Unconventional Gas: Strong Growth in Drilling & Production Forecast

Douglas-Westwood has published the first edition of its Unconventional Gas: World Production & Drilling Forecast – a study which details the multi-billion dollar opportunities in this rapidly developing energy sector through to 2020.

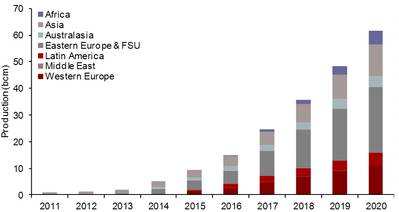

Andrew Reid, CEO, commented, “Douglas-Westwood forecast strong and continual development in the unconventional gas sector in Europe and Asia-Pacific, following the success of the now well established shale gas sector in North America.” Reid continued, “By 2020, Douglas-Westwood forecast the global production of unconventional gas will reach almost 800bcm, up from 450bcm in 2011.” Although production outside North America is currently low, exploration activity has increased dramatically in recent years in countries such as Australia, China and Poland. Global energy market conditions have made unconventional gas development economically feasible, but commercial production in Europe is not expected until at the least the middle of this decade.

The role of natural gas in the world’s primary energy mix is set to grow ever-more important in the coming years. With gas consumption growing relative to oil, natural gas production will increase dramatically in future decades. Natural gas is being touted as a bridging fuel towards a low-carbon world, while lingering doubts around long-term supply of oil are also fueling gas demand. Within this climate, the development of unconventional gas can be viewed as gamechanging. The reserve size and location of gas (along with the prevailing conditions) mean in the coming years unconventional gas development may have an effect on the world similar or greater than that of LNG.

Report author, Joseph Dutton, concludes, “Since 2010 in excess of $70bn has spent on M&A transactions involving unconventional gas operators and service companies. With the majority of these in the North American market, investment has since turned to development opportunities in Europe and Asia-Pacific. The growing importance of natural gas in the global energy market ensures that unconventional gas will play a fundamental role in primary energy production in the future.”