MRS '24 - Panel 5: Identifying Risk, Measuring Success in the "Gray Zone"

The Maritime Risk Symposium is an annual three-day conference in which government and maritime industry leaders, port representatives, researchers, and solution providers convene to examine current and emerging threats to maritime security. MRS2024 is scheduled to take place June 11-13 2024 at Naval Postgraduate School (NPS) in Monterey, CA.A look @ Panel 5: Facilitator: Eric “Coop” Cooper, CAPT, USCG (retired)This panel will inform participants and generate discussion to improve understanding of the risk of gray zone activities pose to the economy…

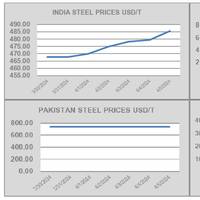

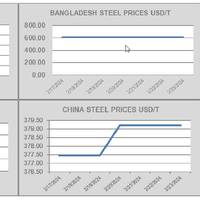

A Few Surprise Sales This Week in Ship Recycling

Ship recycling has again been quiet across the ship recycling globe, reports cash buyer GMS.“Moreover, as an increasing number of vessels past beached have been nearly recycled, and barely any meaningful arrivals have been reported at the respective waterfronts (zero in India this week), frustrated industry players are just … going with the depressive flow,” states GMS.“With that being said and reportedly this week, amidst a sea of floating oldies several high-priced sales were surprisingly confirmed to the various markets (essentially Bangladesh and Pakistan)…

Brent Oil Hits Highest Price This Year on Fresh Supply Threats

Global oil benchmark Brent on Tuesday rose above $89 a barrel for the first time since October, albeit briefly, as oil supplies faced fresh threats from Ukrainian attacks on Russian energy facilities and escalating conflict in the Middle East.Brent futures for June delivery were up $1.35, or 1.5%, at $88.76 a barrel by 11:40 a.m. EDT (1540 GMT) after touching a peak of $89.08.U.S. West Texas Intermediate (WTI) crude futures for May rose $1.27, or about 1.5%, to $84.98 after touching a peak of $85.46…

Asia Crude Imports Surge as China, India Snap Up Russian Oil

Asia's imports of crude oil are expected to rise to the highest in 10 months as heavyweights China and India lifted arrivals from Russia, but impending maintenance schedules and rising prices mean such levels may not be sustained.The world's top importing region is forecast to see arrivals of 27.48 million barrels per day (bpd) in March, up from 26.70 million bpd in February and January's 27.18 million bpd, according to data compiled by LSEG Oil Research.The bulk of oil arriving in March was arranged before the current increase in prices…

Red Sea Attacks Temporarily Increase Demand for Ships

The BIMCO Container Shipping Market Overview & Outlook for March 2024 has been published, and Niels Rasmussen, BIMCO’s Chief Shipping Analyst, highlights that ship supply is expected to grow on average 9.1% in 2024 and 4.1% in 2025.Rerouting via Cape of Good Hope is assumed to impact the first half of 2024. Ship demand increases an estimated 9.5% in 2024 and falls 0.5% in 2025. The supply/demand balance is expected to tighten in the first half of 2024 but then weaken when ships can return to the Suez Canal routing.According to the IMF…

SAAM Closes 2023 with Historic Earnings

SAAM reported net income of US$501 million in 2023, representing its best-ever results thanks to the sale of its port and logistics assets to Hapag-Lloyd, which generated a net gain of US$422 million.Sales for the year totaled US$540 million and EBITDA was US$160 million, surpassing the prior year by 17% and 9%, respectively."The sale of our port terminal and inland logistics operations leaves us in a solid position to move forward on the path we have set for ourselves: to lead the consolidation process in the towage industry and grow in air cargo logistics services.

Sharp Uptick Seen in Crude Tanker Ordering

Contracting activity for for crude tanker newbuilding has risen sharply to start 2024, driven by a steep rise in orders for very large crude carriers (VLCC), according to shipping organization BIMCO.In the first two months of 2024, crude tanker newbuild contracting surged to 7.4 m DWT, a 490% leap y/y. Notably, the 19 VLCCs ordered in January and February is more than was ordered for the entirety of 2023.Freight rates for crude tankers spiked at the start of the war in Ukraine, and they have largely stayed strong since, said Filipe Gouveia, shipping analyst at BIMCO.

BIMCO: Tanker Supply/Demand Balance will Tighten

The BIMCO Tanker Shipping Market Overview & Outlook February 2024 by Niels Rasmussen, BIMCO’s Chief Shipping Analyst, forecasts that the supply/demand balance will tighten further during both 2024 and 2025.Low fleet growth, along with increasing sailing distances, create the foundation for the improvement despite a slowing of growth in oil demand. The product tanker supply/demand balance is also expected to tighten in 2024 but weaken in 2025. Like the crude tanker market, longer sailing distances support demand growth despite slowing oil demand.

Red Sea Ship Attacks Hit Regional Economies

“During the first seven weeks of 2024, cargo volumes to and from ports in the Gulf of Aden and Red Sea declined 21% y/y. The number of ships arriving in these ports significantly declined as merchant shipping increasingly avoided transiting through the region due to concerns over attacks on ships by the Houthis,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Since November 2023, Houthi forces have attacked ships in the Red Sea and Gulf of Aden. In December, most container and gas carriers started avoiding the region and by January…

Ship Recycling Market Faces Tonnage Shortage

Global ship recycling markets are now being exclusively driven by the relentless and futile shortage of tonnage that is expected to continue until Spring (at the very least), says cash buyer GMS.“The much-anticipated rebound in global recycling volumes that so many in our industry had been waiting (hoping) for before the turn of the year, has unfortunately failed to materialize.”Markets in Turkey and India remain well off the competitive pace, so Pakistan and Bangladesh remain are leading the market despite the continued drop in supply of vessels.

S&P Downgrades Orsted on U.S. Offshore Risks

S&P downgraded Danish wind power giant Orsted to BBB on Wednesday, citing higher leverage on its balance sheet and major U.S. impairments in 2023 due to supply chain delays and higher costs.S&P said Orsted's business risk profile has weakened from last year, but was still satisfactory. It expects the world's biggest offshore wind farm developer would be able to successfully manage the substantial industry risks it faces.The offshore wind industry has been struggling with rising inflation, interest rate hikes and supply chain delays, which have endangered plans by U.S. President Joe Biden and several states to replace fossil fuels with offshore wind to fight climate change.The ratings agency maintained a stable outlook on Orsted…

Royal Caribbean Upbeat on 2024 Profit

Royal Caribbean Group projected 2024 profit above Wall Street expectations after robust demand for cruise vacations and steeper ticket prices helped it beat fourth-quarter earnings estimates on Thursday.With travelers opting for cruises instead of more expensive land-based vacation options, operators are experiencing record levels of bookings compared to pre-pandemic levels, giving them enough room to mark up ticket prices."2023 was an exceptional year, propelled by unmatched demand for our brands from new and loyal guests…

US Trade Deficit Shrinks on Falling Imports

The U.S. trade deficit unexpectedly narrowed in November as imports of consumer goods fell to a one-year low amid slowing domestic demand, a trend that, if it persists in December, could result in trade having no impact on economic growth in the fourth quarter.The report from the Commerce Department on Tuesday also showed exports declined in November amid cooling demand overseas. Demand is slowing both in the United States and abroad following hefty interest rate increases by global central banks since 2022 to tackle rampant inflation.The Federal Reserve's rate hiking cycle has likely ended…

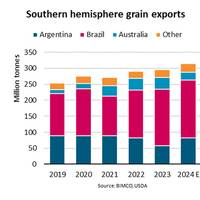

Argentina’s Grain Exports Could Jump 40%

“Argentina is on track to boost grain exports by 40% in 2024, recovering from last year’s drought which afflicted crops, but still below the 2019-2022 average. Climate patterns and government policy are shaping the outlook,” says Filipe Gouveia, Shipping Analyst at BIMCO.El Niño has brought improved weather conditions for Argentina’s grain crops. The wheat harvest is nearly complete and estimated to be 20% larger than a year ago. Meanwhile, the favorable conditions continue to support the growing maize and soybean crops.

Amogy Brings Ammonia Into the Mix

Ammonia is one of several renewable fuels seen as an option to help the maritime industry decarbonize.One of the companies working to unlock the fuel’s potential is Brooklyn, N.Y. based Amogy, developer of an onboard system that feeds liquid ammonia through a cracking process to create hydrogen on demand for power generation via fuel cell—without carbon emissions.Having already demonstrated its technology on an aerial drone, tractor and semi-truck, Amogy is currently working to…

Valaris Takes Delivery of Two New Drillships

Offshore drilling company Valaris has taken delivery of newbuild drillships VALARIS DS-13 and DS-14 for an aggregate purchase price of approximately $337 million.VALARIS DS-13 and DS-14 will be mobilized from South Korea to Las Palmas in Spain, where the rigs will be stacked until they are contracted for work.The purchase of the rigs is expected to increase the company’s fourth quarter 2023 capital expenditures by approximately $355 million, representing the purchase price for the rigs and costs associated with preparing the rigs to mobilize from South Korea to Las Palmas…

Baltic Dry Bulk Index Doubles in November

The Baltic Exchange's dry bulk sea freight index .BADI gained for the sixth consecutive session on Thursday, more than doubling in November to hit an one-and-a-half year peak helped by mounting supply of tonnage and cargo demand.The overall index .BADI, which factors in rates for capesize, panamax, supramax shipping vessels, was up 241 points or 8.9% at 2,937.

China Leads Global Renewables Race

Currently on target to reach a record-breaking 230GW of wind and solar installations this year, China leads the global renewables market. This is more than double the number of US and Europe installations combined, according to latest report ‘How China became the global renewables leader’ by Wood Mackenzie.Wind and solar project investment for China is expected to reach US$140 billion for 2023, according to the report’s findings.Alex Whitworth, Vice President, Head of Asia Pacific Power and Renewables research at Wood Mackenzie…

Biden's Clean Energy Agenda Faces Mounting Headwinds

Canceled offshore wind projects, imperiled solar factories, and fading demand for electric vehiclesA year after the passage of the largest climate change legislation in U.S. history, meant to touch off a boom in American clean energy development, economic realities are fraying President Joe Biden’s agenda.Soaring financing and materials costs, unreliable supply chains, delayed rulemaking in Washington and sluggish permitting have wrought havoc ranging from offshore wind developer Orsted’s project cancellations in the U.S.

Hapag-Lloyd CEO Optimistic that Shipping Markets will Rebalance

Global shipping markets, which are due to add more capacity than anticipated demand will support, have a good chance of rebalancing within two years, the chief executive of Germany's Hapag-Lloyd told reporters on Thursday."The gap between supply growth and demand growth is possibly smaller than people think and therefore, the outlook that the market may recover to a more balanced situation in one or two years is better than most people feel," said CEO Rolf Habben Jansen.The company, the world's number five in container shipping, earlier this month said it will cut some services to save costs a

Accelerating US CTV Market Development with Hybrid Solutions

As the world looks to renewable energy sources to combat climate change and reduce reliance on fossil fuels, offshore wind has emerged as a promising frontier in the United States. A report by the University of California Berkeley released in August concluded that due to the nation’s long coastlines with sustained winds in many areas and falling turbine costs, offshore wind could feasibly supply between 10% and 25% of the country’s energy demand by 2050.While that may paint a rosy picture of a cleaner…

CMA CGM Reports Drop in Quarterly Profit

CMA CGM said on Friday its profit fell in the third quarter as a COVID-era boom in shipping continued to fade, but its volumes picked up as a destocking trend in the United States was offset by brisk demand in other parts of the world.The French-based shipping giant was cautious about next year's outlook, with the prospect of a recovery in global trade - as U.S. firms finish destocking - tempered by expectations of modest economic growth and an influx of new vessels.CMA CGM, privately controlled by the Saade family…

Hapag-Lloyd Posts 77% Drop in Nine-month Net Profit, Cuts Outlook

German container shipper Hapag-Lloyd on Thursday posted a net profit of 3.2 billion euros ($3.43 billion) for the first nine months of 2023, down by 77% from a year earlier, and cut its forecasts for full-year earnings.Net profit was down from 13.8 billion euros in comparable 2022 when the shipping industry, a proxy for global trade, boomed amid post-pandemic recovery and because logistics disruptions drove up prices for consumers.This year, the global economic slowdown and the clearing of port log-jams sent freight rates down sharply…