Tankship Ocean Transportation Demand: Forecasting Essentials

Marine transport advisors, McQuilling Services, give an insight into how they forecast the development of tanker demand, which is a constituent part of their recently published '2014-2018 Tanker Market Outlook' report.

At a global level, marine transportation demand is related to world trade, which is directly related to the state of the world economy. This means that demand for crude oil and petroleum products grows with an expanding global economy.

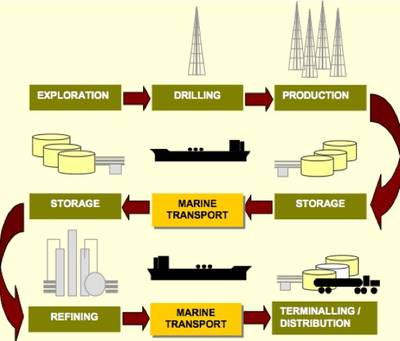

Marine transportation demand for tankers is a derived demand. It arises from the energy consumption requirements of regional economies. Petroleum product marine transportation demand arises from matching consumption with refined product production in refining regions. Integrated with the supply logistics chain for petroleum, crude oil marine transportation demand for tankers arises from matching refinery raw materials requirements with crude oil production.

Demand Characteristics

Tanker demand can be defined as the requirement to transport by ship liquid hydrocarbons in bulk from origin to destination. The parameters comprising tanker demand are several. Demand is characterized by the type of cargo required to be transported and by extension the ships capable of doing so. The parcel size of the cargo is a function of the trade and driven by either custom or constraint at the loading port or discharging port. Related to parcel size is the frequency of the demand for delivery of the cargo. Finally, cargoes are loaded and discharged in a plethora of locations worldwide on numerous trade routes.

Adding to the complexity of calculating tanker demand is the fact that these four parameters are also a function of time. Fortunately, the practical application is simplified by the way vessels, cargoes and trades have collectively evolved over time.

VLCC and Suezmax demand is comprised almost entirely of crude oil transport. Aframax and Panamax tanker demand is made up of crude oil transport and the carriage of residual petroleum products such as fuel oil. LR2, LR1 and MR demand is comprised mainly of the transport of clean petroleum products such as gasoline, jet fuel and diesel.

Trade Logistics

The evaluation of tanker transportation demand reduces to the understanding how much of what type of cargo is transported on what type of ships over what geographic trade routes. This latter spatial element is critically important to the proper evaluation of transport demand. This is because it takes more of the same sized vessels to deliver an equivalent stream of crude oil or products on a longer voyage between load port and discharge port than on a shorter voyage.

The schematic to the right here illustrates this point. The various bars represent the number of Suezmax vessels required to deliver 100,000 barrels per day over trade routes of various lengths. These results are based on round trip voyage assumptions, transporting cargo from load port to discharge port and traveling back to the load port empty (in ballast). Clearly, the trade dimension to tanker demand must not be neglected.

Tanker demand, with this spatial dimension included, is referred to as a demand matrix or trade matrix. This trade matrix is characterized by different sized vessels carrying different types of cargoes of crude oil and refined products on voyages between loading regions and discharging regions around the world. Each of these voyages consumes a specific amount of time directly related to the length of the voyage. The sum of all of the cargoes requiring transport over all of these distances collectively represents the global demand for tankers at a given point in time, represented in units of ton-miles.

A cargo of 280,000 metric tons of crude oil transported from Ras Tanura in Saudi Arabia to LOOP in the US Gulf represents 3,461,080,000 ton-miles of tanker demand.

If the characteristics of the trade matrix change in any way, demand for tankers will also be impacted. Changing trade patterns may elevate or reduce tanker demand. Shifting volumes, even if offsetting, may give rise to substantial changes in underlying tanker demand by virtue of the trades on which the volumes exist. In practice, when trading patterns are stable, cargo volume fluctuations lead directly to transportation demand fluctuations. However, if new trades emerge or old patterns change, the demand effect may be substantial and must be considered.

McQuilling Services add that in their 'Tanker Market Outlook' the researchers start with bilateral marine trade of crude and refined products between countries and transform this information into global ton-mile demand by vessel class.

For more information go to: www.mcquilling.com