US Could Eliminate Energy Imports -EIA

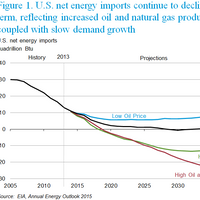

EIA's AEO2015 projects that U.S. The Annual Energy Outlook 2015 (AEO2015) released today by the U.S. Energy Information Administration (EIA) presents updated projections for U.S. energy markets through 2040 based on six cases (Reference, Low and High Economic Growth, Low and High Oil Price, and High Oil and Gas Resource) that reflect updated scenarios for future crude oil prices. "EIA's AEO2015 shows that the advanced technologies are reshaping the U.S. energy economy," said EIA Administrator Adam Sieminski.

China Imports More Oil Than U.S. for First Time Ever

China reached this milestone in December 2012, as its net petroleum imports surpassed those of the U.S. In a recent press release NYC-based PIRA Energy Group reports that weak reported oil demand in the U.S. reduced the commercial stock draw. In Japan, crude runs began to ease, which built crude stocks. Every year for at least the last two decades, Chinese oil demand has increased in both absolute and relative terms, that is, as a percent of world total demand. Since the price spike of 2008 and the following recession, U.S. oil demand has been declining in both absolute and relative terms, for all years except 2010. This, coupled with growing U.S. oil production, has led to a downward trend in U.S. net oil imports, while Chinese net oil imports continue to grow inexorably.

GlobalSantaFe Reports 2004 Results

Worldwide oil and gas drilling contractor GlobalSantaFe Corporation (NYSE: GSF) today reported a net loss for the quarter ended December 31, 2004, of $7.6 million, or $0.03 per diluted share, on revenues of $498.3 million. The 2004 fourth quarter included a primarily non-cash tax charge of $42.5 million, or $0.18 per diluted share, related to a realignment of the company's subsidiary structure. Excluding this charge, the company had income of $34.9 million, or $0.15 per diluted share for the fourth quarter of 2004. For the year ended December 31, 2004, the company reported net income of $143.7 million, or $0.61 per diluted share, on revenues of $1.7 billion. In the fourth quarter of 2004, the company completed a transaction to create separate international and U.S.