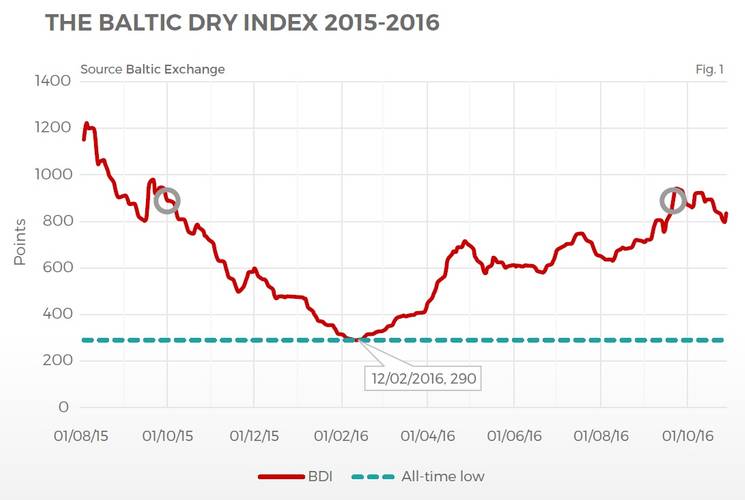

In the last month, we have seen the Baltic Dry Index (BDI) recover to the same level it was 12 months ago (see circles in fig.1). Vessel values have started to firm, but not at the same rate and are still at historically low levels.

In the last 12 months, contrarian owners have taken advantage of the low values and have been buying cheap tonnage. With hindsight, this looks to have paid off with many values having increased above the purchase price.

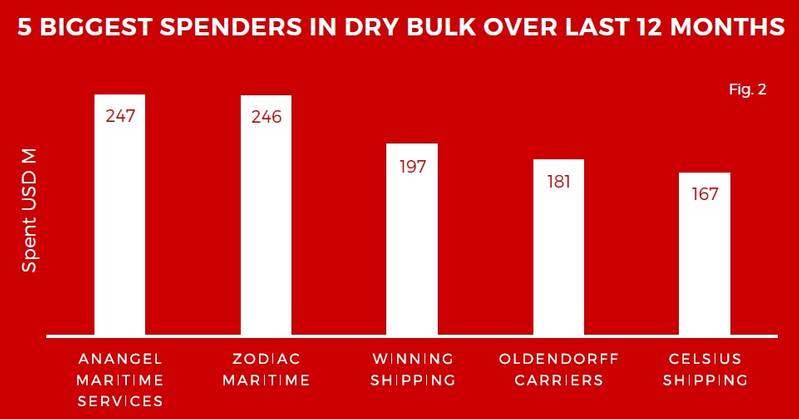

This article takes a look at which dry bulk owners have been buying the most in the last year.

Anangel Maritime Services

Spend: $247 million

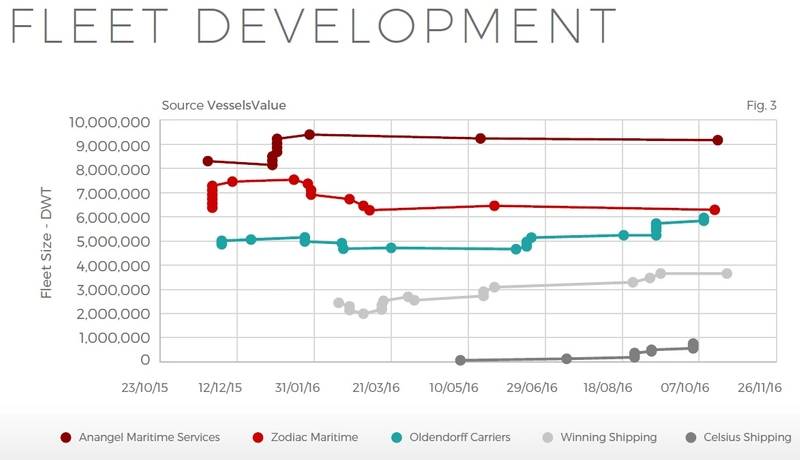

Size change: 863,200 DWT

In January of this year Anangel purchased seven Capes (four resales from Star Bulk and three one-year-old vessels from Scorpio Bulkers) at USD 247m. Current VV market value is $230 million.

John Angelicoussis, principal at Anangel, has a reputation at picking the bottom of the market. For example, following the supercycle in 2007-2008 he bought the cape resale Anangel Argonaut (177,800 DWT, 2009 Blt, SWS) at $63.50 million. Following this he bought three more resale capes from Scorpio also at a market bottom in April 2015. Fig. 4 illustrates the timing of these purchases Vs the market.

Zodiac Maritime

Spend: $246 million

Size change: -91,000 DWT

Eyal Ofer's operation was buying steadily throughout 2015 and closed the year off with a mammoth acquisition from Scorpio. Following two lone purchases in December 2015 (PRT Future) and March 2016 (Grand Future), Zodiac began scrapping, shedding nearly 1.5 million DWT. This brought Zodiac's fleet back to the similar level it was at in 2015, shrinking the fleet by 57,800 DWT year-on-year. Following a spend of $246 million (today’s equivalent price: $236 million), new additions to the fleet have a VV value of $235 million.

Winning Shipping

Spend: $197 million

Size change: 1,207,800 DWT

Winning begun the year scrapping some of their older tonnage as the rates and asset prices slumped. Winning’s first purchase was the acquisition of the Golden Hope (176,900 DWT, 2009 Blt, Namura) at $18.5 million. Winning focused on buying throughout the rest of 2016, also purchasing two Capes with its management arm, Winning Alliance. Winning has grown their fleet by 49 percent with a spend of $197 million. The current value of acquisitions is $192 million.

Oldendorff Carriers

Spend: $181 million

Size change: 1,095,500 DWT

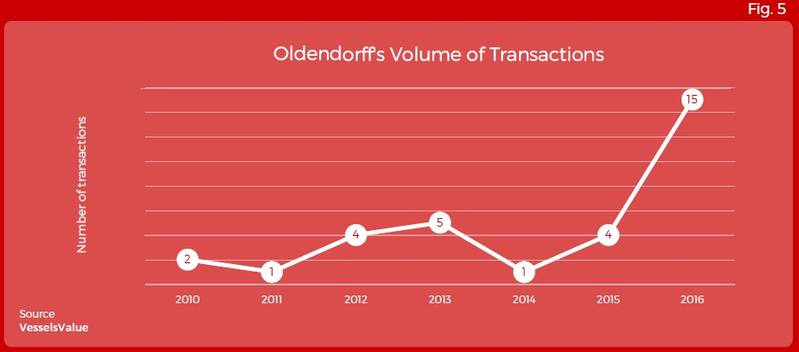

Oldendorff has been more active in S&P in weaker markets and the last 12 months have been very busy for the ship owner (see fig. 5). Overall fleet growth in the period was 23 percent adding 1.1 million DWT to the fleet. Oldendorff’s first purchase was a bank sale of Paragon Shipping’s distressed assets. The ship owner’s purchases have predominantly been distressed transactions and cheap Chinese ships adding good value to the acquisitions. In the early months of 2016, a spate of scrapping removed some of the fleet’s older assets and a further sale of a 2005 laid up Supramax in March saw the fleet at its smallest in year. From then on Henning Oldendorff has been active in bulker S&P. Oldendorff spent $181 million and the acquisitions now have a VV Value of $216 million, a 19 percent increase in asset prices.

Celsius Shipping

Spend: $167 million

Size change: 688,800 DWT

Prior to the dry bulk crash Celsius were exclusively in the small chemical tanker sector. Backed by Breakwater Capital (U.K.) and Bayside Capital (U.S.), Celsius purchased an Ultramax resale at Hantong SHI in May. Their appetite was for Chinese-built, modern ships, snapping up a number of resales, many direct from the yards including Huangpu and Yangfan Zhoushan. Over the course of 2016 their fleet grew by 688,000 DWT (newbuilds included) with a spend of $167 million. They now operate a fleet of four Ultramaxes and Supramaxes with three vessels still to be delivered. As it stands Celsius’ fleet of bulkers now has a market value of $196 million which equals a rise in values of 17 percent from the purchase price.

The Author

William Bennett is a senior analyst for VesselsValue.com.