China's July Crude Imports Drop to Lowest Since January

China's crude oil imports in July fell 18.8% from the previous month to the lowest daily rate since January, customs data showed on Tuesday, as major exporters cut back overseas shipments and domestic stocks continued to build. Crude shipments into the world's biggest oil importer in July totaled 43.69 million metric tons, or 10.29 million barrels per day (bpd), the data from the General Administration of Customs showed. June's 12.67 million bpd of imports were the second-highest on record.

Second Wave of Floating Storage Triggered by Ailing Oil Market

A stalled global economic recovery from the coronavirus pandemic is leading to a fresh build-up of global oil supplies, pushing traders including Trafigura to book tankers to store millions of barrels of crude oil and refined fuels at sea again.The use of so-called floating storage onboard tankers comes as traditional onshore storage remains close to capacity as supplies outpace demand.Trading house Trafigura has chartered at least five of the largest tankers each capable of storing 2 million barrels of oil…

Buyers Seek US Waivers to Buy Iranian Oil amid New Sanctions

South Korea said on Wednesday it would seek U.S. exemptions to buy Iranian oil, a path many big oil consumers are likely to follow in the wake of new U.S. sanctions on Tehran, which will tighten world oil markets and push up prices.Iran is the third-largest oil producer in the Organization of the Petroleum Exporting Countries (OPEC) and a key supplier, especially to refiners in Asia.The United States plans to impose new unilateral sanctions after abandoning an agreement reached in late 2015 which limited Iran's nuclear ambitions in exchange for removing joint U.S.-Europe sanctions…

Oil Trades Strengthen to Mid-2015 Levels on Iranian Unrest

Oil prices posted their strongest opening to a year since 2014 on Tuesday, with crude rising to mid-2015 highs amid large anti-government rallies in Iran and ongoing supply cuts led by OPEC and Russia. U.S. West Texas Intermediate (WTI) crude futures traded flat at around $60.40 by 1200 GMT after hitting $60.74 earlier in the day, their highest since June 2015. Brent crude futures, the international benchmark, were also flat at around $66.80 after hitting a May 2015 high of $67.29 a barrel earlier in the day.

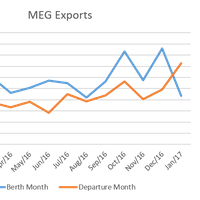

Middle East Gulf Exports Soar in January 2017

During January – a month when all eyes were on oil production cuts – exports leaving the Middle East Gulf (MEG) region hit the highest level in at least two years, according to Genscape. At the end of November 2016, the Organization of the Petroleum Exporting Countries (OPEC) addressed the perceived global oversupply of oil and consequent low prices. OPEC members agreed that all countries, except Iran, would cut total production by 1.2 million barrels per day (bpd), starting on January 1.

US Crude Stocks Plunge as Tankers Delay Arrival on Storm Warning: Kemp

U.S. crude oil inventories plunged by more than 14.5 million barrels in the week ending on Sept. 2, the largest weekly drop since 1999. The reasons for the drawdown are not hard to find with a modest acceleration in refinery processing rates and a sharp slowdown in crude imports. Crude imports fell from an average of 8.9 million barrels per day in the week ending Aug. 26 to just 7.1 million bpd in the week ending Sept. 2, according to the U.S. Energy Information Administration. Crude imports fell by a total of almost 13 million barrels compared with the previous week, accounting for most of the reported decline in inventories. Crude…

Brent Oil Rises as Euro Gains Against Dollar

Brent oil prices rose on Wednesday as the euro strengthened against the dollar following a boost in business morale in the euro zone's top two economies. The euro was up 0.6 percent against the dollar, the currency in which crude oil futures trade. The dollar lost 0.5 percent against a basket of currencies, making dollar-traded commodities more attractive for holders of other currencies. Brent crude oil was up 74 cents at $55.85 a barrel by 1236 GMT. U.S. light crude oil was up 35 cents at $47.86 per barrel. Germany, Europe's largest economy, saw business morale rise for the fifth month in a row in March, hitting its highest since July 2014, Ifo's business climate index showed. Business morale also rose in France to its highest for nearly three years. U.S.

Oil's Worst Year Since 2008

Oil prices fell on Wednesday as concerns about demand for fuel kept worries about a global supply glut intact. Both Brent and U.S. crude significantly pared losses just before government data showed U.S. crude oil inventories fell 1.8 million barrels last week, a bigger drop than analyst expectations for a 100,000-barrel dip in stocks. After initially paring more losses, crude futures pushed lower. U.S. gasoline stocks rose 3.0 million barrels and distillate stocks were up 1.9 million barrels last week, data from the Energy Information Administration (EIA) showed, as refiners lifted capacity utilization 0.9 percentage point to 94.4 percent. The EIA data followed American Petroleum Institute data released on Tuesday that showed an increase in U.S. stockpiles.

Oil Falls Towards $111 on Libya Ports Deal

Oil fell towards $111 a barrel on Wednesday, its lowest in almost three weeks, on a possible substantial recovery in Libyan exports after rebels said they would reopen two oil terminals. Libyan rebels blockading eastern oil ports have agreed to reopen the remaining two terminals at Es Sider and Ras Lanuf. The port seizures have crippled the OPEC producer's oil industry since last summer. If fulfilled, the deal would bring back around 500,000 barrels per day (bpd) of crude oil export capacity, although production would remain well below the total of around 1.4 million bpd. There have been repeated reports in the past that ports would reopen and production increase, but analysts said the latest developments were likely to have more impact.

Brent eases below $108 on Ukraine diplomacy

EU leaders set to warn, not sanction Russia; U.S. crude stocks rise more than expected. U.S. jobs data, services data point to lower oil demand. Brent crude reversed gains made earlier on Thursday after Crimea's parliament voted unanimously to join Russia, even as the West and Russia engaged in high-stakes diplomacy to cool the crisis in Ukraine. The announcement sets a referendum on the future of Crimea in 10 days, raising the stakes in the most serious East-West confrontation since the end of the Cold War. The North Sea benchmark has fallen $4 since reaching two-month highs on Monday, when worries of an armed conflict between Ukraine and Russia peaked.

Oil falls below $110 as Ukraine worries ease

Putin orders troops in military exercise back to base. U.S., EU warn Russia could face sanctions over Crimea; U.S. crude inventory likely rose 1 mln bbls last week. Oil fell more than $1 on Tuesday to below $110 a barrel after President Vladimir Putin recalled troops to base from military exercises in western Russia near its borders with Ukraine. April Brent crude was down $1.47 at $109.73 a barrel by 0900 GMT. It closed the previous session at its highest since Dec. 27. U.S. crude for April delivery fell as low as $103.60, after reaching a 5-1/2-month high at $105.22 on Monday. The contract was currently down $1.11 at $103.81. Russia invaded Ukraine's autonomous Crimea region at the weekend…

Asia-Pacific Crude-Weaker; ONGC sells Sokol

The Asia-Pacific crude market weakened on Monday with differentials for Russian Sokol depressed by slow demand during peak maintenance season, but a recovery in the naphtha market offset some of the losses. India's ONGC sold 700,000 barrels of light sweet Sokol crude for May 1-4 loading to Glencore at $7.50 per barrel above Oman/Dubai quotes on a cost and freight (CFR) basis, traders said. The company last sold Sokol for April loading at a premium of $8.50 per barrel. Sentiment in the crude market has weakened with many regional refiners undergoing maintenance, however, slight gains in the naphtha and middle distillate markets were supportive. Brent-Dubai Exchange of Futures for Swaps (EFS) <DUB-EFS-1M>, or Brent's premium to Dubai swaps, widened 11 cents to $4.01 per barrel.

When Up Is Down

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) rose by 1.5 million barrels last week. Total commercial petroleum inventories increased by 5.0 million barrels. So how do these increases actually represent a declining inventory situation? It is by looking at the shrinking surplus to year-ago levels. Even with these increases, the petroleum inventory surplus that has existed in the United States for over a year is shrinking fast. U.S. crude oil inventories, which were about 40 million barrels above year-ago levels as recently as the week ending March 1, stand at just 3.9 million barrels above year ago levels for the week ending April 19.

ANS Crude Sold At Discount

A cargo of Alaska North Slope (ANS) for September delivery was sold to a California refiner at a discount of $2.75 a barrel to September West Texas Intermediate (WTI) crude. The deal marked a further widening of the ANS discount against WTI since a low for the year was set on July 3 with two deals at discounts of $1.59 and $1.61. In January of this year the discount stood at levels of over $5. On Wednesday of this week two deals were struck for September delivery of ANS to Hawaii at the same price of $2.25 a barrel below ANS on a delivered basis. Traders had said this equated to a price of about $2.75/$3.00 per barrel below WTI for delivery to California or Washington state, because of the higher cost of shipping to Hawaii. Crude values have been weakening on the U.S.

Fog May Pose Threat to Gulf Coast Shipping

Fog, which has shrouded parts of the U.S. Gulf of Mexico coast in recent weeks, could remain an intermittent threat to shipping and crude oil imports through April, according to a government meteorologist. In February, March and April sea fogs can form quickly along the Gulf coast as warm moist air heading in from the Gulf hits cooler coastal waters, causing the moisture to condense. “All of a sudden it’s like you drive into a brick wall and the visibility goes down to a sixteenth of a mile. Most ships don’t do much traveling in that,” said National Weather Service meteorologist Kent Prochazka. It’s a phenomenon that can disrupt the steady traffic of crude oil tankers to Gulf Coast terminals and refining centers such as Corpus Christi…

Statoil Hydro wins Offshore Brazil Bid

Statoil Hydro on November 27 said it has won a bid to conduct offshore exploration off Brazil. The Norwegian group was awarded two blocks offshore. The blocks, numbered CM529 and CM530, are located in sea depths of around 100 m. The licenses for the two blocks were to be operated by Anadarko Petroleum Corporation that would have a 50 percent stake, the same as Statoil Hydro. Statoil Hydro did not state what the bid cost. The blocks were located next to the heavy oil field Peregrino that was slated to come on stream in 2010. Statoil Hydro has a 50-percent-stake in the Peregrino field in the Campos basin. The Norwegian group was created October 1 when Statoil and its rival Norsk Hydro merged their oil and gas activities.

U.S. Crude Oil Production October Exceeded Imports Reports EIA

The U.S. Energy Information Administration (EIA) releases latest short-term energy outlook. Monthly estimated domestic crude oil production exceeded crude oil imports in October 2013 for the first time since February 1995. The weekly U.S. average regular gasoline retail price has fallen by more than 40 cents per gallon since the beginning of September. EIA's forecast for the regular gasoline retail price averages $3.24 per gallon in the fourth quarter of 2013, $0.10 per gallon less than forecast in last month's STEO.

Oil Prices Slip

According to reports, oil prices fell by three per cent Monday, slipping below $59 a barrel as traders looked ahead to U.S. supply data due out Wednesday that is expected to show rising inventories of crude. Doubts about OPEC's ability to implement a 1.2 million barrels a day production cut also weighed on prices. Last week, oil prices surged after the U.S. Energy Department data showed a large decline in crude-oil inventories. But some analysts believe the market overreacted to the data by failing to account for the impact of a temporary shutdown of the Louisiana Offshore Oil Port, through which 10 per cent of all U.S. oil imports flow.