Medicare Set Asides – and You

Jones Act and LHWCA employers must protect Medicare’s interest or pay the price. It may be boring, but it is important. Read and heed.

Attention maritime entities that employ Jones Act Seamen covered by liability insurance, including self-insurance, or land based employees covered by no-fault insurance or any workers’ compensation act: you MUST protect Medicare interests. These plans are also known as Non-Group Health Plans (NGHP). Failure could mean a fine of $1,000.00 per day per claim or liable to reimburse Medicare for payments made to a claimant. This reimbursement could be pursued from the insurance company, the insured, or even counsel, possibly including defense counsel.

Medicaid Medicare SCHIP Extension Act of 2007 (MMSEA) §111 has added mandatory reporting requirements with respect to Medicare beneficiaries who receive a settlement, judgment, award or other payment from an entity. This includes Jones Act and Longshore and Harbor Workers’ Compensation Act (LHWCA) employers. Under this reporting scheme, these entities are designated as a Responsible Reporting Entity (RRE).

First of all, who can be considered an RRE is not so straight forward. It could be the employer or it could be liability insurer (including self-insurer), no fault insurer, or workman’s comp insurer. In short, it can be a real “spaghetti monster.” And, for any maritime attorney settling Jones Act and LHWCA 905(b) claims, this is a very important – and complicated – issue. In the end, all the analysis points to the conclusion that the employer will ultimately be held responsible.

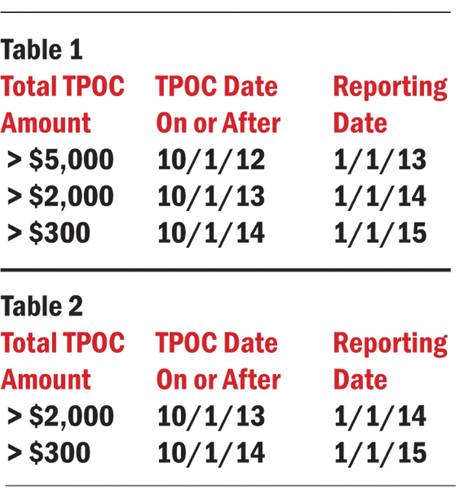

According to MMSEA §111, RREs have a responsibility to: 1.) determine whether a plaintiff/claimant is entitled to Medicare benefits on any basis; and 2.) upon settlement of a Medicare beneficiary’s claim, submit all information required by Centers for Medicare and Medicaid Services (CMS) with respect to the claimant to CMS. The actual RRE reporting is triggered by settlement, award, judgment or other payment to a Medicare beneficiary. A Medicare beneficiary is a person age 65 or older, a person under 65 with certain disabilities, and a person of all ages with end-stage renal disease. However, the analysis concerning the determination of a Medicare beneficiary is not as simple as it may seem. To satisfy these responsibilities, the RRE is required to input either a Medicare Health Insurance Claim Number (HICN) or the injured party’s Social Security Number (SSN), the first six characters of the Medicare beneficiary’s last name, his/her date of birth, and gender. Other relevant information may include the nature and extent of the injury or illness, facts about the incident giving rise to the injury or illness, information sufficient to assess the value of reimbursement, and information sufficient to assess the value of future care planning. RREs are ultimately responsible for complying with the reporting process including ensuring the accuracy of all reported information. While RREs may not contract away their obligation under this law, they may elect to use an agent for reporting purposes. RREs must report settlements, judgments, awards, or other payments regardless of whether or not there is an admission or determination of liability. Table 1 provides when reporting requirements become mandatory after a Total Payment Obligation to the Claimant (TPOC) threshold is meet for Liability Insurance, including self-insurance.

Table 2 provides when reporting requirements become mandatory after a TPOC threshold is meet for Workers’ Compensation. These reporting requirements will result not only in added infrastructure cost (personnel and systems) for RREs, but also in additional steps in legal claim resolution by mandating verification of CMS benefits throughout litigation until resolution. To avoid lengthy delays, it is best to begin investigating a person’s Medicare beneficiary status as soon as a colorable Medicare beneficiary claim arises.

If the claimant/plaintiff was not a Medicare beneficiary at a time when the RRE assumed ongoing responsibility for future medical care, the RRE must continue to monitor the claimant’s/plaintiff’s Medicare status, because it may change over time. If the claimant/plaintiff becomes a Medicare beneficiary, the RRE must report when that individual becomes a Medicare beneficiary unless responsibility for ongoing medicals has terminated before the individual becomes a Medicare beneficiary. If reporting entity’s responsibility for future medical costs terminates before the claimant/plaintiff becomes a Medicare beneficiary, there is no reporting requirement. In cases involving more than one defendant, if more than one RRE has assumed responsibility for ongoing medicals, Medicare would be secondary to each such entity and, therefore, each such entity must report.

There is no safe harbor for an RRE, and the status of every claimant should be verified through the query process regardless of the claimant’s age or any other threshold. It is critical to start the verification process at the onset of a new claim, or at the latest, when settlement appears to be a realistic near-term goal. The process takes time; so early submission is urged to capture any data that will be reported at settlement. Reported data is to be sent electronically from the RRE to the CMS Coordination of Benefits Contractor (COBC). Each RRE must assign or name an Authorized Representative. This individual must have the legal authority to bind the organization to a contract in the terms of MMSEA §111 requirements and processing. The Authorized Representative has ultimate accountability for the RRE’s compliance with the reporting requirements and, therefore, cannot be an agent of the RRE.

Additionally, each RRE must assign or name an Account Manager. Each RRE ID can have only one Account Manager. This is the individual who controls the administration of an RRE’s account and manages the overall reporting process. The Account Manager may be an RRE employee or agent. The Account Manager may choose to manage the entire account and data file exchange, or may invite other company employees or data processing agents to assist.

At the RRE’s discretion, the Account Manager may designate other individuals to register as users of the Coordinator of Benefits Secured Website (COBSW) associated with the RRE’s account, known as Account Designees. Account Designees assist the Account Manager with the reporting process and may be RRE employees or agents. There is no limit to the number of Account Designees associated with an RRE ID. In short, if you enter into a settlement, judgment, award or make other payments to a seaman or land based employee you must protect Medicare’s interests. Failure could result in a fine of $1,000 per day per claim or you may end up reimbursing Medicare for a claimant’s medicals years later.

(As published in the April 2013 edition of Marine News - www.marinelink.com)