Enterprise Products Gets Port License for Gulf of Mexico Oil Terminal

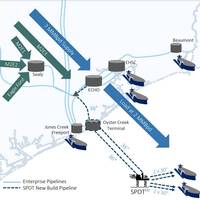

Enterprise Products Partners said on Tuesday it had received a deepwater port license for its Sea Port Oil Terminal (SPOT) in the Gulf of Mexico from an agency of the U.S. Department of Transportation.The project, located near Freeport, Texas, would become the biggest offshore oil export terminal in the U.S. after completion with a capacity to load two supertankers at a time and export 2 million barrels of crude oil per day."The receipt of the license is the most significant milestone to date in the development and commercialization of SPOT…

Russia Eases Harsh Weather Restrictions to Boost Oil Exports

Russian ports are operating during more severe storms and easing restrictions for non ice-class vessels during winter, traders said and regulations showed, in an attempt to boost exports following disruptions from Western sanctions and harsh weather.Following the European Union oil embargo, Russia has to rely mostly on seaborne loadings, rather than westbound pipeline supplies via the Druzhba pipeline.Traders and analysts said the easing of restrictions carried technical and ecological risks, but could help Russia's revenues that are heavily reliant on oil.Russian pipeline monopoly Transneft,

Five Dead, Six Injured in Pemex Offshore Platform Fire

Five workers were killed and six injured in Sunday's fire on an offshore platform in the southern Gulf of Mexico operated by Petroleos Mexicanos (Pemex) that cut about a quarter of Mexico's oil production, the company said on Monday.The fire broke out as crews were performing maintenance on the platform, and a search for missing workers continues, Pemex Chief Executive Octavio Romero told a news conference.The platform remains out of operation, with about 421,000 barrels per day of oil lost and 125 wells offline, he said.

Belgium's Euronav Posts 2Q Loss on Low Oil Tanker Demand

Belgium's Euronav, which provides shipping and storage services for crude oil, swung to a second-quarter loss, it said on Thursday, as recovering demand for oil and easing production cuts had yet to lead to better shipping rates.The Antwerp-based group posted a loss of $89.7 million for the period compared to a $259.6 million profit a year earlier."Improving crude demand and the tapering of OPEC+ production cuts have yet to translate into freight rate recovery," Chief Executive…

Venezuela's PDVSA Imports Condensate to Boost Oil Blending

Venezuela's state-run PDVSA began discharging 620,000 barrels of imported condensate crude oil at the nation's largest oil port this week in an effort to boost blending operations, according to two company documents, sources and vessel tracking data.Venezuela had not imported condensate since September when it received a 2.1 million-barrel cargo from Iran, a political and commercial ally of President Nicolas Maduro that since 2020 has also supplied the South American nation with fuel.PDVSA this year doubled down on efforts to boost blending and upgrading of crudes from the OPEC member country's largest producing region, the Orinoco belt…

Saudi Arabia's Oil Exports at Four-Month High

Saudi Arabia's crude oil exports rose in May to 5.649 million barrels per day (bpd), their highest level in four months, Joint Organisations Data Initiative (JODI) said on its website on Monday.Crude oil exports rose from 5.408 million bpd in April, while the country's total oil (crude oil and total oil products) exports stood at 6.94 million bpd in May compared with 6.62 million bpd the previous month.The world's largest oil exporter's crude output rose by 0.410 million bpd month-on-month to 8.544 mln bpd in May…

Soldier-run PDVSA and AWOL Oil Output

Last July 6, Major General Manuel Quevedo joined his wife, a Catholic priest and a gathering of oil workers in prayer in a conference room at the headquarters of Petroleos de Venezuela SA, or PDVSA.The career military officer, who for the past year has been boss at the troubled state-owned oil company, was at no ordinary mass. The gathering, rather, was a ceremony at which he and other senior oil ministry officials asked God to boost oil output."This place of peace and spirituality…

China Navy Ship Makes Maiden Visit to Venezuela

A Chinese naval ship has traveled to Venezuela for the first time, following a visit by President Nicolas Maduro to Beijing this month, where he had been looking to gain China's support for the Latin American nation's struggling economy.The naval medical ship, known as the "Peace Ark", arrived on Saturday at the Venezuelan port of La Guaira for an eight-day period of "friendly visits" to the country, the official Xinhua news agency said on Sunday.Maduro, whose leftist government is under fire in Venezuela as the economy struggles with a fifth year of recession and hyperinflation…

Trump Administration Approves Eni Plan to Drill Offshore Alaska

Eni US will become the first energy company allowed to explore for oil in federal waters off Alaska since 2015 after the Trump administration this week approved a drilling plan on leases the company has been sitting on for 10 years. The approval is conditional on Eni getting other state and federal permits, which in past cases are generally granted once BOEM gives the green light. "We know there are vast oil and gas resources under the Beaufort Sea, and we look forward to working with Eni in their efforts to tap into this energy potential," said BOEM's acting Director Walter Cruickshank.

GE to Merge Oil & Gas Unit with Baker Hughes

General Electric Co said on Monday it would merge its oil and gas business with Baker Hughes Inc, creating the world's second-largest oilfield services provider as competition heats up to supply more-efficient products and services to the energy industry after several years of low crude prices. The deal to create a company with $32 billion in annual revenue will combine GE's strengths in making equipment long-prized by oil producers with Baker Hughes's expertise in drilling and fracking new wells. Shares of Baker Hughes were down nearly 7 percent, a drop that executives said likely was due to the deal's complicated structure. GE is already the world's largest oilfield equipment maker, supplying blowout preventers, pumps and compressors used in exploration and production.

Asian Crude Demand Pushes Charter Rates

Robust Asian demand for West African crude is fueling a worldwide surge in shipping rates for the largest oil tankers that is being felt from Houston to Singapore. Chartering rates for Suezmaxes and very large crude carriers (VLCCs) have recovered rapidly in recent weeks after plunging to their lowest in more than year this summer. The spike in rates comes as Asian refiners return to the market after a seasonal turnaround period, and as several key streams of West African crude are finally loading for export after supplies were constrained because of pipeline disruptions in Nigeria. The higher rates, which imply fewer imports into the United States, could support benchmark oil prices in coming weeks.

Another Hurdle for Iran Oil Tankers Comeback

Iran's oil tanker fleet is expected to face more hurdles before many of the vessels can start trading again due to insurance hiccups and tougher requirements over sea worthiness by potential foreign clients, despite easing of sanctions, reports Reuters. The top tanker firm NITC was readying its return to international markets and was in talks with Western insurers while also looking to expand its fleet, says Iranian media. It's unable to secure foreign insurance or international classification services as it remains blacklisted by the United States and European Union since 2012. Classification services certify ships have met safety and environmental standards necessary to get access to most ports.

Iran to Step up Production One Week post-Sanctions

Iran will boost its crude oil production within one week once international sanctions are lifted and is determined to regain its lost market share, senior Iranian oil officials reiterated on Monday. Iran will raise production by 500,000 barrels per day in the first week after sanctions are lifted, Rokneddin Javadi, general manager of the National Iranian Oil Company, was quoted as saying by oil ministry news agency Shaha. "A 500,000-barrel increase in Iran's oil production will take place in less than a week after the effective lifting of sanctions," Shana quoted Javadi as saying. On Sunday, the United States approved conditional sanctions waivers for Iran…

Oil Steadies as Equities Rally

Recovering stock markets boost oil prices; U.S. crude on track for first weekly gain in nine weeks. Oil prices steadied on Friday after bouncing back from six-and-a-half-year lows on recovering equities markets, strong U.S. economic growth and news of low crude supplies from Nigeria. Oil saw its biggest one-day bounce since 2009 on Thursday, with North Sea Brent and U.S. light crude rising more than 10 percent. U.S. crude is on track for its first weekly gain in nine weeks, ending its longest losing streak since 1986. Brent was down 25 cents at $47.31 a barrel by 1200 GMT. It settled $4.42 higher at $47.56 on Thursday. U.S. crude was down 10 cents at $42.46 a barrel, after ending up $3.96.

Abu Dhabi to Invest $25 Billion Offshore to 2020

Abu Dhabi National Oil Company (ADNOC) plans to invest around US$25bn over the next five years in a bid to boost oil production from offshore fields. The investment is part of the UAE's strategy to increase its crude oil output potential from its current production of 2.8 million barrels per day (bpd) to 3.5 million bpd by 2017-18, Reuters reported. ADNOC’s offshore exploration and production directorate manager Qasem al-Kayoumi said that ADNOC plans to drill 160 wells per year over the next couple of years. One of the main UAE oilfields being developed by Exxon is the giant Upper Zakum, whose production capacity ADNOC would like to increase to 750,000 bpd by 2017-18, This may be further increased to one million bpd by 2024, added the company.

Maersk Mulls Port of Tema Expansion

Maersk Group is committed to support the expansion of the Port of Tema to the tune of US $1.5 billion, says Nils Smedegaard Andersen, Chief Executive Officer of Maersk Group. Maersk will also contribute its quota in the US$6 billion oil exploration work to be undertaken by Italian firm Eni Exploration in Ghana. Nils called on the President of Ghana John Dramani Mahama to extend the group's support to expand the Port of Tema to nearly four times its existing capacity in addition to increasing current road infrastructure including the development of the motorway to a 6-lane. The CEO of Maersk Group said that the funding arrangements for…

US Oil Output May Stall in Late 2015 -IHS

U.S. oil production may stop growing in the second half of this year and could fall in 2016 as low oil prices make the majority of oil wells uneconomic, according to a report released on Tuesday by IHS Inc energy analysts. Global oversupply of oil has knocked 60 percent off prices since June last year, forcing a slowdown in drilling and putting the brakes on a five-year boom that pushed U.S. production to record highs. Production will likely grow in the next few months as oil producers honor contractual obligations and finish work on a backlog of wells that have already been drilled. But growth will halt in the second half of the year if oil prices remain below $60 a barrel, according to the IHS report based on a study of 39,000 oil wells. U.S.

NITC: Says EU Sanctions Lifted

European Union sanctions on Iran's main oil tanker firm NITC have been annulled after the EU failed to appeal against a court ruling that ordered the measures to be lifted, the shipping company said on Tuesday. NITC - a major transporter of Iran's oil - had contested the EU's blacklisting, arguing that the firm is privately owned by Iranian pension funds. It has denied any links with the Iranian government or with the Revolutionary Guards. The sanctions - imposed in 2012 over Tehran's disputed nuclear programme - prohibited any trade between the EU…

Kuwait to Boost Oil Exports to China

Kuwait plans to increase the volume of crude oil exports to China to 500,000 barrels a day (bpd) in three years, an executive at the state-run Kuwait Petroleum Corporation (KPC) said Saturday. On Monday, Kuwait concluded a new 10-year deal with a China's Sinopec Corp to nearly double its supplies by offering to ship the oil and sell it on a more competitive cost-and-freight basis. "With new and mutual cooperation between the two parties, there is a good sign of increasing the volume of our crude oil exports to China up to 500,000 bpd in the next three years," Nasser Al-Mudhaf, KPC's Managing Director of International Marketing told Kuwait's News Agency (KUNA).

Iran Oil Tanker Firm Still Faces Sanctions

Iran's main oil tanker firm NITC will struggle for some time to call at European ports, get foreign insurance and overcome obstacles under western sanctions, even after a top court has annulled its blacklisted status in the European Union. An interim deal between Iran and world powers signed in November has provided the Islamic Republic with some sanctions relief, helping to boost oil sales. But continued restrictions on shipping and insurance have meant that a return to Tehran's pre-sanction export level of over 2 million barrels per day (bpd) is still some way off. The European court ruling "will not give them carte blanche to transport cargos…

Libyan Oil Port Re-Opening Delayed

Technical problems have delayed the reopening of Libya's eastern Zueitina oil export terminal after the government reached a deal with rebels to end an eight-month blockade of the port, a minister said on Sunday. Two weeks ago, the Tripoli government reached an agreement with rebels in the restive east to end their occupation of four oil ports which had halted vital exports. Under the plan, the Hariga and Zueitina ports were due to open immediately while the larger Ras Lanuf and Es Sider terminals would resume oil exports within a month. But justice minister Salah al-Merghani said Hariga port located in Tobruk in the far east would be the only one to start operations due to technical problems at Zueitina.

Libya's Zueitina Oil Port Reopening Delayed

Technical problems have delayed the reopening of Libya's eastern Zueitina oil export terminal after the government reached a deal with rebels to end an eight-month blockade of the port, a minister said on Sunday. Two weeks ago, the Tripoli government reached an agreement with rebels in the restive east to end their occupation of four oil ports which had halted vital exports. Under the plan, the Hariga and Zueitina ports were due to open immediately while the larger Ras Lanuf and Es Sider terminals would resume oil exports within a month. But justice minister Salah al-Merghani said Hariga port located in Tobruk in the far east would be the only one to start operations due to technical problems at Zueitina.

Petrobras Setbacks Threaten 2014 Production Goals

Brazilian state-run oil company Petroleo Brasileiro SA suffered another setback in its effort to boost oil output last month when Italian contractor Saipem SpA dropped a 2.3 km steel pipe into the Atlantic Ocean. On March 16, the rigging used to wrangle the pipe into position on a floating oil platform failed, and the high-grade, metal-alloy tubes plunged about 1,800 meters (5,900 feet) to the seabed, a total, crumpled loss. The pipe itself was worth about $2 million but the cost of the accident will be much higher, two sources with direct knowledge of the situation told Reuters. By setting back efforts to expand Roncador, Brazil's No. 2 oil field, by at least a month, Petrobras will lose tens of millions of dollars in oil output, salaries and equipment leases when it can least afford it.