the MENA region accounting for most onshore conventional gas production in the lead-up to 2050, while North America will continue to dominate unconventional gas production.

Total Wins 40% Stake in Unconventional Gas Concession

Abu Dhabi National Oil Company (Adnoc) has awarded a 40 per cent stake in the Ruwais Diyab gas concession to French energy major Total.Adnoc group, for which the award is an important milestone to reach the target of 1 Bcfd of unconventional gas production before 2030, said in a press release that it will retain a 60% stake in the concession.Under the terms of the agreement, Total will explore, appraise and develop the concession area’s unconventional gas resources.The agreement includes a six to seven-year exploration and appraisal phase which will then be followed by a 40-year production term. It was signed in ADNOC’s Thamama Subsurface Collaboration Center, by Dr. Sultan Ahmed Al Jaber, ADNOC Group Chief Executive Officer, and Patrick Pouyanné, CEO and Chairman of Total.

Excelerate, TGS Join for Argentina LNG Export Study

Excelerate Energy and Transportadora de Gas del Sur (TGS) have provisionally agreed to jointly assess the viability of an LNG liquefaction and export project at Bahia Blanca in Argentina.Argentina currently imports liquefied natural gas (LNG) through two floating import terminals, particularly during the country's peak winter consumption.The successful development of Argentina's shale gas reserves resulted in a potential excess of natural gas during the summer months. The project aims at studying the technical and commercial viability of liquefying and exporting natural gas during the summer season, allowing a more sustainable development of shale gas resources and reducing Argentina's annual natural gas net import needs.The study is expected to be completed by the end of 2018…

Global Oil Demand to Peak in 2023

While DNV GL’s model predicts global oil demand to peak in 2023, demand for gas will continue to rise until 2034. New resources will be required long after these dates to continue replacing depleting reserves. DNV GL’s 2018 Energy Transition Outlook, an independent forecast of the world energy mix in the lead-up to 2050, predicts global upstream gas capital expenditure to grow from USD960 billion (bn) in 2015, to a peak of USD1.13 trillion in 2025. Upstream gas operating expenditure is set to rise from USD448 bn in 2015 to USD582 bn in 2035, when operational spending will be at its highest.“The energy transition will be made up of many sub-transitions. Our Outlook affirms that the switch in demand from oil to gas has already begun.

Saudi Aramco CEO Points to Energy Future

Speaking at this year’s Offshore Northern Seas (ONS) Conference and Exhibition, Khalid A. Al-Falih, Saudi Aramco president and CEO, addressed the challenges facing the industry and gave insights into Saudi Aramco’s strategy for turning these into opportunities, informs the Middle East energy major. In his speech, Al-Falih outlined some of the chief challenges that major producers such as Saudi Aramco face, including rising project costs, critical manpower shortages, global economic weakness and political turmoil in many oil producing regions, including Africa, the Middle East and the former Soviet Union. Al-Falih said, focusing on long-term strategies for meeting the growing global need for energy and enhancing “our industry’s resilience to the kinds of shocks…

Gassing About Ukraine

Ukraine’s oil and gas production appears to have been largely unaffected by the ongoing crisis involving Russia’s annexation of Crimea and the uprising of pro-Russian separatists in the east of the country. Most of the Black Sea state’s producing gas fields are located away from the areas of unrest, therefore through geographical location have avoided disruption. However, Ukraine has lost control of its offshore deposits due to their location in Crimean waters – with the local authorities due to hand over producer Chernomornaftogaz to Russian state-player Gazprom.

HongHua Group Signs Agreement for GE Waukesha Gas Engines

With China seeking to boost its production of unconventional gas supplies to meet Asia's growing energy needs, GE Power & Water's Distributed Power business (NYSE: GE) and China's leading drill rig manufacturer HongHua Group (HK 196) today signed a three-year agreement for GE to supply its Waukesha VHP gas engines that will power drill rigs used in new shale gas projects in China. The announcement was made at the Offshore Technology Conference being held in Houston. In recent years, GE's gas engine factory in Waukesha, Wisconsin, has seen orders steadily increase as more countries seek to develop their domestic natural gas resources to increase their local energy independence.

Shell, CNPC cooperating in deep-sea exploration, shale gas

Royal Dutch Shell and the China National Petroleum Corp (CNPC) have signed a deal to boost cooperation in sectors like deep sea exploration as well as liquefied natural gas (LNG) and unconventional gas sources like shale, CNPC said on Wednesday. The two companies had agreed to join forces in the development of both upstream and downstream energy businesses, CNPC said on its website. Ben van Beurden, in his first overseas visit since becoming Shell's chief executive, told CNPC Chairman Zhou Jiping that both sides have set up deep and wide-ranging ties and have huge room for further cooperation. The Anglo-Dutch firm is already one of the biggest overseas investors in China's energy sector…

“Shale Gas Needed to Reduce UK Gas Imports”

Speakers set to fuel energy debate at Unconventional Gas Aberdeen 2014. Leading figures from industry and government speaking at Unconventional Gas Aberdeen 2014 will tomorrow highlight the impact U.K. shale development could have on reducing costly gas imports but admit that more needs to be done to reassure communities on aspects such as fracking. With more than 50 percent of U.K. gas supplies now coming from imports, predominantly from Norway and the Middle East, shale gas is being promoted as part of the solution in creating a secure and affordable energy mix.

The FLNG Market is Poised for Growth

There are many different views on the future of energy supplies, but strong agreement in two areas; over the next 25 years or so population growth and GDP growth in the developing economies, particularly China and India, will drive global energy demand to increase by some 50% and second; while oil’s share of the energy mix will decline, the largest growth will be in consumption of natural gas. Why? Natural gas is an outstanding fuel for power generation, gas-fired power plant has the lowest Capex…

LNG Capital Expenditure

A strong continuation in the recovery of LNG expenditure is underway worldwide, driven by a growing demand for natural gas. The new eighth edition of Douglas-Westwood’s (DW) World LNG Market Forecast expects that global capital expenditure (Capex) will total nearly $228B during the 2013-2017 period. The surge includes capital expenditure on base-load onshore and offshore fixed LNG liquefaction, LNG carriers and LNG regasification, via both onshore and offshore fixed import terminals.

Industry Leaders Drive Unconventional Gas Debate

Global stakeholders in the unconventional arena will meet to identify and overcome the barriers to all types of unconventional gas developments at the third Unconventional Gas Aberdeen conference and exhibition March 25-26, 2014. Dan Byles, MP and leader of the All-Party Parliamentary Group for Unconventional Oil and Gas (APPG UG), will address hundreds of delegates at the two day event at Aberdeen Exhibition and Conference Center. He is joined by other distinguished speakers including Duarte Figueira, head of the new Office of Unconventional Gas and Oil at DECC and Ken Cronin, CEO of U.K.

PetroChina Takes Stake in Australian Offshore Exploration

PetroChina Company signs agreements with ConocoPhillips to take interests in W. Australian exploration assets & a JSA in China. Under these agreements, PetroChina will acquire 20% interest in the Poseidon offshore discovery in the Browse Basin, and 29% interest in the Goldwyer Shale onshore Canning Basin. In addition, PetroChina and ConocoPhillips will enter into a Joint Study Agreement (JSA) to study unconventional gas resource in the Neijiang-Dazu Block in China’s Sichuan Basin. The agreements still require government and partner approvals. The signing of these agreements marks a significant step toward increased global collaboration between PetroChina and ConocoPhillips.

BP US Leadership Changes

John Mingé, Regional President BP Alaska, appointed Chairman/President of BP Americas Inc., succeeded by Janet Weiss. John Mingé, has served as head of BP’s Alaska business since January 1, 2009. He will be based in Houston, where he will serve as BP’s lead representative in the US. “BP’s history in Alaska stretches back more than five decades and it is one of the largest and most important businesses in BP’s global portfolio,” Mr. Mingé said. Ms. Weiss serves currently in Alaska as Regional Vice President, Resources, accountable for resource progression and subsurface activities, as well as for IT. In her new role, she will be responsible for BP's oil and gas exploration, development and production activities in Alaska, as well as its interests in the Trans-Alaska oil pipeline.

Technip Acquires Stone & Webster

Technip acquires Stone & Webster process technologies & associated oil & gas engineering capabilities from the Shaw Group. Technip paid cash consideration of around €225 million from existing cash resources, which will be subject to customary price adjustments. • Add skilled resources, notably in research in the US, and engineering in the US, the UK and India. To make the most of these strengths, a new business unit, Technip Stone & Webster Process Technology, will be developed within the Onshore/Offshore segment. “I am delighted to welcome a high-skilled team into the Technip family.

IEA Report: Natural Gas’ Potential “Golden Age”

As supply and demand factors increasingly point to a future in which natural gas plays a greater role in the global energy mix, the International Energy Agency (IEA) released a special report exploring the potential for a “golden age” of gas. The new report, part of the World Energy Outlook (WEO) 2011 series, examines the key factors that could result in a more prominent role for natural gas in the global energy mix, and the implications for other fuels, energy security and climate change. The report, titled, “Are We Entering a Golden Age of Gas?” presents a scenario in which global use of gas rises by more than 50% from 2010 levels and accounts for more than a quarter of global energy demand by 2035.

Westwood: N. Sea Future is "Bright"

“Despite a long-term decline in oil & gas production in the North Sea, its services and support industry has a bright future,” said John Westwood, Chairman of energy business advisors Douglas-Westwood, in Aberdeen this week. Addressing a major event organized by the Norwegian British Chamber of Commerce on opportunities and challenges for the industry in the North Sea area, Westwood noted that the North Sea is a major world-class basin that for the past 40 years has delivered huge economic benefits to Norway and The UK. “However, oil & gas production is in decline,” he said.

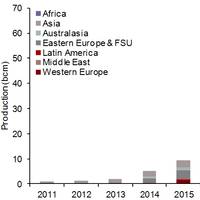

Unconventional Gas: Strong Growth in Drilling & Production Forecast

Douglas-Westwood has published the first edition of its Unconventional Gas: World Production & Drilling Forecast – a study which details the multi-billion dollar opportunities in this rapidly developing energy sector through to 2020. Andrew Reid, CEO, commented, “Douglas-Westwood forecast strong and continual development in the unconventional gas sector in Europe and Asia-Pacific, following the success of the now well established shale gas sector in North America.” Reid continued…

LNG in marine propulsion: Disruption to Maritime Industry?

According a new forecast by MEC intelligence nearly 10,000 vessels could be adopting LNG propulsion by 2020 triggering a huge growth in the market. A ground breaking report published by the maritime cleantech market insight firm MEC Intelligence estimates more than 5% of the world fleet will adopt LNG propulsion by 2020 a huge growth considering less than 100 vessels presently. Strict environment regulations requiring the reduction of SOx, NOx to 0.1% in ECA zone in 2015 and 0.5%…

World Petroleum Congress Poll on Energy Careers

Delegates at the World Petroleum Congress believe the oil and gas industry is not doing enough to encourage future generations to join the sector, according to research from GL Noble Denton. Oil and gas industry professionals believe that the sector needs to work harder to encourage future generations to choose a career in energy, according to a poll conducted yesterday at the World Petroleum Congress in Doha. 57% of participants said companies need to make greater efforts to demonstrate the benefits of a career in the oil and gas industry to young people…

Oil & Gas Execs: Market Moving Up

While forecasts of financial gloom dominate mainstream news casts, there is an emerging feeling of optimism in fo the near term prospects for the oil and gas business. Oil and gas industry leaders have forecast improved performance and higher levels of capital expenditure this year, despite concerns over global economic instability, according to a new report on the future of the sector. Increased investment across the industry will focus on exploration activity, with North America emerging as the area with the greatest opportunities in 2012.