Gulf of Mexico Lease Sale Pulls in $191.6 Million

The Biden administration's auction of oil drilling rights in the U.S. Gulf of Mexico generated more than $190 million in high bids, bringing in more money for taxpayers than any government offshore lease sale since early 2019.The Department of Interior auction came days after the U.S. joined a global agreement that for the first time asked governments to accelerate emissions cuts by phasing down coal and fossil fuel subsidies.It was the first auction under President Joe Biden, whose administration paused drilling sales under a promise to end development on federal properties.

Upstream Sector Leads O&A M&A in 2019

A latest research revealed that the upstream sector accounted for the bulk of mergers and acquisitions (M&A) in the global oil and gas industry in 2019, generating some high-value transactions during the process.According to GlobalData's theme report, ‘M&A in Oil and Gas – 2020’, the acquisition of Anadarko Petroleum by Occidental Petroleum in April 2019 for a purchase consideration of US$57bn was the highlight of oil and gas M&A activity last year, says GlobalData, a leading data and analytics company.Ravindra Puranik, Oil & Gas Analyst at GlobalData, said: “In 2019, the upstream sector, more specifically the US shale plays, witnessed the highest deal activity in the oil and gas industry.

US Shale Operators Achieves Positive Cash Flow

In a remarkable turnaround, the second quarter of 2019 is the first three-month period on record when US shale operators achieved positive cash flow from operations after accounting for capital expenditures, according to Rystad Energy.Rystad Energy has studied the financial performance of 40 dedicated US shale oil companies, focusing on cash flow from operating activities (CFO). This is the cash that is available to expand the business (via capital expenditure, or capex), reduce debt, or return to shareholders.In the second quarter of 2019, 35% of operators in the peer group balanced their spending with operational cash flow, and reported an accumulated $110 million surplus in CFO versus capex.“That is an industry first,” says Rystad Energy senior analyst Alisa Lukash.

Global LNG Demand 16% Up in Q2

Global liquefied natural gas (LNG) demand was 86 million tonnes (mt) in the second quarter, compared with 74 mt in the second quarter of 2018, an increase of 16%, said GasLog Ltd.The Monaco-headquartered international owner, operator and manager of liquefied LNG carriers said that higher European imports (up 110% year-on-year) accounted for most of the growth, while demand from Northeast Asia (Japan, China, South Korea and Taiwan) was flat year-on-year, according to Poten.Natural gas prices were at multi-year lows in the second quarter of 2019 as the leveling off in demand growth from key LNG consumers in Northeast Asia coupled with elevated inventories and new LNG supply depressed LNG prices in Asia and Europe.However…

US Gulf Production Restarting After Barry

U.S. oil companies on Monday began restoring some of the more than nearly 74% production shut at U.S. Gulf of Mexico platforms ahead of Hurricane Barry, the U.S. offshore drilling regulator said.There was 1.3 million barrels per day (bpd) of oil production off line in the U.S.-regulated areas of the Gulf of Mexico on Monday, about 80,000 barrels less than on Sunday, according to the U.S. Bureau of Safety and Environmental Enforcement (BSEE).Workers also were returning to the more than 280 production platforms that had been evacuated.

Anadarko Signs LNG Supply Deal with JERA, CPC

US hydrocarbon exploration company Anadarko has signed a Sale and Purchase Agreement (SPA) with Japanese power company JERA and Taiwanese oil and gas company CPC.The SPA calls for the delivered ex-ship supply of 1.6 million tonnes per annum (MTPA) for a base term of 17 years from the commercial start date. Mozambique LNG's portfolio of long-term sales now includes four of the top five LNG importing markets in the world."This co-purchasing agreement with JERA and CPC brings together two prominent Asian foundation customers and will ensure a reliable supply of cleaner energy to meet the growing demands of both Japan and Taiwan," said Mitch Ingram…

Anadarko Bidding War Heats Up

American multinational energy corporation Chevron is working on integrating the hydrocarbon exploration company Anadarko Petroleum, even as it faces a higher rival takeover bid for the oil explorer from Occidental Petroleum Corp, said a report in Bloomberg.However, it is becoming increasingly difficult for Anadarko to justify sticking with Chevron's$30.9 billion takeover as its shares gain following Occidental Petroleum higher offer."The bidding war is breaking out over Anadarko, together using Occidental making an offer it says is about a 20% premium into Chevron’s deal announced earlier this month, some rare movement not often seen from the U.S.

Chevron Buys Anadarko for $50Bln

Chevron, the second-largest US oil and gas company, has agreed a $50bn deal to buy Anadarko Petroleum (APC) in a massive deal that will bolster its natural gas and shale operations.The cash and stock deal announced Friday values Anadarko at $65 per share, 39% higher than the oil company's closing stock price on Thursday. Based on Chevron’s closing price on April 11, 2019 and under the terms of the agreement, Anadarko shareholders will receive 0.3869 shares of Chevron and $16.25 in cash for each Anadarko share. The total enterprise value of the transaction is $50 billion.The acquisition of Anadarko will significantly enhance Chevron’s already advantaged Upstream portfolio and further strengthen its leading positions in large, attractive shale, deepwater and natural gas resource basins.

Anadarko, Bharat Petroleum Sign LNG Deal

American petroleum and natural gas exploration and production company Anadarko, on behalf of the Mozambique Area 1 partners, signed a deal with Bharat Gas Resources (BGR) for the supply of liquefied natural gas (LNG) volumes from the Mozambique LNG development.The sale and purchase agreement (SPA) is for 1 million tonnes per annum (MTPA) for a term of 15 years. BGR is a wholly owned subsidiary of Government of India controlled oil and gas giant Bharat Petroleum Corporation Ltd. (BPCL)."In addition to BPCL being an upstream equity co-venturer in the Mozambique LNG project, we are also pleased to have them as one of our foundation customers…

Anadarko Shell Deal for Mozambique LNG

US company Anadarko Petroleum has signed a major long-term contract to shore up its proposed liquefied natural gas (LNG) terminal in Mozambique.The Woodlands-based oil and gas company said that Mozambique LNG1 Company, the jointly owned sales entity of the Mozambique Area 1 co-venturers, has signed a Sale and Purchase Agreement (SPA) with Shell International Trading Middle East. The SPA is for 2 million tonnes of LNG per annum (MTPA) for a term of 13 years. "We are very pleased to announce this SPA with Shell, which builds upon previously announced deals and takes our total long-term sales to more than 7.5 MTPA, with additional deals expected in the near future…

Anadarko Sells LNG to CNOOC

U.S. oil giant Anadarko Petroleum said it has signed a deal with one of China’s biggest importers to supply 1.5 million tonnes of liquefied natural gas (LNG) a year from Mozambique for a period of 13 years.The contract, signed by Anadarko and China’s GNOOC Gas and Power Singapore Trading & Marketing, gives China’s biggest liquefied natural gas importer access to world-class gas resources from Mozambique LNG, Mitch Ingram, executive vice president of Anadarko’s International, Deepwater and Exploration division, said."Mozambique LNG is extremely pleased to have CNOOC onboard as one of our foundation customers," added Ingram. "This agreement adds to our growing list of customers in the Asia-Pacific region…

Shell in Talks to Sell $1.3 Bln of Gulf Coast Assets

Royal Dutch Shell Plc is in talks to sell its assets in a Gulf of Mexico oilfield to Focus Oil to pay for its takeover of BG Group Plc, Bloomberg reported on Thursday, citing people familiar with matter.The deal could value Shell's stake in the Caesar Tonga field at about $1.3 billion, the report said.Shell has a 22.5 percent working interest in Caesar Tonga, with the rest owned by companies including Anadarko Petroleum Corp, Equinor ASA and Chevron Corp, Bloomberg said, citing company filings.Shell and Focus Oil did not immediately respond to a request for comment.(Reporting by Sathvik N in B

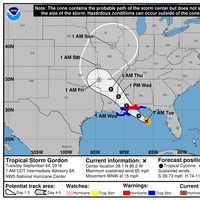

Gulf Platforms Shut ahead of Hurricane

U.S. oil prices edged up on Tuesday, rising back past $70 per barrel, after two Gulf of Mexico oil platforms were evacuated in preparation for a hurricane.U.S. West Texas Intermediate (WTI) crude futures were at $70.04 per barrel at 0034 GMT, up 24 cents, or 0.3 percent from their last settlement.Anadarko Petroleum Corp said on Monday it had evacuated and shut production at two oil platforms in the northern Gulf of Mexico ahead of the approach of Gordon, which is expected to come ashore as a hurricane.International Brent crude futures…

Storm Gordon Starts Kicking Up Waves on U.S. Gulf Coast

Waves began to batter parts of the U.S. Gulf Coast on Tuesday as the region felt the first hit of Tropical Storm Gordon, which is expected to become a hurricane before it comes ashore with high winds and heavy rain, forecasters said.The storm also caused a jump in global oil prices after the evacuation of two oil platforms in the Gulf of Mexico.Gordon was due to come ashore late on Tuesday near the border between Louisiana and Mississippi, and drop as much as 12 inches (30 cm) of rain in areas still recovering from last year's hurricanes…

Argentina Offshore Auction Attracting Oil Producers

International oil firms including Norway's Statoil, U.S.

LNG Heats Up Again as Market Changes: Russell

If you were looking for signs that the liquefied natural gas (LNG) merry-go-round is starting to spin a little faster, the announcement of a planned massive expansion in Papua New Guinea is ample evidence. Global majors Exxon Mobil and Total are considering plans to double LNG exports from Papua New Guinea to about 16 million tonnes per annum, their partner Oil Search said on Feb. 20. If approved, three new trains would be added to the existing Exxon-operated PNG LNG facility, with natural gas from Total's fields supplying two of the units and the third using existing fields and a new Exxon development. While a final investment decision on the $13 billion expansion is still more than a year away…

Asia's Soaring Gas Demand Beckons New LNG Projects

Global LNG imports rose by 20 percent in 2017; new demand emerges across South, Southeast Asia. Soaring gas demand from China, India and Southeast Asia is sucking up an LNG supply glut previously expected to last for years, opening opportunity for new production from East Africa to North America that had been deemed part of the overhang. Trade flows in Eikon show global liquefied natural gas (LNG) imports have risen 40 percent since 2015, to almost 40 billion cubic metres (bcm) a month. Growth accelerated in 2017, with imports up by a fifth, largely due to China, but also South Korea and Japan. Asia's LNG market has been glutted since 2015, following massive development that began in the early 2000s.

Anadarko Posts Quarterly Profit on Higher Crude Prices

Anadarko Petroleum Corp on Tuesday beat analysts' estimate for quarterly profit, helped by improved crude oil prices and lower costs. Crude prices are recovering from the lows hit in 2016 after a global crude oil glut. The company cut its 2018 capital investment outlook to a range of$4.1 billion to $4.5 billion, from $4.2 billion to $4.6 billion it previously forecast. Total full-year sales volume outlook was cut to a range of 238-248 million barrels of oil equivalent (MMBOE) from 245-255 MMBOE.

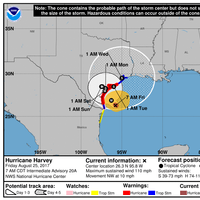

Oil Firm Evacuate Workers as Storm Approaches Texas

Oil companies evacuate workers as storm takes aim at Texas. Royal Dutch Shell, Anadarko Petroleum and Exxon Mobil announced they were curbing some oil and gas output on Wednesday at facilities in the Gulf of Mexico ahead of a storm expected to hit the Texas coast later this week. The U.S. National Hurricane Center (NHC) issued a hurricane watch Wednesday for much of the Texas coast, calling for slow-moving Tropical Depression Harvey to intensify as it nears landfall. Shell said it was evacuating all personnel from the roughly 100,000 barrel-per-day (bpd) Perdido oil and gas production platform as a precaution. Anadarko said it had shut in production and was evacuating workers from its Boomvang, Gunnison, Lucius and Nansen platforms in the Gulf of Mexico.

Hurricane Harvey Strengthens, Threatens US

Hurricane Harvey intensified early on Friday into potentially the most powerful hurricane to hit the U.S. mainland in more than a decade, as authorities warned locals to shelter from what could be life-threatening winds and floods. Harvey is set to make landfall late Friday or early Saturday on the central Texas coast where Corpus Christi and Houston are home to some of the biggest U.S. refineries. Oil and gas operations have already been disrupted and gasoline prices have spiked. "Now is the time to urgently hide from the wind.

Residents Flee South Texas Ahead of Harvey

Residents fleeing most powerful storm on U.S. mainland since 2005. Businesses closed and lines of cars streamed out of coastal Texas as officials called for residents to evacuate ahead of Hurricane Harvey, expected to arrive about midnight as the most powerful storm to hit the U.S. mainland in more than a decade. The hurricane is forecast to slam first near Corpus Christi, Texas, drop flooding rains along the central Texas coast and potentially loop back over the Gulf of Mexico before hitting Houston, some models showed. "My urgent message to my fellow Texans is that if you live in a region where evacuation has been ordered, you need to heed that advice and get out of harm's way while you can," Texas Gov. Greg Abbott said in a televised address.

NOIA Appoints Four to BoD

National Ocean Industries Association (NOIA) Chairman David Welch has appointed four new members to the association’s Board of Directors. The appointments were announced today during NOIA’s fall meeting in Jackson Hole, Wyoming, where the association is commemorating 45 years of commitment to America’s offshore energy industry. Today, the oil and gas industry, long centered in the Gulf of Mexico, produces 17% of America’s domestic oil and 5% of our domestic natural gas, while off the coast of Rhode Island, America’s first offshore wind farm is providing energy to residents and businesses on Block Island. “The offshore energy industry has come a long way in the last 45 years.

As US Opens Up Offshore Waters, Eastern GoM Beckons

President Donald Trump's administration has proposed opening up nearly all of America's offshore waters to oil and gas drilling, but the industry says it is mainly interested in one part of it, now cordoned off by the Pentagon: the eastern Gulf of Mexico. The industry's focus on an area located near a sprawling network of existing platforms, pipes and ports could ease the path to new reserves, and assuage the drilling opponents near other places offered under the Interior Department's proposed drilling plan issued last week, like California's Pacific, the Atlantic and Arctic. But accessing it would likely require the consent of the U.S. military.