Lenders Take Control of Polarcus' Ships After Default on Debt

Lenders took control of Polarcus' ships on Tuesday after the seismic surveyor defaulted on its bank loans and bonds, hit by a drop in spending by energy companies struggling with the COVID-19 pandemic and volatile oil prices.The company's Oslo-listed shares plunged as much as 47% after they resumed trading following an earlier suspension.Polarcus said lenders had taken over shares in subsidiaries that own seismic vessels and replaced directors in each subsidiary, but wanted to continue its operations."In parallel with their actions described above…

Op/Ed: Connecting to the Future of Offshore

120 miles out at sea, 6,000-horsepower devices lift drilling equipment weighing up to 3 million pounds out of holes lying 10,000 feet beneath the water. Keeping such sea monsters in good working order, often for years at a time, is no mean feat. Oil companies spend between $300,000 and $800,000 per day on each vessel drilling offshore. Any failures can result in losses that run into hundreds of thousands of dollars per day.With such high costs and massive market pressures, including volatile oil prices…

Innovation Paving the Way for Marine Industry in 2016

From the price of oil to environmental regulation, 2015 was a year of turmoil and uncertainty for the marine sector. Despite this, there were some common global trends that will define 2016. In December 2015, world leaders met at the COP21 conference to discuss climate change. The event’s outcome marks a decisive move towards a low carbon future focused on achieving the agreed-upon world target of 1.5 degree climate change ceiling. Indeed, despite being the most carbon-efficient form of commercial transport[1]…

Brightoil Reports Steady Growth in Interim Results

Brightoil Petroleum (Holdings) Limited announced its interim results for the six months ended December 31, 2014, reporting steady growth over the period. During the period, profit attributable to the owners of the group increased 3% year-on-year to HK$561 million. Basic earnings per share amounted to 6.41 HK cents, up 3% from a year ago. Total revenue climbed 11% from HK$40.3 billion in 1HFY2014 toHK$44.9 billion for the period as the twin-engines business model (upstream and mid-downstream businesses) enabled the group to secure steady growth amid volatile oil prices.

Bureau Veritas Selects New Offshore Lead

Bureau Veritas has appointed Matthieu de Tugny as Senior Vice President in charge of offshore activities within the marine and offshore operating group. He is tasked with driving forward Bureau Veritas Group initiatives in the oil and gas offshore market and enhancing Bureau Veritas’ technical leadership and recognition in this market. Matthieu de Tugny graduated from the Ecole Nationale de la Marine Marchande, France and from the Ecole Supérieure d'Electricité, France as an engineer. He started his career at Bureau Veritas in 1994 in the Electricity and Automation Section.

OW BUNKER Says Outsourcing Model Is Natural Evolution For Fuel Supply

OW Bunker, one of the world’s leading suppliers and traders of marine fuel, today stated that outsourcing fuel procurement is a natural evolution within the shipping industry as ship owners and operators look to maximise efficiencies and reduce costs within their operations. “Although fuel oil is not core to ship owners’/operators’ end service it still represents over 50% of a vessel’s operating costs. Combined with the volatile oil prices and regulatory pressures, as well as…

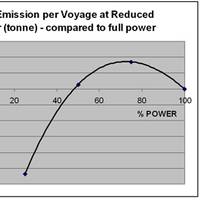

LR: Flexible Ships Needed in Volatile Times

High or volatile oil prices and environmental concerns, point to the need for new designs capable of operating efficiently at different speeds. Lloyd’s Register warns that care needs to be taken when running at reduced power outputs. Most container ships trading today, and on order, were designed for a world of relatively low energy prices. With oil at recent high levels many owners have been implementing or considering slow steaming strategies. Slow steaming may also be seen at present as an answer to over-capacity.