North American Oil Supply Shocks Markets

IEA’s Medium-Term Oil Market Report sees companies overhauling global investment strategies; meanwhile, surge in non-OECD refining capacity shakes up product market

The supply shock created by a surge in North American oil production will be as transformative to the market over the next five years as was the rise of Chinese demand over the last 15, the International Energy Agency (IEA) said in its annual Medium-Term Oil Market Report (MTOMR). The shift will not only cause oil companies to overhaul their global investment strategies, but also reshape the way oil is transported, stored and refined.

According to the MTOMR, the effects of continued growth in North American supply – led by U.S. light, tight oil (LTO) and Canadian oil sands – will cascade through the global oil market. Although shale oil development outside North America may not be a large-scale reality during the report’s five-year timeframe, the technologies responsible for the boom will increase production from mature, conventional fields – causing companies to reconsider investments in higher-risk areas.

In virtually every other aspect of the market, developing economies are in the driver’s seat. This quarter, for the first time, non-OECD economies will overtake OECD nations in oil demand. At the same time, massive refinery capacity increases in non-OECD economies are accelerating a broad restructuring of the global refining industry and oil trading patterns. European refiners will see no let-up from the squeeze caused by increasing US product exports and the new Asian and Middle Eastern refining titans.

“North America has set off a supply shock that is sending ripples throughout the world,” said IEA Executive Director Maria van der Hoeven, who launched the report at the Platts Crude Oil Summit in London. “The good news is that this is helping to ease a market that was relatively tight for several years. The technology that unlocked the bonanza in places like North Dakota can and will be applied elsewhere, potentially leading to a broad reassessment of reserves. But as companies rethink their strategies, and as emerging economies become the leading players in the refining and demand sectors, not everyone will be a winner.”

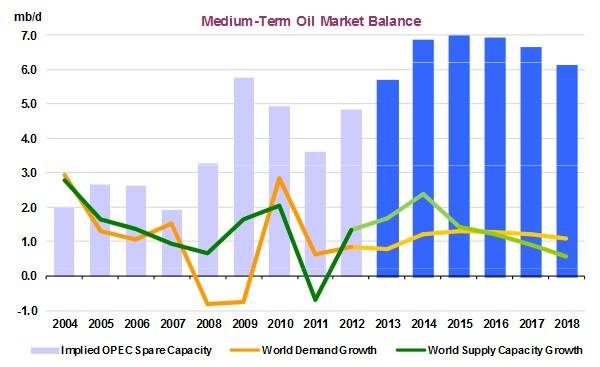

While geopolitical risks abound, market fundamentals suggest a more comfortable global oil supply/demand balance over the next five years. The MTOMR forecasts North American supply to grow by 3.9 million barrels per day (mb/d) from 2012 to 2018, or nearly two-thirds of total forecast non-OPEC supply growth of 6 mb/d. World liquid production capacity is expected to grow by 8.4 mb/d – significantly faster than demand – which is projected to expand by 6.9 mb/d. Global refining capacity will post even steeper growth, surging by 9.5 mb/d, led by China and the Middle East.

The growth in North American oil production presents opportunities and challenges, notes the MTOMR. With large-scale North American crude imports tapering off and with excess US refining output looking for markets, the domino effects from this new supply will continue. Having helped offset record supply disruptions in 2012, North American supply is expected to continue to compensate for declines and delays elsewhere, but only if necessary infrastructure is put in place. Failing that, bottlenecks could pressure prices lower and slow development.

While OPEC oil will remain a key part of the oil mix, OPEC production capacity growth will be adversely affected by growing insecurity in North and Sub-Saharan Africa. OPEC capacity is expected to gain 1.75 mb/d to 36.75 mb/d, about 750 kb/d less than forecast in the 2012 MTOMR. Iraq, Saudi Arabia and the UAE will lead the growth, but OPEC’s lower-than-expected aggregate additions to global capacity will boost the relative share of North America.

Rising non-OECD participation in the oil market will be associated with continued growth in commercial and strategic storage capacity, along with strategically located storage hubs to support long-haul crude and product trade. African economies will play a larger role in the global market than previously expected. Although data leave room for improvement, there is strong evidence that African oil demand has been routinely underestimated, and may grow by a further 1 mb/d over the next five years.

Finally, steep growth in non-OECD refining capacity will accelerate the transformation of the global product supply chain, exerting downward pressure on refining margins and utilisation rates and leaving OECD refineries at risk of closure, notably in Europe. Product supply chains will continue to lengthen as new merchant refining centres extend their reach, resulting in higher disruption risks and potentially more volatile markets in product-importing economies.

www.iea.org