Wind-assisted Propulsion for World's Largest Ore Carrier

Brazilian mining firm Vale will install five Rotor Sails from Anemoi Marine Technologies Ltd (“Anemoi”), a supplier of wind-assisted propulsion technology for commercial vessels, onboard a 400,000 dwt Valemax, the world’s largest ore carrier. The vessel is owned by Omani shipowner, Asyad.Five 35-meter-tall, 5-meter-diameter cylindrical sails will be installed on the Sohar Max VLOC. The Rotor Sails will be installed on Anemoi’s folding deployment system, whereby the sails can be folded from vertical to mitigate impact on air draft and cargo handling operations.

Anemoi Scales Up Rotor Sail Technology

Anemoi Marine Technologies, a UK-based developer of rotor sails for the shipping industry, said it is enhancing its efforts to provide its technology for ship owners, managers and charterers to install onboard vessels as they look to decarbonize their operations.Anemoi offers a range of rotor sails, varying in height from 24 to 35m, suitable for installation and retrofitting on deep-sea vessels including bulk carriers, tankers, ferries, ro-ros, and multipurpose vessels. These…

Vale Inks Deal with KDI Targetting Emission Reductions

After implementing the vessel-to-cloud Vessel Insight technology to Guaibamax Bulk Carriers in 2020, Vale, iron ore producer and charterer of one of the world’s largest fleet of ore carriers, has signed with Kongsberg Digital to install Vessel Insight on four Valemax vessels, a continuation of Vale's investment in technology for efficient vessels, such as the Valemax and Guaibamax freighter classes.Vale signed the agreement with Kongsberg Digital to implement Vessel Insight Connect to Valemax bulk carriers, which are long-term charted and owned by Asyad Shipping.

VIDEO: Berge Bulk to Install Anemoi Rotor Sails on Two Dry Bulk Vessels

Singapore-based dry bulk owner Berge Bulk has signed a deal with wind-assisted propulsion firm Anemoi Marine Technologies to supply and fit two vessels in their dry bulk fleet with Anemoi Rotor Sails.Rotor Sails are large mechanical sails that harness the renewable power of the wind to reduce emissions and fuel consumption on commercial ships when driven to spin. Anemoi predicts that the four-rotor system will save Berge Bulk 1200-1500 metric tons of fuel per vessel each year.The first vessel…

A Newbuild VLOC is the First Wind-powered Bulk Carrier

Brazilian miner Vale expects to soon put into service the first-ever bulk carrier propelled partially sails, the company said on Thursday.The rotor sail-equipped newbuild, a very large ore carrier (VLOC) named Sea Zhoushan, is being built in China for owner by Pan Ocean Ship Management and will be chartered by Vale upon delivery in the coming days. Not only is Sea Zhoushan the first bulk carrier to be fitted with rotor sails, the 340-meter, 325,000 dwt vessel is also the largest ship ever to be outfitted with the fuel-saving and emissions-reducing technology…

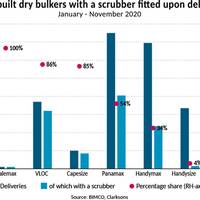

Did You Know?: 47% of all Newbuild Dry Bulkers Sport Scrubbers

We have known it all along; the bigger the bunker fuel consumption of the ship, the more likely it is that shipowners will choose an SOx scrubber as the tool to comply with the IMO 2020 sulfur cap.Whiles only three Handysize bulkers in total have been delivered from the newbuilding yards with a scrubber fitted in 2020, one in three Handymax bulkers were delivered with scrubbers installed.Most scrubber-fitted bulkers were delivered in the Panamax sub-sector, that saw 81 units out of 150…

Sanmar Delivers New Svitzer Tug in Port of Sohar

Turkish tug building specialist Sanmar Shipyards followed up on recent deliveries of the two Sirapinar class ASD tugs to Oman's Port of Sohar with the delivery of the first of a three part order of the larger and more powerful Bigacay class ASD tugs. The arrival of this tug to the Port of Sohar, alongside its two sisters due shortly, will conclude the fleet development aims of the operator Svitzer and Port of Sohar; agreed as part of the 15 year renewal of the former's marine services contract, awarded in early 2019.

Dry Bulk Fleet Growth to Slow to 3.1% in 2020

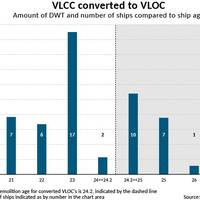

The largest international shipping association representing shipowners, BIMCO said that it expects dry bulk fleet growth to slow to 3.1% in 2020, after a 3.9% fleet expansion in 2019.As this level of growth still exceeds demand growth, the market will also deteriorate in 2020, it pointed out.Meanwhile, demolitions are expected to rise to 12 million deadweight tonnage (DWT) in 2020, up 4.2 million DWT from 2019. With expected deliveries of 39.3 million DWT, the dry bulk fleet is set to exceed 900 million DWT for the first time.Demolitions this year are expected to include up to half of the VLOCs that were converted from very large crude carriers between 2007 and 2011.At the start of February…

BIMCO Pessimistic on Dry Bulk Market

BIMCO expects the fundamental market balance in the dry bulk shipping to deteriorate in 2019 which will do nothing to improve freight rates as the 2020 sulfur cap nears.Earnings for Capesize vessels have continued their roller-coaster ride, reaching their highest level since the end of 2013, at USD 36,101 per day on 2 September 2019. Between 2 April, the low point of the year so far, and 2 September rates have risen 943%, into solid profit-making territory.The strong increase in Capesize and Panamax earnings reflects a change in the market dynamics since the beginning of the year. Following major disruption at the start of the year, Brazilian iron ore exports have increased, although monthly exports since March remain lower than what they had been in the corresponding months last year.

BIMCO: "Continued Pressure" for Bulkers

Demolition of dry bulk ships in the first four months of 2019 was 120% higher than in the same period of 2018. Much of this increase comes from demolitions of Capesize ships, up from 1.1m DWT between January and April 2018 to reach 3.4m DWT in the first four months of 2019.Despite the increasing in scrapping, the bulk carrier market, particularly on the large ship side, will remain under pressure for a number of reasons, starting with stagnant demand, from the short term shock and impact of the dam collapse in Brazil and bad weather in Australia…

“It’s the steel production, stupid!”

BIMCO's Peter Sand, in a new report, weighs in on the implications for the Dry Bulk sectors.Chinese imports of iron ore keep falling, while its crude steel production keeps growing. China’s increased use of scrap metal for its production of crude steel is fundamentally critical to the dry bulk shipping industry. Mostly Capesize ships are impacted by this, way beyond the temporary iron ore export disruptions in Brazil and Australia.Chinese steel production grew by a massive 12.6 million tonnes (+9.2%) in the first two months on 2019 as estimated by China Iron and Steel Association (CISA).

Progress in Brazil Repair Yard Project

The Brasil Basin Drydock Company (BBDC), a joint venture of McQuilling Services and Promon Engenharia, is setting up an industrial facility that will drydock and repair seagoing merchant vessels up to the largest merchant ships in the world.McQuilling announced the signing of a Protocol of Intention with the government of the state of Paraíba, Brazil, along with Chinese ship repair yard IMC YY.David Saginaw, Commercial Director for McQuilling Services, signed the Protocol on behalf shareholders of the Brasil Basin Drydock Company (BBDC). Governor João Azevedo signed on behalf of the government and Chen Yong, President of IMC YY ship repair yard in Zhoushan, China, signed on behalf of the yard.

Uncertainty Mounts in Dry Bulk Shipping

Uncertainty mounts in dry bulk shipping against a backdrop of weaker growth in Chinese imports, said BIMCO."The extent of the freight rate recovery in 2018 was limited – when compared with initial expectations – by a faster-growing fleet. Q4-2018 wasn’t as strong as it often is either, but we now know that was merely the beginning of a sharp downturn. On top of that, in the first month of 2019, leading the way even further down was a massive lack of cargoes. By early February, the industry appeared to be paddling in quicksand," the report said.The November dip in Capesize freight rates was just an ill omen of what was to come. For the whole of January…

Dry Bulk Shipping: No Room for Newbuilds

DemandThe improved fundamentals during 2017 are clearly seen in the freight rate levels during the first four months of 2018. Freight rates for Handysize, Supramax and Panamax went up by 25-27 percent as compared to the same period of last year. All three sectors moved from loss-making average earnings in the full year of 2017 to a profitable level in first four months of 2018.Meanwhile, capesize freight rates improved by only 5 percent as compared to the same period last year…

CMHI, DNV GL Ink LoI for Two Jack-ups

DNV GL announced it has signed a letter of intent (LoI) with shipyard China Merchants Heavy Industry (Jiangsu) Co., Ltd (CMHI) for the classification of two multi-activity jack-up units at the Offshore Technology Conference (OTC) in Houston.Ordered by OOS Energy B.V., which is affiliated with Netherlands-based Overdulve Offshore Services (OOS) International, these 96 m long units will be purpose-built for the decommissioning market. Construction is scheduled to start later this year.The two identical four-legged…

Dry Bulk, Tanker Newbuilds on the Rise -BIMCO

Tanker and dry bulk vessel newbuild contracts have been signed at an increasing pace so far in 2017, with newbuild activity for the first half of 2017 surpassing the same period last year by 20 percent. According to BIMCO, 5.9 million DWT was contracted in May 2017 and 3.1 million DWT so far in June 2017, which brings the total amount of newbuild orders up to 19.6 million DWT for 2017. So far for June 2017, 22 tankers have been contracted amounting to a total of 2.6 million DWT. For the crude oil tanker segment, this has been entirely for suezmax ships with 1.9 million DWT ordered.

‘Vintage’ Converted VLOCs Still Profitable -BIMCO

With an average age of 23.8 years, the fleet of very large ore carriers (VLOC) converted from very large crude carriers (VLCC) is vintage compared to the average age of 5.7 years for non-converted ore carriers above 200,000 DWT, according to BIMCO. But despite the huge 18.1 years age gap between converted VLOCs and normal VLOCs, the age itself is not the all-important explanatory factor behind a demolition decision. Naturally safety is a paramount issue, but also the fact that the vessels are still employed on a contract.

MacGregor's Pusnes Deck Machinery for Vale's New VLOCs

MacGregor has won Pusnes deck machinery orders for a new series of 400,000 dwt very large ore carriers (VLOCs) under construction at Chinese shipyard, Qingdao Beihai Shipbuilding Heavy Industries. The orders are booked in Cargotec's 2016 third quarter order intake. MacGregor will deliver high-pressure hydraulically-operated deck machinery based on Pusnes designs. "The equipment is simple to operate, well-proven and known for its high-quality," says Esko Karvonen, Head of Smart Ocean Technology division at MacGregor. "For example, the windlasses are equipped with MacGregor's proven dual-motor installation, which ensures high capacity and reliability." Construction of the Valemax vessels is part of an agreement between Brazilian mining company, Vale and the Chinese Government.

Chinese Shippers Order for 30 Valemax Vessels

The Chinese shipping companies - Chinese shipping majors Cosco Group, China Merchants Group and ICBC Financial Leasing Co- ordered 30 Valemaxes worth a combined $2.5 billion for delivery starting from 2018, deployed on Brazil-China trade routes, reports WSJ. The vessels will bosst the trade between China and Brazil and also will invest billions of dollars into delaying shipbuilding industry in the country. The vessel will be employed on Brazil-China trade routes, boosting the import of Vale iron ore in China. Sources said the three state-controlled shipping companies ordered 10 ships each from four local yards—Shanghai Waigaoqiao Shipbuilding, Beihai Shipbuilding, CIC Jiangsu and Yangzijiang Shipbuilding—with deliveries scheduled to begin in 2018.

Valemax Mastermind Roger Agnelli Dies in a Plane Crash

The man responsible for giving the dry bulk industry the valemax died on Sunday in a Sao Paulo plane crash. Roger Agnelli, the former head of the Brazilian mining giant Vale, has died after his private jet crashed into a residential building in Sao Paulo, local media reported. He was 56. Agnelli, his wife and two of his children were among seven killed when his aircraft slammed into the building around 18:20 GMT on Saturday, minutes after taking off from an airport in northern Sao Paulo, an aviation official told Reuters news agency. Agnelli took over as president and chief executive of Vale in 2001 after nearly 19 years at one of the country’s largest banks, Banco Bradesco, which is a major shareholder in Vale.

Vale Sells 3 Valemax Iron Ore Ships to ICBC

Brazil's Vale SA said it has sold three of its giant "Valemax" iron ore ships to a group led by Industrial and Commercial Bank of China, continuing efforts to unload assets to cut debt and focus investment on its main mining activities. Vale will receive $269 million for the ships when they are delivered to the Chinese-led group, likely in August, Vale said in a statement late on Thursday. Vale said it was also seeking to sell other Valemax ships. The vessels, also known as Very Large Ore Carriers (VLOC's) are about 300 meters (984 feet) long and carry up to 400,000 deadweight tonnes, making them some the largest ships afloat. (Reporting by Jeb Blount; Editing by Sandra Maler)

Vale Says Ships Sale, Leaseback Could Fetch $1.1 Bln

Brazil's Vale SA said on Friday that it plans to sell its 11 remaining Valemax iron ore carriers and lease them back in transactions that could raise $1.1 billion. Vale has said it has experienced some delay in selling the ships, the key to its attempt to cut transportation costs between its Brazilian mines and Asian customers, as it seeks to get the best freight rates under contracts to lease the ships back from the new owners. Each more than 360-meter-long (1181-ft-long) ship can carry 380,000 to 400,000 tonnes of ore and are among the biggest vessels afloat. Vale has been selling its part of the world's 35-vessel Valemax fleet for about $110 million each, Luciano Siani, chief financial officer of Rio de Janeiro-based Vale told investors at a conference in London.

Vale Completes Sale of 4 Ore Carriers to Chinese Consortium

Brazilian iron ore miner Vale SA said late on Tuesday in a filing it had completed the sale of four very large ore carriers (VLOC), also known as Valemax class ships, to a consortium lead by ICBC Financial Leasing. ICBC is a subsidiary of the Industrial and Commercial Bank of China Limited. The deal was valued at $423 million and the resources were transferred to Vale on Tuesday. Each VLOC has the capacity to carry 400,000 tonnes of ore. Reporting by Reese Ewing