Ship Recycling Prices Plunge 25%

Demolition Prices for elderly ships have fallen by a quarter in 2012 to date, and owners are encouraged to dispose of recycling candidates sooner rather than later, says Mark Williams of Braemar Seascope.

Addressing the 7th Annual Ship Recycling Conference in London on 19th June, the Braemar Seascope Research Director told delegates that deflating international steel prices were likely to translate into lower offers for recycling tonnage in the coming quarters.

Meanwhile, rapid reductions in the value of the Indian, Pakistani and Bangladeshi currencies against the US dollar are causing difficulties for cash buyers and end users struggling to pass on cost increases to their own customers, despite long-term strong recycled steel demand growth prospects in the sub-Continent.

Forex risk for recyclers has been compounded by intermittent limited availability of credit. Buyers’ banks have been challenged by “sight LC’s” – letters of credit that must be honored on sight, which can be hampered by a shortage of hard currency.

Meanwhile cash buyers paying hard currency for recycling candidates are bearing the forex and credit risk of selling in local currency to the recycling facilities.

Falling demolition price assessments, as published by the Baltic Exchange, are likely to influence second hand vessel prices, says Williams: “For example, it could be argued that over-age oil tankers are now priced off scrap, which will lead to increased numbers of younger ships being sucked into the recycling markets.”

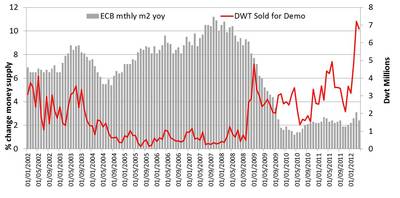

Williams also presented the hypothesis that spikes in scrapping are driven not only by low freight rates, or high scrapping prices, but by credit crunches. “Credit crunches coincided with peaks in recycling in 1986 (the year the Biffex bottomed out at 550 points and banks had stopped supporting technically bankrupt owners following the savings and loan crisis), 1998 (the Asian financial crisis which led to an Asia‐wide credit crunch and high scrapping despite relatively low values per LDT) and 2008/09 (the global financial crisis)” which is clearly depicted on the chart.