Big Carriers Reduce North-South Options

Maritime research company, Drewry, said in this week’s container insight report that it is not just on the East-West routes that big container lines are consolidating, but consortia have also been expanding in North-South tradelanes, thereby reducing the number of weekly services available to shippers.

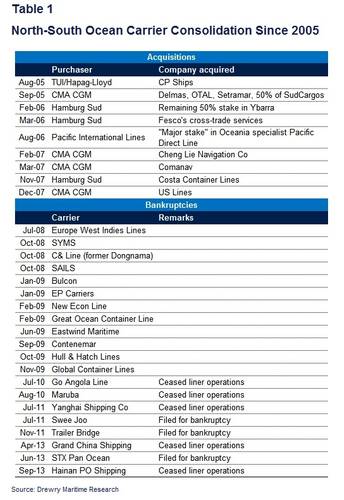

Hapag-Lloyd’s recent reduction in the number of weekly services offered to customers between Northern Europe and the East Coast of South America through slot charters is just another step towards carrier and joint service consolidation in the North-South trades. It is not just niche-market players who have been struggling on the routes, although they have clearly felt most of the pain so far (see Table 1), implying that greater structural changes lie ahead.

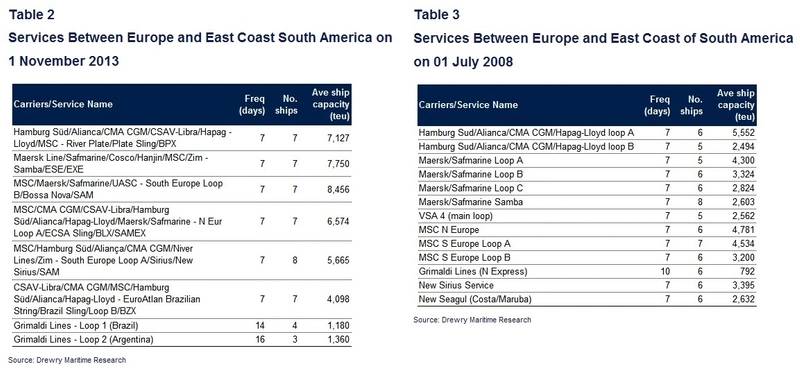

Whatever form these changes take, including the possible extension of East-West alliances, shippers will already be concerned by the dramatic decrease in services offered by ocean carriers. Over the past five years, the number of separate strings offered between Europe and ECSA alone fell from 13 to eight (including two fortnightly con-ro services offered by Grimaldi Lines). In the interim, only Costa/Maruba fell by the wayside, so the rest were lost through consortia expansion.

Tables 2 and 3 shows the omnipresent way that consortia have spread their tentacles between Europe and ECSA since 01 July 2008, with Maersk, MSC and CMA CGM separately ending up with 72% of all vessel capacity on 1 November 2013, and Hamburg Sud another 4%, although much of this is offered to other lines through slot charters. Hapag-Lloyd’s arrangement with MSC’s ECSA service is no longer one of these, however.

In the tradelane between Asia and ECSA, the corresponding reduction in services was from 10 to six, but Maersk, MSC, CMA CGM and Hamburg Sud have independently only ended up with 48% of all vessel capacity.

The consolidation process has been spurred on by the cascading of much bigger ships no longer required in East-West trades due to weak cargo growth in 2012 and 2013, which will not last forever.

The danger of such declines in shipper choice is highlighted in UNCTAD’s latest Review of Maritime Transport 2013, including East-West trades, which states: “Based on UNCTAD’s Liner Shipping Connectivity Index (LSCI), the average number of carriers per country has decreased by 27% over the past decade, from 22 in 2004 to 16 in early 2013. This reduction in choice among shippers poses challenges, especially for smaller developing countries, which are confronted with potentially oligopolistic markets”.

In Drewry’s view, most of this consolidation took place in North-South tradelanes, where many niche market players have either folded or been taken over (see Table 1).

According to Drewry, the significance of the service rationalization that has been taking place in the North-south trades is that whilst regulatory authorities are considering whether or not the P3 and G6 alliance extension should be allowed in the East-West trades, shippers have already been confronted with many partner lines sharing vessels to similar extents – but without major protest so far.

drewry.co.uk