Swedbank Adopts Poseidon Principles

Swedbank has signed the Poseidon Principles, a global framework for integrating climate considerations into lending decisions within ship financeThe Poseidon Principles provide a standardised methodology for data collection and reporting of emissions from banks’ shipping portfolios, with the overall ambition of supporting and facilitating the decarbonization of the shipping industry.The Poseidon Principles are consistent with the policies and ambitions of the IMO, including its…

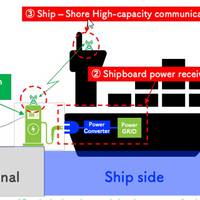

Japanese Partners Aim to Promote Standardized Shore Power Systems

A group of Japanese organisations have claimed a world-first with their initiative to advance standardized, zero emission shore power systems.Japanese ports and coastal industrial zones are responsible for about 60% of the country's CO2 emissions and are therefore a target for decarbonization, with Japan aiming to be carbon neutral by 2050. Shore power is attracting particular attention because approximately 40% of CO2 emissions in ports come from diesel generators on docked ships.

Global Supply Disruptions Could Still Get Worse, Central Bankers Warn

Supply constraints thwarting global economic growth could still get worse, keeping inflation elevated longer, even if the current spike in prices is still likely to remain temporary, the world’s top central bankers warned on Wednesday.The disruptions to the global economy during the pandemic have upset supply chains across continents, leaving the world short of a plethora of goods and services from car parts and microchips to container vessels that transport goods across the seas.“It’s ...

WFW Advises on Race Bank Wind Farm Deal

Watson Farley & Williams (WFW), an international law firm based in London, said that it has advised Race Bank Wind Farm Limited on its USD 608 million sale of transmission system assets relating to the 573 MW Race Bank offshore wind farm to Diamond Transmission Partners.Race Bank is a joint venture owned by Ørsted (50%), Macquarie European Infrastructure Fund 5 (25%), a fund established by Sumitomo Corporation, Sumitomo Mitsui Banking Corporation and Development Bank of Japan (12.5%), and Arjun Infrastructure Partners and Gravis Capital Management (12.5%).Diamond Transmission Partners is a 50/50 partnership between Diamond Transmission…

Sovcomflot, NYK Pact on Financing 2 LNG Carriers

Russian maritime shipping company specializing in petroleum and LNG shipping Sovcomflot (SCF Group) and NYK Line have announced that they have signed a new $176 million non-recourse credit facility for eight years with three leading international banks.The banks are: Sumitomo Mitsui Banking Corp. of Japan (through its German subsidiary, SMBC Bank EU AG); Société Générale of France; and Shinsei Bank of Japan. The agreement was reportedly signed through joint venture companies belonging to SCF Group and NYK Line.The facility will be used towards refinancing two ice-class LNG carriers servicing the Sakhalin-2 project, Grand Aniva and her sister ship Grand Elena, which are jointly owned and operated by SCF Group and NYK Line.

K Line Gets $406M Loan

Japanese shipping company Kawasaki Kisen Kaisha (K Line) has decided to raise JPY 45 billion (USD 406 million) through a new subordinate loan.According to a stock exchange annoucement, the loan proceeds will be used for the repayment of interest-bearing debts and capital expenditures mainly for vessels.The loan, valid from April 2019 through March 2054, has been agreed with lenders including Mizuho Bank, Development Bank of Japan and Sumitomo Mitsui Trust Bank."In addition to the business structural reforms set forth in the announcement dated March 7, 2019, the K Line group has been developing its core businesses through the ongoing rebuilding portfolio strategy, with an aim to expand the stable income business and achieve a sustainable growth.

Macroeconomic Trends Signal Good News for Shipping

The current global economic growth (GDP) looks like it may be as good as it gets, with indicators across the globe signaling healthy expansion, but at a slower pace compared to the levels seen in the last half of 2017.Global economic growth seems on track to reach its highest level since 2011, as the International Monetary Fund (IMF) maintain its projection for the world GDP at 3.9 percent and expects the global economic growth to be supported by a strong momentum, favorable market sentiment and accommodative financial conditions in 2018 and 2019.

BTMU to Refinance Two K-Line Vessels

Watson Farley & Williams (WFW) has advised The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU), Japan’s largest bank, as facility agent for a syndicate of international lenders comprising itself, Development Bank of Japan Inc. and Societe Generale on the $180m refinancing of two K-Line LNG vessels, Arctic Voyager and Arctic Discoverer which are time chartered to Statoil ASA, the world’s largest offshore operator. The WFW Hong Kong Asset Finance team advising on the transaction was led by Partner and Office Head Madeline Leong, supported by Senior Associate Ryan Tan, Registered Foreign Lawyer Rueben Tan and Legal Assistant Sandrea Mar. London Finance Partner Rob McBride provided advice on the hedging elements of the financing.

Yen Drops on Rate Cut Talk; Oil Climbs

The U.S. dollar rose to a three week high against the yen on Friday, on a report of likely further monetary policy easing from the Bank of Japan, while a rise in crude oil prices was offset by poor technology sector earnings, leaving Wall Street stocks steady. The dollar rose more than 2.0 percent against the yen to 111.80 yen, its highest level since April 1 after a media report said the BOJ is considering expanding its negative rate policy to bank loans and could cut rates further. A rise in oil prices helped energy stocks, but disappointing earnings from top technology companies, including Google's parent, Alphabet, weighed on the tech sector on Wall Street, leaving the U.S.'s benchmark S&P 500 stock index little changed for the day.

Shipping Market in 2015 & Looking Forward - BIMCO

Global economy: menacing clouds in the sky cast a shadow on global economic developments 2015 never really took off, even though the global economic activity looked stronger earlier in the year. The negative indicators seen at the end of 2014 were not overcome, and we saw a significantly lower level of growth for global GDP in 2015 than in the previous five years. This was primarily due to the struggling emerging markets and developing economies, led by changes in China’s economic focus. As BIMCO’s hope for a bounce-back in 2016 wanes, shipping should brace itself for yet another challenging year. Despite this, the International Monetary Fund has forecast higher GDP growth rates for 2016 across the board.

MHI, IHI & DBJ Join Forces On Investments

Mitsubishi Heavy Industries, Ltd. (MHI), IHI Corporation and the Development Bank of Japan Inc. (DBJ) concluded a three-way formal agreement today on their respective investments into a new commercial aero engine company, Mitsubishi Heavy Industries Aero Engines, Ltd., to be launched on October 1. The new company will succeed to MHI's business in commercial aero engines under a company split action, as MHI previously announced on March 31 and August 28. To solidify its position as a partner company in joint international development programs in the commercial aero engine market - where continuous and robust growth is expected - the new company will focus on improving its financial base.

Multilateral Institutions Visit Panama Canal Expansion

Representatives from the multilateral institutions financing the Panama Canal Expansion Program visited today the new locks project construction in the Pacific side as part of their regularly scheduled visits. Experts from the Inter-American Development Bank (IDB), the European Investment Bank (EIB), Japan Bank for International Cooperation (JBIC), International Financing Corporation (IFC) and the Andean Development Corporation (CAF) participated in meetings for two days and visited the Expansion Program construction site. ACP executives made a comprehensive presentation of the current status of the project, including details of the work stoppage by Grupo Unidos por el Canal, S.A. (GUPC), the new locks project contractor.

Multinational Institutions Visit Panama Canal

Representatives from the five multilateral institutions that have signed agreements for the financing of the Panama Canal Expansion Program took part in the annual visit organized to oversee the program’s progress. “This visit is part of the agreement signed between the Panama Canal Authority and the five institutions that have provided partial financing for the Expansion Program,” Panama Canal Administrator Jorge L. Quijano said at the end of the tour. The delegation included experts from the Inter-American Development Bank (IDB)…

Safe Bulkers $122.4M Credit Agreements

First Financing Arrangement of its kind between a Greece-Based Shipping Company and Japanese Governmental Financial Institutions Safe Bulkers, Inc. (NYSE: SB), an international provider of marine drybulk transportation services, announced today that it has entered into three credit agreements with Japanese governmental financial institutions amounting to US $122.4 million to finance the acquisition of three Japanese Post-Panamax class newbuild vessels. The previously-announced…

Financing Structure for Canal Expansion Program

Panamanian President Martín Torrijos announced the final financing structure for the historic Panama Canal Expansion Program. Five major multilateral agencies from Europe, Asia and offered to finance the Canal expansion project. The Panama Canal Authority, after months of extensive negotiations, has accepted the banks’ offers. The $2.3 billion financing package will cover a portion of the $5.25 billion total cost of the project. Financing agencies are the European Investment Bank (EIB)…

Obituary: John Newbold

John "Jock" Newbold died Saturday, April 12, in New York. He was among the most well-known and highly respected figures in shipping and financial circles. Jock was most recently a Non-Executive Director of Castalia Partners Limited and also a member of the Advisory Board of Castalia Straits L.P. Newbold retired from Citigroup in 1997 after a 36-year career, the last 21 of which were spent with Citibank’s business with the shipping industry. From 1985 to 1997, Newbold was Division Executive in charge of the Global Shipping Division with offices in New York, London, Piraeus, Tokyo and Hong Kong. Earlier in his career, he held positions as Head of the Corporate Bank in Japan…

Financial Groups Meet to Discuss Financing for Panama Expansion

After presenting the Expansion Program at key financial centers around the world, the Panama Canal Authority (ACP) hosted a two-day workshop on the waterway's expansion financing in Panama this week. Amid a packed room at the ACP training center, some of the best known global multilateral development banks attended a workshop, held December 11-12, to gain more insight on the project and the ACP's desire to finance a portion of expansion. ACP Administrator/CEO Alberto Alemán Zubieta opened the forum with welcome remarks, and senior ACP officials answered questions and conducted presentations outlining various aspects of the expansion. Discussion topics included: market and economic trends, risk management, dredging requirements, workforce development and availability, and the environment.

Finance Groups Meet to Discuss Canal Expansion

After presenting the Expansion Program at key financial centers around the world, the Panama Canal Authority (ACP) hosted a two-day workshop on the waterway’s expansion financing in Panama this week. Amid a packed room at the ACP training center, some of the best known global multilateral development banks attended a workshop, held December 11-12, to gain more insight on the project and the ACP’s desire to finance a portion of expansion. ACP Administrator/CEO Alberto Alemán Zubieta opened the forum with welcome remarks, and senior ACP officials answered questions and conducted presentations outlining various aspects of the expansion. Discussion topics included: market and economic trends, risk management, dredging requirements, workforce development and availability, and the environment.

Sumitomo Mitsui to Double Overseas Banking Staff

According to a Bloomberg report, Sumitomo Mitsui Financial Group Inc. will double its overseas banking staff that works on financing for ship construction, as Japan's biggest arranger of such deals tries to take advantage of surging demand for vessels. China's appetite for iron ore will boost demand for vessels with cargo capacity of more than 100,000 tons by 44 percent between last year and 2010, according to a report last month by Mitsui O.S.K. Lines Ltd., owner of the world's largest merchant fleet. Corporate lending at Japan's biggest banks contracted 0.7 percent from a year earlier in September, the sixth straight month of declines, a Bank of Japan report showed last month. Sumitomo Mitsui lent $2.7b for ship construction in 2006, according to the U.S. magazine Marine Money.