Shippers Eye Trade Boost from El Nino Threat

A potential El Nino weather phenomenon, which could wreak havoc on global crops, is set to disrupt shipping patterns and raise freight costs, leaving suppliers and importers to cover their food needs from longer-haul destinations.

El Nino, a warming of sea-surface temperatures in the Pacific, can trigger floods and drought in different regions, hitting production of key foods such as rice, wheat and sugar. Weather forecasters are increasingly predicting it will return in 2014 for the first time in five years.

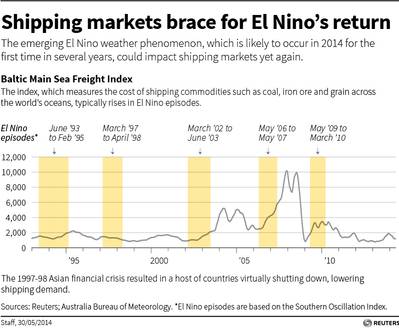

During previous El Nino patterns, the main sea freight index at London's Baltic Exchange has risen significantly. In February 2009 when El Nino appeared, the BDI was at 1,099 and it reached 2,998 in March 2010 before the phenomenon abated. From March 2006 to February 2007, it went from 2,708 to 4,765.

"Disruptions are always very favourable to the freight market/BDI," said Khalid Hashim, managing director of Precious Shipping, one of Thailand's largest dry cargo owners.

While countries in Asia are scrambling to reduce El Nino's impact, shipping markets expect trade flows will be affected. Rice trade is likely to feel the effect if producers in Thailand and Vietnam are hit, shipping analysts say.

"The weather changes could lead to changes in the trades of agricultural commodities," said Marc Pauchet of shipbrokers ACM.

"Traditionally, South Asian rice heads for Africa and the Middle East. It is therefore those routes that would feel the brunt of potential shortfalls, and those countries may seek their rice elsewhere, in the U.S. ... This will increase tonne-mile demand comprehensively."

Tonne miles are a key indicator of shipping demand, measuring the volume of the transported cargo multiplied by the distance of the voyage. Weather delays may also impact flows.

"Grains and other agribulks are sensitive to rain as they cannot be loaded or discharged in wet conditions. This could potentially lead to heavy congestion at ports and increase waiting times," said Burak Cetinok of consultancy Hartland Shipping.

"In theory, this would have a positive impact on freight rates."

Potential shortfalls in wheat production by major exporter Australia could also boost longer-haul imports, especially for the panamax ship sector, which carries 60,000-tonne grain loads. Australia's approaching winter is likely to be warmer and drier than normal in many regions as climate models point to a developing El Nino.

"East and Southeast Asian countries might look at increasing their supply from the U.S. and Canada. The impact for shipping would be a significant boost for the panamax ships that tend to service this cargo," ACM's Pauchet said.

"Wheat represents about 5 percent of the volume of cargo transported by those vessels every year. Rice, on the other hand, only represents about 3 percent of the volumes carried by handys and supras (smaller ships). There is potential for a decent boost for these assets due to El Nino."

Indian purchases of wheat from local farmers are set to climb at least 8 percent this year, bolstering government stocks against forecasts of below-average monsoon rains and the spectre of a possible El Nino.

Banana Supply Threat

The last El Nino event occurred from 2009 to 2010, and since then the Pacific has either been in a cooler state, called La Nina, or neutral.

"Looking back to 2009 we may expect drought in Australia and when that is realised by the grain market, we may see early buying of grains to compensate," said Jens Ismar, chief executive of shipping group Western Bulk.

"We may also see a delayed monsoon season in India that may keep up coal demand for a longer period than what is normal. Both these scenarios may benefit the market short-term."

For the ship container markets, which also transport refrigerated cargoes such as bananas, an El Nino is potentially less positive.

"On land, the volumes of food and bananas from Ecuador and Central America could be severely affected," said Ole Schack Petersen, with the world's No.1 container group Maersk Line .

"If there is less volume of bananas moving from a combination of Ecuador and Colombia then the world will simply not be able to make up for those banana volumes - there are no main supply areas that can cover for a serious reduction in output in Ecuador and Colombia."

Petersen said in the event of any negative impact, Maersk would potentially change deployments of its fleet in the region.

"When we are affected negatively in (places) like the west coast of South America including Ecuador because of no or few substitutions, a loss is a loss," he said. "It is not that we can make it up elsewhere."

(By Jonathan Saul, Additional reporting by Keith Wallis in Singapore; Editing by Veronica Brown and Dale Hudson)