HIGHLIGHTS:

• Revenue rose 9.3% to $26.1 million despite loss of bareboat charter revenue from three chemical tankers leased to BLT

• Revenue contribution from chemical tankers to be deployed in the ‘Nordic Siva’ pool and product tanker to be chartered to Petrobras expected to kick in from 2QFY12

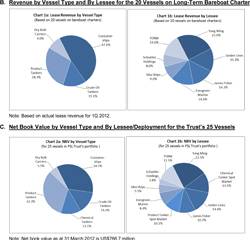

• Vessels on spot and short-term charter complement long-term bareboat charters that continue to provide a stable revenue base for the Trust

SINGAPORE – FSL Trust Management Pte. Ltd. (FSLTM), as trustee-manager of First Ship Lease Trust, announced the financial results of FSL Trust for the quarter ended 31 March 2012. Revenue for 1QFY12 rose $2.2 million or 9.3% year-on-year to $26.1 million. The net increase in revenue was contributed by the full quarter lease revenue from the two vessels leased to TORM A/S which were acquired in June 2011, as well as higher freight income from the vessels trading in the spot market. This was partially offset by the loss in bareboat charter revenue from the three chemical tankers previously leased to PT Berlian Laju Tanker Tbk.

However, the Trust posted a net loss of $4.2 million for 1QFY12 against a net loss of $2 million in the previous year. This weaker performance was largely due to the default of lease payments by BLT in February 2012. As a result, against the corresponding quarter last year, cash generated from operations declined by 14.7% to $9.8 million.

Excluding voyage and vessel operating expenses of $5.3 million, operating expenditure increased by 6.7% year-on-year to $17 million. The higher expenditure was due mainly to a one-off expense of $0.8 million relating to the redelivery of the three chemical tankers from BLT to FSL Trust.

In light of the weak market outlook for 2012, the Trust continues to be prudent. To conserve cash, the Trust maintains a total distribution of $0.7 million or distribution per unit (DPU) of 0.10¢ to its unitholders for 1QFY12.

UPDATE ON THREE CHEMICAL TANKERS TO BE DEPLOYED IN A POOL

Within six weeks after the payment default by BLT, FSLTM acted promptly to repossess the three chemical tankers that were leased to them. This enabled the Trust to immediately redeploy them under the commercial management of Copenhagen-based Nordic Tankers Management A/S (Nordic Tankers), thereby minimizing the loss in lease revenue. The chemical tankers are expected to enter the ‘Nordic Siva’ pool managed by Nordic Tankers within the second quarter of 2012 (2QFY12).

Excluding the impact of the loss in lease revenue from BLT, the three chemical tankers generated a bareboat charter equivalent loss of $0.9 million for 1QFY12 due to the mismatch in recognition of freight income and expenses. For vessels trading in the spot market, freight income can only be recognized upon completion of the voyage and/or cargo discharge. In 1QFY12, voyage and vessel operating expenses incurred by all three chemical tankers were accrued whilst corresponding freight income for only one vessel was recognized. The remaining two chemical tankers completed their voyages in mid-April 2012 and the respective freight income will be recognized in 2QFY12.

UPDATE ON PRODUCT TANKERS ‘FSL SINGAPORE’ AND ‘FSL HAMBURG’

The two product tankers, ‘FSL Singapore’ and ‘FSL Hamburg’, were deployed in the product tanker spot market during the quarter and generated a bareboat charter equivalent revenue of $0.4 million compared to a loss of $1.1 million in the previous year. FSL Trust has recently reached an agreement with Petròleo Brasileiro S.A. (Petrobras) to charter ‘FSL Singapore’ at a gross fixed rate of $14,000 per day under a three-year time charter and commencement of the charter is expected within 2QFY121.

OUTLOOK

Mr Philip Clausius, Chief Executive Officer of FSLTM said: “We are pleased to secure the three-year time charter contract with Petrobras for ‘FSL Singapore’ and are bidding for a similar contract for ‘FSL Hamburg’. With continued volatility in the industry, the fixed-rate time charter contract will bring further stability to our cash flows.

In this current difficult environment, we will have to remain nimble and flexible to make the right decisions for the short-term and long-term. Our long-term bareboat charters will continue to provide a stable revenue base while our vessels trading on spot give us the opportunity to position ourselves for the upturn.

The entire shipping industry is going through an extraordinary down cycle and we appreciate the backing of our bankers and the patience of our unit holders during this difficult time. Even as we work to improve returns, we have also undertaken to conserve our capital and strengthen the balance sheet to ensure a sustainable future for FSL Trust and all stakeholders.”

Further to the Trust’s earlier announcement regarding the two product tankers leased to TORM2, the Trust’s lenders have given their consent and support to the realignment of charter terms. Revenue contribution from the two product tankers is expected to be reduced to variable