Panama Canal Woes to Delay Grain Ships well into '24

Bulk grain shippers hauling crops from the U.S. Gulf Coast export hub to Asia are sailing longer routes and paying higher freight costs to avoid vessel congestion and record-high transit fees in the drought-hit Panama Canal, traders and analysts said.The shipping snarl through one of the world's main maritime trade routes comes at the peak season for U.S. crop exports, and the higher costs are threatening to dent demand for U.S. corn and soy suppliers that have already ceded market share to Brazil in recent years.

Methanol Expanding in Bulker Segment

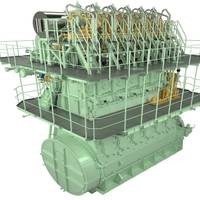

Long-term MAN Energy Solutions licensee Mitsui E&S Machinery has won another contract to supply the individual MAN B&W 6G50ME-LGIM (-Liquid Gas Injection Methanol) engine for a 65,700 dwt bulk carrier slated for construction at Tsuneishi Shipbuilding Co., Ltd. The vessel represents the latest methanol-fueled engine ordered by the bulk carrier segment in recent weeks.Sachio Okumura, Representative Director and President & Executive Officer of Tsuneishi Shipbuilding, said, “For Tsuneishi Shipbuilding…

KDI inks deal with Rocktree to 'Digitalize' Bulk Carrier

Kongsberg Digital (KDI) signed a contract with Singapore-based transshipment company Rocktree to provide its Vessel Insight technology for the Supramax size Bulk carrier modified to an Offshore Floating Terminal (OFT) RT LEO. Together with the Vessel Insight Customer Success team, Rocktree plans to develop dashboards to measure cargo moved in tons/hour, fuel consumption, monitor emissions and benchmark its vessels.“Historically, the Bulk carrier segment has been a bit slow in terms of digitalization compared to Tankers and Offshore…

Panama Remains Top Flag State for Bulker Carriers

The Panama Ship Registry is the largest in the world since 1993. This year, most of the vessels that entered the Panamanian registry were bulk carrier vessels. Panama-flagged bulk carriers represent 22% of the world´s bulk carrier fleet, with 2,725 vessels and 112.1 million gross tons (GT), according to Clarksons Research.Between January and August 2021, Panama has incorporated 218 newly-built ships to its fleet, contributing 6.6 million GT, of which 61 vessels are from the bulk carrier segment.Additionally…

New Guidance Issues on Bulk Carrier Ventilation

Proper ventilation is essential to preventing damage to the cargo and to ensure the safety of the crew and vessel in bulk carriers. To provide ship’s masters and crew with an understanding of different ventilation requirements for bulk cargoes, INTERCARGO, The Standard Club and DNV GL, the world’s leading classification society, have launched a new ventilation guide.The guide covers the main aspects on how and when to ventilate to control of humidity and to remove flammable and toxic gases released from cargoes.

Global Marine Lubricants Market to Grow by 2.17% to Hit USD 6.66 bln in 2023

The global marine lubricants market is estimated to be USD 5.98 billion in 2018 and is projected to reach USD 6.66 billion by 2023, at a CAGR of 2.17% from 2018 to 2023.The growth of the market is driven by the emerging alternative technology trends, said a report by Research and Markets.Also, rising infrastructure developments (port infrastructure) to strengthen the shipping industry globally are fueling trade activities, leading to the growth of marine lubricants market. However, fewer trade activities and the rising number of idle ships are restraining the market's growth.Mineral oil is the largest oil type segment of the global marine lubricants market. By oil type, the mineral oil segment is estimated to account for the largest share of the global marine lubricants market in 2018.

Emission Regulation Welcome, But Should be Wise: INTERCARGO

On the implementation of the 0.5% sulphur cap for ships’ bunkers from 2020, International Association of Dry Cargo Shipowners (INTERCARGO) is promoting the consideration of transitional issues such as the availability and safety aspects of compliant fuels, and incidents of non-availability of low sulphur bunkers at certain ports. INTERCARGO encourages the effective implementation of the “2020 Sulphur Cap” regulation yet with a pragmatic approach. A reasonable and measured enforcement of the Regulation during an initial transitional period would thus be welcome instead. INTERCARGOraises its concerns about the practical - technical and operational - challenges faced by shipowners in achieving compliance from 01 Jan 2020, given the bunkers’ supply landscape and widespread uncertainty.

BWM Should Not Distort the Market: Intercargo

In view of the International Maritime Organisation’s (IMO) Marine Environment Protection Committee upcoming meeting (MEPC 71 during 3-7 July 2017), Intercargo re-iterates its welcoming the entry into force of the Ballast Water Management (BWM) Convention in September. Aspiring to the Convention’s effective implementation, our Association will be making MEPC 71 Committee aware of the critical challenges faced by the bulk carrier segment of the industry. The world bulk carrier fleet is by far the largest single sector by deadweight tonnage and a significant proportion of it utilizes the highly energy efficient gravity discharge system for the topside ballast water tanks. Topside tanks are an integral part of bulk carriers.

Marine Propulsion Market Poised for Growth -Report

The marine propulsion engine market was valued at $9 billion in 2015 and is projected to reach $12 billion by 2022, growing at a CAGR of 4.1 percent from 2016 to 2022, according to a new report published by Allied Market Research. Diesel propulsion system segment is expected to maintain its dominance throughout the forecast period. Asia-Pacific accounted for the highest share of 51 percent in 2015, and is anticipated to maintain this trend. Increase in production and sales of ships globally and rise in international seaborne trade drives the market growth.

J. Lauritzen: No Dry Cargo Recovery

“The dry cargo markets have shown no signs of recovery during Q3. A lack of demand growth in combination with deliveries of new tonnage will make this the reality of the market for an extended period. Our Q3 result in dry cargo is as expected and a reflection of these market conditions. Our gas carriers continued to perform as forecasted," says Jan Kastrup-Nielsen, President and CEO of J. Lauritzen. Continued reduction of the owned dry bulk fleet was offset by increase of short-term chartered dry bulk tonnage. 12 months time-charter of two 10,000 cbm ethylene gas carriers with purchase obligation after expiry of the charter period late 2016. EBITDA for the first nine months amounted to USD (30.0)m against 28.4m in the same period last year.

Panama Canal's Tonnage Up

The Panama Canal registered an increase in tonnage to 326.8 million Panama Canal tons (PC/UMS) during fiscal year 2014 which concluded on September 30. This figure represents a 2 percent increase compared to the 320.6 million PC/UMS tons registered in FY 2013. The increase was primarily driven by the bulk carrier segment which registered an 18.2 percent increase totaling 85.9 million PC/UMS tons, compared to the 72.7 million PC/UMS tons registered the previous year. The dynamic movement of bulk through the Panama Canal in the last year is attributed to the surge in grain cargo flows from the US Gulf to Asia. Other top market segments during this fiscal year included car carriers with 45.8 million PC/UMS and gas carriers with 6.0 million PC /UMS tons…

Panama Canal Registers Tonnage Increase

The Panama Canal registered an increase in tonnage to 326.8 million Panama Canal tons (PC/UMS) during fiscal year 2014 which concluded on September 30. This figure represents a 2 percent increase compared to the 320.6 million PC/UMS tons registered in FY 2013. The increase was primarily driven by the bulk carrier segment which registered an 18.2 percent increase totaling 85.9 million PC/UMS tons, compared to the 72.7 million PC/UMS tons registered the previous year. The dynamic movement of bulk through the Panama Canal in the last year is attributed to the surge in grain cargo flows from the US Gulf to Asia. Other top market segments during this fiscal year included car carriers with 45.8 million PC/UMS and gas carriers with 6.0 million PC /UMS tons…

Dry Bulk Carrier Segment Revival Seen by Analyst

Freight rates are set to rise across all dry bulk carrier segments as the global economic recovery gains momentum, ending the sector’s most bearish run since the start of the economic crisis in 2008/2009, according to Newport Shipping’s 'Dry Bulk Market Outlook 2014 Q2'. Seaborne trade in bulk commodities is expected to pick up after almost two years of slow to moderate economic growth to almost 9% this year, after which it will ease off slightly to an annual growth rate of about 7%. The dry bulk markets, especially panamax, supramax and handy size, have not been at the current low levels since the financial crisis in early 2009. Strong…

MAN B&W Engines in Two New Capesizes EEDI Compliant

Centrans (Tianjing) Ocean Shipping has received EEDI compliance certificates for two 180,000 dwt newbuildings. The company reports this as being a first in the global Capesize bulk carrier segment. The two ships are each powered by a single MAN B&W 6S70MC-C8.2 low-speed engines built by Dalian Marine Diesel, and the vessels were built at QingDao Beihai Shipyard in Eastern China. The vessels received their EEDI compliance certificates from Lloyds Register in late 2012. The EEDI…

JACCAR Holdings Enters Into Gas and Dry Bulk Ownership

Greenship Holdings, a fully-owned Singapore subsidiary of JACCAR Holdings, has established two separate entities to expand into ship-owning and operating activities in the gas and dry bulk sectors. Greenship Holdings is aiming to own and operate advanced, fuel-efficient and environmentally-friendly vessels. Its original commitment, totaling 30 vessels in the gas and dry bulk sectors, with a total investment of around $900 million, has a secured financing structure and will go into operation in full within the next two years. Greenship Gas, a company fully owned by Greenship Holdings, has been established with the two-fold strategy of combining effective asset management with unparalleled in-house operations.

SCI Expands Fleet

SCI signed contracts for acquisition of two Supramax bulk carriers on resale basis which were originally contracted by M/s Grand Yard Investment Pvt. Ltd., China and were under construction at M/s Guoyu Shipyard, China. SCI had signed contracts for these two resale vessels during April 2011. The second vessel is scheduled to be delivered to SCI by July end. The vessel has a gross tonnage of 33,032 tons and deadweight of 56,638 tons. The vessel has been classed with BV and IRS and has been built to comply with the latest and most stringent international regulations.

Shipbuilding Prices Firm Up

International shipbuilders enjoyed a healthy year, with the main contributors being tankers and container vessels. Following upon these ordering activities, R.S. Platou saw shipbuilding prices firming up from the bottom level the previous year. Price for the tankers increased on average by 16 percent but the corresponding figure for container vessels was only 6.5 percent. Bulk prices showed a firming almost equal to that of tankers, but ended at an average of 13 percent after the prices for smaller bulkers softened towards the end of the year. Korean yards were again this year the most aggressive, securing 46 percent of all new orders, equaling 18.5 mill. cgt. Proof of their dominance was that they secured 71 percent of all crude tanker orders and 57 percent of all product tanker orders.