Profitability Rests in Carriers’ Hands

As expected the industry just about scraped over the break-even line in 2012, albeit only because of the results of a handful of leading lights. There is every chance that lines will make decent money in 2013, but only if they refrain from old habits and stick to pricing and capacity discipline.

Drewy’s latest Container Forecaster report gives our headline industry operating profit estimate for 2012 of $280 million. Clearly, this is a very poor return for moving nearly 170 million teu of loaded containers, although any sort of profit seemed highly unlikely after the heavy losses sustained in the first quarter of 2012.

It also represents a significant improvement on the estimated $7.7 billion loss endured in 2011. Whether or not carriers are satisfied is debatable.

Spooked by that awful start to the year, carriers avoided another 2009 and 2011-esque financial meltdown and turned things around through a combination of prudent capacity management and unity on freight rate increases.

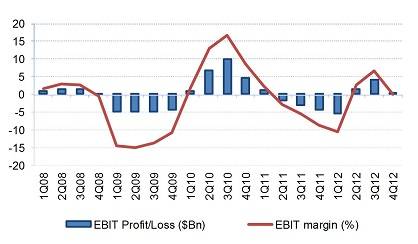

Worryingly for carriers, the revival in fortunes that saw all carriers back in the black for the third quarter has quickly dissipated and many lines lost money again in the fourth quarter.

Estimated carrier industry EBIT profit/loss and EBIT margins, 1Q08-4Q12

Our previous forecast for 2012 profitability did anticipate a weaker fourth quarter, but judging by the sample of available results we were slightly too optimistic. Drewry estimates that the average operating margin of carriers in the fourth quarter shrank to 0.1%, down from 6.6% in the third quarter, as spot market freight rates plummeted on the key westbound Asia-Europe (-23% quarter-on-quarter) and eastbound transpacific (-11% Q/Q) trade routes.

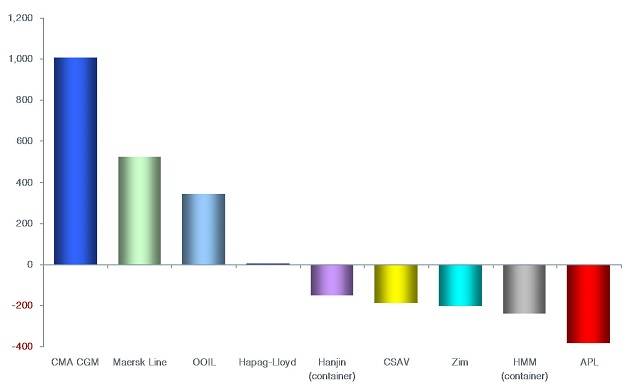

Subsequently, only three major carriers (CMA CGM, Maersk Line and OOCL) returned a meaningful operating profit for the full year, although Hapag-Lloyd did salvage a tiny profit of $3 million. Ultimately, these select few “winners” neutralised the losses accrued by the rest so that our industry average balanced out at close to zero.

EBIT profit /loss of selected carriers in 2012, $ millions

The mixed-bag of results for 2012 tells the tale of how successful (or not) individual carriers were at getting a grip on costs as well as their exposure to high or low yielding trade routes. Unquestionably, that focus on cost optimization will need to be maintained and intensified if carriers are to see improved profitability in 2013.

The slide back into the red during the fourth quarter clearly does not bode well for carrier profitability in 2013. However, there is some cause for mild optimism among carriers. For 2013 we remain optimistic that carriers can return a decent profit as average freight rates and volumes for the year are expected to rise by around 3% and 4% respectively, while bunker costs are predicted to come down by 1.5%, the first year-on-year decrease since 2009.

Drewry container industry profitability forecast, 2012-13

We do expect carriers to make money again this year, but it should be reiterated that carriers themselves are the biggest risk to this forecast. While there are significant profit gains to be had through cost-cutting, if lines were to lose their pricing discipline and enter into a new rate war heavy losses will undoubtedly follow.

With so many variables to consider any industry-wide profit forecast is a hostage to fortune, but we have to believe that ultimately carriers will do what is in their best interest. Particularly so when you consider that the last five years have essentially been a lost half-decade with a cumulative loss of $700 million between 2008-12.