GMS: Ship Recycling Market Still Slow

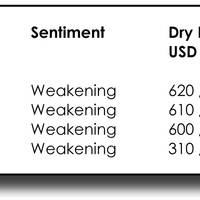

Despite Chinese new year holidays concluding on Friday, a pervading theme of an unrelenting dearth in the overall availability of tonnage across global ship recycling markets has been enduring for several quarters now, says cash buyer, GMS.This has resulted in another dreary week of market inactivity and silence across all recycling destinations.Charter rates continue to remain artificially elevated (especially) in the dry bulk sector, consequently placing a tighter squeeze on the overall supply of vessels for recycling.

Ship Recycling Markets Remain Muted

Markets remain precariously poised as Diwali holidays occupy the sub-continent markets and the industry heads into the final months of the 2023, says cash buyer GMS. Although several sales have reportedly registered into India at some impressive levels, sentiments and pricing here remains muted overall.“On the Eastern end and in the lead up to the Bangladeshi elections due in mid-January 2024 - disruptions, protests, and even strikes have embattled the country and as such, it is expected to become even more challenging to get lines of credit open and deliveries completed into Chattogram…

Ship Recycling Market Cools

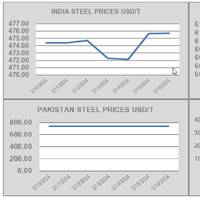

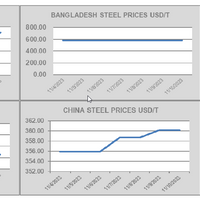

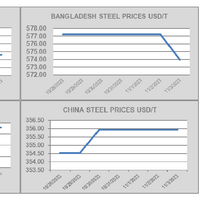

Inflation, fundamentals, currencies (except in India), vessel pricing, and overall weakening sentiments have beset the ship recycling market over the past week, reports cash buyer GMS.The effects have been felt across all the sub-continent ship-recycling destinations (even Turkey to an extent), which have cooled by about US$ 20/LDT over recent weeks, says GMS. However, India and Bangladesh have reported surprising increases in steel plate prices over the last week.“Seemingly on the back of global steel plate prices…

Ship Recycling Market Remains Strong

Recycling markets remain firmly poised for another week, following a stunning resurgence by the Bangladeshi market (in particular) that leaves them atop the price rankings board.Levels close to and even over $600/LDT are now being regularly presented on various vessels and this is inducing more Ship Owners to sell their vessels, especially as freight rates in the dry bulk and container sectors are failing to improve sufficiently for Owners to keep holding onto their aging tonnage.Cape rates have come back this past week…

Ship Scrapping Business Picks Up with Dry Bulk Swoon

This week, several more sales have registered as sub-continent ship recycling markets come roaring back – and a previously subdued Bangladesh starts to seemingly find some form once again, with some workable L/Cs from privately financed (rather than state controlled) banks.Despite the ongoing discussions about an IMF loan in the amount of about USD 2 - 3 billion, end buyers have been working to find alternate ways to pay for vessels for some time now and without the troublesome central bank approval, which is denying the disbursements of U.S.

Ship Recycle Market Continues Downward Trend

The ongoing sub-continent collapse in prices fully materialized this week, with all sectors talking down the market and refusing to offer anew on any fresh tonnage whilst they wait for markets to stabilize. As the Ukraine conflict endures, fundamentals continue their collapse at all of the major recycling destinations, as plate prices take turns to precipitously plummet (in India this week) and a combination of the two have likewise afflicted Bangladesh.A global currency meltdown at the major recycling destinations has also been unfolding…

War Shocks: Ship Scrap Prices Spike on Russian Invasion of Ukraine

According to ship recycling leaders at GMS, sub-continent markets remain firmly poised for another week, particularly in Bangladesh and a now resurgent India.Pakistan, as seems to be typical for the market there, has gone quiet over much of the international uncertainty surrounding the possible outcome of the recent Russian invasion of Ukraine.Bangladeshi buyers have in turn, ramped up their buying and price offerings, mindful of the fact that some increased oil / gas prices due to the unfolding crisis in Ukraine…

Ship Recycling Prices March Forward (Again)

Chinese (Lunar) New Year holidays concluded this week and there appears to be a real spring in the step of industry players, as international ship recycling markets continue to push on once again, according to GMS.Both, Pakistan and Bangladesh, have been at the forefront of this recent resurgence, with an improved India (that is still unable to compete on any regular / non-HKC / non-specialist tonnage) and a relatively stable Turkey that has defied explanation for the most part…

Russia's TMK Says U.S. Tariffs to Benefit U.S. Unit

TMK, Russia's largest of steel pipes for the oil and gas industry, said on Friday it expected new U.S. import tariffs on steel and aluminium to benefit its U.S. unit IPSCO. TMK said IPSCO did not import steel, so should benefit from President Trump's move. The company had yet to finish evaluating how the import duties would affect other parts of its business, it said in a written reply to a Reuters request. TMK also said an initial public offering of IPSCO, announced this year but put on hold due to volatility on global markets, was "postponed but not cancelled".

Houston Port Throughput Up 22%

Activity across Port of Houston Authority docks continues to show strength as February 2015 tonnage figures reflected a 22-percent increase compared to February 2014. Executive Director Roger Guenther released the information today during the monthly meeting of the Port Commission of the Port of Houston Authority. Guenther reported that the Port Authority's Barbours Cut and Bayport container terminals were particularly busy. A combined 40 percent more loaded containers than a year ago was handled. ". . . Our sharp increases in container volume are not just from East Asian services and diversion from the West Coast," Guenther said. The Port Authority, which handled a record 37 million tons of cargo in 2014, moved more than six million tons through the first two months of this year.

Maritime Exchange Urges Bush to Repeal Tariffs on Steel Imports

The Maritime Exchange for the Delaware River and Bay, in a coordinated effort with business leaders and local longshore unions, today called on President Bush to repeal the Section 201 tariffs imposed on steel imports in March of last year. This action was taken following the release of the International Trade Commission (ITC) report on the effects of the steel tariffs on domestic steel-consuming industries and domestic steel producers. In a letter to President Bush, Maritime Exchange President Dennis Rochford, cited the adverse economic impact these tariffs have had on the tri-state regional port complex. "Steel ship arrivals will drop from 210 last year to 150 by the end of this year.

Port of Houston: Steel Imports Plummet

The Port of Houston Authority posted its slowest start in operating revenues since 1999 during the first three months of 2002. Operating revenues through March 31, 2002, decreased slightly to $25.3 million from $25.5 million in the same period in 2001. Operating income for the year was $4.1 million compared to $5.1 million in the first three months of 2001. Compared with the first three months of 2001, steel imports dropped 10 percent in reaction to new steel import restrictions imposed in March. "The decrease in import steel has had a negative effect on Port revenues," said Port Authority Chairman James T. Edmonds. Steel imports have been affected by new trade regulations, including U.S. tariff increases of up to 30 percent imposed on a range of steel imports.