Container Cascading is Hurting Trade Dynamics

Ocean carriers are doing some things right to secure profitability, but cascading is now really hurting the dynamics of the North-South trades.

Drewry Maritime’s latest annual Container Market Annual Review and Forecast 2013/14 highlights that while there is a good deal of excessive market behavior resulting in weak freight rates, ocean carriers are getting half of it right.

With more than 25 ULCVs (ships of at least 10,000 teu) delivered so far this year, carriers have coped pretty well with deployment of tonnage in the main East-West trades. As of October 1, Drewry estimates that headhaul capacity in the three main East-West routes has increased by only 2.3% year-on-year. However, there is still a structural over-capacity, and Asia to North Europe spot rates have fallen in 33 of the 39 weeks so far this year.

Given the weak fundamentals, carriers have been much more focused on their costs in order to achieve any kind of decent profitability. Drewry calculates that the industry will save $5.5 billion on fuel this year, partly because of lower physical market prices, but also due to network changes, slow steaming, the introduction of more fuel-efficient ships and bunkering in Russia. The importance of bunker savings was clearly demonstrated by Maersk in its surprisingly strong second-quarter financials this year.

Furthermore, there now seem to be considerable gaps between the best and worst performing lines in the industry. Part of this may well be down to cost savings and it could be that some of the operators with a higher percentage of ULCVs in their fleets are now starting to reap the true benefits of their economies of scale.

However, the constant supply-side pressures mean that the global cascade of tonnage is hurting the North-South trades – regions where all operators are placing their faith for the future. Rates in the once-stellar Asia to East Coast South America trade have fallen 61% to $780 per teu this year. And in the Asia to Australia trade, they have plummeted 65% to an unsustainable $400 per teu in the same time frame.

Global fleet growth is forecast to be 7.4% next year, which will continue to challenge carriers’ stability.

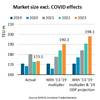

Unless criers limit capacity growth at the trade route level to realistic market levels, they run the risk of ruining the trade lanes that they see as the future. Drewry said it does not forecast annual global trade growth rising above 6% between now and 2017, and so carriers need to find another way of defending their profitability beyond the futile monthly GRI attempts. The formation of the P3 alliance is we believe one way of stabilizing operational supply, but much more work is needed.

With global idle activity at around 2-3% only, this does not appear to be the way forward.

Neil Dekker, Drewry’s head of container research, stated, “Good strategies on one side of the equation are being unravelled quickly simply because the carriers cannot have it both ways. Pouring too much capacity into the system means that at some stage it will overflow and we would argue that this has already happened to some extent. Although 2013 will turn out to be an OK year for the industry and the main stakeholders should make a small profit, many carriers will still be in the red. Liner companies can no longer treat the ULCVs as a secure passport to profitability unless they release the pressure elsewhere.”

drewry.co.uk