New Maritime Bank Targets 2Q 2014 Operations

Maritime & Merchant - A new maritime bank aims to bridge funding gap in maritime finance market

An experienced team of shipping, offshore and finance professionals are pleased to announce the intention to establish Maritime & Merchant Bank (M&M) a niche financial institution dedicated to meeting the funding needs of owners active in the shipping and offshore industries, worldwide.

The newly formed project company, Maritime & Merchant AS (M&M AS), will file a banking license application on behalf of M&M during the autumn of 2013. The main sponsoring shareholders of M&M AS are currently Arne Blystad, Henning Oldendorff, Nergaard Investment Partners, controlled by Alex and Birger Nergaard and Landmark Holdings in Shanghai.

M&M will be a highly specialized niche financial institution focused on the maritime and offshore industries, providing a broad range of services, including secured lending, syndication, hedging products and payment services. Pending the successful resolution of the filing process, the bank is expected to begin operations in the second quarter of 2014.

According to Managing Director of M&M AS Halvor Sveen (formerly Senior Vice President, Offshore & Shipping at Pareto Bank ASA), the bank is being established to meet the industry´s growing demand for financing. “Over the past four years, the introduction of stricter capital requirements has forced many banks to either discontinue lending to owners or scale back on activities in ship finance,” he said. “This tight credit market has left many small to medium-sized owners seeking financing with no place to go – until now.”

Sveen adds that established banks with diverse investment portfolios unrelated to the shipping and offshore segments have been forced to introduce tighter lending controls to maintain their activities in core business areas. “Owners have turned to alternative sources, such as the bond market, private equity and export credit agencies, to fill the gap,” he said. “We saw a demand for a highly specialized bank with experience in the shipping and offshore industries that is able to make quick decisions.”

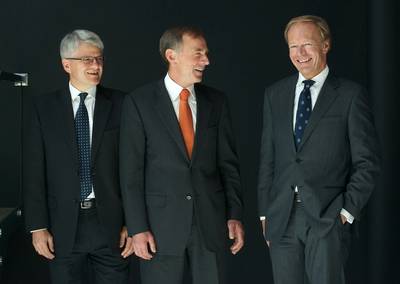

Sveen adds that the new entity will recruit a small and competent team consisting of shipping and banking professionals with global experience. This international competence is also reflected in the Board of Directors of M&M AS, which include Endre Ording Sund (Chairman), Klaus Kjærulff, formerly the CEO of Torm and current Chairman of Skuld, German shipowner Henning Oldendorff, Norwegian shipowner Arne Blystad, Singapore-based Norwegian investor Alex Nergaard and Paal Utvik, a Shanghai-based investor.

Chairman of the Board, Endre Ording Sund (former CEO of the A. Wilhelmsen Group) is confident the new bank will be profitable from day one. “The timing is right,” he said. “Market values in most segments are in the lower part of the cycle, resulting in a low default risk for new loans, while margins and fees are high. Within five years, we expect M&M to build a substantial portfolio’’.

The Cleaves Group, a specialist sale and purchase broker and marine finance company in the shipping and offshore segments, has been instrumental in the development phase. Partner and director of Cleaves; Lars Edvard Høgestøl (formerly Managing Director of DVB Group Merchant Bank (Asia) Ltd) commented, “The Bank will have a simple but effective business model, the right personnel and a highly experienced and independent board,” he said. “We have a strong capital base to support M&M’s expansion and will meet all regulatory requirements to operate as a bank. More to the point, there is a clear demand in the market for a focused bank that provides secured project lending to the shipping and offshore industries in order to help make good business ideas become a reality. We believe M&M is perfectly positioned to achieve that goal.”