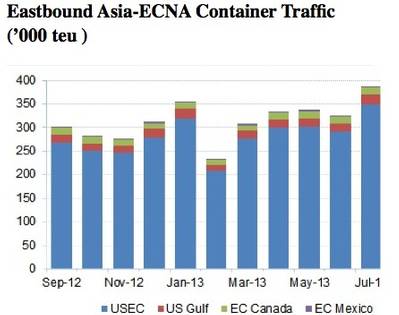

Asia/US East Coast Shipments Continue to Rise

The surprising surge in cargo volumes from Asia to the East Coast of North America since July remained strong in September, and even appears to have continued in October says a Drewry Maritime Research analysis.

Eastbound

Shipments from Asia to the East Coast of North America (ECNA) continued to grow impressively in September, reaching 382,000 teu. It brought the total for the peak season quarter up to 1.14 million teu, a startling 18% increase over the same period last year. In turn, this took the year-to-date increase up to 10%, which was significantly better than the West Coast’s 3%. It means that the East Coast’s proportion of the whole trade from Asia to North America reached 26.7% between January and September, compared to 25.2% for the whole of 2012.

The reasons for the gain are unclear, particularly as the East Coast’s freight rate premium has been rising, but presumably relate to ocean carriers’ much improved services via the Suez Canal and higher inland transport costs between West Coast ports and their hinterland. Whatever the reason, Chinese exports to North America are increasing impressively.

Westbound

Trade from the East Coast of North America to Asia remained lacklustre in September, reaching just 166,000 teu. Although this took y-o-y growth in Q3 up to 2%, the year-to-date volume was still 4% less than between January and September 2012. As the corresponding changes from WCNA were 6% and -0.5% respectively, East coast ports clearly lost market share. Customs data for 3Q 13 is not yet available, so it is not possible to analyse this situation in more detail, although differing cargo mixes could well be partly responsible. More agricultural produce is shipped out of West Coast ports at this time of year.

Drewry's view

Poor economic growth in the US suggests that its surge in imports from Asia between July and October is artificial, and not only related to the peak season, so will be short lived. The implication is that the winter season will be harder than normal for ocean carriers.

Source: Drewry Maritime Research