Akastor’s Subsidiary Wins $101M Case Against Seatrium's Jurong Shipyard

MHWirth, a subsidiary of Norwegian oil services investment firm Akastor, has received an arbitration award issued by a tribunal in a dispute with Seatrium’s subsidiary Jurong Shipyard over the termination of four drilling rig unit contracts.As part of the ruling, MHW has been awarded an amount of $101 million as payment of termination fees.In addition, MHW has been made eligible for the reimbursement of legal costs and certain suspension costs (totaling about $7 million), as well as interest.Although the drilling rig unit contracts are held by MHW…

Gulf LNG Tugs to Provide Towage at Texas LNG Terminal in Brownsville

Gulf LNG Tugs of Texas has been selected to provide towage services for the Texas LNG export terminal to be constructed in the Port of Brownsville.Gulf LNG Tugs, a consortium of Suderman & Young Towing Company, Bay-Houston Towing, and Moran Towing Corporation, will build, deliver and operate tugboats under a long term agreement to assist LNG carriers arriving at the facility.Texas LNG will be a 4 million tonnes per annum (MTPA) liquefied natural gas (LNG) export terminal owned and managed by Glenfarne Energy Transition.

Wave of New LNG Export Plants Threatens to Knock Gas Prices

A flood of liquefied natural gas (LNG) export projects due online worldwide in mid-decade will vie against lower-cost renewable energy and a revived nuclear power sector, which could rock gas prices and hurt some proposed projects, analysts say.Proposed and approved new LNG plants would boost LNG supply by 67% increase to 636 million tonnes per annum (mtpa) by 2030 from 2021 levels, potentially saturating the gas market."There's over a trillion dollars of natural gas infrastructure being built in the world today.

Yinson Bags $5.3B Deal for its First FPSO Project in Angola

Malaysian company Yinson has secured a firm contract to provide and maintain an FPSO for Azule Energy, a BP-Eni joint venture, in Angola.The contract, awarded by Eni Angola, is for the provision of the FPSO for the Agogo Integrated West Hub Development Project in Angola (“FPSO Agogo”).According to Yinson, the contract is worth about $5.3 billion in total and has a firm period of 15 years from the date of the final FPSO's acceptance. Azule Energy will have the option to extend for another five years. The FPSO Agogo is expected to start operations in the fourth quarter of 2025.

Venezuela's Oil Exports Fall in Spite of Iranian Assist

Venezuela's oil exports last year declined due to infrastructure outages, U.S. sanctions and rising competition in its key Asia market despite assistance from ally Iran, according to shipping data and documents.Exports this year are expected to get a lift after the United States relaxed oil sanctions by authorizing some partners of state-run firm Petroleos de Venezuela (PDVSA) to resume taking Venezuelan crude.Iran expanded its role in Venezuela last year, sending supplies to boost exports and technicians to repair a refinery.

Chevron Can Resume Key Role in Venezuela's Oil Output, Exports

Chevron Corp on Saturday received a U.S. license allowing the second-largest U.S. oil company to expand its production in Venezuela and bring the South American country's crude oil to the United States.The decision grants broader rights for the last big U.S. oil company still operating in U.S.-sanctioned Venezuela. However, it restricts any cash payments to Venezuela, which could reduce the oil available to export.License terms are designed to prevent state-run oil firm Petróleos de Venezuela, known as PDVSA PDVSA.UL, from receiving proceeds from Chevron's petroleum sales, U.S. officials said.

LR Names Abi-Saab Chief Technology and Innovation Officer

Lloyd’s Register (LR) has appointed Chakib Abi-Saab to its newly created role of Chief Technology and Innovation Officer (CTIO). Abi-Saab, who was previously with Bahri (formerly known as the National Shipping Company of Saudi Arabia) as their Chief Technology Officer, joins LR with considerable expertise in technology and digital enablement from both maritime and the oil and gas industry. Before his time with Bahri, Abi-Saab held executive roles at ship management company OSM, offshore energy provider Bumi Armada and Oil and Gas Services provider Baker Hughes.

Rising Calls for U.S. LNG Revive Stalled Export Projects, but at Higher Costs

Soaring demand for U.S. liquefied natural gas (LNG) as buyers steer clear of Russian fuel is putting some long-stalled U.S. export projects back on track. But rising costs for materials and labor threaten to snarl these plants once again.Two developers with projects sidelined due to the U.S.-China trade war – Energy Transfer with its Lake Charles LNG and Tellurian Inc with its Driftwood LNG – have begun talks with construction provider Bechtel Group over costs, according to a…

Offshore Energy: Are Decommissioning Costs set to Spiral?

As offshore market activity recovers and continues to increase through the next decade, as we expect it to, oilfield service (OFS) capacity is expected to tighten.As offshore market activity recovers and continues to increase through the next decade, as NorthStone Advisors expect it to, oilfield service (OFS) capacity is expected to tighten. In NorthStone Advisors’ view, this will create a period of increased scarcity and cost inflation, presenting significant cost and schedule risk to decommissioning programs.Many eyes are on the UK…

Oil Hits Seven-year High

Oil prices surged to seven-year highs on Friday, extending their rally into a seventh week on ongoing worries about supply disruptions fueled by frigid U.S. weather and ongoing political turmoil among major world producers.Brent crude rose $2.16, or 2.4%, to settle at $93.27 a barrel having earlier touched its highest since October 2014 at $93.70.U.S. West Texas Intermediate crude ended $2.04, or 2.3%, higher at $92.31 a barrel after trading as high as $93.17, its highest since September 2014.Brent ended the week 3.6% higher…

Baker Hughes Finds US Drillers Add Most O&G Rigs Since April

U.S. energy firms this week added the most oil and natural gas rigs in a week since April as rising oil prices prompt more drillers to return to the wellpad.The oil and gas rig count, an early indicator of future output, rose 13 to 601 in the week to Jan. 14, its highest since April 2020, said Baker Hughes in its weekly report. The total count was up 228, or 61%, over this time last year.U.S. oil rigs rose 11 to 492 this week, their highest since April 2020, while gas rigs rose two to 109, their highest since March 2020.

Baker Hughes Signs Deal with Shell for Renewable Energy Credits

Oil major Royal Dutch Shell's clean energy unit will provide renewable energy credits (REC) to oilfield firm Baker Hughes' facilities in United States for a two-year period, the companies said on Wednesday.

Equinor Sanctions $8B Bacalhau Field Development in Brazil

Norwegian oil and gas company Equnior has made a final investment decision for the development of the Bacalhau field offshore Brazil.The development of the field located in the Santos Basin will cost around $8 billion. Arne Sigve Nylund, Equinor’s executive vice president for Projects, Drilling, and Procurement said: "This is an exciting day. Bacalhau is the first greenfield development by an international operator in the pre-salt area and will create great value for Brazil, Equinor, and partners.

Oil Jumps on Weather Concerns in Gulf of Mexico

Oil prices jumped 2% on Friday after three days of losses, driven higher as a storm formed in the Gulf of Mexico, but were on track for a weekly fall as investors braced for the return of Iranian crude supplies after officials said Iran and world powers made progress a nuclear deal.Brent crude futures rose $1.33, or 2%, to $66.36 a barrel by 1:06 p.m. ET (1606 GMT), while U.S. West Texas Intermediate was at $63.54 a barrel, up $1.61, or 2.6%.A weather system forming over the western Gulf of Mexico has a 40% chance of becoming a cyclone in the next 48 hours, the U.S.

Oil Surges After OPEC+ Extends Cuts

Oil prices jumped about 3% on Friday, hitting their highest levels in over a year, following a stronger-than-expected U.S. jobs report and decision by OPEC and its allies not to increase supply in April.Brent futures rose $2.10, or 3.2%, to $68.84 a barrel by 11:25 a.m. EST (1625 GMT). Earlier in the session, the global benchmark hit its highest since January 2020.U.S. West Texas Intermediate (WTI) crude rose $1.87, or 2.9%, to $65.70 per barrel, after earlier scaling its highest since April 2019.For the week…

Report: Baker Hughes, 17 Other Firms Quit Nord Stream 2 Pipeline Project to Avoid Sanctions

Baker Hughes Co and AXA Group and 16 other companies recently quit work on Russia’s Nord Stream 2 natural gas pipeline and will not be sanctioned, according to a document the Biden administration sent to Congress last week which was seen by Reuters.Russian energy company Gazprom and its western partners are racing to build the pipeline to take Russian gas to Germany under the Baltic Sea, and hope to finish it this year. President Joe Biden believes the pipeline is a “bad deal” for Europe.Many U.S. lawmakers and officials say the pipeline would increase Russia’s political and economic leverage over Europe. The $11 billion pipeline, which would double the capacity of its existing duct, would bypass Ukraine through which Russia has sent gas to Europe for decades.

Oilfield Services Firms Moving Beyond Oil

Heavyweight oilfield service providers like Saipem and Baker Hughes are moving past just oil and gas projects and embracing more renewable energy projects going forward.In 2014, non-upstream oil and gas activities accounted for 22% of revenues among service suppliers. This share grew to 27% in 2018.According to Rystad Energy, the trend to accelerate in the next decade.“If pure-play contractors within drilling, well services and seismic – which don’t have much to offer outside the upstream oil and gas industry – are removed from the equation, activities outside of upstream accounted for nearly 30% of last year’s revenues,” says Audun Martinsen…

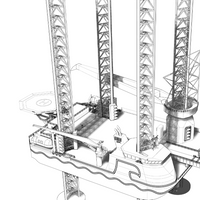

ABS to Class Silver Eagle's New Jack-Ups

ABS, a classification services provider to the marine and offshore industries, will provide classification for a series of "highly innovative Self-Elevating Drilling Units (SEDU)" for Silver Eagle Global.Silver Eagle, of Manama, Bahrain, says the self-propelled design is capable of working at greater water depths and in harsh environments. According to Silver Eagle Global, the Silver Eagle SEDU 430WC-4 will have the industry’s largest deck area and deck load capacity, large accommodation…

U.S. Drillers Cut Rigs Again: Baker Hughes

U.S. energy firms this week reduced the number of oil rigs operating for a seventh week in a row as producers follow through on plans to cut spending on new drilling this year.Drillers cut 3 oil rigs in the week to Oct. 4, bringing the total count down to 710, the lowest since May 2017, General Electric Co's Baker Hughes energy services firm said in its closely followed report on Friday.In the same week a year ago, there were 861 active rigs.The oil rig count, an early indicator of future output…

Chart Gets Order for Calcasieu Pass LNG

U.S. LNG equipment maker Chart Industries has received full notice to proceed (FNTP) regarding its production of cold boxes and brazed aluminium heat exchangers for Venture Global’s 10 million tpy Calcasieu Pass LNG export terminal project.The U.S. Federal Energy Regulatory Commission (FERC) approved Venture Global LNG request to proceed with full site preparation at its proposed 10 million tonnes per annum (MTPA) export terminal in Louisiana earlier this week.Venture Global recently announced its final investment decision (FID) and the closing of project financing for its Calcasieu Pass LNG facility and associated TransCameron pipeline in Cameron Parish, Louisiana.The proceeds of the debt and equity financing fully fund the balance of the construction and commissioning of Calcasieu Pass.

Digitalization: Oil Industry Could Save up to $100Bln

The global oil and gas industry can save as much as $100 billion through automation and digitalization in the 2020s, energy research firm Rystad Energy said."As much as $100 billion can be eliminated from E&P upstream budgets through automation and digitalization initiatives in the 2020s. Service companies are reinventing themselves to help operators unlock these savings," said the study by Rystad.In 2018, $1 trillion was spent on operational expenditures, wells, facilities and subsea capital expenditures across more than 3,000 companies in the upstream space. There are varying degrees of potential savings within offshore, shale and conventional onshore activity budgets…

Oil and Gas Industry Adopts VR

The oil and gas industry is witnessing wide-scale deployment of virtual reality (VR) technology across its value chain, according to GlobalData.According to the report, ‘Virtual Reality in Oil & Gas’, VR is finding its way into upstream, midstream and downstream sectors with applications in the simulation of new processes, analysis of project designs, reviewing of maintenance requirements and planning disaster responses.Ravindra Puranik, Oil and Gas Analyst at GlobalData, said: “Over time, this technology will transform oil and gas processes and workflows and help create new growth opportunities for organizations.”VR provides an interactive experience for oil and gas processes within a simulated environment and presents a superior alternative to images…

Offshore Energy Outlook for 2020

The “new normal” is a phrase tossed around often in offshore energy circles today as those servicing and operating in the sector grapple with the harsh realities of the prolonged industry downturn. Operators, service companies and equipment suppliers have been forced to adjust to oil selling at prices well below the $100+ per barrel mark seen in years past. As of this writing, Brent oil was hovering around $62 per barrel, and analysts expect prices will remain in this range for some time into the future.On top of this…