Future Prospects of Shipping COVID-19 Vaccines by Sea

The lucrative prospect of transporting COVID-19 vaccines by sea has intensified the spotlight on the maritime industry’s cold supply chain and its ability to carry high-value pharmaceuticals.At present, speed to market is critical to stemming the spread of the pandemic, so the vaccines are being shipped by air to international destinations. Delivering them by sea is a longer-term strategy; certainly, the present urgency would have to calm considerably before enough confidence could be built to support delivery times in weeks…

Future Prospects of Shipping COVID-19 Vaccines by Sea

The lucrative prospect of transporting COVID-19 vaccines by sea has intensified the spotlight on the maritime industry’s cold supply chain and its ability to carry high-value pharmaceuticals.At present, speed to market is critical to stemming the spread of the pandemic, so the vaccines are being shipped by air to international destinations. Delivering them by sea is a longer-term strategy; certainly, the present urgency would have to calm considerably before enough confidence could be built to support delivery times in weeks…

North P&I Club Names Arklow Shipping's Tyrrell as Chair

North P&I Club has elected James Alexander Tyrrell as its new chair of the board, succeeding Pratap Shirke, in a change at the helm of the global marine insurer that also sees Ioanna Procopiou become the Club’s first female vice-chair.Tyrrell, a director of North member Arklow Shipping, takes up the role from February 4, having previously served as vice-chair of the North board. The formal announcement follows full approval by the Prudential Regulation Authority, which supervises around 1…

Energy, Finance & the GoM

Some positive market indicators could presage an investment revival in the U.S. Gulf of Mexico – and beyond. The good news, reported by Bloomberg, is that in the third quarter of 2016, the largest oil companies increased cash from operations by nearly $26 billion. This reflects a 67 percent increase from the previous quarter and more than twice the amount of the first quarter of 2016. Exxon Mobil, Royal Dutch Shell, Chevron, Total and BP indicated that the increase was due to lower spending, increased output and rising crude prices, although the numbers were still below last year’s numbers.

North Group Increases Projected Free Reserve

Directors of the North P&I Club and Sunderland Marine Insurance Company (North Group) have revised their projection for the group’s year-end free reserve up to $380 million, an increase of 12 percent on last year and $20 million more than estimated at the half-year point. The directors also forecast that North’s combined ratio will improve from 109 percent to 87 percent this year. "The Club’s long-term average combined ratio is amongst the best within the International Group of P&I Clubs," Shirke said. He confirmed North has set a general premium increase of 2.5 percent for both P&I and freight, demurrage and defence (FD&D) for the 2016/17 policy year.

Tough Line on Shipping Loans: ECB

ECB in discussion with German supervisors; question over treatment of ship loans in health check. Compromise emerging which may involve 'haircut' on loan valuations. The European Central Bank is taking a hard line on the controversial issue of how shipping loans should be valued in a wide-ranging review into the health of the euro zone's banks, several sources familiar with the matter said. The ECB is making sure the euro zone's most important banks have properly valued their assets and have enough capital to withstand future crises so it can begin with a clean sheet when it takes over as their supervisor from Nov 4. In the past, critics said national supervisors overlooked or even tolerated warning signs of potential shortfalls at banks for fear of causing upsets.

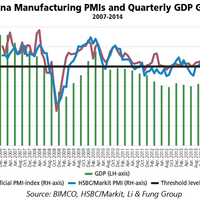

China’s Growth Plans are Positive for Global Shipping

China’s aim of 7.5% GDP growth for 2014 is positive news for the shipping market – in particular, dry bulk, the Baltic and International Maritime Council (BIMCO) said in a report published today. Despite being a little down on the 2013 GDP growth of 7.7%, BIMCO said the growth target of 7.5% set by China’s Premier Li Keqiang at his first appearance at China’s annual parliamentary session bodes well for shipping, trade and commodity demand in 2014. In 2013, Chinese seaborne imports surpassed the 2 billion metric tons, mark according to CRSL.

North P&I, Sunderland Merge to Form North Group

North of England P&I Association (North) and Sunderland Marine Mutual Insurance Company Limited (SMMI) merged to form the North Group on Friday 28 February 2014 following approval by the Bank of England’s Prudential Regulatory Authority and other U.K. and overseas regulators. The merger between two of the longest-established and most successful international marine insurance businesses - both of which are based in north-east England - has created one of the largest global marine insurance operations, with a premium income of over $500 million, free reserves of $350 million and total assets of $1,500 million. North Group has been over two years in the making, starting with a strategic alliance between North and SMMI in January 2012.

POLB Commissioners Elect Thomas Fields President

The Long Beach advertising executive & former city planning commissioner, will lead the commission for a 1-year term from 1, July 2013. Thomas Fields will succeed Commissioner Susan E. Anderson Wise, who has served two years as President. The Board President serves as chair of the commission, running board meetings and often representing the Port to the public and shipping industry. “I look forward to serving as Board President; this is an exciting time for the Port as we look…

Algoma Bulker Renamed in Honor of Retired Director

Algoma Central Corporation's 'M/V Algobay' renamed 'Radcliffe R. Latimer' in a rededication ceremony in Port Colborne. The self-unloading bulk carrier, which transports commodities such as grain, coal, iron ore and gypsum to ports around the Great Lakes, St. Lawrence Seaway and Atlantic Canada will now be called the M/V Radcliffe R. Latimer. Mr. Latimer, who recently retired from the Algoma Central Corporation board of directors, has an association with the company spanning 46 years and acted as its chairman between 2003-2010. Mr.

Alexander & Baldwin Finalizes Financing

New A&B Will Have a Well-Capitalized Balance Sheet Providing Strong Liquidity and Financial Flexibility; Receives Favorable IRS Ruling on Tax-Free Nature of Planned Separation. Alexander & Baldwin Holdings, Inc. (NYSE: ALEX) ("Company"), successor by merger to Alexander & Baldwin, Inc., today announced that, in connection with previously announced plans to separate its transportation and land businesses into two publicly traded companies, it has entered into new financing arrangements for the land business ("New A&B"). The new financing arrangements will provide significant liquidity and support New A&B in the execution of its growth strategies as a stand-alone company and complement separately announced financing arrangements that have been made for Matson Navigation Company, Inc.

Keppel Appoints New CFO

In a move towards succession planning, the Board of Directors of Keppel Corporation Limited ("Keppel" / the "Company") announced that Mr Teo Soon Hoe will relinquish his role as Group Finance Director with effect from 1 January 2012. Mr Teo, 62, will continue to serve as Senior Executive Director and remain on the Keppel Board. He will remain as Chairman on the boards of Keppel Telecommunications & Transportation Ltd and M1 Limited. He will assist the CEO, Mr Choo Chiau Beng to strategize and grow Keppel's competencies in Sustainable Development, and oversee Keppel's investment portfolio and special projects such as the Sino-Singapore Tianjin Eco-City.

The China Factor

In recent weeks, we have examined various aspects of Chinese shipping developments and we make no apology for reporting a recent New York conference at which China was again the key focus. The country is, after all, the principal factor that is fueling the dry and liquid bulk markets and the container trades. Only a few tanker owners can remember super-profits on today’s scale and bulk carrier owners have only ever dreamt of the rates prevailing today. Shipbuilding capacity in China, meanwhile, is expanding at an exponential rate and, in the long term, it is the shipbuilders’ strategy to be building half of the world’s ships by 2050. They could be doing that long before then, some already believe.

GoCargo.com Establishes 24-Hour Global Trading Floor

its online B2B exchange has reached 6,000, consisting of approximately 5,000 shippers (exporters/importers) and approximately 1,000 service providers (carriers and intermediaries). GoCargo.com's team of 20 international traders are operating 24 hours a day, five days a week, offering local decision makers from Tennessee to Hong Kong the ability to bid on and book shipments online with the personal assistance of GoCargo.com account managers who speak numerous languages, such as Mandarin, Korean and German. The new exchange at Broadway and Wall Street is bringing 21st century trading concepts to the tradition-bound shipping industry, with real benefits to both the buyside and the sellside: saving as much as 40% on shipping contracts for the shippers…

Seacor Smit Drilling Unit Chiles Offshore Files IPO

Chiles Offshore LLC, the 55-percent owned unit of offshore oil exploration company Seacor Smit Inc., has filed for an initial public offering of 8 million common shares in a range of $17-$19 each. Chiles owns and operates ultra-premium jack-up drilling rigs -- mobile offshore drilling platforms with legs that lower to the ocean floor to support the platform while drilling. Ultra-premium rigs differ from other drilling rigs because of their greater depth capabilities and more powerful mud pumps that speed up well drilling. According to papers filed with the Securities and Exchange Commission, the Houston-based firm has applied for an American Stock Exchange listing. A ticker symbol will be disclosed later.

MISNA Elects New Slate of Officers for 2001

At a recent meeting of their board of Directors in Vancouver, British Columbia, the Maritime Information Services of North America (MISNA) elected a new slate of officers for 2001. Stepping down as president after three consecutive terms is Capt. Manny Aschemeyer, executive director for the Marine Exchange of Los Angeles-Long Beach Harbor. Aschemeyer is a founding director for MISNA and has been responsible for bringing the organization through a new period of growth and industry outreach. Aschemeyer, a graduate of the California Maritime Academy, has had a long career within the maritime industry and holds an active Master Mariners License (unlimited). Before joining the Marine Exchange, Aschemeyer was vice president of customer service and marketing with Stevedoring Services of America.

P&O Powers Through Poor News

Britain's Peninsular and Oriental Steam Navigation Co (P&O) shrugged off higher fuel costs and fears of a downturn in the United States to beat forecasts with a 12 percent rise in profits. P&O, which last year shed its cruise liner division to concentrate on its core ports, container shipping and ferry businesses, announced pre-tax profits before exceptionals of 269 million pounds ($390 million). "These results are considerably better than what the market would have hoped for, despite last year's increase in oil prices," chairman Lord Sterling said. "We are cautious regarding the U.S. Sterling said the company was particularly pleased with the performance of P&O Nedlloyd…

General Dynamics Sets High for the Year on Pentagon Spending Approvals

Shares in military contractor General Dynamics Corp. rose to a fresh 52-week high Monday after Congress approved on Friday a supplemental spending bill with money earmarked for the company's main products. Two analysts reiterated bullish forecasts on Monday, citing the budget approvals, helping General Dynamics shares rise $1.75, or 2.4 percent, to $73.42 in recent trading on the New York Stock Exchange. The stock reached as high as $73.59 earlier in the session, eclipsing its pervious year high of $72.92. On Friday, Congress passed an additional $70 billion spending for Iraq and Afghanistan as part of a record Pentagon budget of $448 billion, which included new funding for General Dynamics' M-1 Abrams tank and Stryker armored vehicle programs.

Van Tol Honored for 30 Years of Service

Arie Van Tol, a veteran Port Authority employee who currently manages the New York Marine Terminals, has been honored for more than 30 years of distinguished service to the bistate agency and the maritime community, Port Commerce Director Richard M. Larrabee announced today. Larrabee presented Van Tol, a Montville, N.J., resident, with the Lillian C. Borrone Award, given to individuals who render unusually effective service to the port community. The award is named for Lillian C. Borrone, a longtime director of the Port Authority’s Port Commerce Department who retired in 2001. “Arie is the consummate maritime industry professional who cares deeply about the Port Authority’s maritime terminal facilities and its tenants,” Mr. Larrabee said.

Prices Stay High As OPEC Plans To Maintain Curbs

Oil prices marched boldly along near 32-month highs last week after key OPEC exporters said output cuts should be kept in place until March next year. On Sept. 14 Benchmark Brent blend for delivery in October was trading 20 cents firmer at $23.68 a barrel, just four cents off a 32-month high touched the day before. Brokers cautioned that technical factors to do with the expiry Sept. 15 of the October contract on London's futures market had inflated Brent's value. However, they agreed the trend was moving in favor of the Organization of the Petroleum Exporting Countries, the producer group of Middle Eastern, Asian, African and Latin American countries responsible for 60 percent of the world's oil exports.

Oil Price Drops As Speculators Jump

Euphoria surrounding the soaring price per barrel of oil soured a bit last week, as world oil markets took a nosedive as speculators apparently decided the rally which doubled prices since March had gone far enough. London benchmark Brent blend futures dipped $0.61 cents to $20.02 a barrel in late trading after overnight U.S. data indicated slower than expected demand growth for gasoline in the world's biggest oil consuming nation. Weekly government data showed U.S. gasoline inventories rose in the week to August 20 when dealers were expecting a large decline. "Gasoline supplies appear plentiful," said Prudential Bache broker Nauman Barakat. Traders said the investment hedge funds which have led this year's price rise, in the wake of OPEC supply cuts, sold heavily on Thursday.

Port of NY/NJ Sets Record, Announces Security Initiatives

International cargo volumes in the Port of New York and New Jersey hit record levels in 2005, New Jersey Governor Jon S. Corzine, Port Authority Chairman Anthony R. Coscia and Port Authority Vice Chairman Charles A. Gargano said today as they revealed new port security initiatives, including a public-private task force and a demonstration of technology to enhance security at the East Coast’s largest seaport. Containerized cargo volumes in the Port of New York and New Jersey rose 7.6 percent in 2005 to a new record high, continuing to exceed the authority’s projected cargo growth levels. The dollar value of all cargo moving through the port exceeded $132 billion for the first time, up 15.6 percent from 2004.