Shipbuilding: Yangzijiang Shipbuilding Inks New Orders Worth $1.58B In July

Yangzijiang Shipbuilding Holdings Ltd. reports new orders for 12+5 vessels worth $1.58B in July, and an LOI for another five dual-fuel 7,000 TEU containerships which is expected to take affect in August.(Reuters)

Odfjell Sells Stake in Chinese Terminal

Norwegian shipping and tank terminal company Odfjell SE has finalized the sale of its indirect 55% equity stake in Odfjell Terminals Jiangyin (OTJ), China.Reference is made to the stock exchange announcement of May 8th, 2018, in which Odfjell SE (Odfjell) announced that Lindsay Goldberg (LG) is considering a sale of its 49% shareholding in Odfjell Terminals BV.After LG completed the sales of its shareholdings in the US and European terminals, LG is now in the process of selling its shareholding in the Asian terminals. Connected with this, Odfjell has decided to tag along on LG’s sale of its indirect shareholding in Odfjell Terminals (Jiangyin).Odfjell is pleased to announce that Odfjell Terminals Asia Holding Pte. Ltd.

Yangzijiang Shipbuilding, Mitsui in Shipbuilding JV

A Japanese and a Chinese shipbuilding group have today signed a joint venture, set to start in April 2019, to build and sell merchant ships. Mitsui E&S Shipbuilding Co., Ltd. (Head Office: Tokyo, President and CEO: Tetsuro Koga), in partnership with Yangzijiang Shipbuilding (Holdings), Ltd. (Head Office: Jiangsu Province, Chairman: Ren Yuanlin) and Mitsui & Co., Ltd. (Head Office: Tokyo, President and CEO: Tatsuo Yasunaga), has entered into a shareholders' agreement to establish…

Yangzijiang Shipbuilding Q2 Profit Surges 73%

China’s Yangzijiang Shipbuilding Holdings reported a 73 percent increase in second-quarter net profit, helped by higher revenue from the construction of larger-size vessels, Reuters reported. The company, which specialises in dry-bulk carriers, posted a net profit of 719.92 million yuan (S$146 million) for the second quarter ended June 30, 2017. Revenue increased 27 per cent year on year to 3.79 billion yuan in Q2 due to higher contributions across its different businesses. The revenue derived from its shipbuilding business increased 25 per cent mainly due to higher volume of shipbuilding activities with construction of larger-sized vessels.

Yangzijiang Shipbuilding to Slash 2,000 More Jobs

Chinese shipbuilder Yangzijiang Shipbuilding Holdings Ltd said it plans to cut 2,000 additional jobs, just under 10 percent of its current workforce, stepping up efforts to cut costs as new vessel orders slide amid a volatile global economy. The Singapore-listed firm, which says it is one of the largest private shipbuilding companies in China, has already cut about 4,000 jobs this year, a spokesperson said late on Thursday, bringing its current workforce to 22,000. Earlier this month, it said revenue was nearly halved in the second quarter as it soaked up a broad industry downturn. The company, which has four shipyards in China's Jiangsu province…

Singapore's SembMarine to Take Full Control of PPL Shipyard

Singaporean rig builder Sembcorp Marine Ltd said it had agreed to buy the 15 percent of PPL Shipyard Pte Ltd it did not already own for about $115 million from PPL Holdings Pte Ltd and E-Interface Holdings Ltd. "This will enable the company to optimally manage the businesses, finance and resources of PPLS, and fully align the latter's corporate strategies to the company to generate sustainable returns," SembMarine said in a statement. PPL Shipyard, 85 percent owned by SembMarine, designs and builds oil rigs and ships. Last week, SembMarine, which has been suffering from a slump in orders due to low oil prices, agreed to buy Norway-based ship design firm LMG Marin AS for $20 million.

Yangzijiang Bags Orders for Six VLOCs

China’s biggest private shipbuilder Yangzijiang Shipbuilding Holdings Ltd has won orders for six dry bulk carriers worth a combined US$510 million. The 400,000 DWT very large ore carriers (VLOCs) are the largest dry bulk carriers ever awarded to the group, the shipbuilder announced on Wednesday (April 13). The six vessels will also be the largest VLOCs that Yangzijiang will be building till date. The VLOCs are scheduled for delivery from 2018 to 2019. The orders were placed by ICBC Leasing, "marking a rare case where a state-owned ship owner in China places orders with a private shipyard", the company added. ICBC Leasing is a wholly owned subsidiary of ICBC, China’s biggest state-owned bank.

Yangzijiang Secures Two VLGC Orders

The Singapore-listed and China-based shipbuilder Yangzijiang Shipbuilding has secured new orders worth $730m, including two very large gas carriers, between September and October. The two 84,000 cbm very large gas carriers (VLGCs) were ordered by Shanghai Zhenrong Energy. Yangzijiang had been in talks to secure the two VLGCs since early this year, and the latest order confirmation has reinforced the company’s progress into building higher specification and higher value ships. Apart from the two VLGCs, the orders include four 11,800 TEU container ships ordered by Pacific International Lines (PIL), four 3,800 TEU boxships for Hamburg Sud and two 1,900 TEU ships for Rickmers Group.

Yangzijiang Shipbuilding in Early Talks on Rongsheng Investment

China's Yangzijiang Shipbuilding Holdings Ltd is considering a possible investment in troubled peer China Huarong Energy Co Ltd , formerly known as China Rongsheng, its executive chairman said on Thursday. Ren Yuanlin said the company was still in early talks with stakeholders, and expected to make a decision on the investment by end-June. "The government, banks, and Rongsheng's major shareholder all hope we can be part of the deal, but whether or not we will get in depends on the asset price," he told reporters at a post-earnings briefing in Singapore, where the company is listed. Yangzijiang, in which Ren owns a 26 percent stake and is the biggest shareholder, is one of China's biggest shipbuilders, and the country's most profitable listed shipyard.

Yangzijiang Diversifies into LNG Vessel Buildiing

Yangzijiang Shipbuilding (Holdings) Limited “Yangzijiang” or “the Group” one of PRC’s leading and most enterprising shipbuilder listed on the SGX Main Board, is pleased to announce that the Group has secured new shipbuilding orders from JHW Engineering & Contracting Limited, a subsidiary of JACCAR Holdings, the company that owns EVERGAS, a world leader in ethylene and ethane gas transportation, to build two 27,500CBM LNG (Liquefied Natural Gas) carriers. With downpayments duly received, the two LNG vessels worth US$135 million are now effective orders and included in Group’s order book. The orders are schedulded to be delivered in 2017. Commenting on the new LNG order, Mr.

Shipbuilding: Yangzijiang bags 13 New Orders

Singapore-listed Chinese shipbuilder Yangzijiang Shipbuilding (Holdings) announced that it had entered into 13 new shipbuilding orders in the fourth quarter of last year, comprising nine effective orders with a total contract value worth of US$388 million and four new options with an aggregate value of US$122 million, says a report in Business Times. These include two units of 10,000 twenty-foot equivalent units (TEU) exercised from existing options and seven new shipbuilding contracts consisting of four units of 36,500 deadweight tonnage (dwt) bulk carriers, two units of 2,700 TEU containerships and one unit of 64,000 dwt bulk carrier.

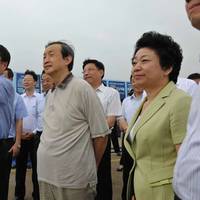

Chinese Leaders Visit Yangzijiang Shipyard

Yangzijiang Shipbuilding Holdings Limited announced that yesterday was a “momentous” for the group, as senior Chinese officials paid visit to Yangzijiang’s shipyard and the group’s chairman received the Outstanding Entrepreneur Award by the Chinese Enterprises Association. On the morning of June 18, Vice-premier of China’s state council, Ma Kai, and Minister of Industry and Information Technology Miao Wei visited the Group’s Jiangsu New Yangzi yard together with national departments, provincial and municipal leaders.

Yangzijiang to Build Huge Ore Carriers for Australia

Chinese shipbuilder on the SGX Main Board Yangzijiang Shipbuilding Holdings Limited announced that it has secured a shipbuilding contract for four 260,000DWT very large ore carriers (VLOC). The shipbuilding contract was secured from an Australia based ore company listed on the Australian Securities Exchange and the contract is the first of its kind in Yangzijiang’s orderbook. Yangzijiang’s ability to break into Australia, a new geographical reach, continues to demonstrate shipowners’ growing confidence in Yangzijiang’s shipbuilding competency, the builder said.

Yangzijiang Shipbuilding Eyes Mega Container Ships

Reuters - Yangzijiang Shipbuilding Holdings Ltd, a top Chinese shipbuilder, plans to build more mega container ships for shipowners eager to cut operating costs. Yangzijiang is China's third-largest listed shipbuilder by market capitalisation and has boasted profit margins that dwarf those of domestic and overseas peers. Yangzijiang is ready to hand over its first mega container ship in March, which can move around 10,000 standard twenty-foot (TEU) containers, and is planning to build vessels that can handle up to 18,000 boxes.

China Shipbuilder Hit by Forex Losses on Contracts

Yangzijiang Shipbuilding Holdings Ltd. China’s second-biggest private shipyard, posted a 7.6 percent decline in second-quarter profit because of higher tax and foreign exchange loss on contracts done in euros, reports Bloomberg. Citing a company statement to the Singapore Stock Exchange, Bloomberg say that Net income in the three months ended June dropped to 812 million yuan ($133 million) from 878 million yuan a year ago, while sales rose 12 percent to 4.42 billion yuan. Yangzijiang is among companies diversifying into offshore drilling and production as demand for new bulk vessels decline. The government has urged financial support…

Chinese Shipyard Inks Creon Jack-up Rig Order

Jiangsu Yangzijiang Offshore Engineering Co. Ltd. signs contract for the rig with Creon associate company Explorer 1. The directors of Creon the resources infrastructure investment company, announce that Jiangsu Yangzijiang Offshore Engineering Co. Ltd. has entered into a contract valued at US$170-million with Explorer I Limited to construct and deliver a Le Tourneau Super 116E Class design self-elevating mobile offshore jack up drilling rig. Delivery of the Rig is anticipated in the second quarter of 2015. It will be built to ABS Classifications and capable of drilling to 30,000 feet in sea depths of up to 350 feet. The rig will be fully equipped with state of the art drilling equipment and will have accommodation for 120 people.

Chinese Shipyard Terminates Greek Contract

Yangzijiang Shipbuilding (Holdings) Ltd has terminated a contract with Greek shipowner FreeSeas Ltd after it failed to make payments The cancelled contract was for Yangzijiang to build two bulk carriers for FreeSeas, an external spokeswoman for the Chinese shipbuilder told Reuters. Although the orders from FreeSeas account for only 1 percent of Yangzijiang's $4.5 billion order book, "the cancellation will still be negative on sentiment as this is Yangzijiang's first contract cancellation on default," said DBS Vickers in a report. It added that among the Singapore-listed shipyards, COSCO Corp Singapore Ltd has the highest exposure to Greece and Europe, with more than 60 percent of its order book from the region, while Yangzijiang will be the least affected among Chinese yards.

Yangzijiang Shipbuilding Up, $2.5B Order

According to a report from Bloomberg, Yangzijiang Shipbuilding Holdings Ltd. (YZJ) climbed the most in almost one month in Singapore trading after winning its first order to build 10,000-container vessels in a contract worth as much as $2.5b. Source: Bloomberg

Yangzijiang Opens Door for Chinese Firms in Taiwan

According to a September 5 report from FinanceAsia.com, Yangzijiang Shipbuilding Holdings will become the first mainland Chinese company to list in Taiwan following a sale of Taiwan depositary receipts (TDRs) that saw it raise $141m. The deal sent the stock 6% higher during the share sale. (Source: FinanceAsia.com)

Yangzijiang Shipbuilding Hedges for Appreciation

According to a report from Bloomberg, Yangzijiang Shipbuilding Holdings Ltd., China’s third-largest shipyard outside state control, is basing currency-hedging on the yuan gaining three percent a year in expectation the government will prevent rises above that pace. The shipyard, which books all of its orders in dollars, is reflecting confidence that China will resist U.S.-led pressure to quicken yuan gains. (Source: Bloomberg)

Yangzijiang Shipbuilding (Holdings) Ltd Announces 6 New Contracts for US $214.2 Million

SINGAPORE: Yangzijiang Shipbuilding (Holdings) Ltd announced six new shipbuilding contracts for a total of US $214.2 million. The company will build two 82,000 DWT (deadweight tonnage) bulk carriers, two 10,000 DWT bulk carriers and two 4,800 TEU (twenty-foot equivalent unit) container ships, to be delivered in 2012 and 2013. During the first quarter of 2011 Yangzijiang has secured a total of 14 shipbuilding contracts adding up to US $512.3 million. Source: Channel News Asia- 11 April 2011

Report: HHI Leads Drop in Shipbuilding Stocks

According to reports, Hyundai Heavy Industries Co., led declines among shipyard stocks on concern of fewer orders for vessels this year after bulk rates fell the most since June 1989. Hyundai Heavy dropped 6.6 percent, the biggest decline in almost five months, to close at 382,500 won. Unit Hyundai Mipo Dockyard Co. declined 6.5 percent, the largest loss in two months, to 244,000 won. Bulk rates plunged last week on concern economic slowdowns in China, the world's biggest buyer of iron ore used to make steel, and the U.S. may reduce trade demand for commodities and consumer goods. Demand from China, Asia's second-largest economy, last year helped lift fees to a record, prompting vessel orders. Shipping lines including STX Pan Ocean Co. and Pacific Basin Shipping Ltd.