By The Numbers: Tug Boat Market Report

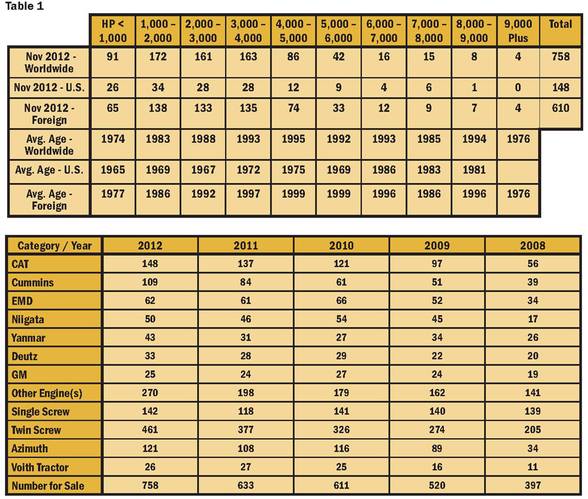

Easily one of the more interesting statistical comparisons and compilations that reach our desk every year is the periodic Marcon International Tug Boat Market Report. We’ve examined this type of report before and it is worth doing so again. Chock full of data on the availability and make-up of tugs for sale here and abroad, the report also drills much deeper than that. We’ve highlighted some of the more interesting aspects of their latest effort (November 2012). Table 1 lists the breakdown of available anchor handling coastal, ocean and harbor tugs, according to Marcon’s records.

Market Overview

Of the 12,077 vessels and 3,750 barges that Marcon tracks, 4,600 are tugs with 758 currently on the market for sale worldwide, up 6.61% since August. 253 or 33.38% of the tugs worldwide, primarily foreign flagged, were built within the last 10 years, are newbuilding re-sales or currently under construction – compared to 32.63% at the last report. 63 (8.31%) are over 50 years of age and three tugs are 75 years of age or older. The two oldest tugs are both 82 years old - a 1930 built triple screw tug (later rebuilt) in the Netherlands and a 1930 built single screw tug (also rebuilt) in Sweden. These “old ladies” are balanced by 55 newbuildings up to 7,000HP range scheduled for delivery through 2013.

Five Years of Telling Data

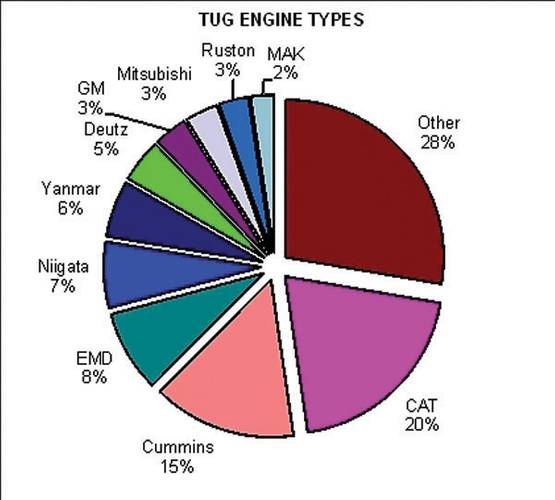

Drilling deeper, it is interesting to note the evolution of the makeup of these offered vessels in terms of engine make, propulsion type, and numbers of boats actually on the market.

And, while it is difficult to draw definitive conclusions from this five year running average, it is clear that operators everywhere are looking to replace older tonnage in increasing numbers.

The majority of tugs Marcon tracks for sale are in the U.S. with 145 tugs officially on the market (up from 144 last report), followed by Southeast Asia with 141, 121 each in Europe and the Far East, 75 in the Mediterranean, 47 Mid East, 31 Caribbean, 17 each in Canada and where location unstated, 12 each in Africa and Latin America, Southwest Asia 11 and 8 in the South Pacific. Marcon reports a record total of 758 tugs for sale worldwide, up a whopping 19.7% since November 2011, with virtually all of the increase in the overseas market with 47 additional tugs coming available for sale and 15 for charter within the last three months. While there have been a few U.S. flag tugs sold, a few more came on the market leaving the number of domestic tugs for sale flat. Slightly more activity in tug sales has been observed, especially with U.S. boats going foreign and Marcon expects this to continue over the next six months.

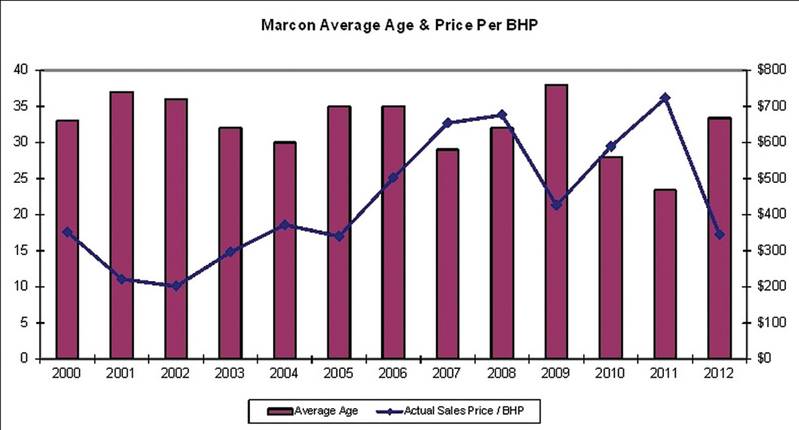

As of this report, the actual sales price compared to BHP (brake horsepower – a measure of an engine’s horsepower before loss in power due to other systems on board), is US$ 344/BHP for a “generic” 1979 built tug. The accompanying graph does not take into account the vessel’s condition and whether azimuthing, twin screw, single screw or tractor; but is just a simple comparison of tugs sold built 33 years ago. 2012’s Price/BHP of US$ 344/BHP to date is fairly close to 2005’s US$ 339.5 for a generic tug two years older. It is unlikely that we will see any major improvement in second-hand tug prices, especially older units, within the near future. Condition, as always, and, more than ever, location are the key factors affecting the final sale price for second-hand tugs. It does not take much of a mobilization cost to make or break a sale in these times. According to Marcon, and taking into consideration today’s sale & purchase market, anything spent on certain second-hand tugs should be dependent only on the earning capability of the tug in existing trades and not on any expected improvement in resale value. For a tug regularly working and very likely to remain in that trade for a number of years, the only return on additional investment that can be counted on will come from continued employment and not from any increase in resale value.

(As published in the January 2013 edition of Marine News - www.marinelink.com)