Cold, Hard Realities of Arctic Shipping

In a recent article in USNI 'Proceedings Magazine' Stephen M. Carmel said: "Maritime pundits believe a shrinking ice cap translates to a frenzy of traffic as shippers rush to exploit shorter sea routes. They’re wrong." Excerpts follow:

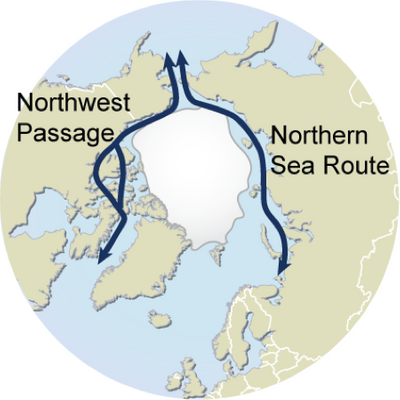

On 16 September 2012 the Arctic reached the point at which ice stops receding and begins to form anew with the approach of winter. Last year that ice minimum set a record at 1.32 million square miles – 300,000 square miles less than the previous record minimum. With that news comes the predictable flood of reports about the pending increase in Arctic shipping, how woefully unprepared the United States is to deal with that onslaught of traffic, and the need for large-scale investment in Arctic capabilities.

Worries about the implications of a thawing Arctic have been around for some time. Conferences and seminars about the Arctic seem to have superseded even piracy as a source of income for the conference-for-profit crowd. There is no doubt that the Arctic is in fact thawing, and there naturally will be increased activity up there. But to formulate appropriate strategy and make intelligent investments it is important to get past the hype and:

• Understand what type of activity is likely to occur

• Determine the time frame in which it is likely to happen

• Recognize that, at least for commercial interests, economics trumps all

Clearly, a great deal can happen in 30 or 40 years, so it is a mistake to try to overlay a melting Arctic on today’s geo-economic situation. It is the state of the world at that future point interacting with a melted Arctic that matters. Already, changes in the patterns of global trade have had significant implications for the utility of Arctic routes. Increasingly expensive labor in China, for example, is pushing Chinese manufacturing to be outsourced to countries in Southeast Asia where costs are lower but Arctic routes offer no advantage.

Carmel concludes that there is no question that the Arctic is becoming more ice-free. There will be an attendant increase in commercial presence in the Arctic that should not be ignored. But a proper understanding of what type of activity there will be, and a realistic assessment of the volume of that activity are necessary to ensure proper policy and investments are made. For commercial shipping, and particularly the types that drive globalization today, Arctic routes do not now offer an attractive alternative to the more traditional maritime avenues, and are highly unlikely to do so in the future.

Source: 'Proceedings Magazine' - July 2013 Vol. 139/7/1,325 - http://www.usni.org/magazines/proceedings/2013-07